This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1170

for the current year.

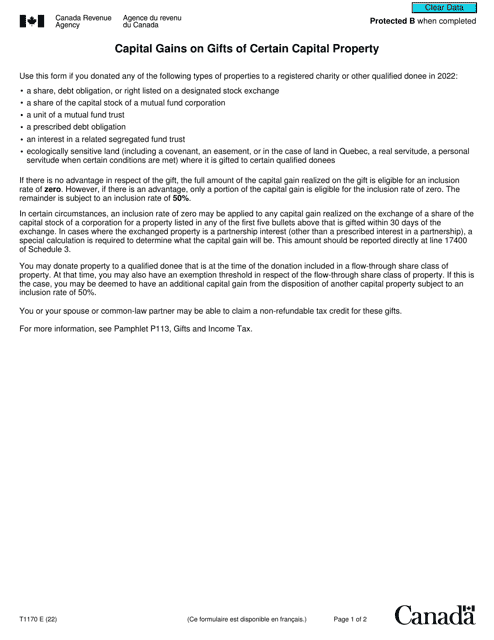

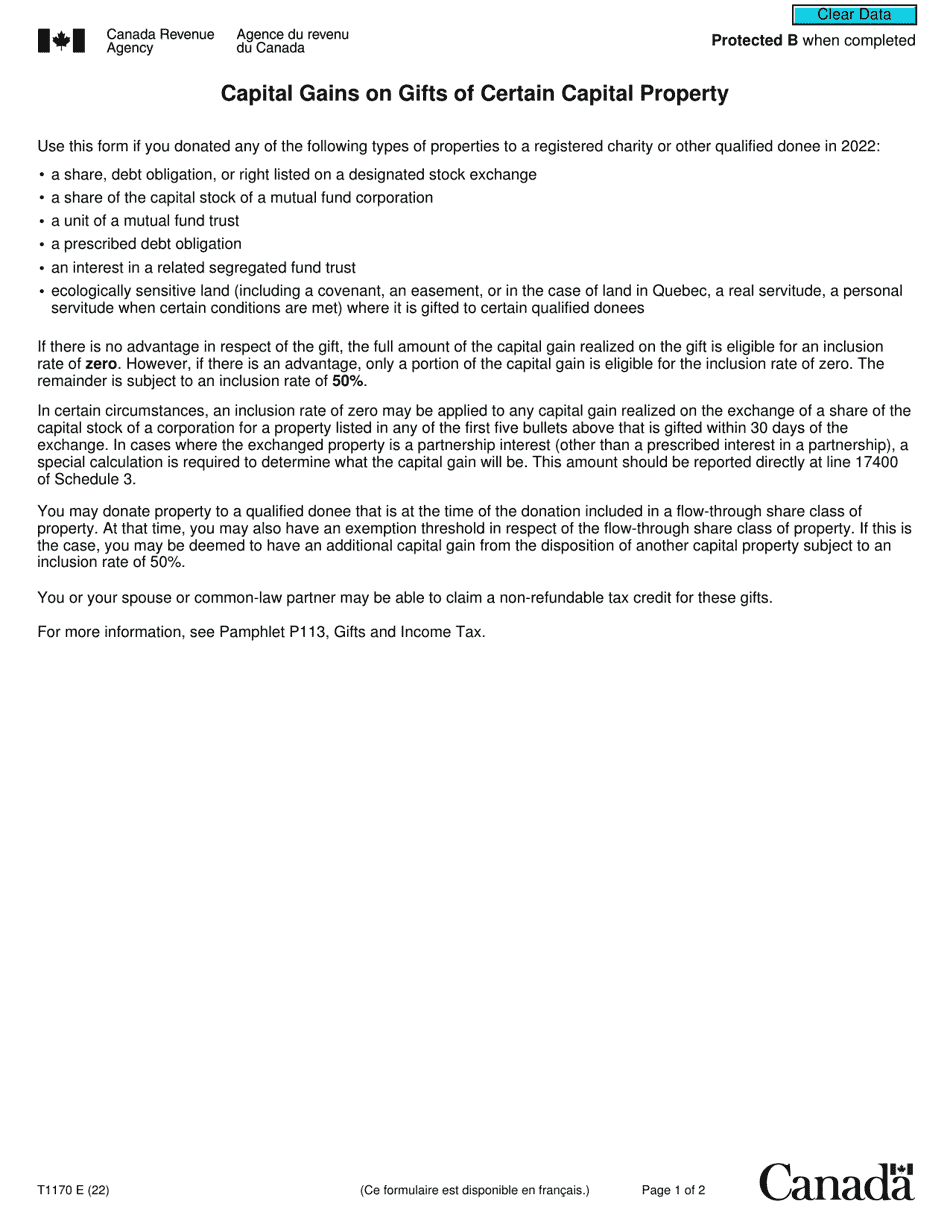

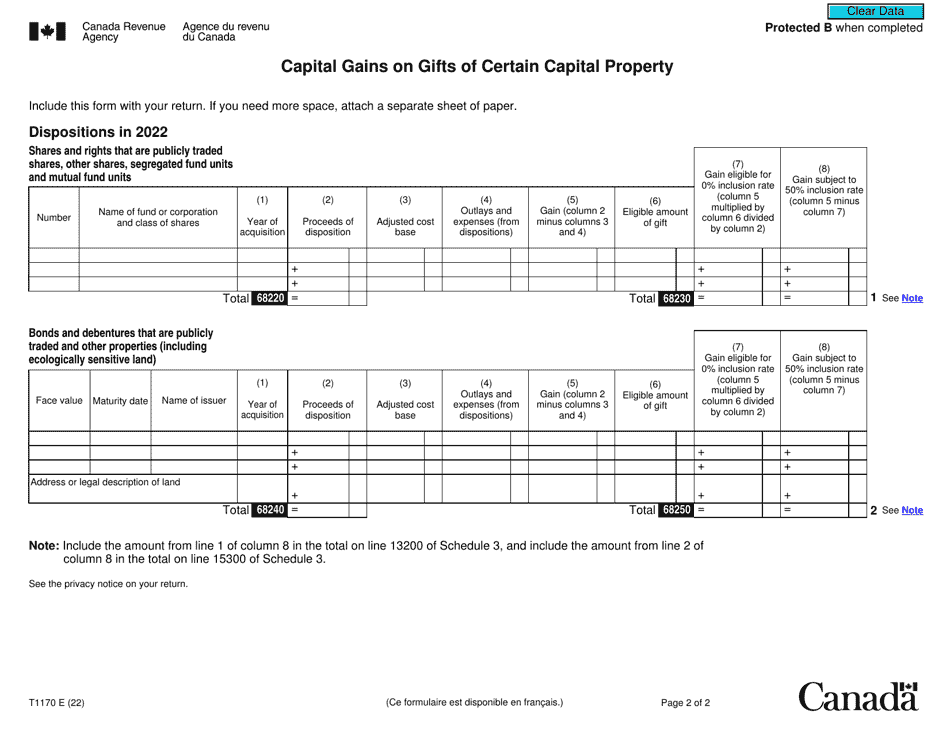

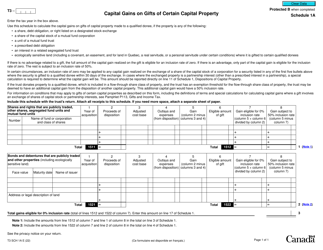

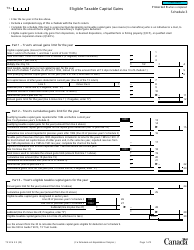

Form T1170 Capital Gains on Gifts of Certain Capital Property - Canada

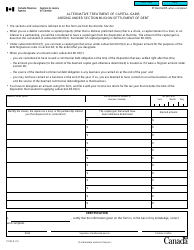

Form T1170 Capital Gains on Gifts of Certain Capital Property in Canada is used to report any capital gains or losses resulting from the gifting of certain types of capital property. This form is required to be filed by individuals who have gifted capital property with an accrued capital gain to a qualified donee, and wish to claim a deduction for the capital gain realized.

The individual who gave the gift files the Form T1170 Capital Gains on Gifts of Certain Capital Property in Canada.

FAQ

Q: What is Form T1170?

A: Form T1170 is a tax form used in Canada to report capital gains on gifts of certain capital property.

Q: Who should use Form T1170?

A: This form should be used by individuals in Canada who have gifted certain capital property and need to report capital gains.

Q: What is capital property?

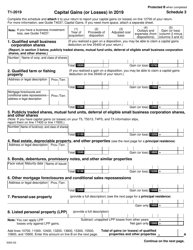

A: Capital property refers to assets such as real estate, stocks, and bonds that are held for investment purposes.

Q: What is a capital gain?

A: A capital gain is the profit made from selling or disposing of a capital asset.

Q: When is Form T1170 due?

A: Form T1170 is generally due on your tax return filing deadline, which is April 30th for most individuals in Canada.

Q: Are gifts of certain capital property taxable?

A: Yes, gifts of certain capital property may be subject to capital gains tax in Canada.

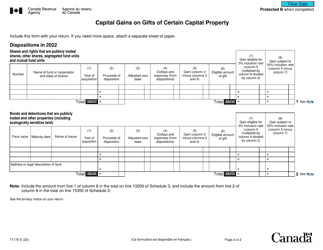

Q: What information is required on Form T1170?

A: Form T1170 requires information about the gifted property, the cost base and fair market value of the property, and the resulting capital gain.

Q: Can I claim a tax deduction for gifts of certain capital property?

A: No, you cannot claim a tax deduction for gifts of certain capital property in Canada.

Q: Do I need to include supporting documentation with Form T1170?

A: Yes, you may need to include supporting documentation such as an appraisal or valuation of the gifted property.