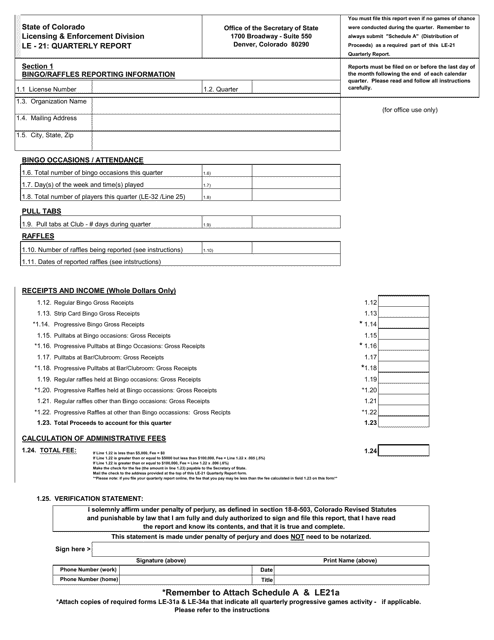

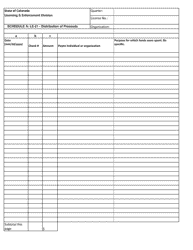

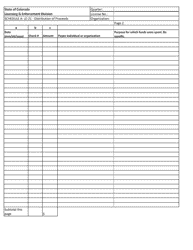

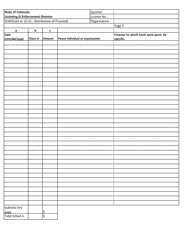

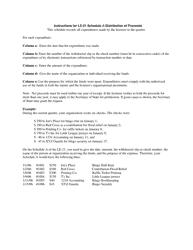

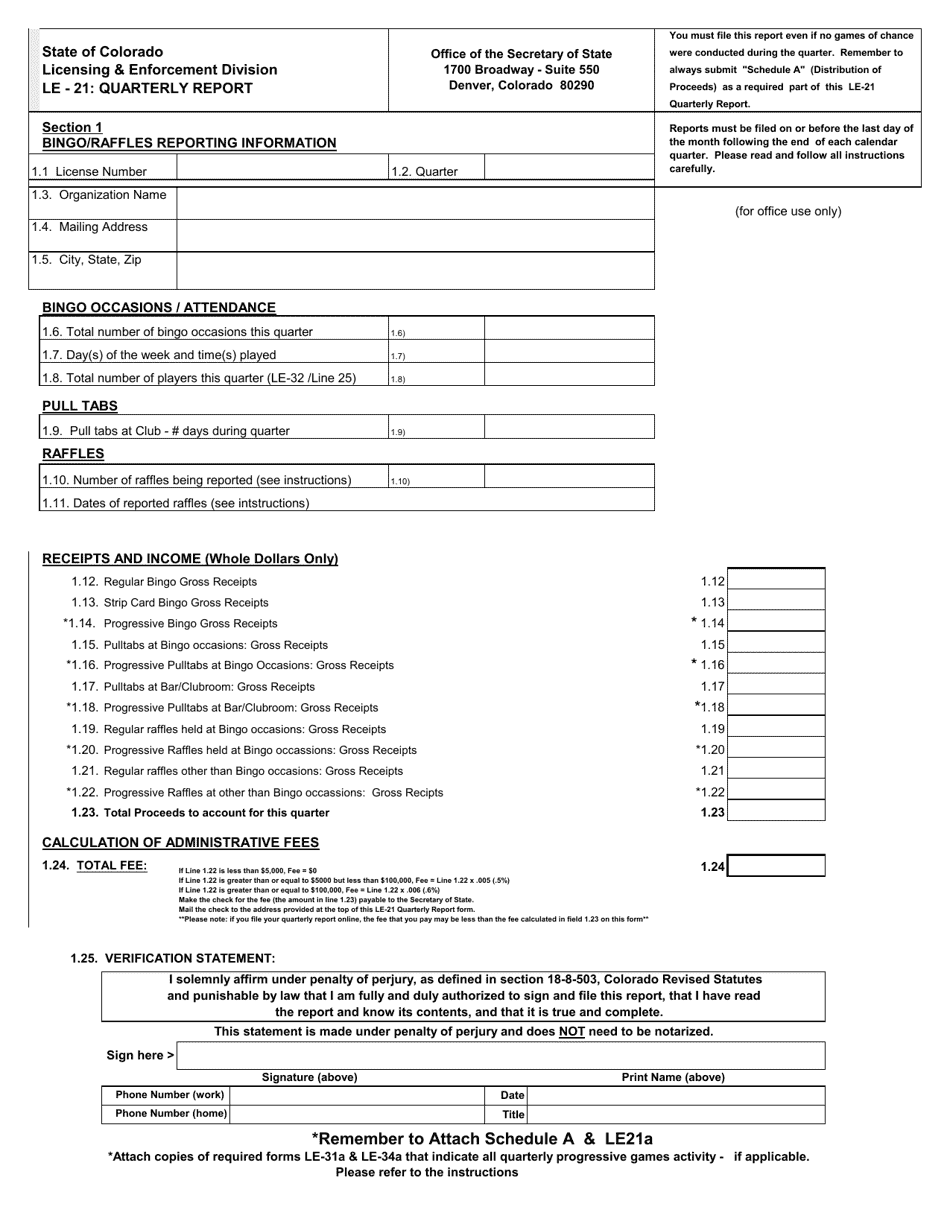

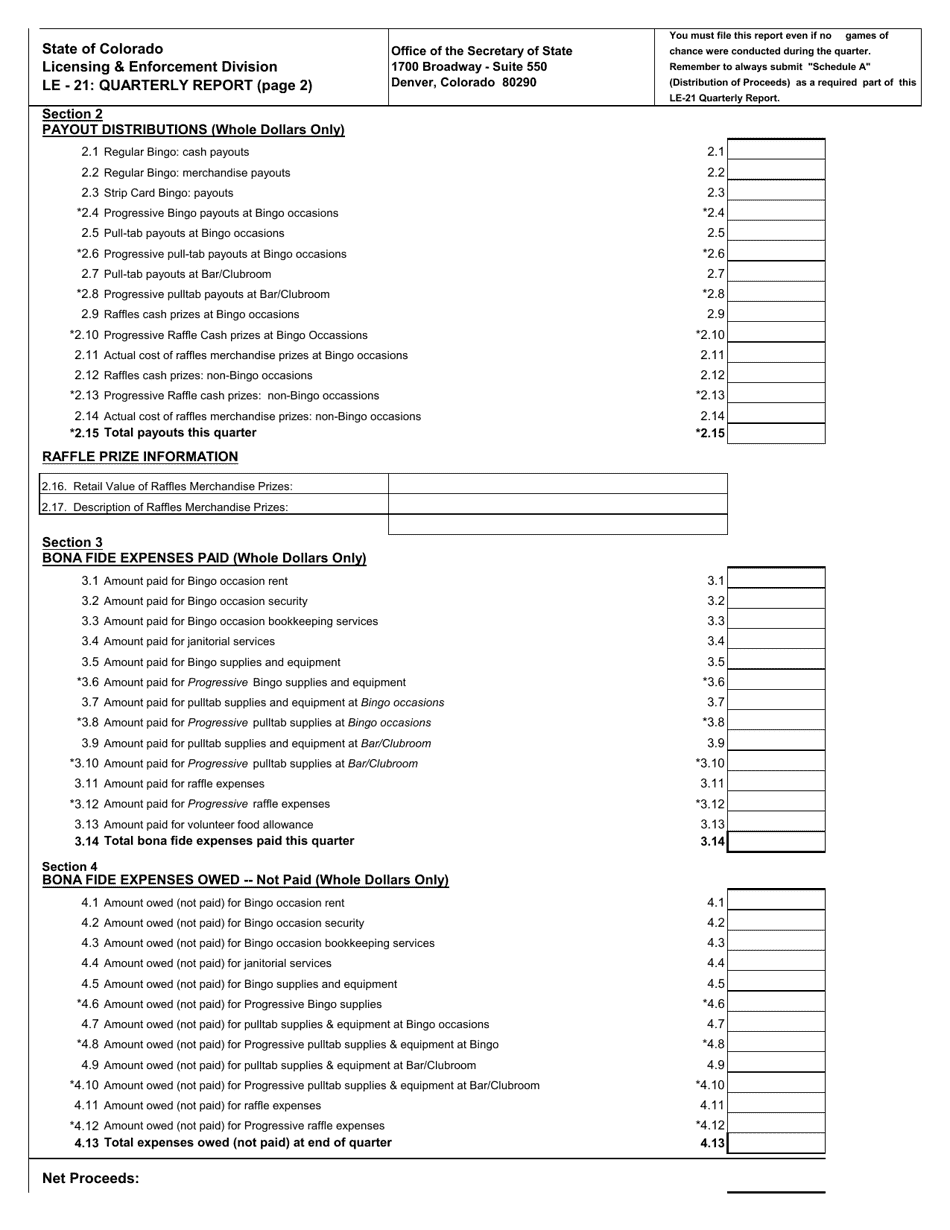

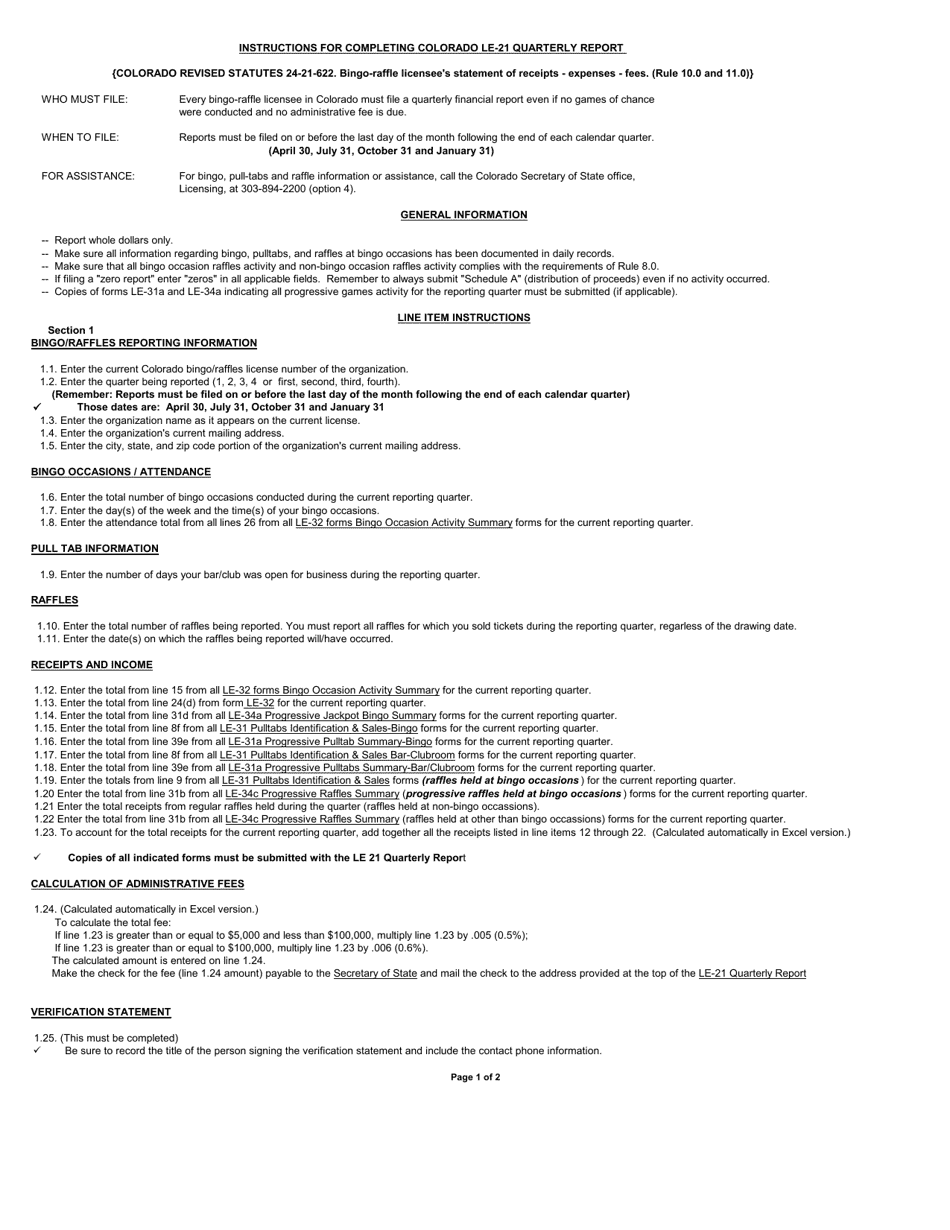

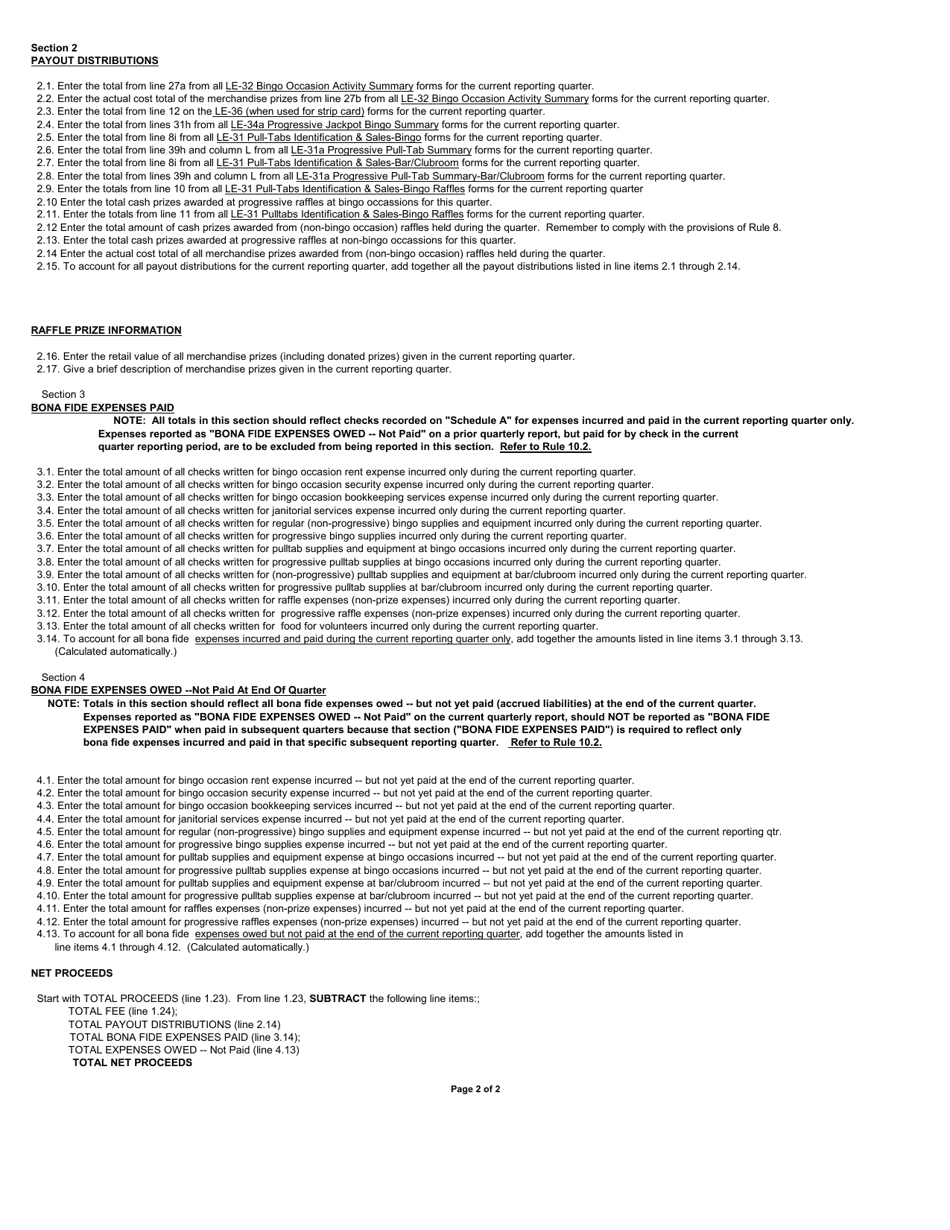

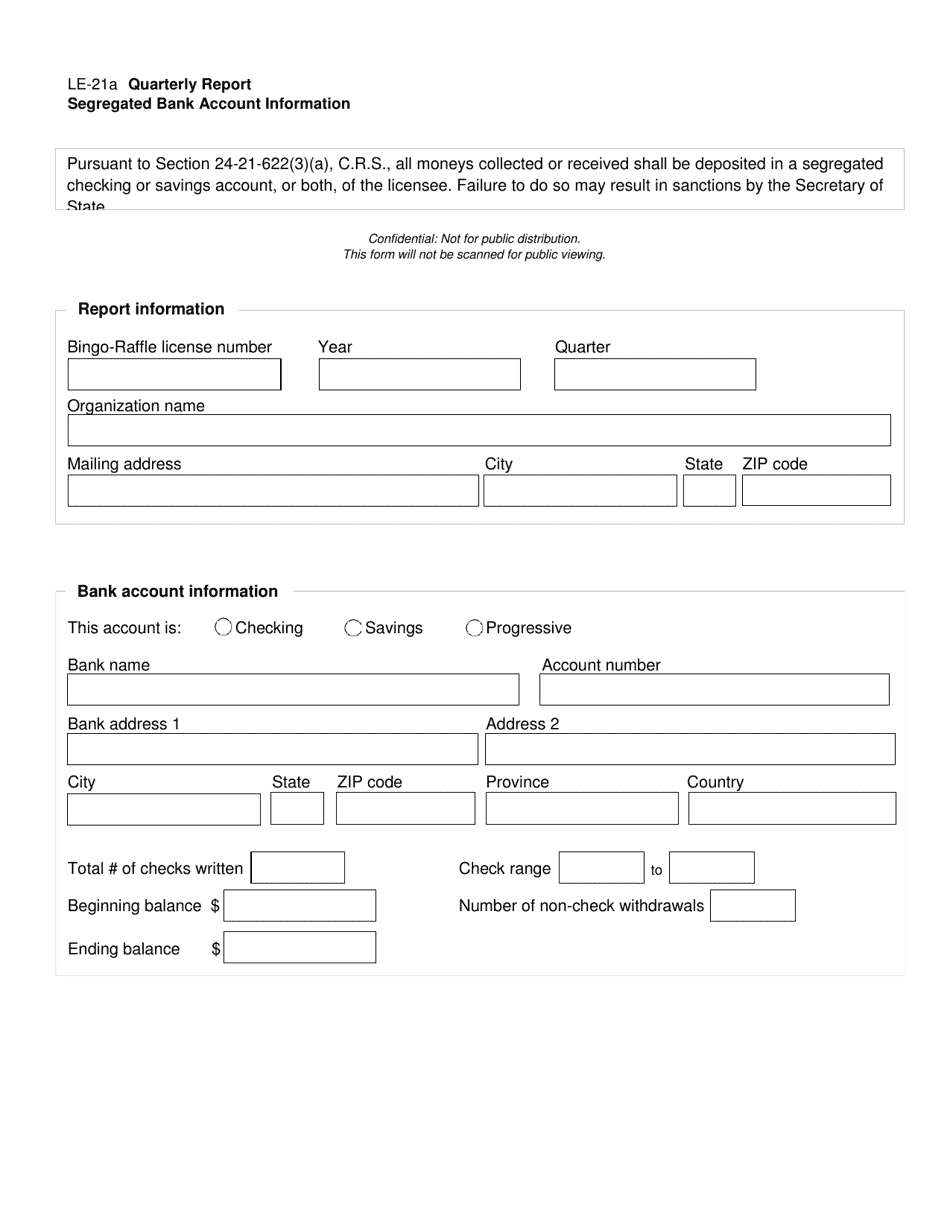

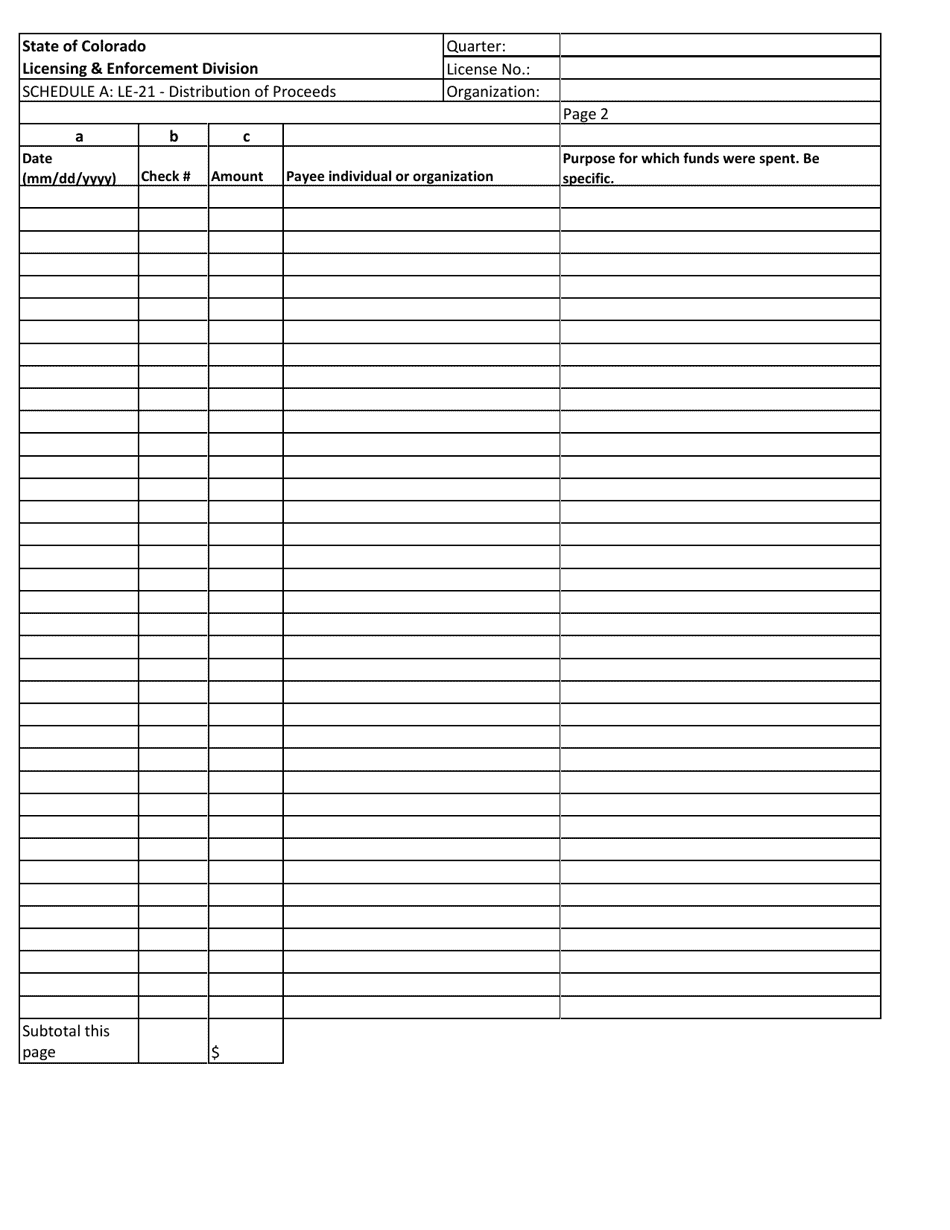

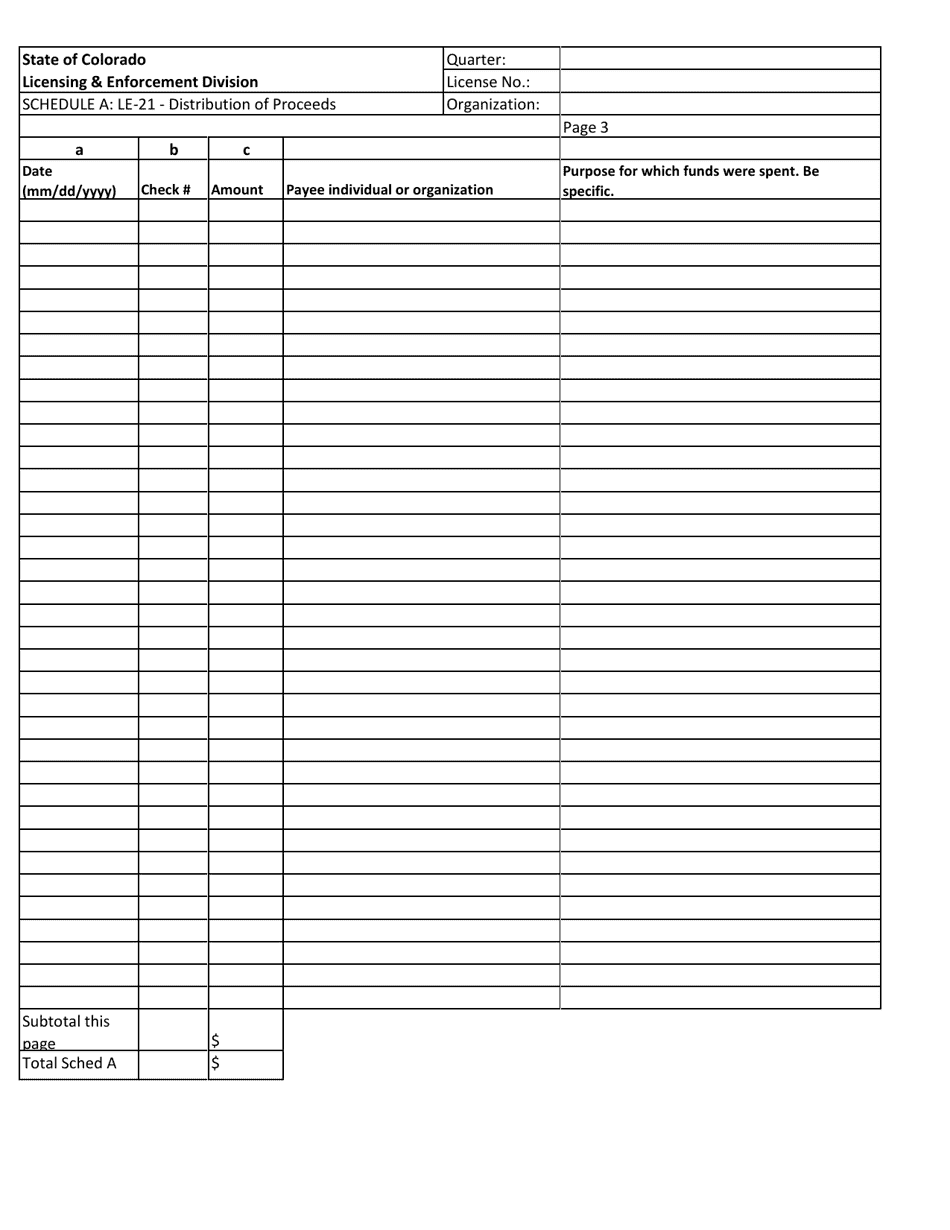

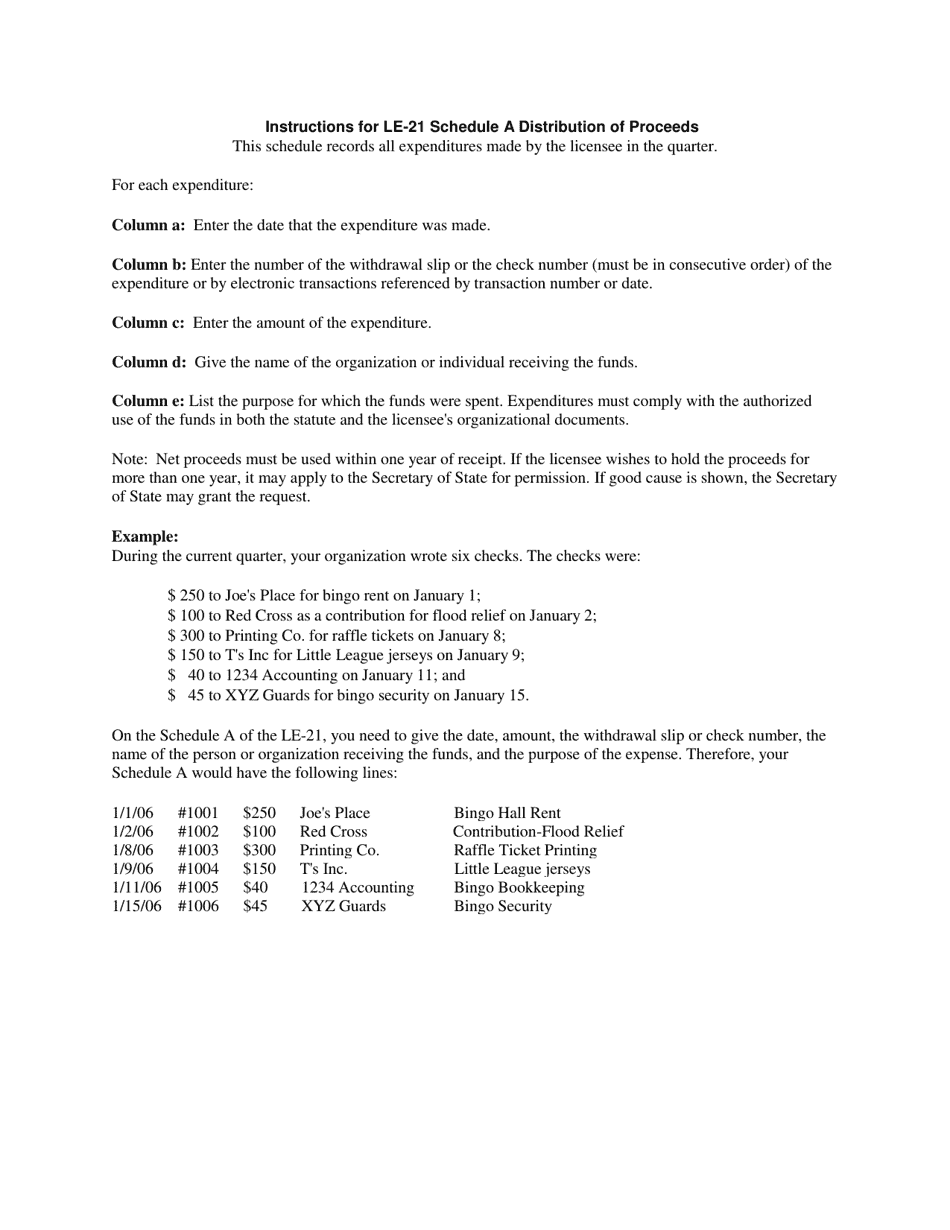

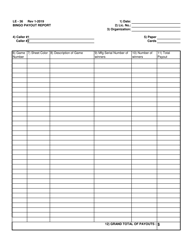

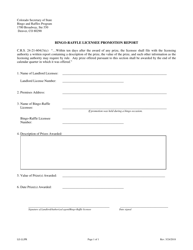

Form LE-21 Quarterly Report - Colorado

What Is Form LE-21?

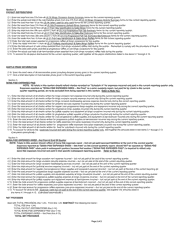

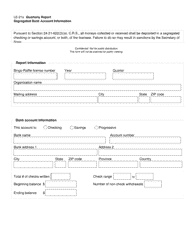

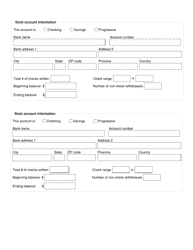

This is a legal form that was released by the Colorado Secretary of State - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LE-21?

A: Form LE-21 is a quarterly report.

Q: Who needs to file Form LE-21?

A: Businesses operating in Colorado may need to file Form LE-21.

Q: What is the purpose of filing Form LE-21?

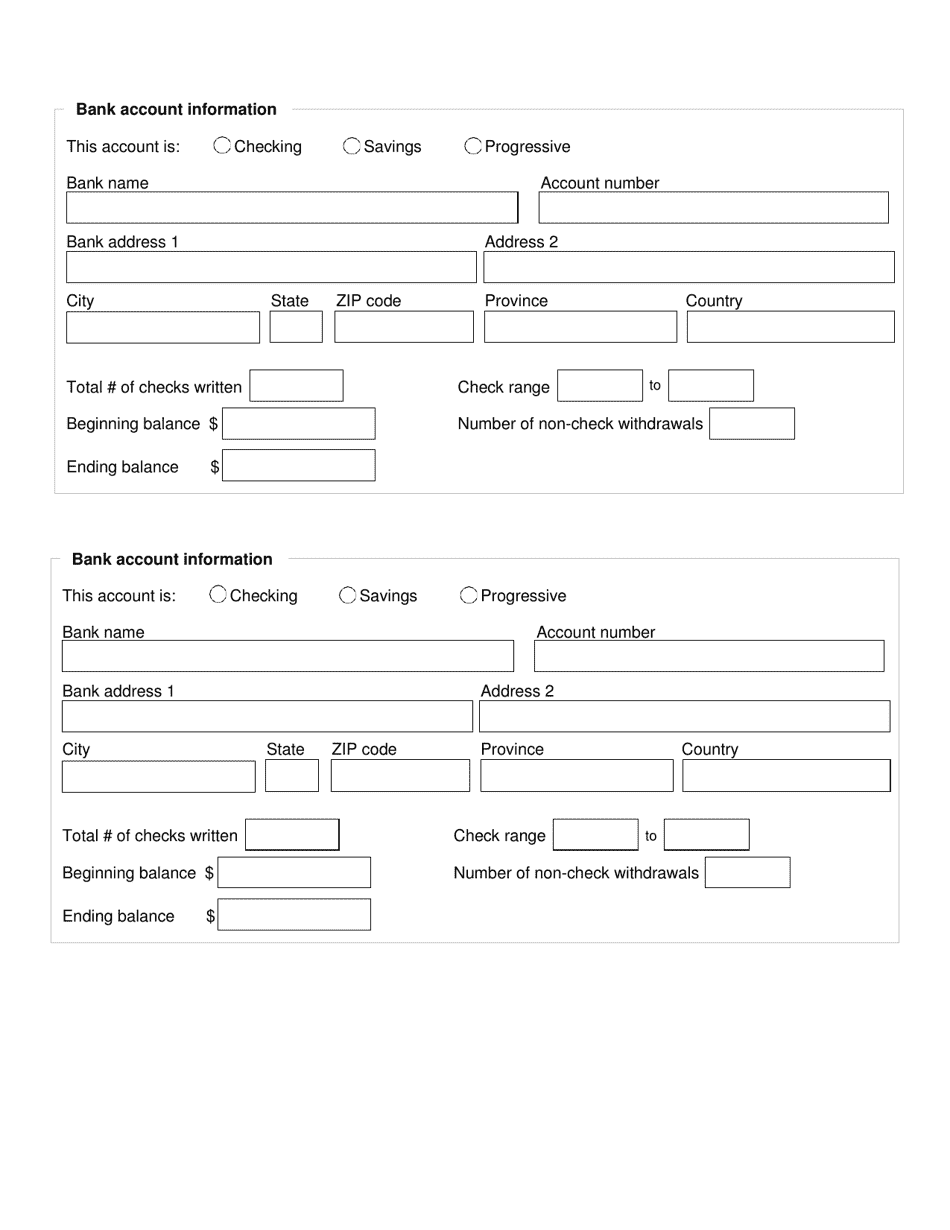

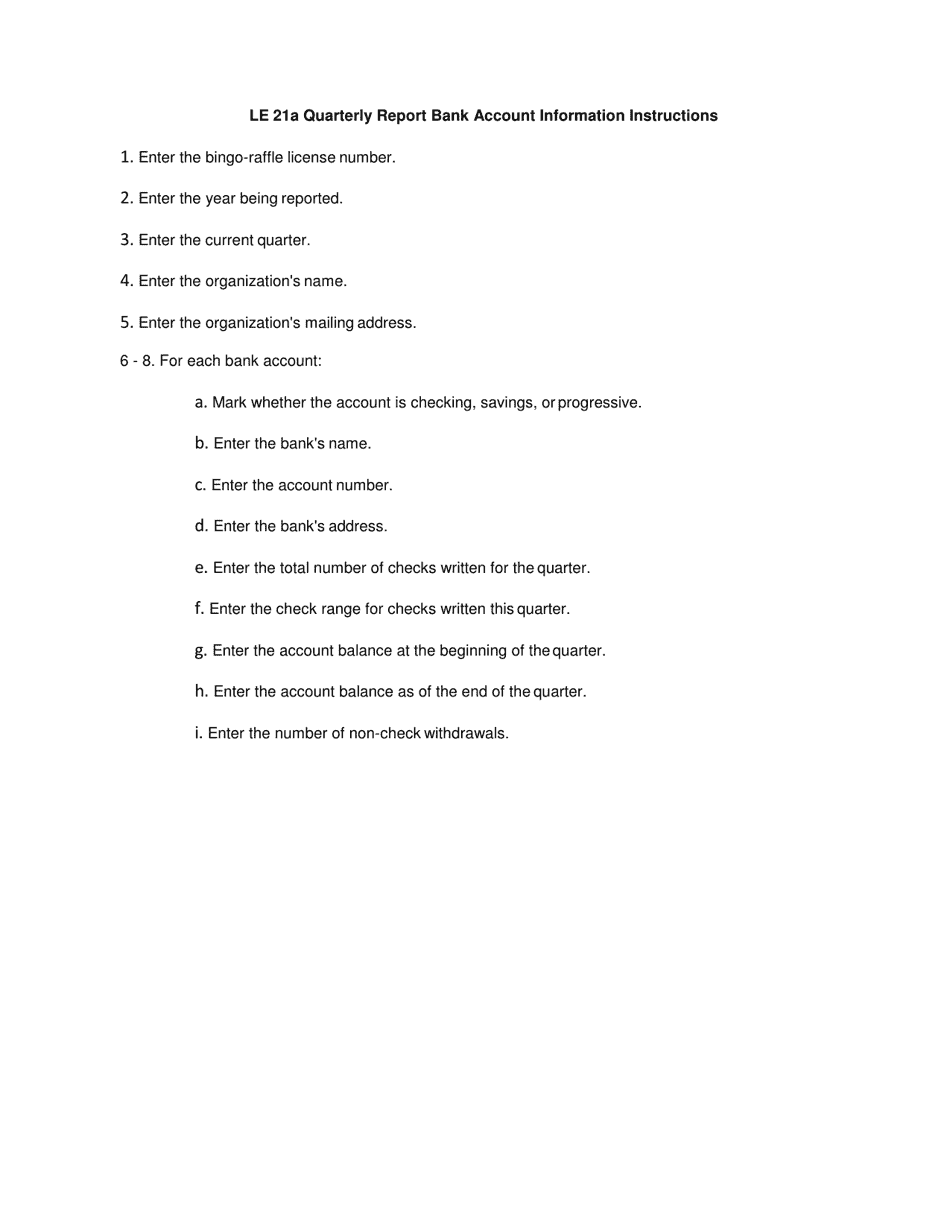

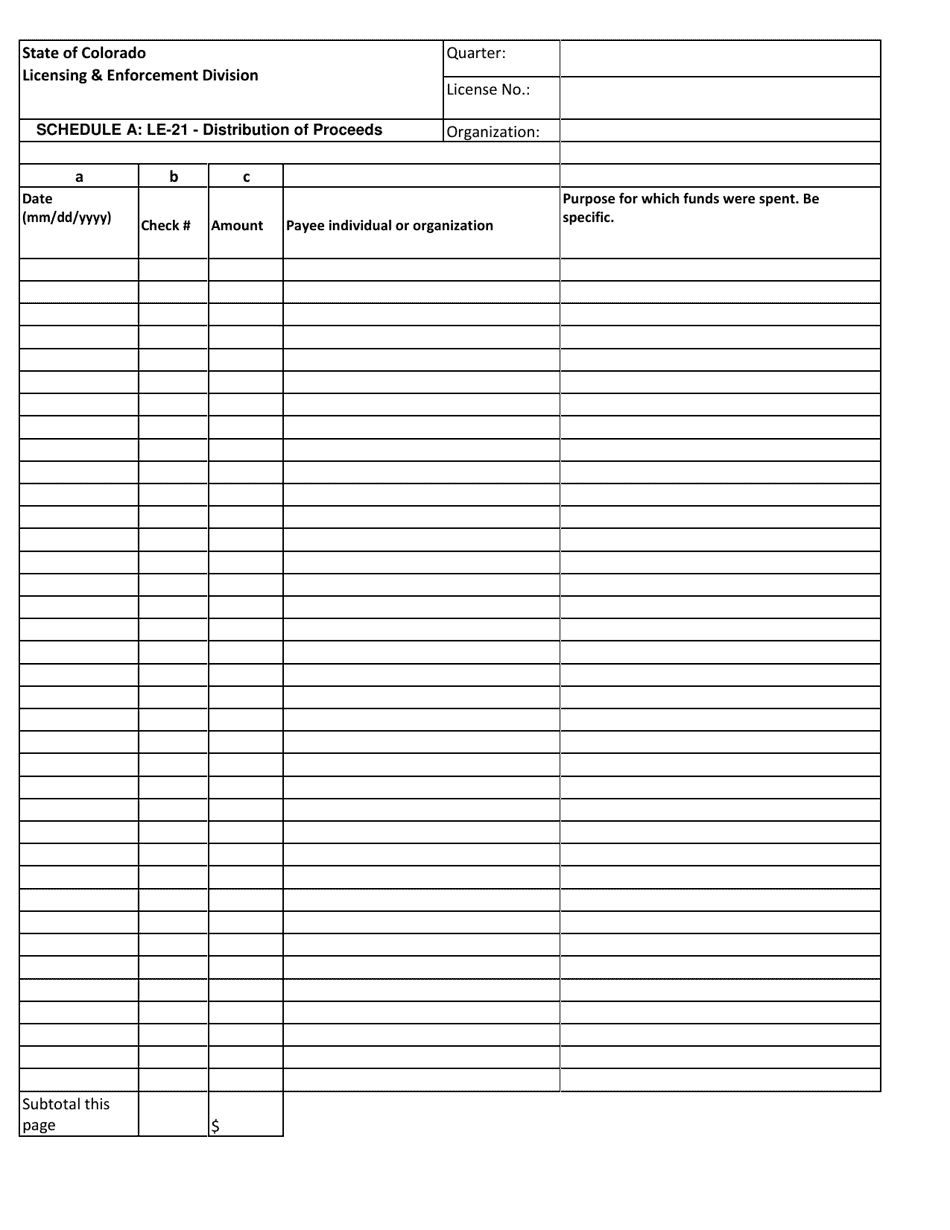

A: The purpose of filing Form LE-21 is to report the business's activities and financial information for the quarter.

Q: When is Form LE-21 due?

A: Form LE-21 is due by the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form LE-21?

A: Yes, there may be penalties for late filing of Form LE-21.

Q: What should I include in Form LE-21?

A: You should include information about your business, such as sales, purchases, and other financial data for the quarter.

Q: Do I need to file Form LE-21 if my business did not operate during the quarter?

A: If your business did not operate during the quarter, you may not need to file Form LE-21, but you should confirm with the Colorado Department of Revenue.

Q: Can I file Form LE-21 electronically?

A: Yes, you can file Form LE-21 electronically.

Q: Is Form LE-21 confidential?

A: No, Form LE-21 is not confidential and may be subject to public disclosure.

Q: What if I made a mistake on my Form LE-21?

A: If you made a mistake on your Form LE-21, you should file an amended return as soon as possible.

Q: Is there a fee for filing Form LE-21?

A: No, there is no fee for filing Form LE-21.

Q: Can I request an extension to file Form LE-21?

A: Yes, you can request an extension to file Form LE-21.

Q: How do I request an extension for Form LE-21?

A: You can request an extension for Form LE-21 by contacting the Colorado Department of Revenue.

Q: What happens if I do not file Form LE-21?

A: If you do not file Form LE-21, you may be subject to penalties and interest.

Q: Can I get assistance with completing Form LE-21?

A: Yes, you can seek assistance with completing Form LE-21 from a tax professional or the Colorado Department of Revenue.

Form Details:

- The latest edition provided by the Colorado Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LE-21 by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.