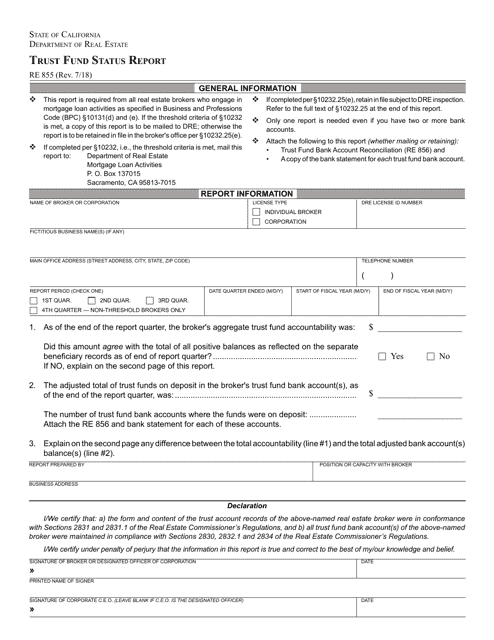

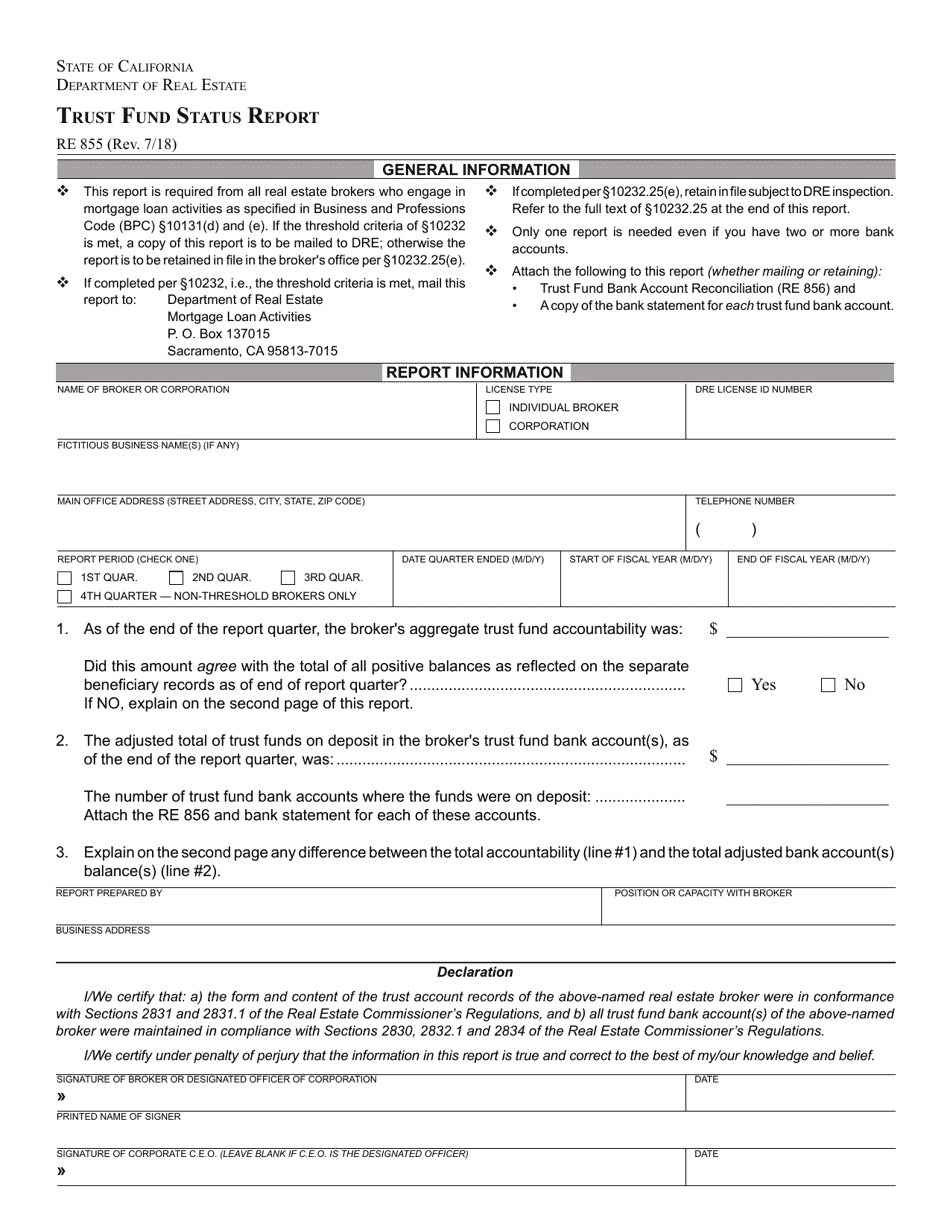

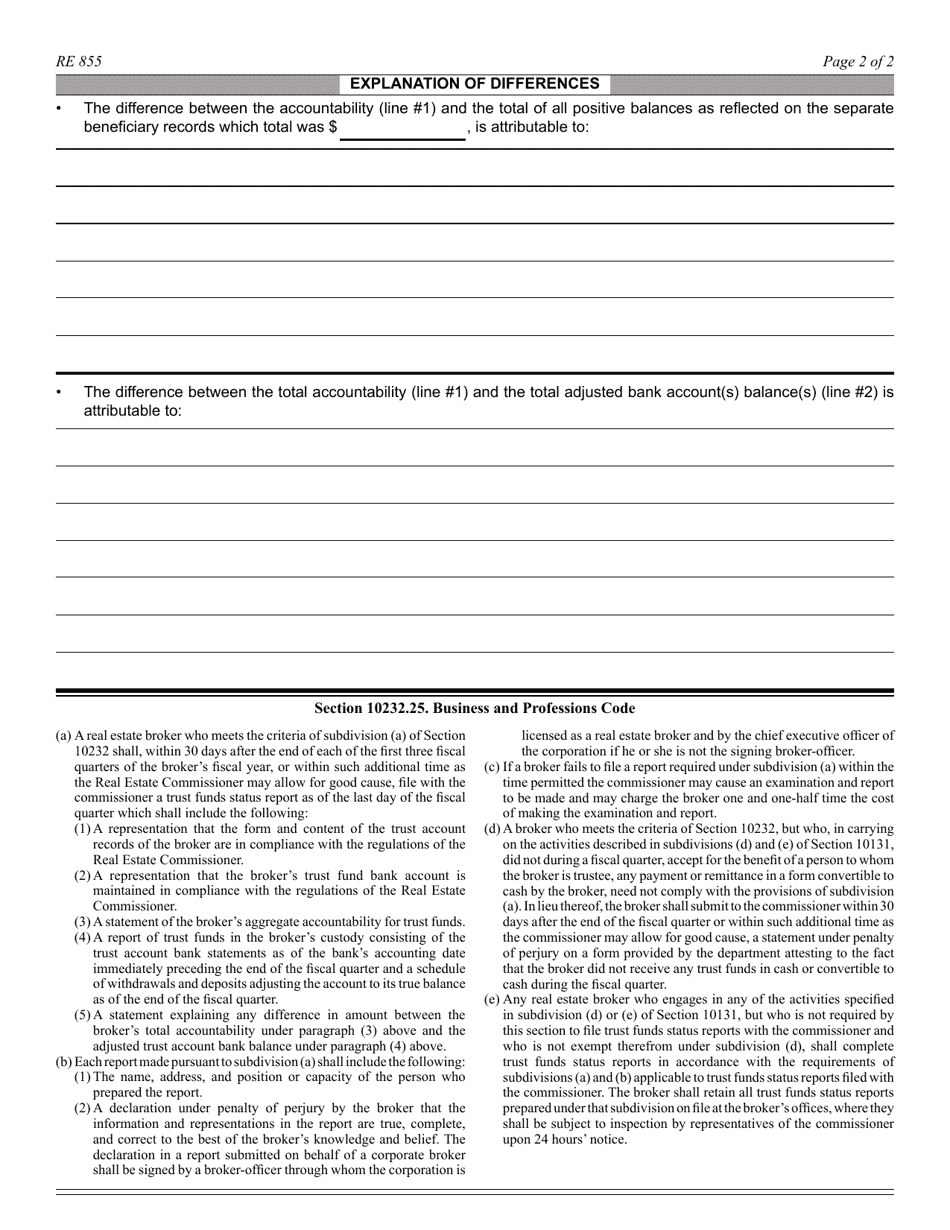

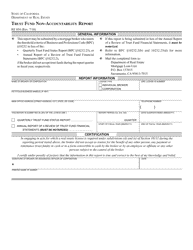

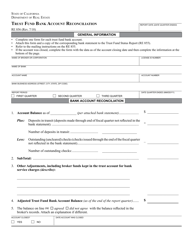

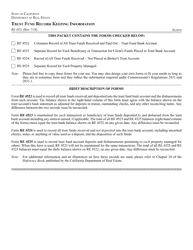

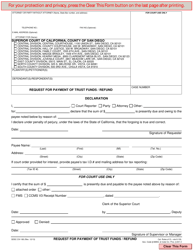

Form RE855 Trust Fund Status Report - California

What Is Form RE855?

This is a legal form that was released by the California Department of Real Estate - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RE855?

A: Form RE855 is a Trust Fund Status Report specific to the state of California.

Q: Who needs to file Form RE855?

A: Any entity that operates a trust fund subject to the laws of California needs to file Form RE855.

Q: What is the purpose of filing Form RE855?

A: The purpose of filing Form RE855 is to provide information about the status of the trust fund.

Q: When is Form RE855 due?

A: Form RE855 is typically due on a yearly basis, with specific deadlines set by the California state authorities.

Q: Is there a fee for filing Form RE855?

A: There may be a fee associated with filing Form RE855, depending on the regulations set by the California state authorities.

Q: Are there any penalties for late filing of Form RE855?

A: Yes, there may be penalties for late filing of Form RE855, as determined by the California state authorities.

Q: What information is required on Form RE855?

A: Form RE855 requires information such as the name and address of the trust fund, information about the trustee, and details about the assets and liabilities of the trust fund.

Q: Who should I contact for more information about Form RE855?

A: For more information about Form RE855, you should contact the California state authorities or seek guidance from a tax professional or attorney.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the California Department of Real Estate;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RE855 by clicking the link below or browse more documents and templates provided by the California Department of Real Estate.