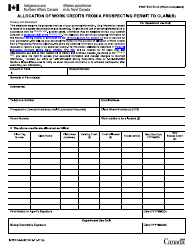

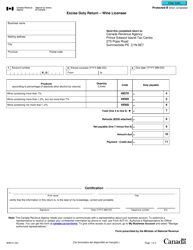

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC634

for the current year.

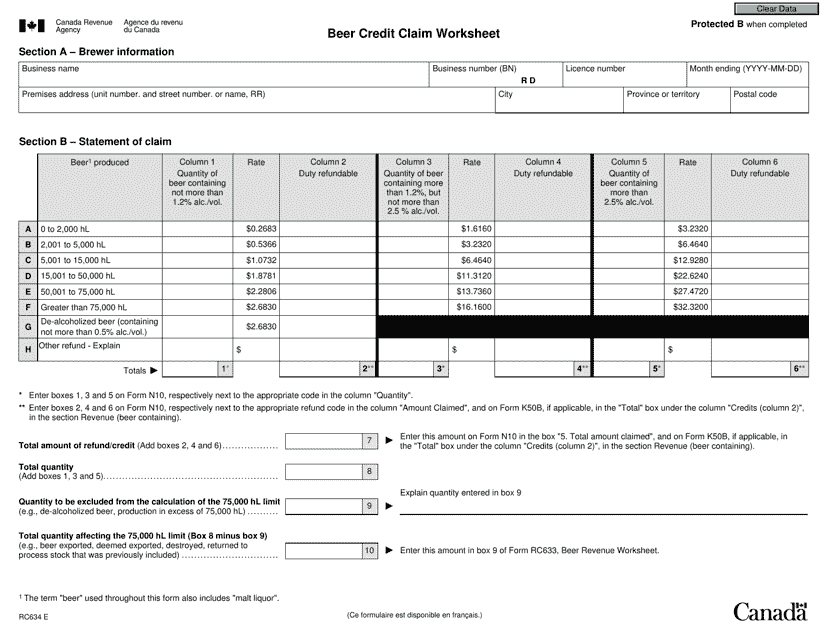

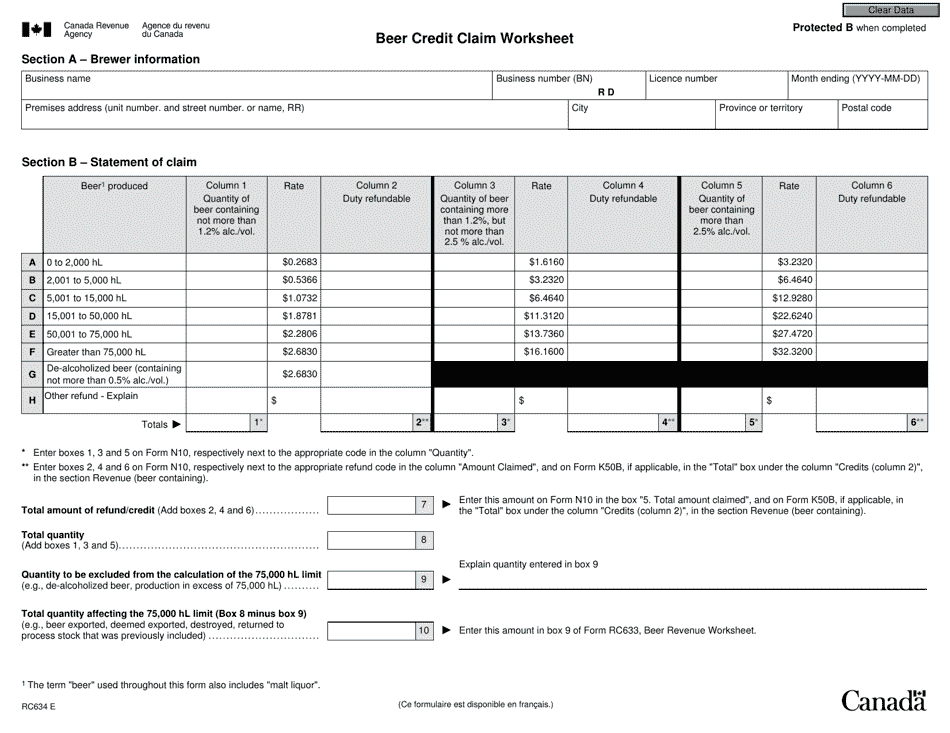

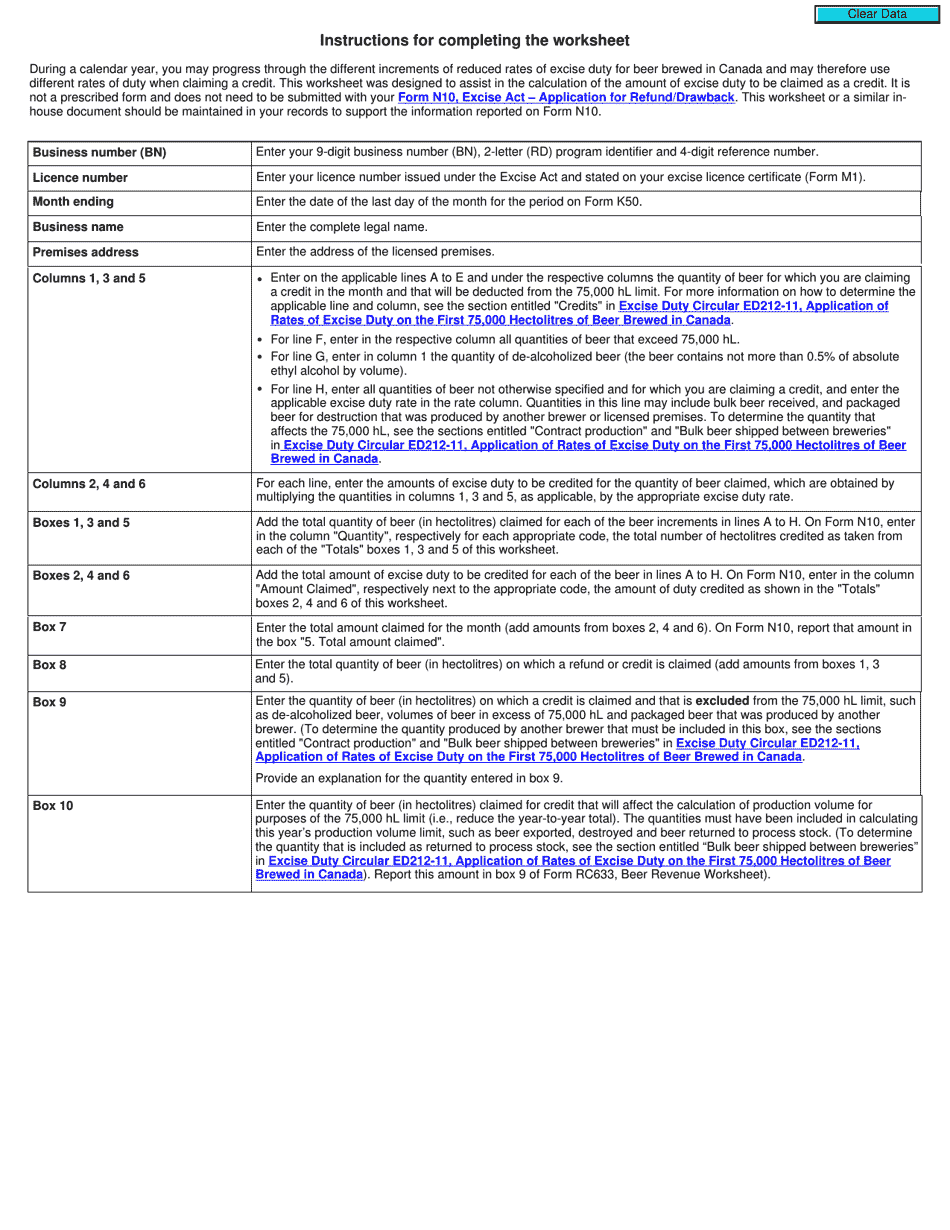

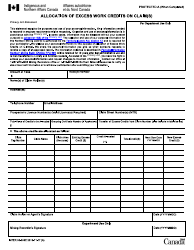

Form RC634 Beer Credit Claim Worksheet - Canada

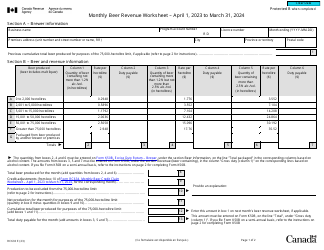

The Form RC634 Beer Credit Claim Worksheet in Canada is used by individuals or businesses in the beer manufacturing industry to calculate and claim the beer credit they are eligible for. This credit helps offset the excise duty paid on beer that is sold in Canada.

The Form RC634 Beer Credit Claim Worksheet in Canada is filed by breweries and brew pubs that are eligible to claim the beer tax credit.

FAQ

Q: What is Form RC634?

A: Form RC634 is the Beer Credit Claim Worksheet used in Canada.

Q: Who needs to use Form RC634?

A: Individuals or corporations who are eligible for the beer credit in Canada need to use Form RC634.

Q: What is the purpose of Form RC634?

A: The purpose of Form RC634 is to calculate and claim the beer credit in Canada.

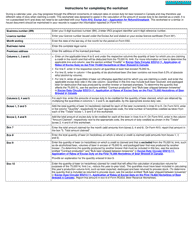

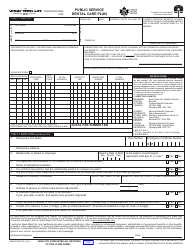

Q: What information do I need to complete Form RC634?

A: To complete Form RC634, you will need information related to your beer production and sales, as well as any other relevant supporting documentation.

Q: When is Form RC634 due?

A: The due date for submitting Form RC634 depends on your reporting period. Please refer to the instructions provided with the form or consult the CRA for specific due dates.

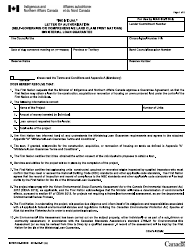

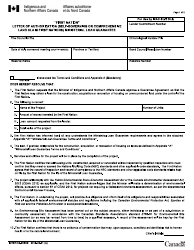

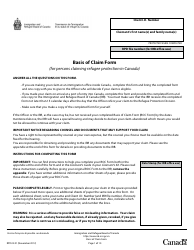

Q: What should I do after completing Form RC634?

A: After completing Form RC634, you should attach it to your income tax return or file it separately as instructed by the CRA.

Q: Are there any penalties for not filing Form RC634?

A: Yes, there may be penalties for not filing Form RC634 or for filing it late. It is important to comply with the CRA's requirements and meet the specified deadlines.

Q: What if I need help completing Form RC634?

A: If you need assistance completing Form RC634, you can consult the instructions provided with the form or seek professional advice from a tax preparer or accountant.

Q: Is Form RC634 only for beer producers?

A: No, Form RC634 is not only for beer producers. It is used by individuals or corporations eligible for the beer credit, which may include beer producers as well as other eligible entities.

Q: Can I claim the beer credit without using Form RC634?

A: No, in order to claim the beer credit in Canada, you must use Form RC634 as specified by the Canada Revenue Agency (CRA).