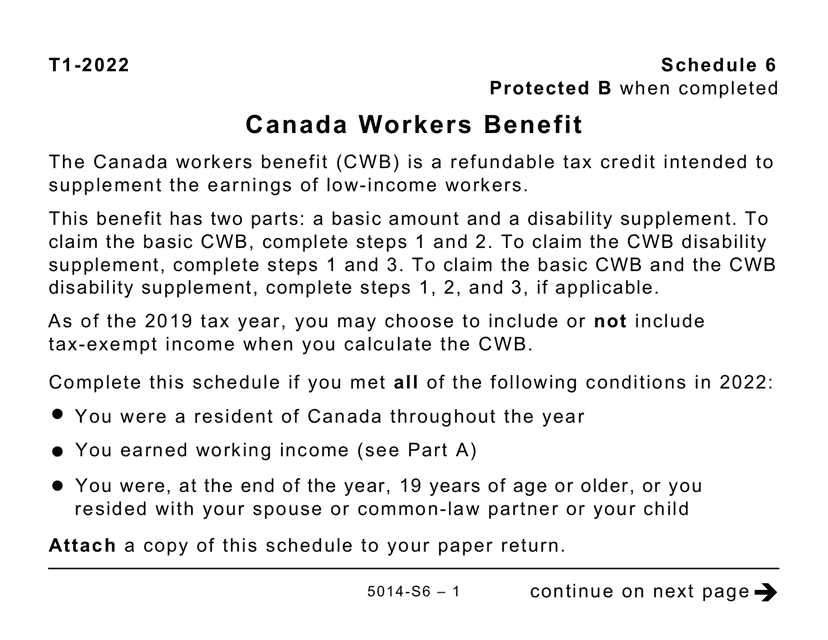

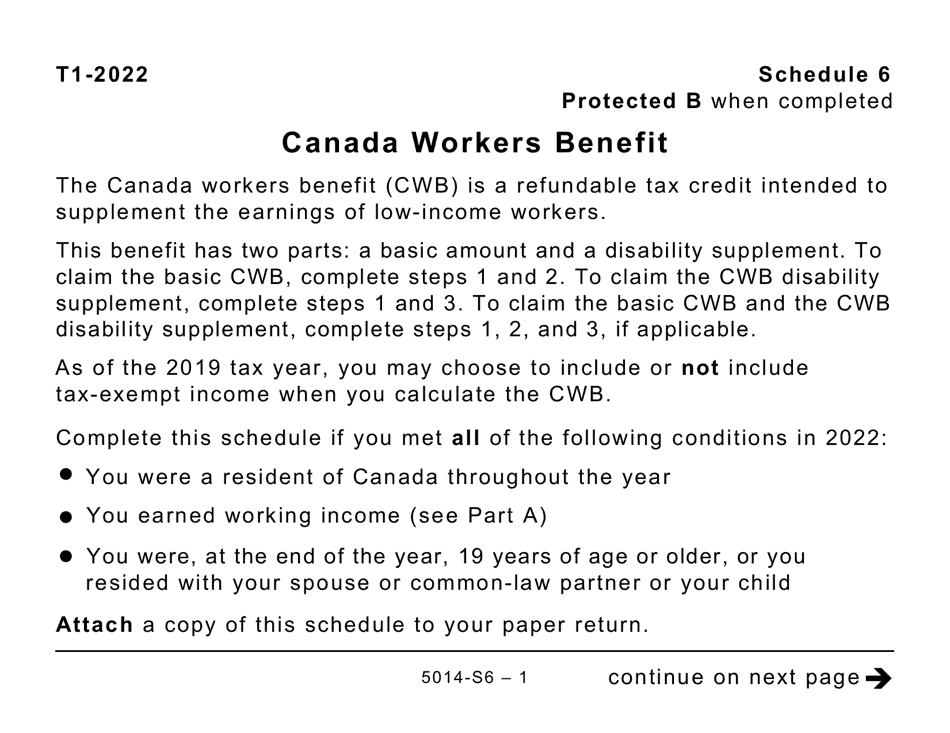

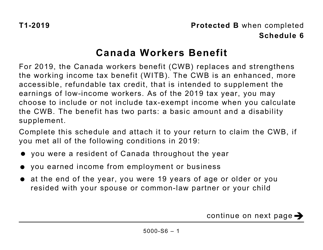

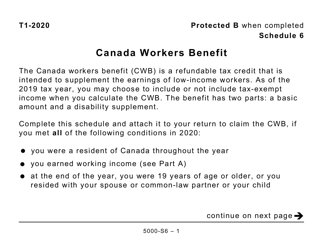

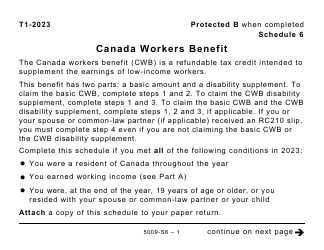

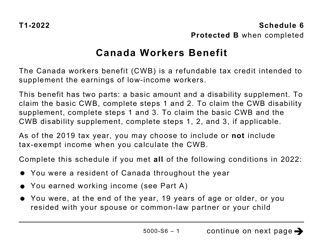

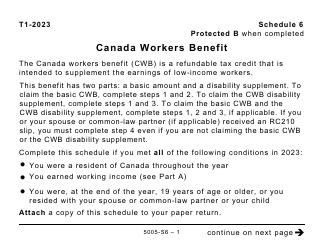

Form 5014-S6 Schedule 6 Canada Workers Benefit (Large Print) - Canada

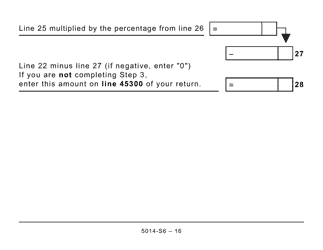

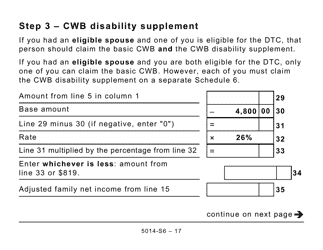

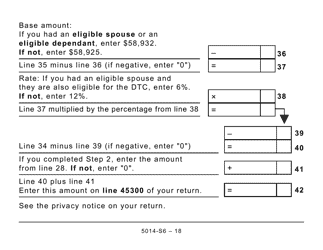

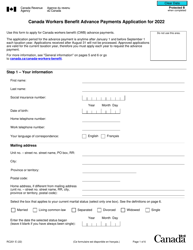

Form 5014-S6 Schedule 6 Canada Workers Benefit (Large Print) is used in Canada to report information related to the Canada Workers Benefit. This form helps individuals determine their eligibility for this benefit and calculate the amount they may be entitled to.

The Form 5014-S6 Schedule 6 Canada Workers Benefit (Large Print) is filed by individual taxpayers in Canada.

FAQ

Q: What is Form 5014-S6 Schedule 6?

A: Form 5014-S6 Schedule 6 is a tax form in Canada.

Q: What is the Canada Workers Benefit?

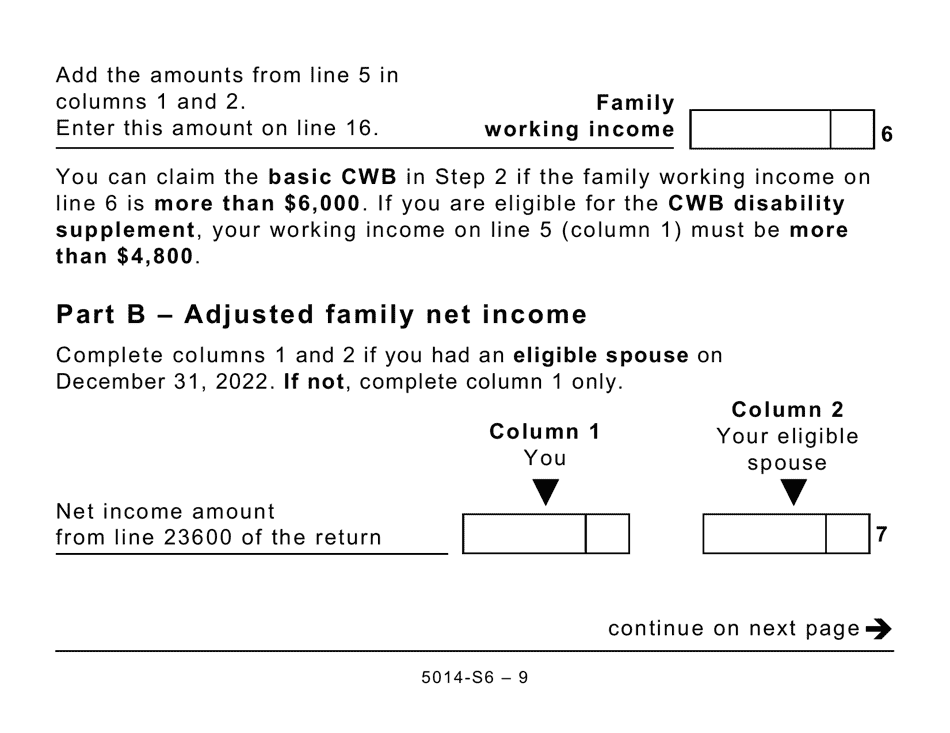

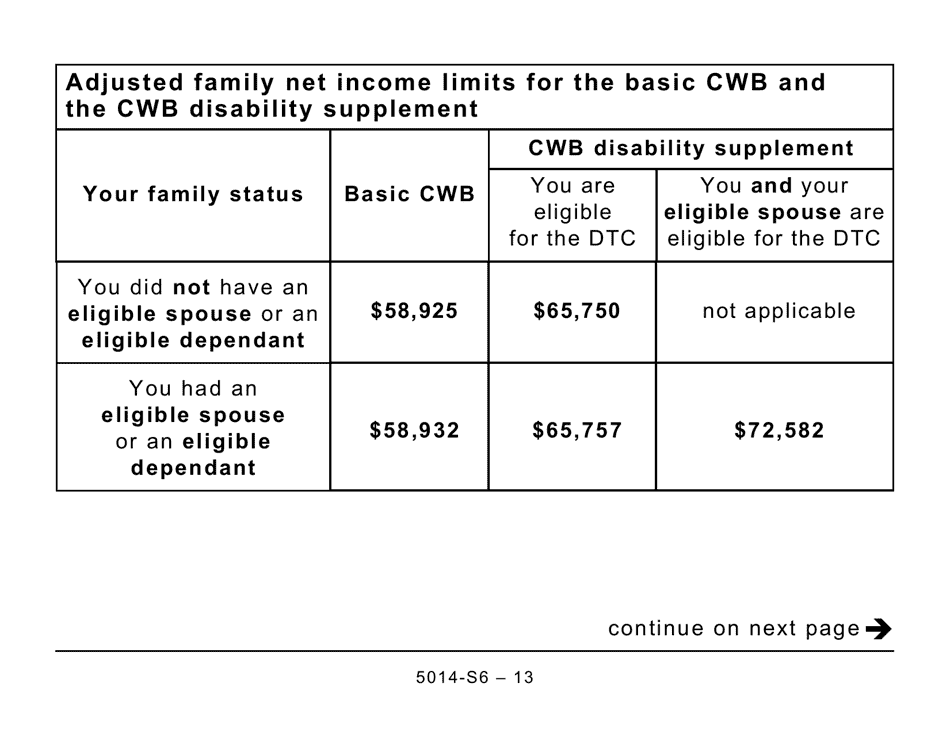

A: The Canada Workers Benefit is a tax credit for low-income individuals and families who are working.

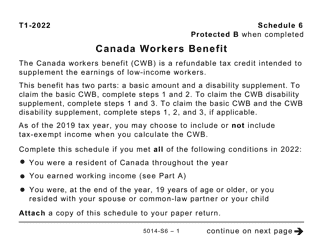

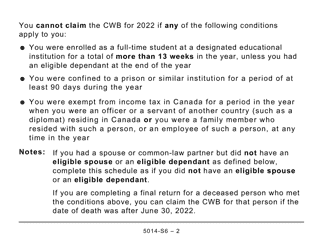

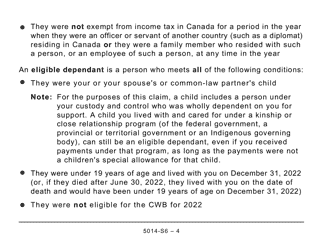

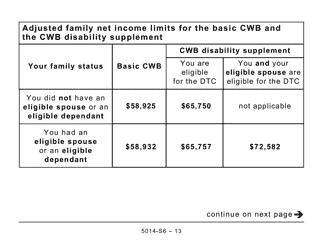

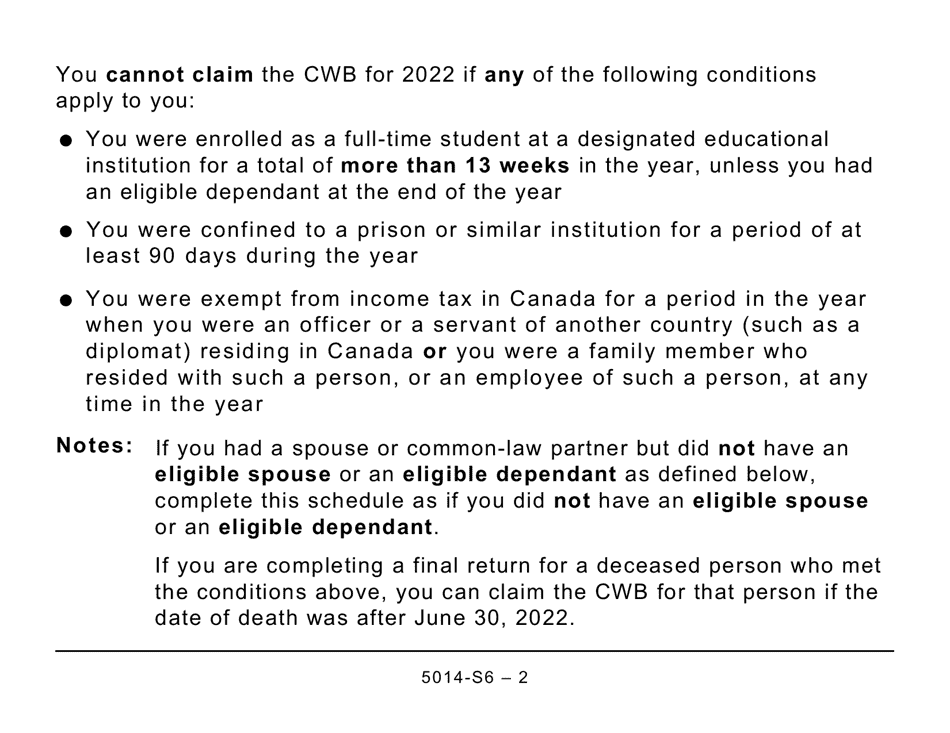

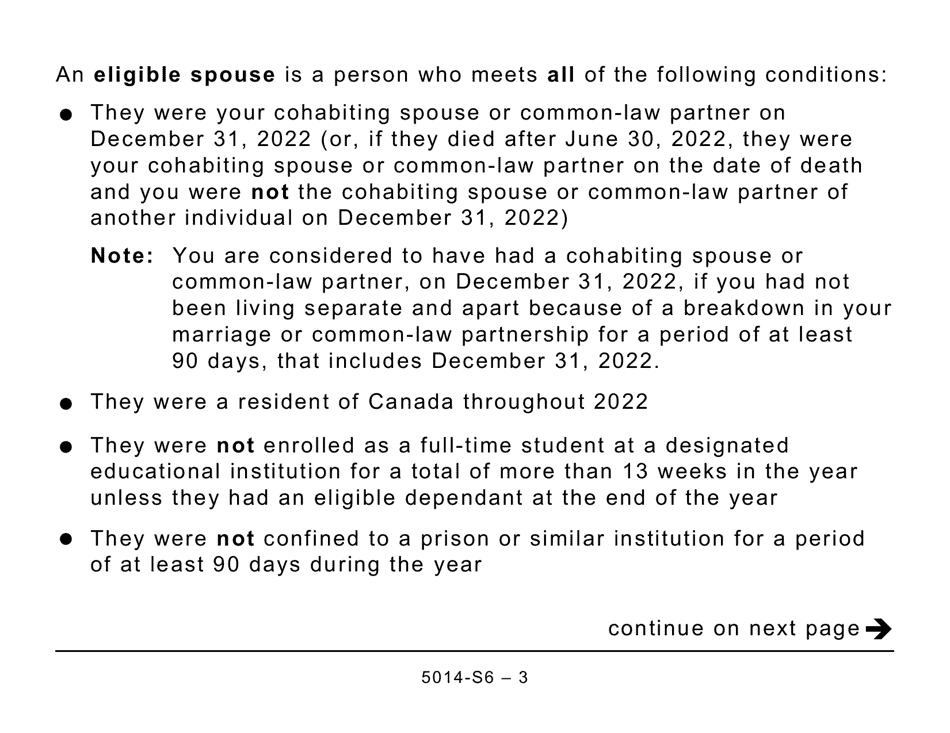

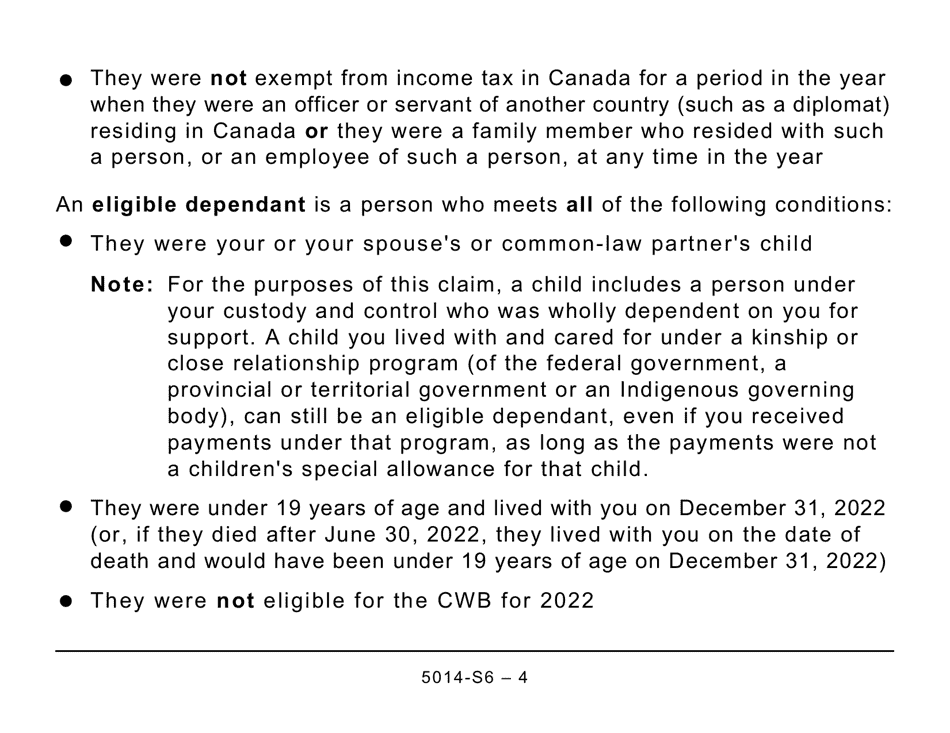

Q: Who is eligible for the Canada Workers Benefit?

A: Individuals and families with low income who are working are eligible for the Canada Workers Benefit.

Q: What is the purpose of Form 5014-S6 Schedule 6?

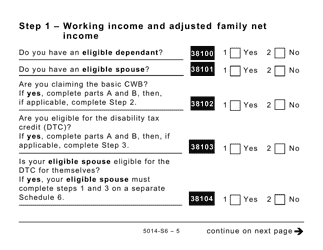

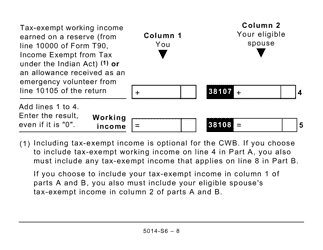

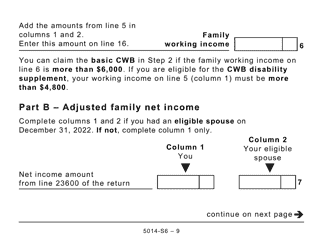

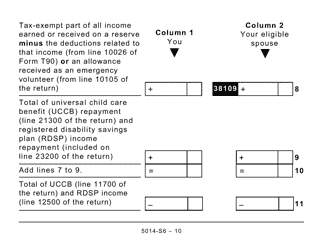

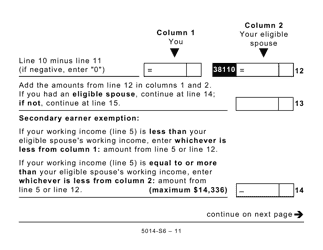

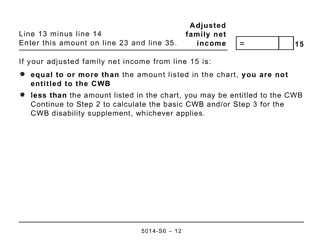

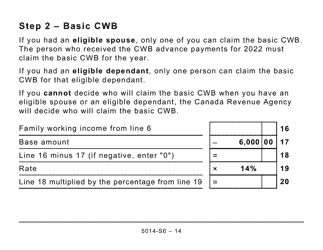

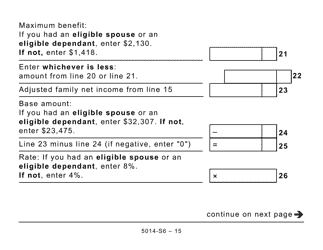

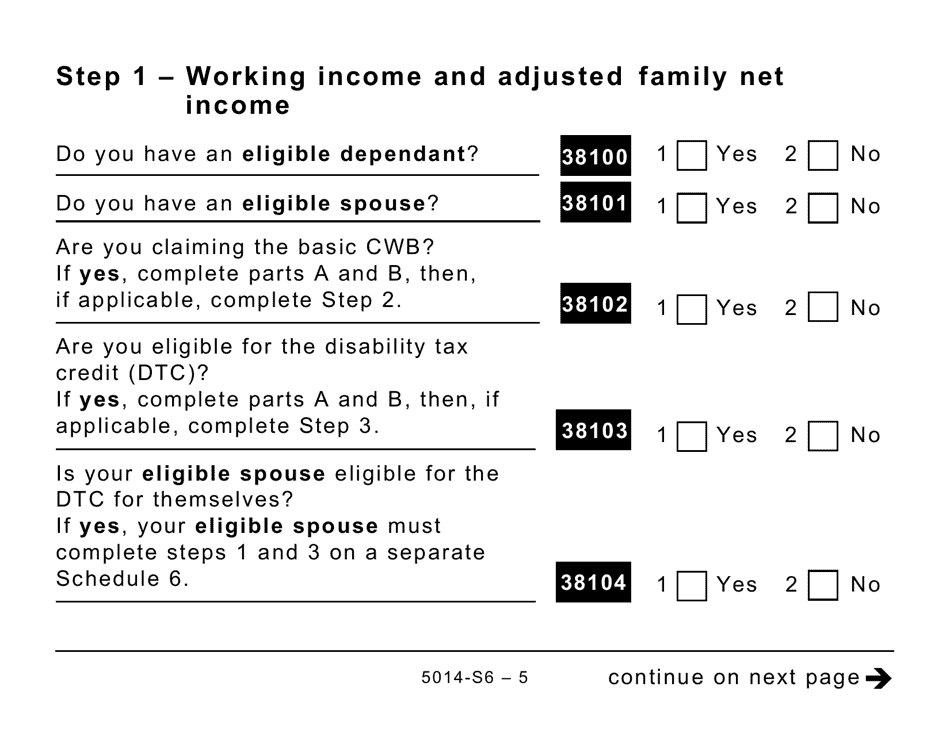

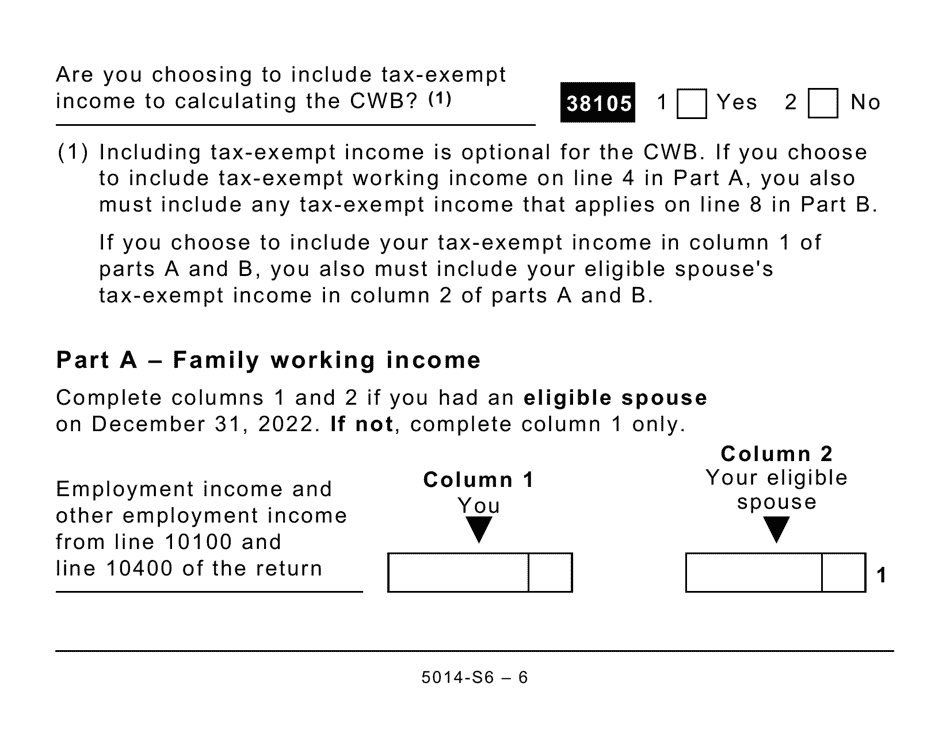

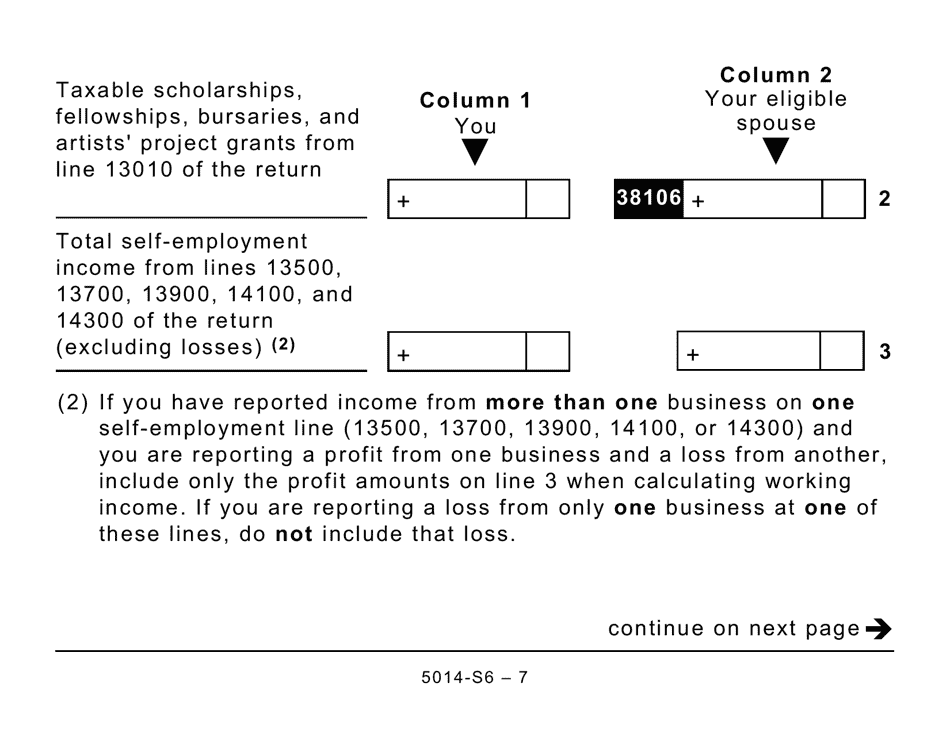

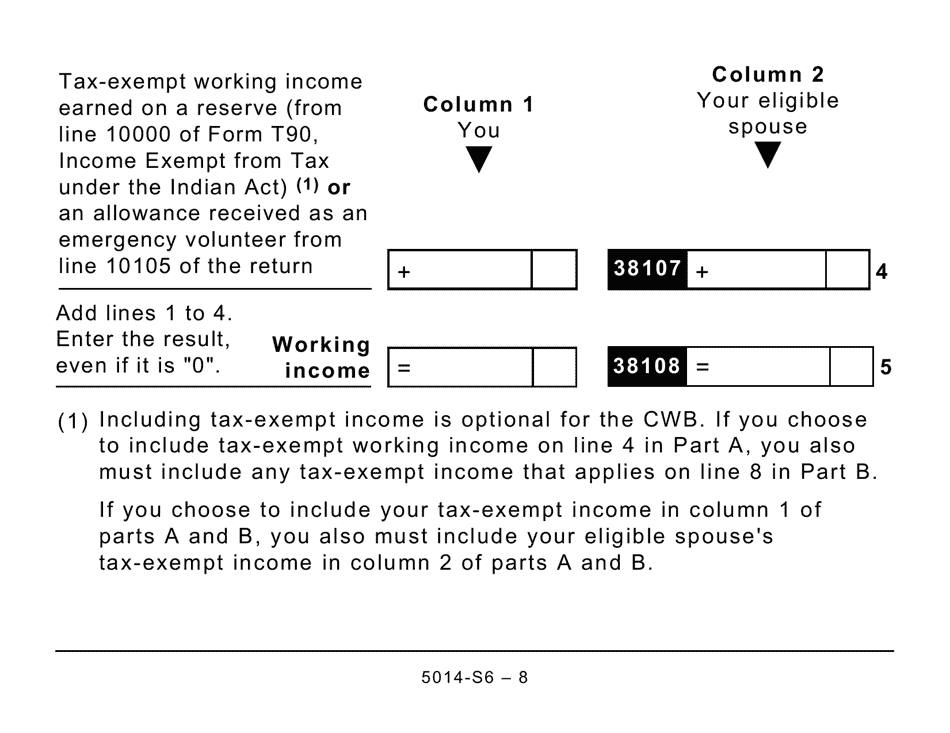

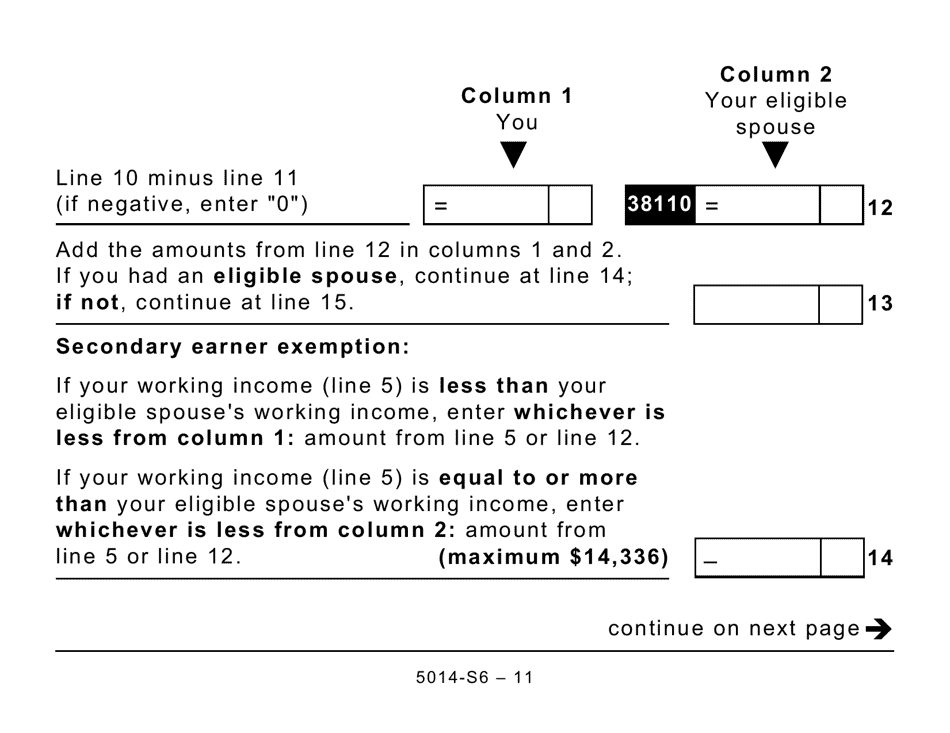

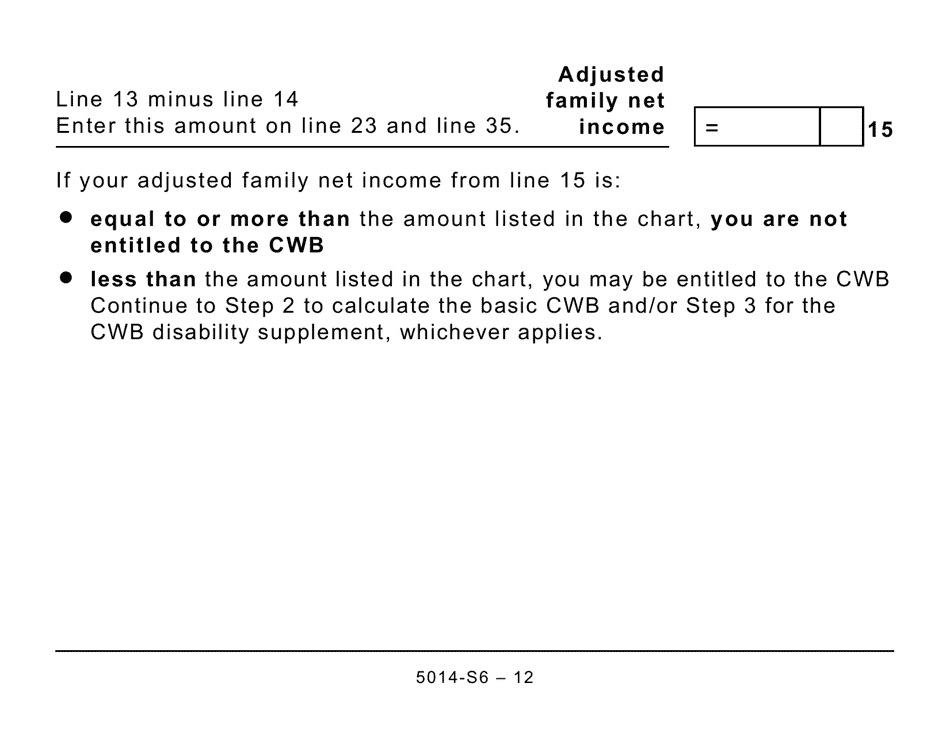

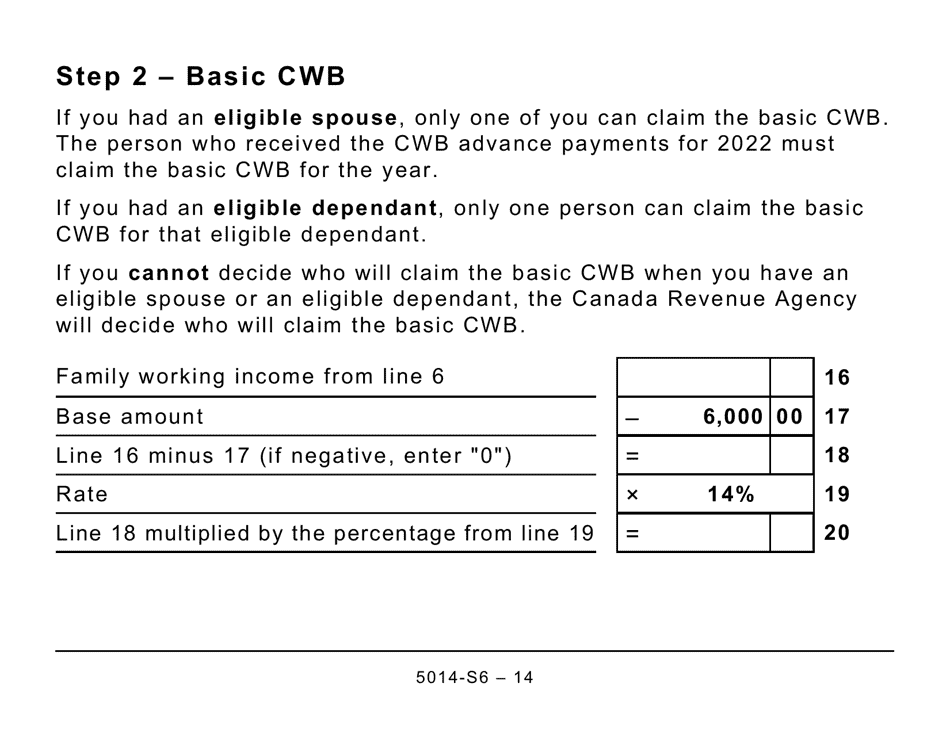

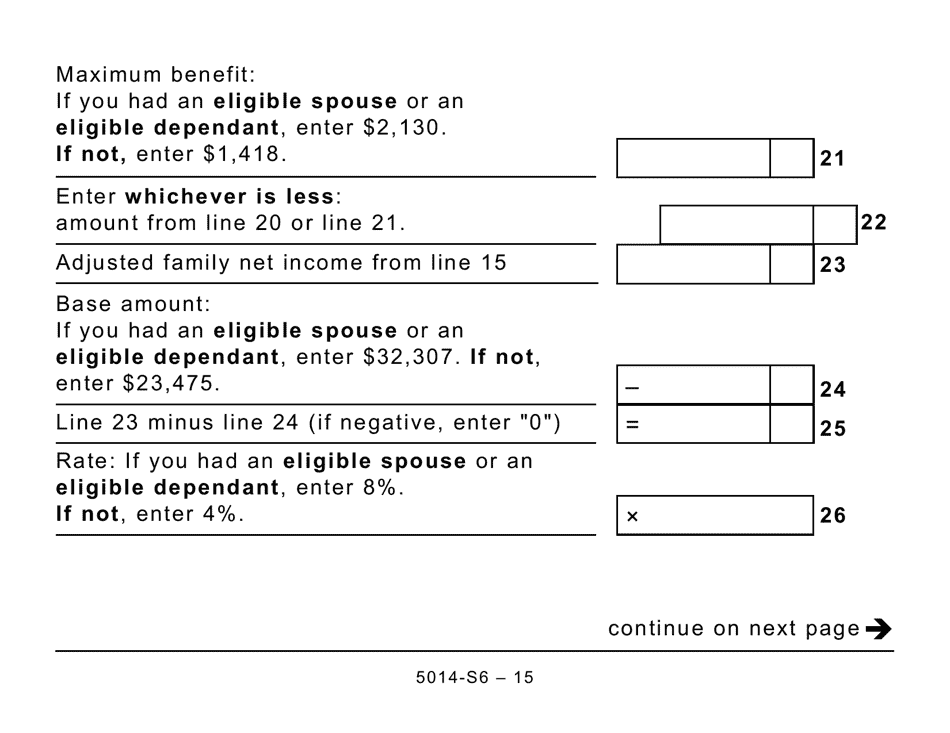

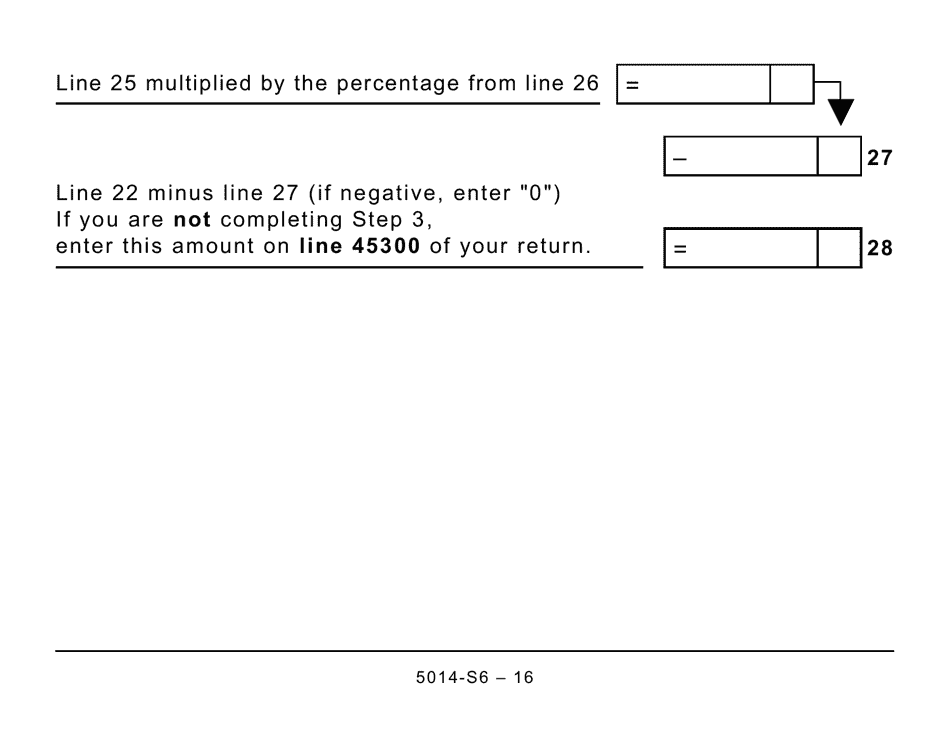

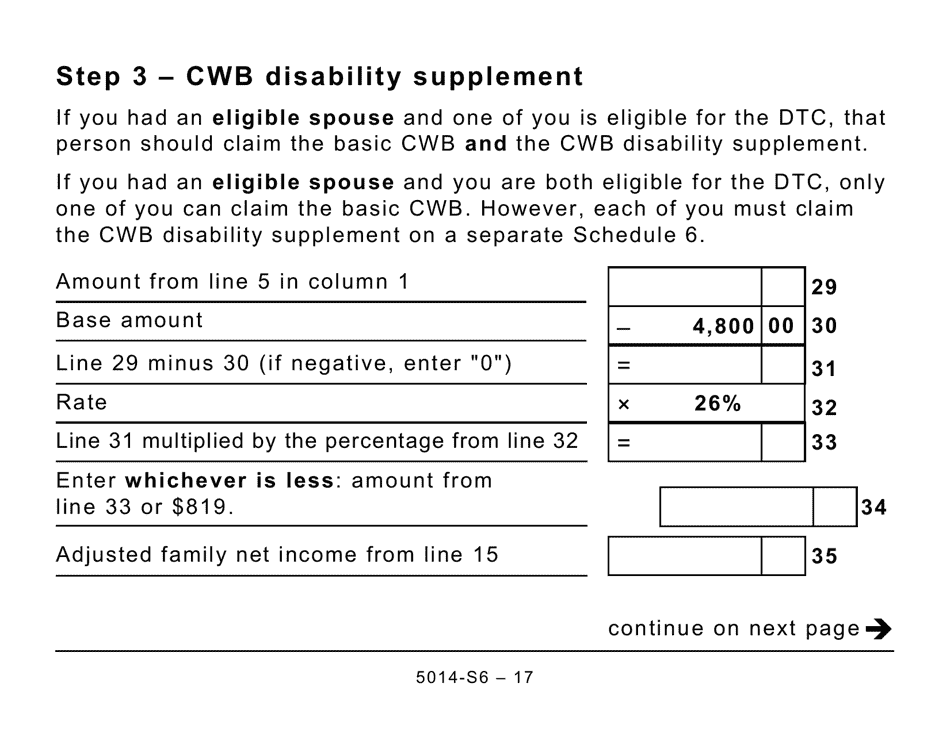

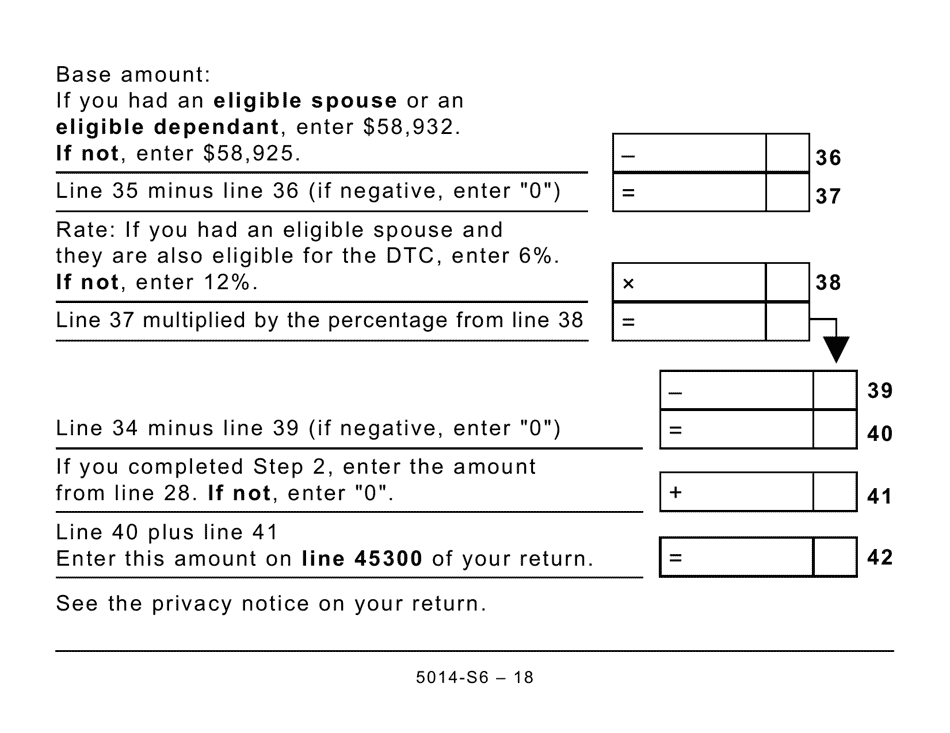

A: Form 5014-S6 Schedule 6 is used to calculate and claim the Canada Workers Benefit.

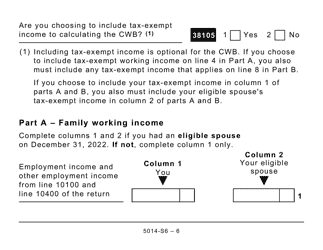

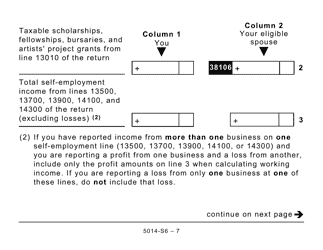

Q: How do I fill out Form 5014-S6 Schedule 6?

A: You need to enter your personal information, income details, and other relevant information to calculate and claim the Canada Workers Benefit.

Q: When is the deadline to file Form 5014-S6 Schedule 6?

A: The deadline to file Form 5014-S6 Schedule 6 is April 30th of each year.

Q: Can I claim the Canada Workers Benefit if I am self-employed?

A: Yes, self-employed individuals can claim the Canada Workers Benefit if they meet the eligibility criteria.

Q: Is the Canada Workers Benefit taxable?

A: No, the Canada Workers Benefit is not taxable.

Q: What other benefits or credits can I claim in addition to the Canada Workers Benefit?

A: You may also be eligible for other benefits or credits such as the Goods and Services Tax Credit and the Canada Child Benefit. It is recommended to consult with a tax professional or the Canada Revenue Agency for personalized information.