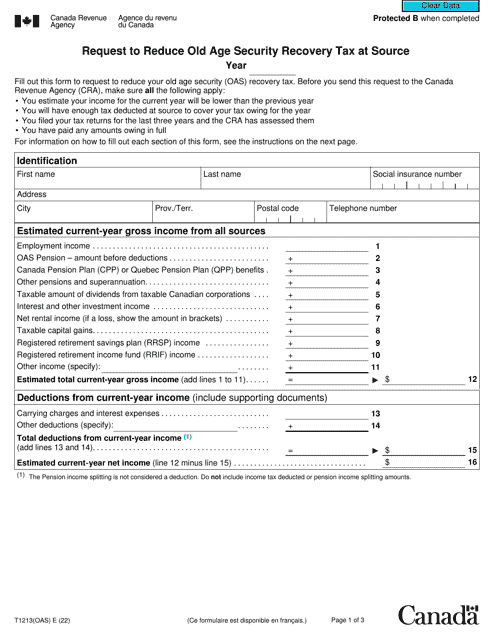

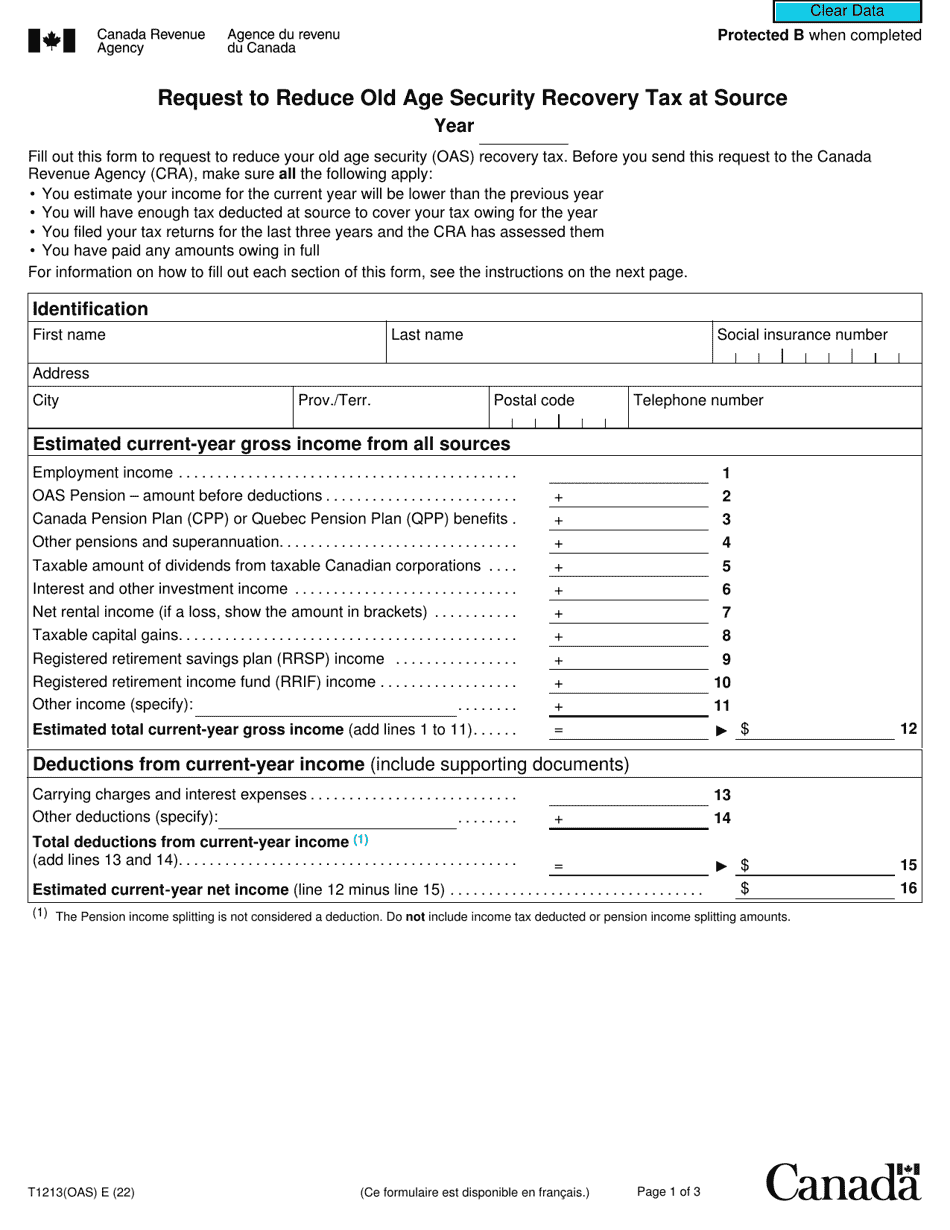

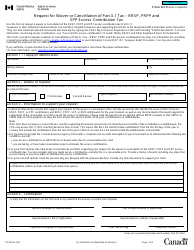

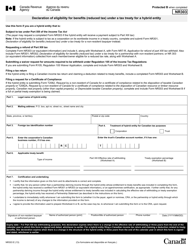

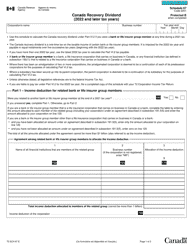

Form T1213OAS Request to Reduce Old Age Security Recovery Tax at Source - Canada

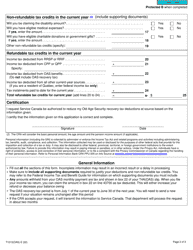

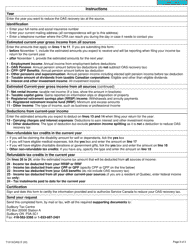

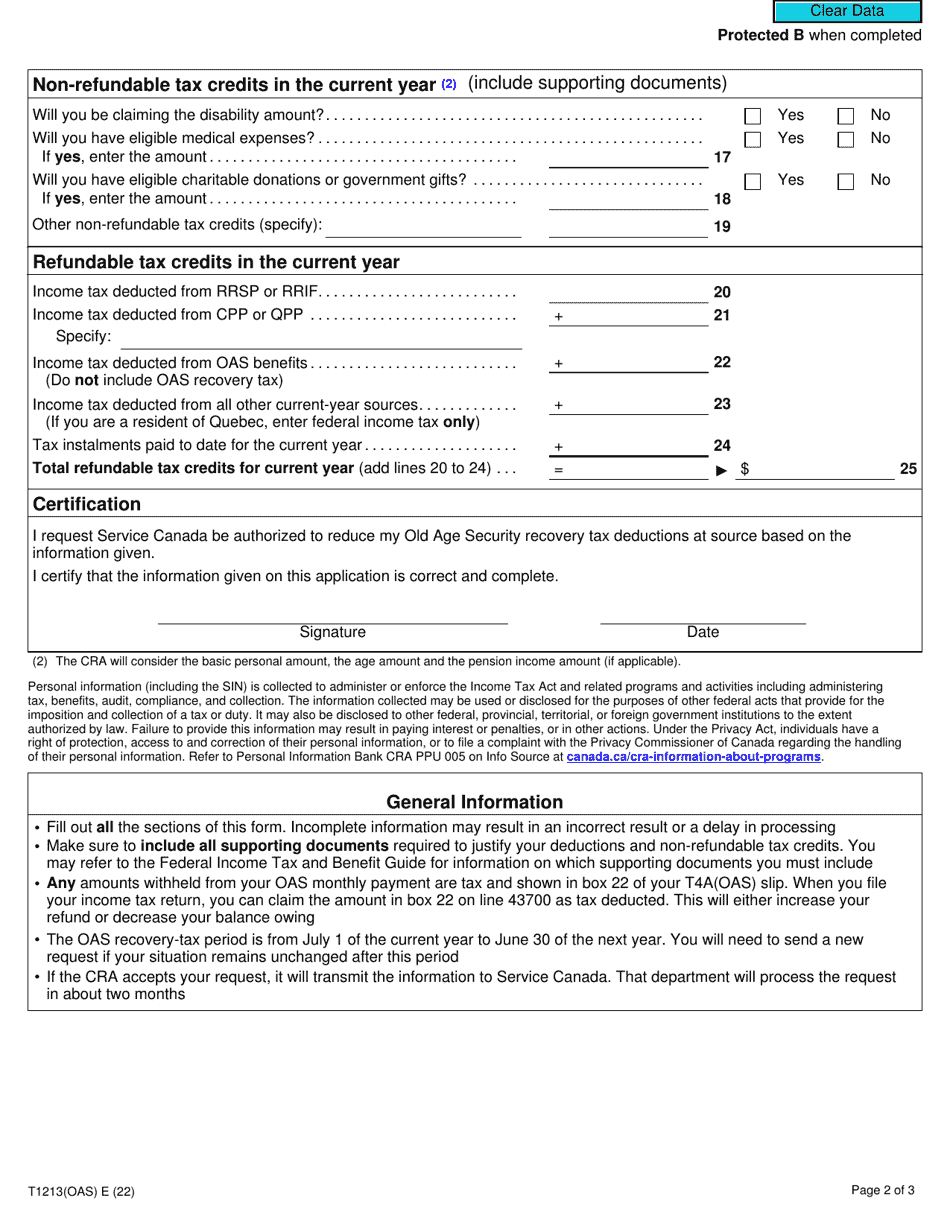

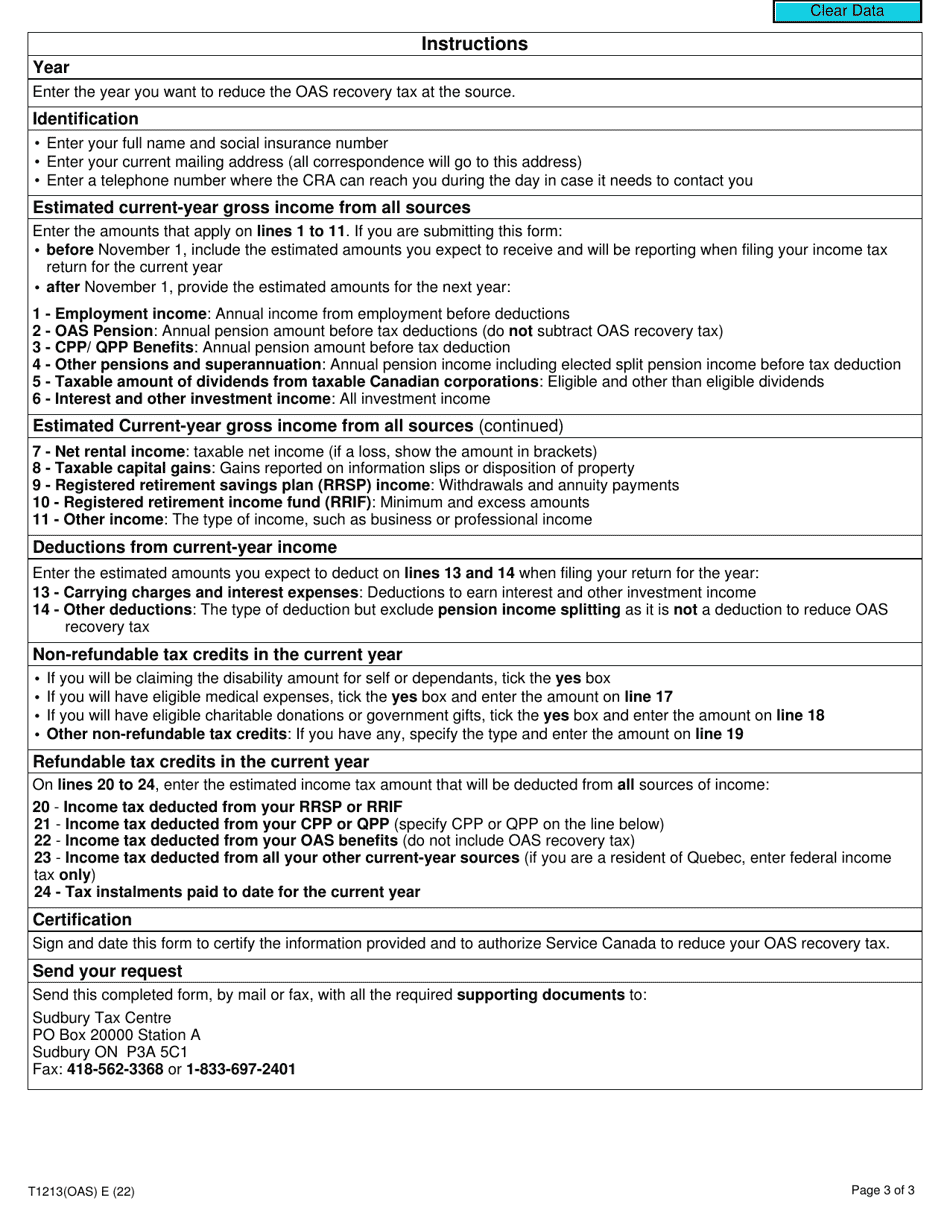

Form T1213OAS, Request to Reduce Old Age Security Recovery Tax at Source, in Canada is used to request a reduction in the amount of Old Age Security (OAS) recovery tax that is deducted from your monthly OAS pension payments. The purpose of this form is to determine if you are eligible for a reduction in the tax withheld at source, based on your financial situation. It helps ensure that you are not overpaying income tax on your OAS payments.

The Form T1213OAS is filed by individuals who wish to request a reduction in the Old Age Security Recovery Tax at source in Canada.

FAQ

Q: What is Form T1213OAS?

A: Form T1213OAS is a request form for Canadian residents to reduce the Old Age Security recovery tax at source.

Q: Who can use Form T1213OAS?

A: Canadian residents who are eligible for Old Age Security and have an income above a certain threshold can use this form.

Q: What is the purpose of Form T1213OAS?

A: The purpose of this form is to request a reduction in the amount of Old Age Security recovery tax that is deducted at source from your monthly payments.

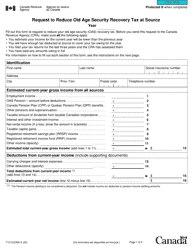

Q: What information do I need to provide on Form T1213OAS?

A: You will need to provide your personal information, income details, and reasons for the request.