This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1237

for the current year.

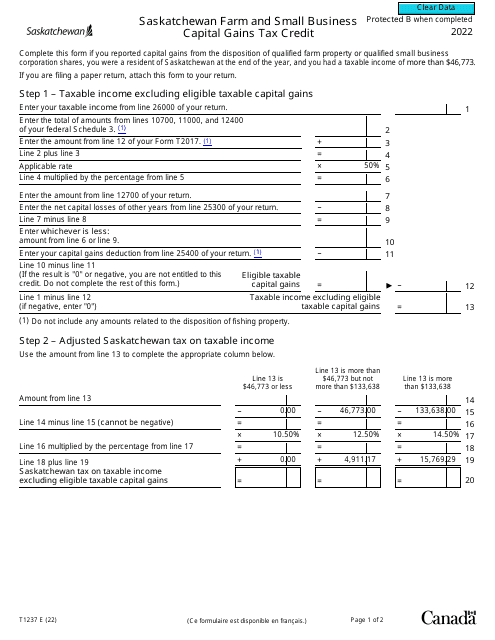

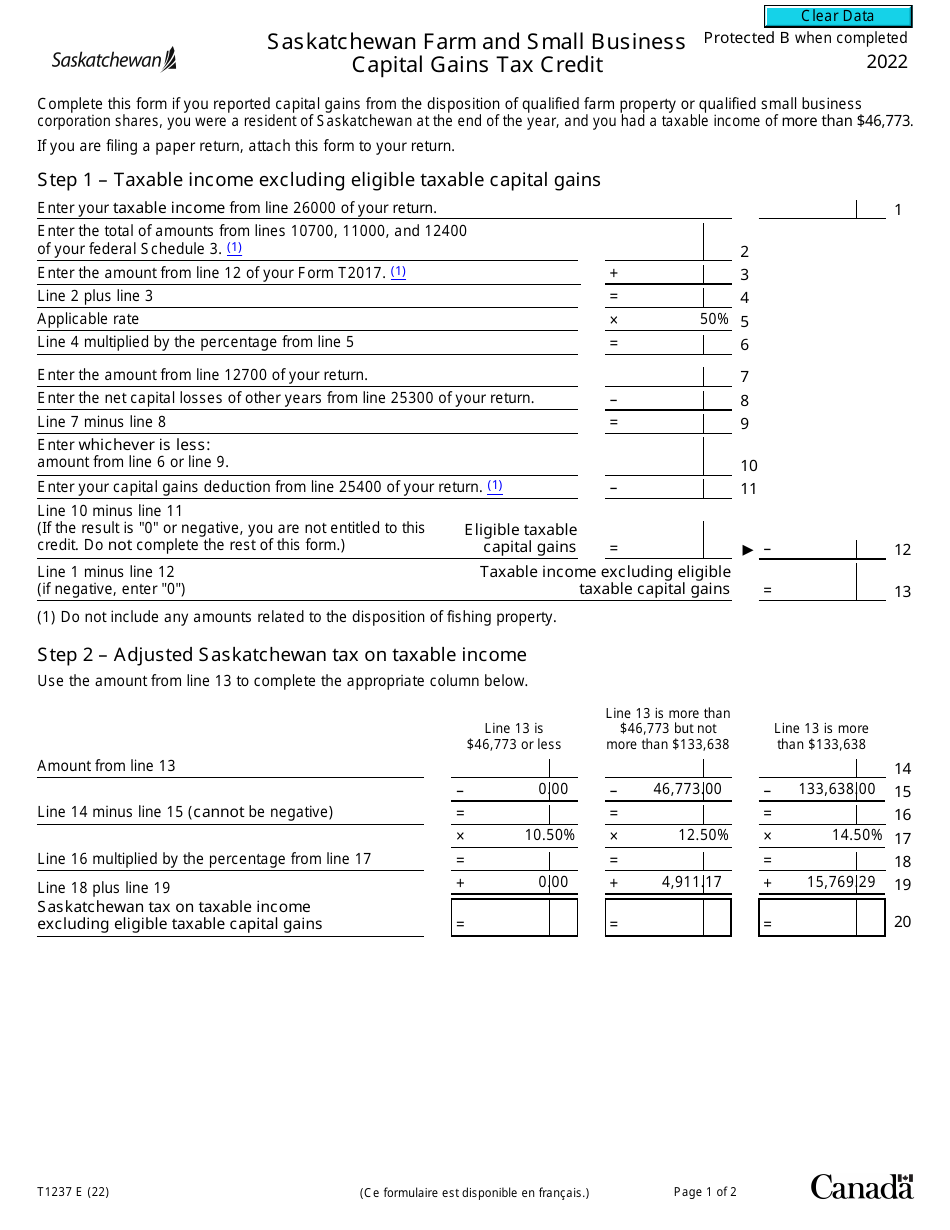

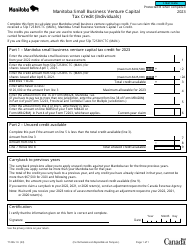

Form T1237 Saskatchewan Farm and Small Business Capital Gains Tax Credit - Canada

Form T1237 in Canada is designed specifically for residents of Saskatchewan who have a capital gains tax obligation due to the sale or disposition of qualified farm or small business property. This form allows them to claim the Saskatchewan Farm and Small Business Capital Gains Tax Credit, which might lessen their overall tax liability. It essentially provides a tax credit for eligible individuals which may serve to offset some of the taxes owed on their capital gains income.

The Form T1237 Saskatchewan Farm and Small Business Capital Gains Tax Credit in Canada is filed by individuals or corporations who earned income from the sale of a qualified farm property or shares in a Saskatchewan-based small business corporation. Qualified individuals who have disposed of property such as farmland, production quota, or fishing property may also file the form. This form isn't filed by every taxpayer, but specifically those who have these types of capital gains during the tax year.

FAQ

Q: What is Form T1237 in Canada?

A: Form T1237 in Canada is known as the Saskatchewan Farm and Small Business Capital Gains Tax Credit form. It is an official tax document that's used to calculate the amount of capital gains tax credit a Saskatchewan resident can claim. This can apply to individuals who have sold farm property or shares of a small business corporation located in Saskatchewan.

Q: Who should file Form T1237?

A: Form T1237 should be filed by residents of Saskatchewan, Canada who have sold farm land, eligible shares of a small business corporation or fishing property and wish to claim a capital gains tax credit. Also, individuals who have inherited such properties and sold them might be eligible.

Q: How can I claim the Saskatchewan Farm and Small Business Capital Gains Tax Credit?

A: You can claim the Saskatchewan Farm and Small Business Capital Gains Tax Credit by filling out and submitting Form T1237 with your annual tax return. This form will require information about the property or shares you sold, the capital gains you made, and any capital gains deductions you're claiming.

Q: Is there a deadline to file Form T1237?

A: Yes, Form T1237 must be filed by the yearly deadline for submitting tax returns in Canada. This is typically on or before April 30th of the year following the year in which the capital gain was realized.

Q: Can I use Form T1237 if I am not a resident of Saskatchewan?

A: No, you cannot use Form T1237 if you are not a resident of Saskatchewan. This tax form is specifically designed for Saskatchewan residents who have sold farm property or shares of a small business corporation located in the province.