This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 5

for the current year.

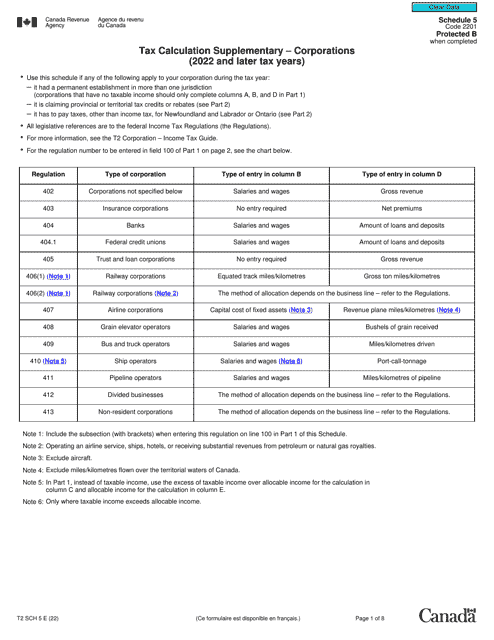

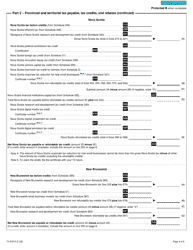

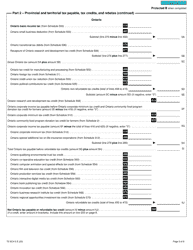

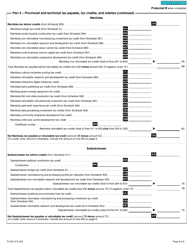

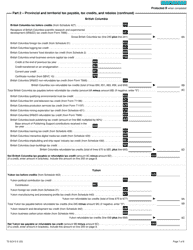

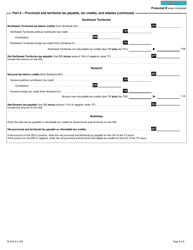

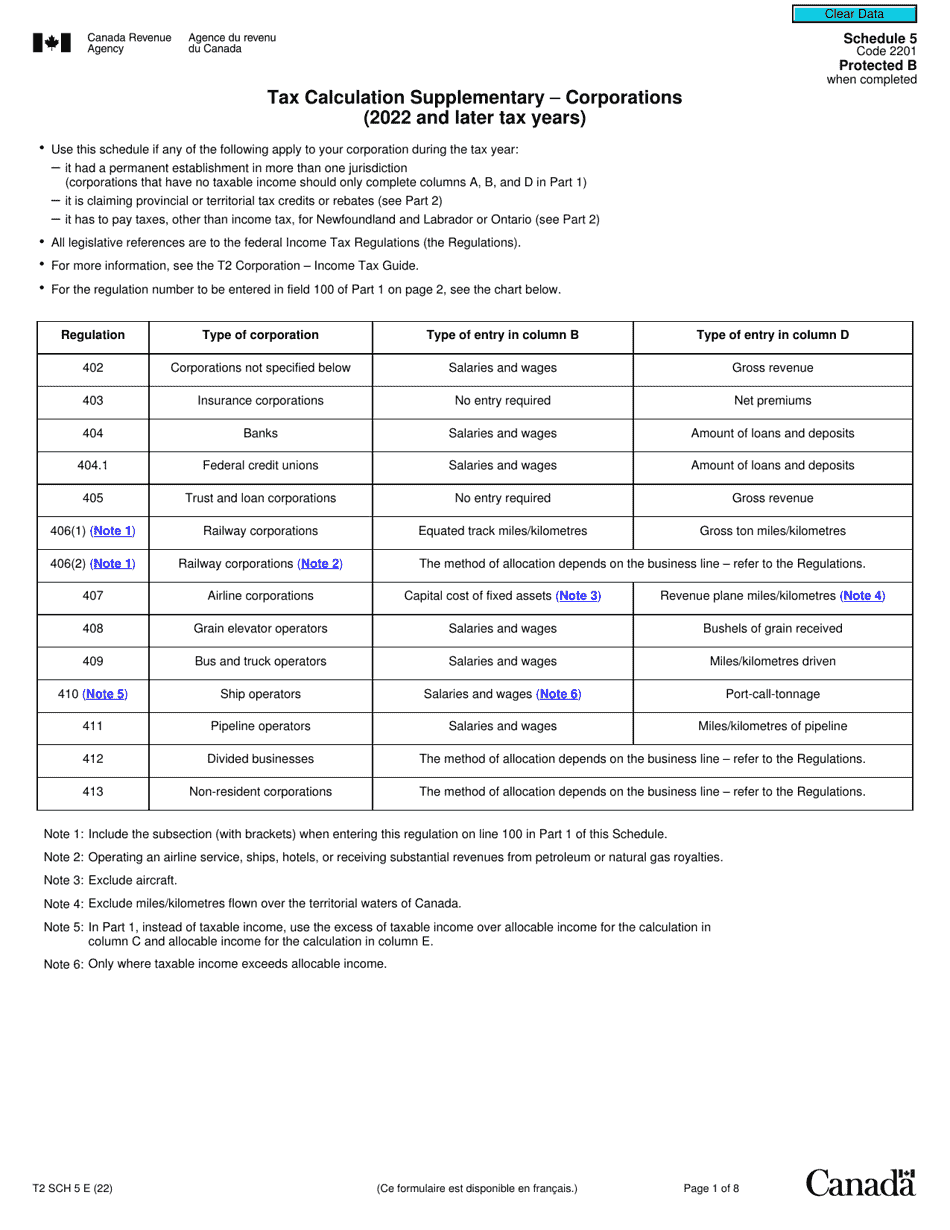

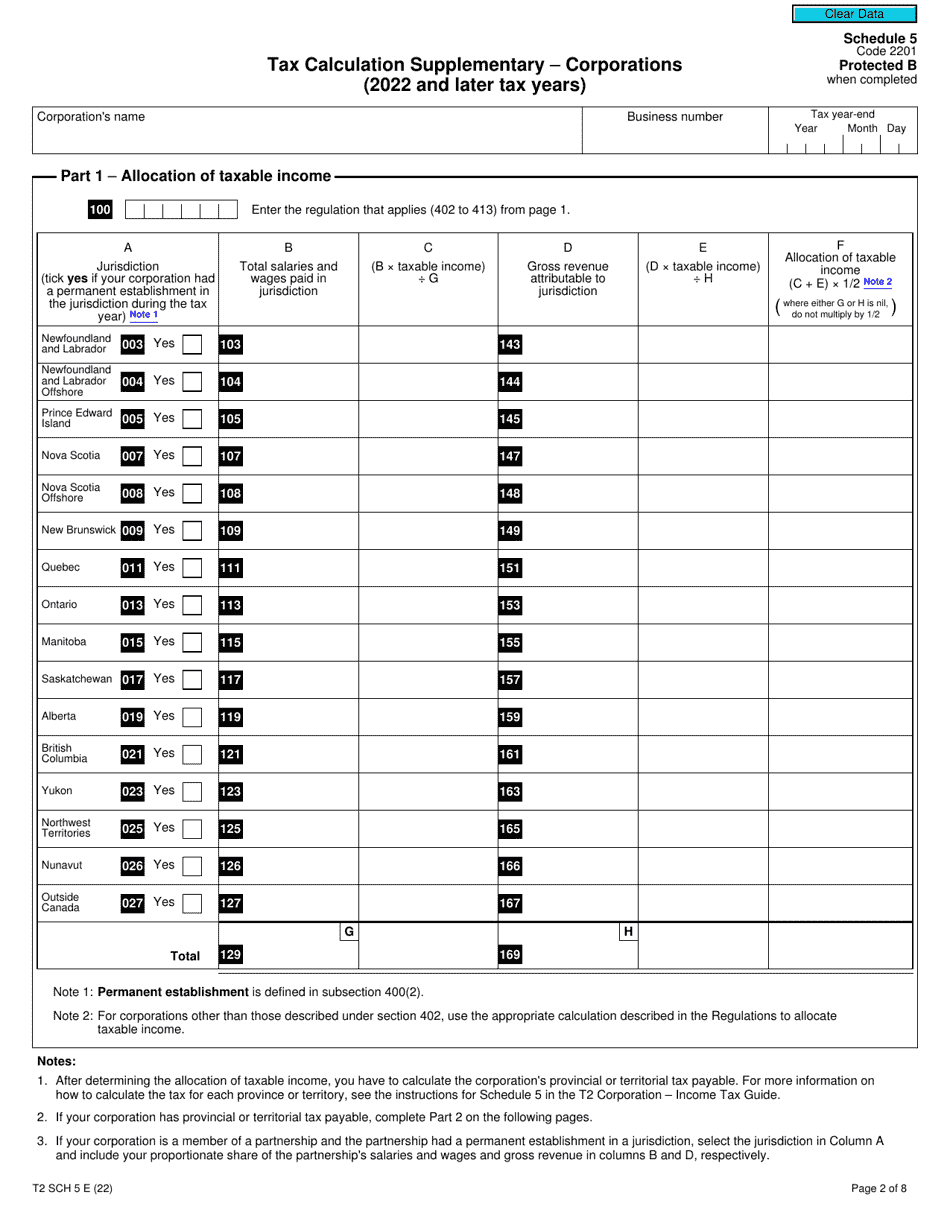

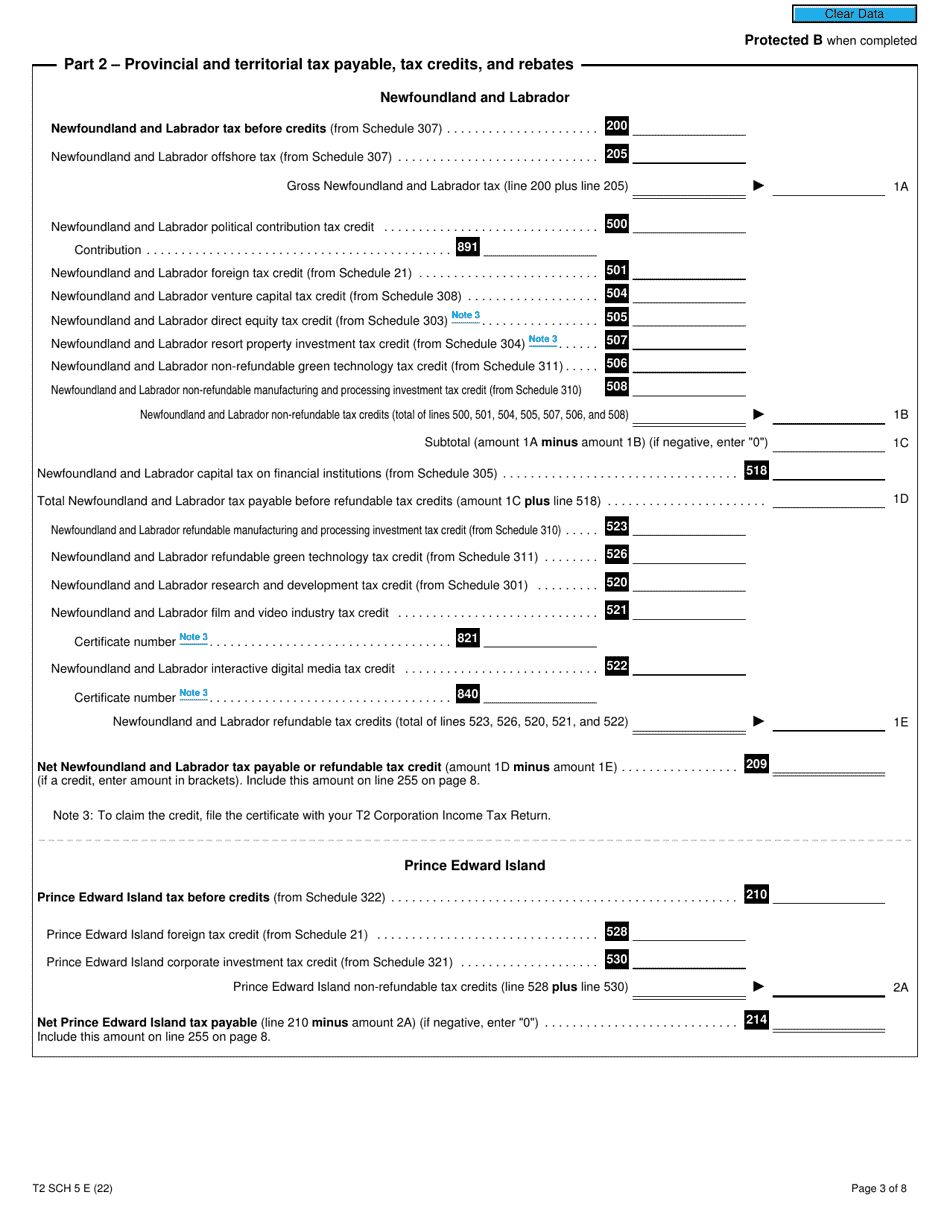

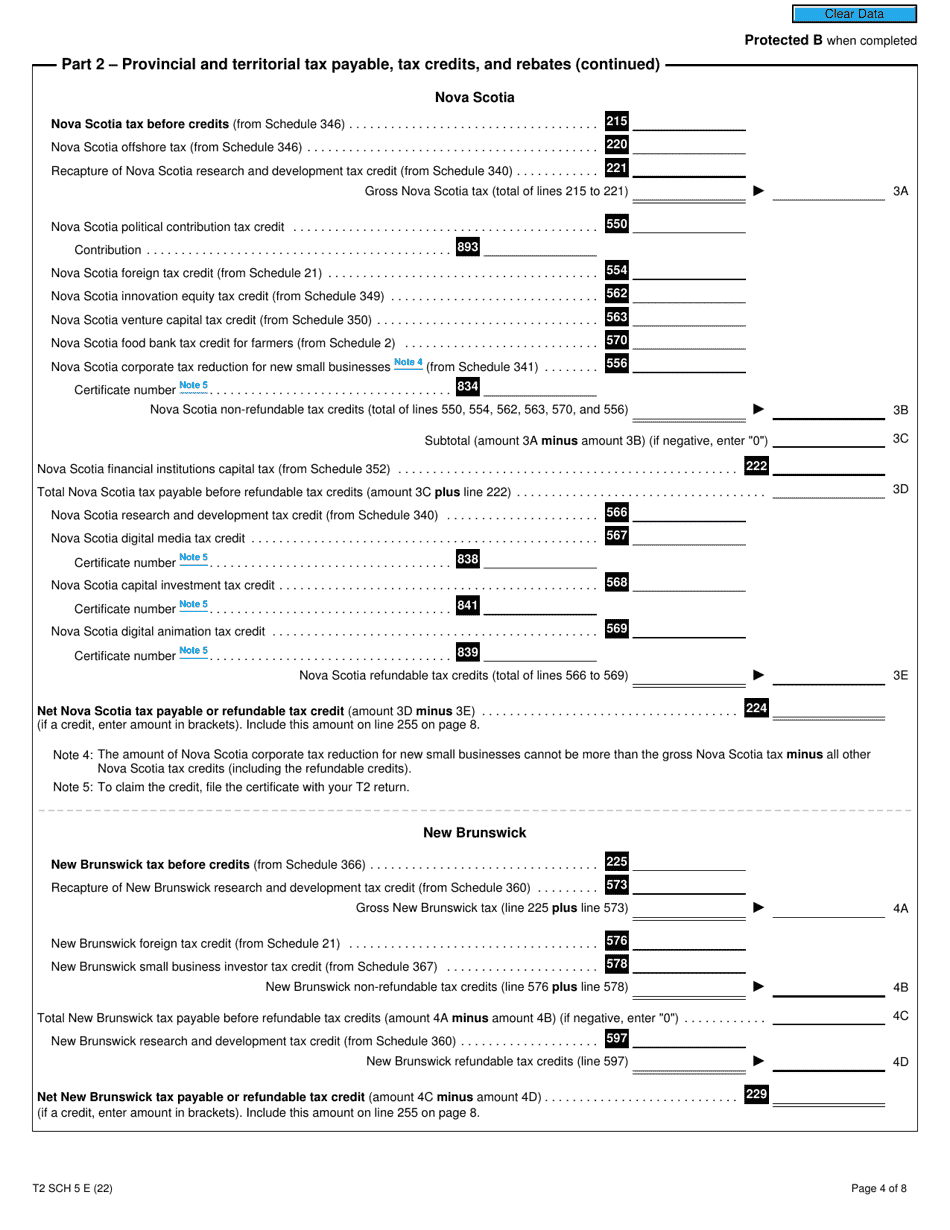

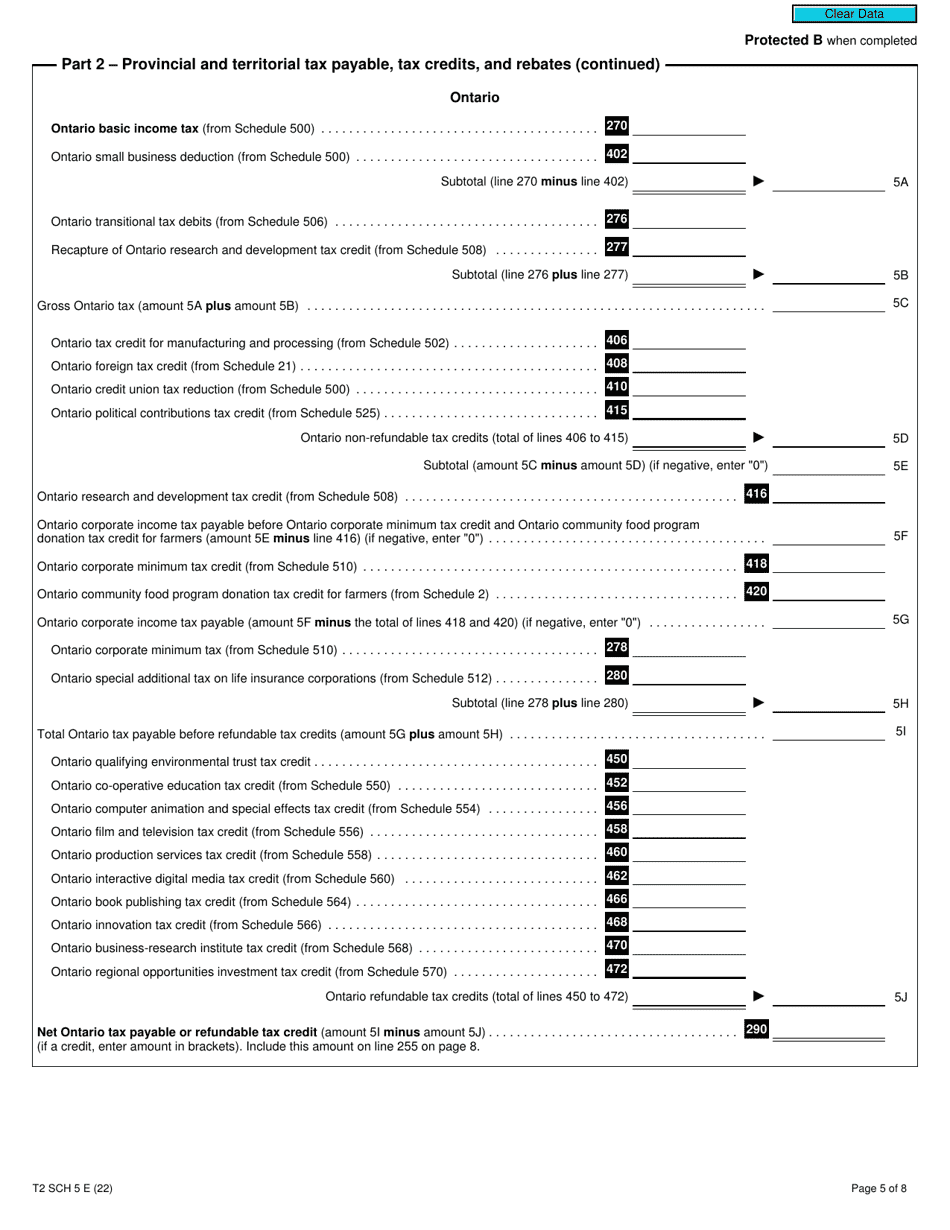

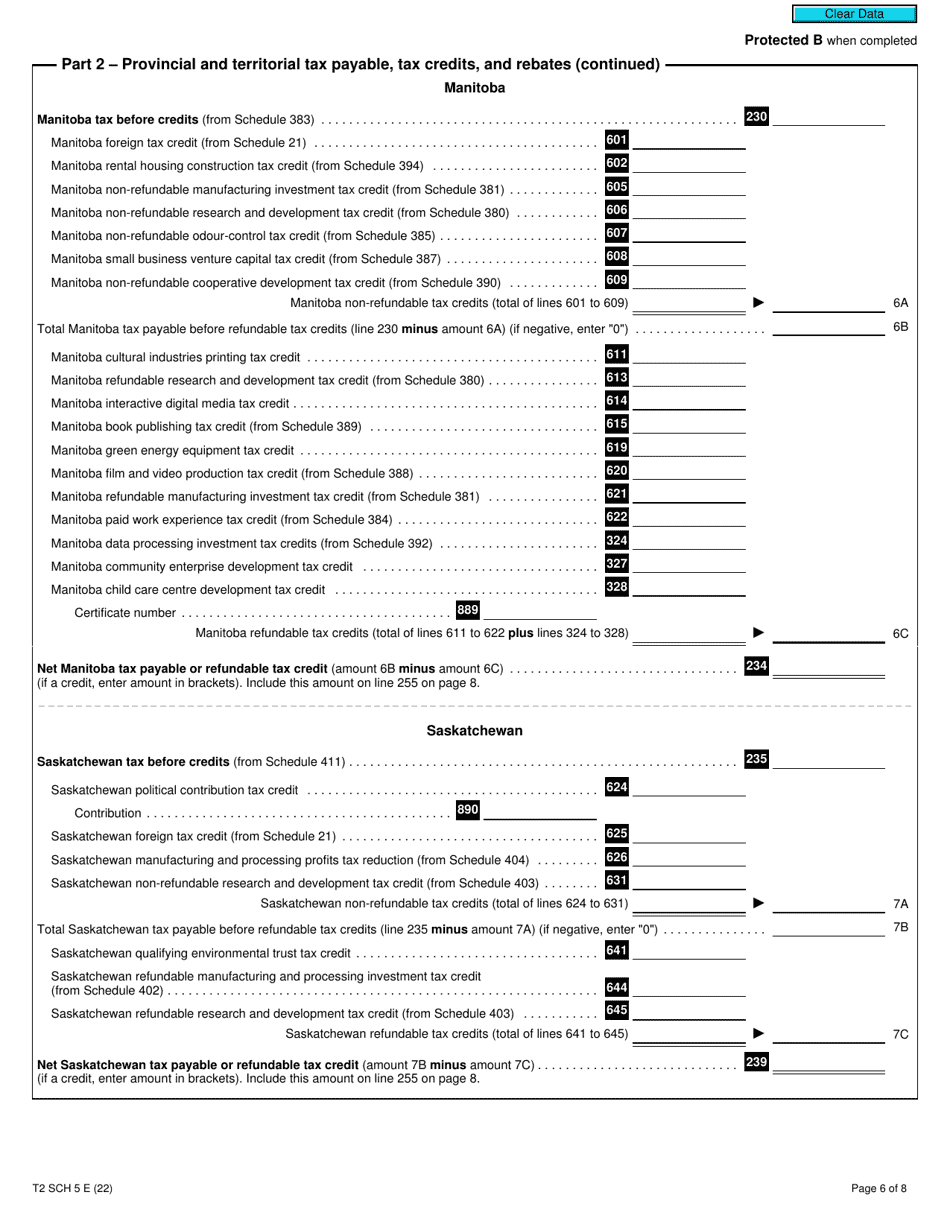

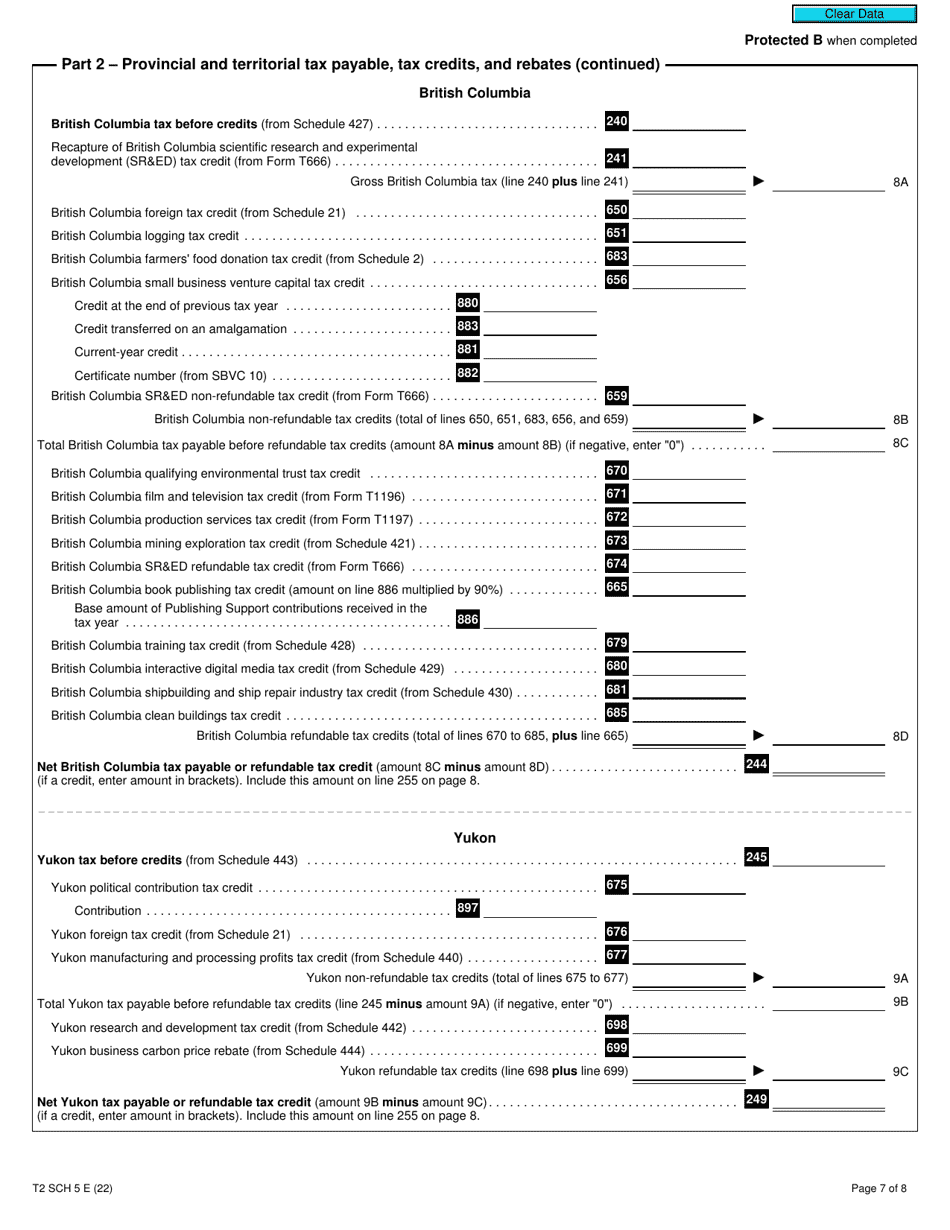

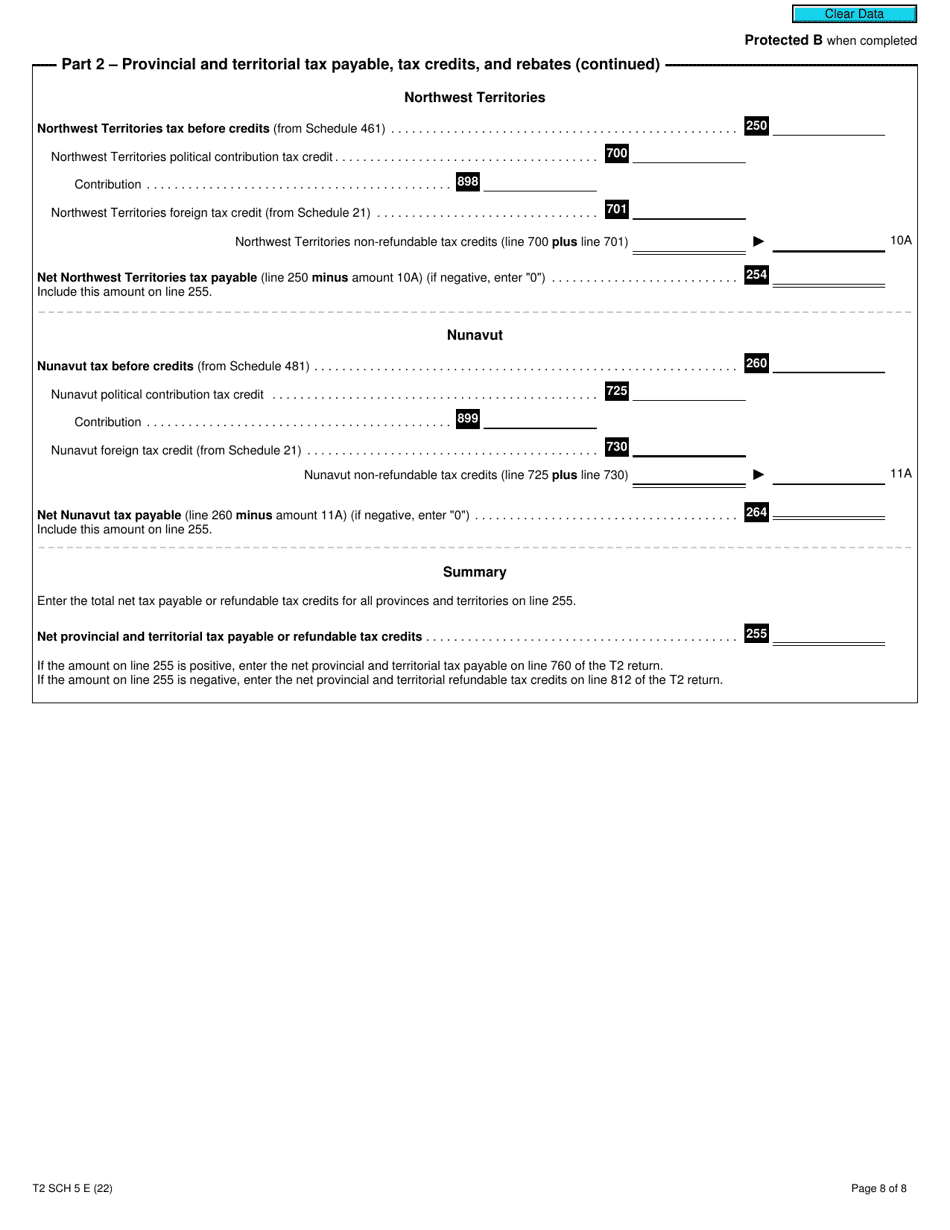

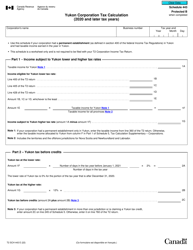

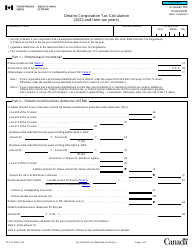

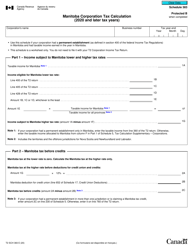

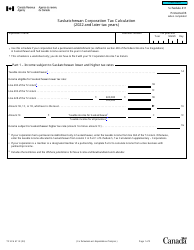

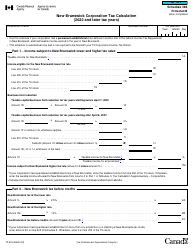

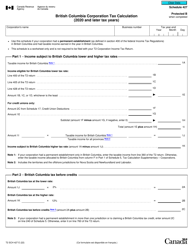

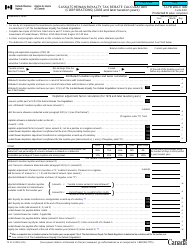

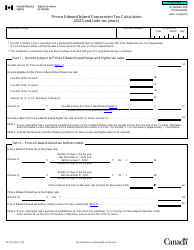

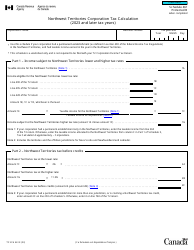

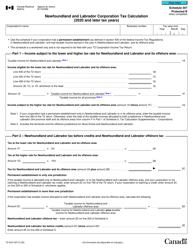

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2022 and Later Tax Years) - Canada

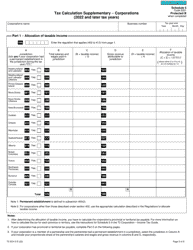

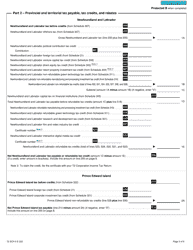

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2022 and Later Tax Years) in Canada is used to calculate the income tax payable by corporations. It provides a detailed breakdown of various tax calculations and adjustments required to determine the final tax liability.

The Form T2 Schedule 5 Tax Calculation Supplementary for corporations in Canada is filed by the corporation itself.

FAQ

Q: What is Form T2 Schedule 5?

A: Form T2 Schedule 5 is a tax calculation supplementary form used by corporations in Canada for tax years 2022 and later.

Q: Who needs to fill out Form T2 Schedule 5?

A: Corporations in Canada with tax years 2022 and later need to fill out Form T2 Schedule 5.

Q: What is the purpose of Form T2 Schedule 5?

A: The purpose of Form T2 Schedule 5 is to calculate various tax amounts and credits for corporations.

Q: What information is required on Form T2 Schedule 5?

A: Form T2 Schedule 5 requires information related to taxable income, federal and provincial tax rates, and various tax credits and deductions.

Q: When is Form T2 Schedule 5 due?

A: Form T2 Schedule 5 is due with the corporation's T2 corporate income tax return, which is generally due within six months after the end of the tax year.