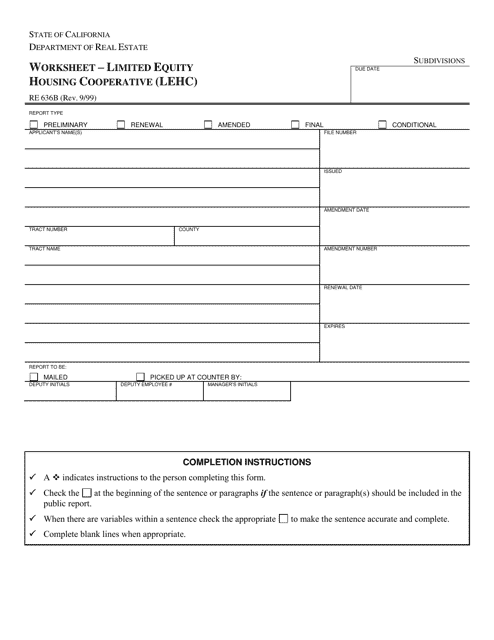

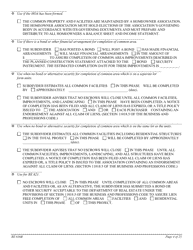

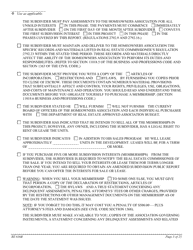

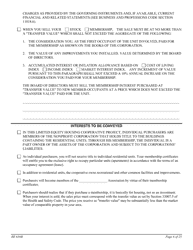

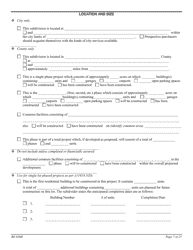

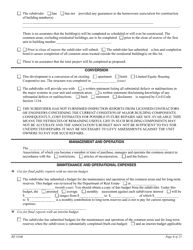

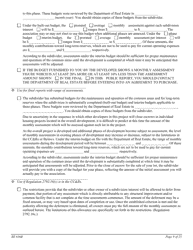

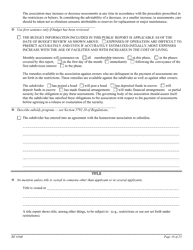

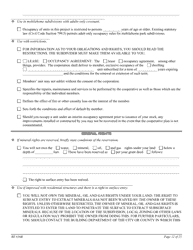

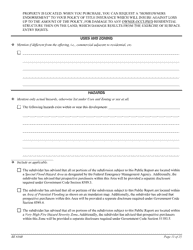

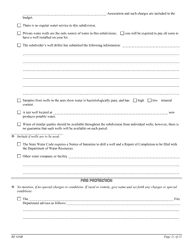

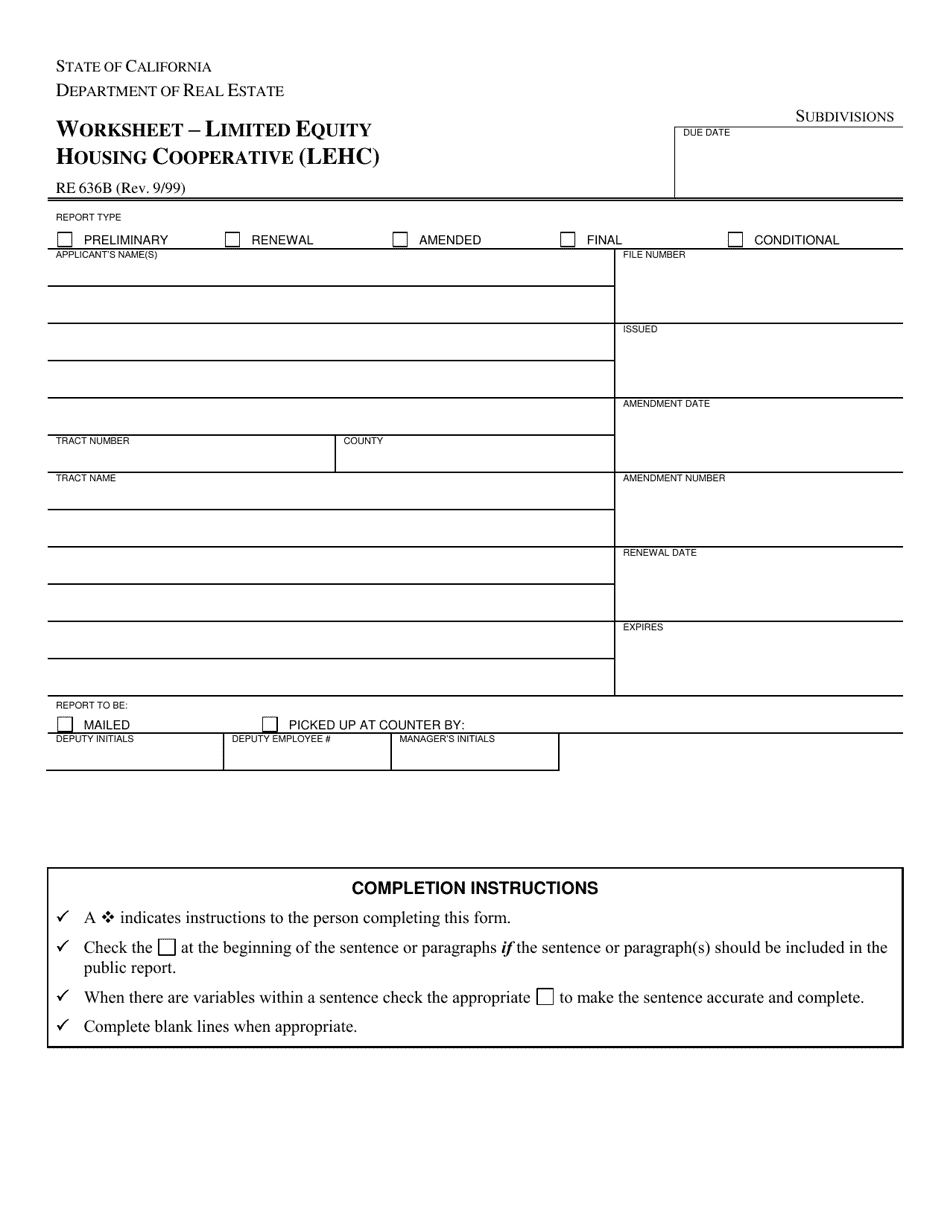

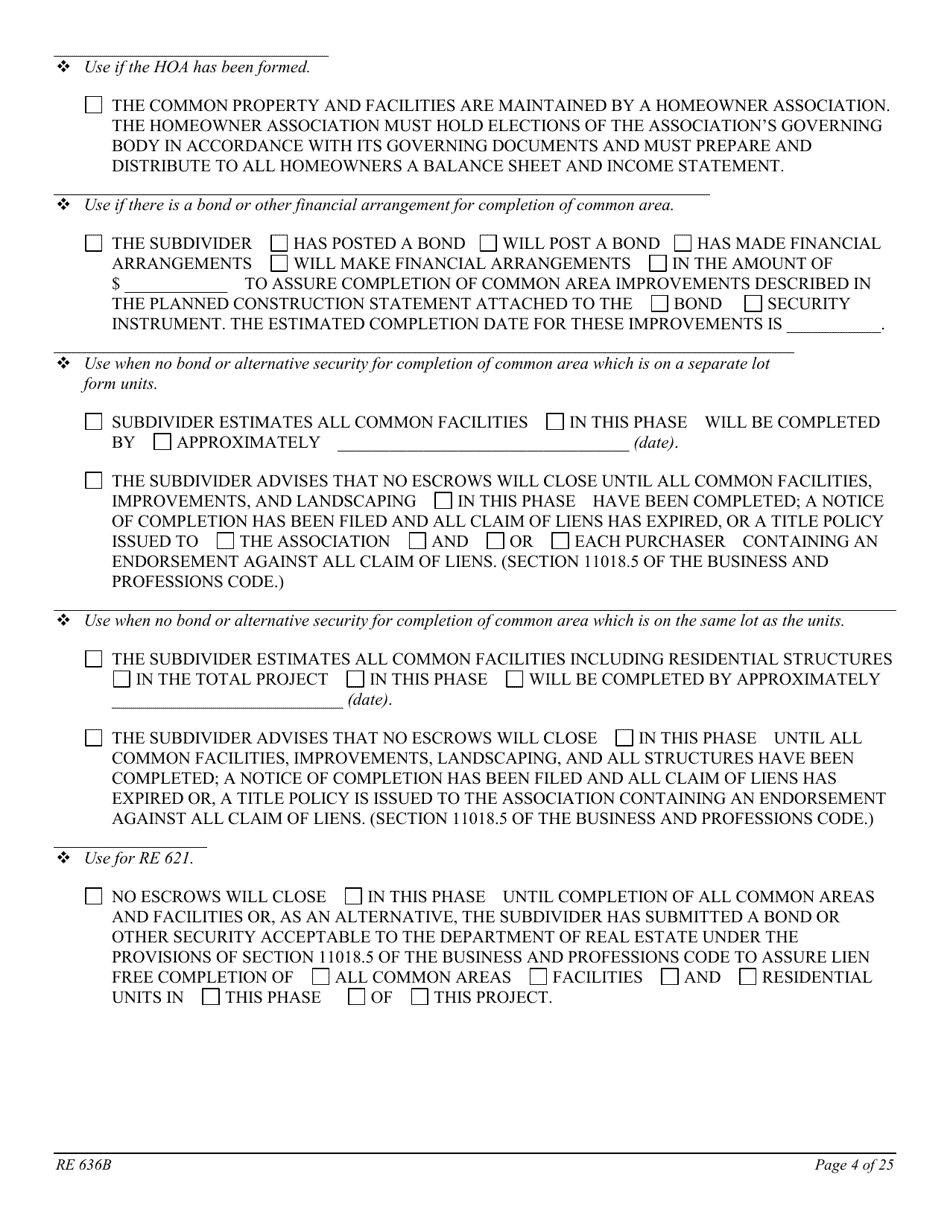

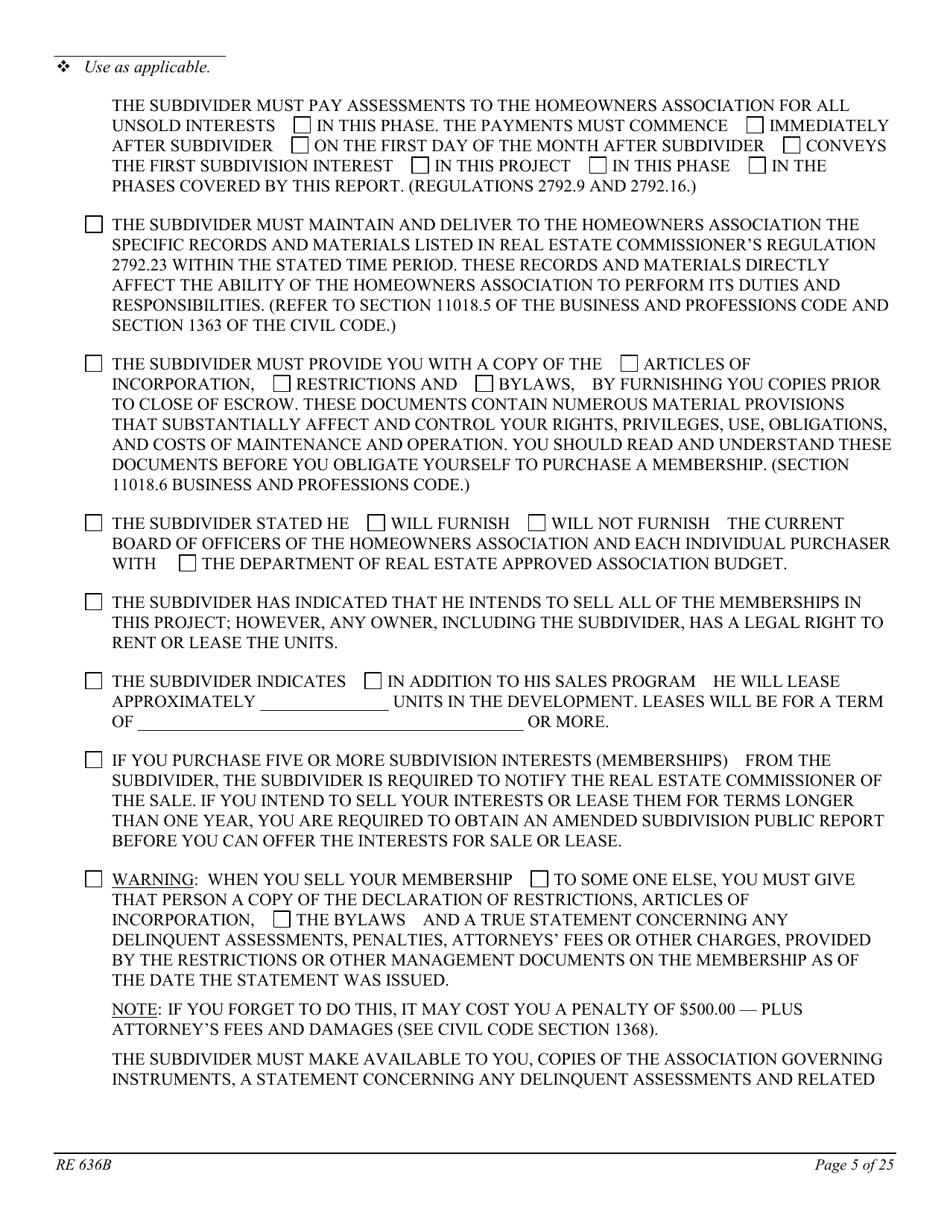

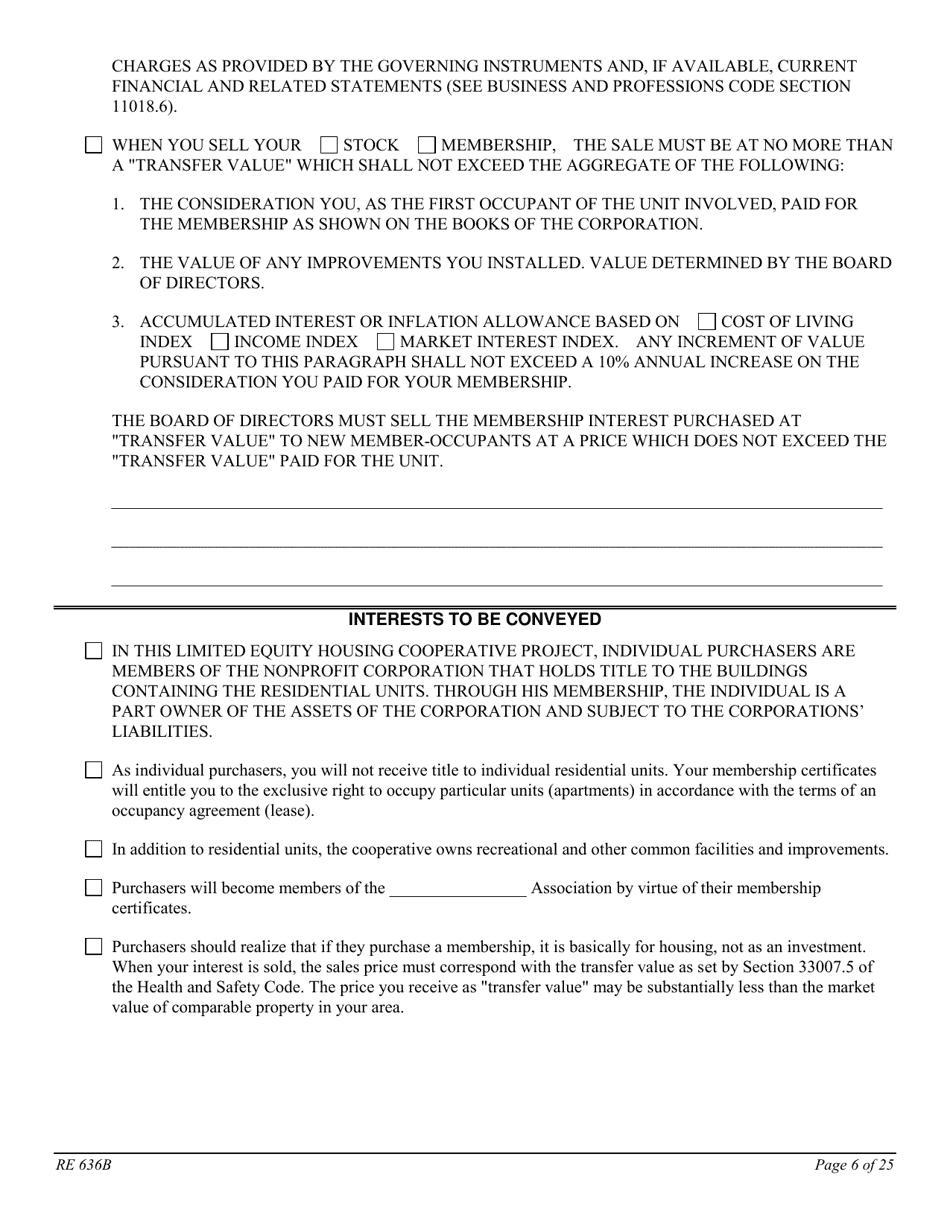

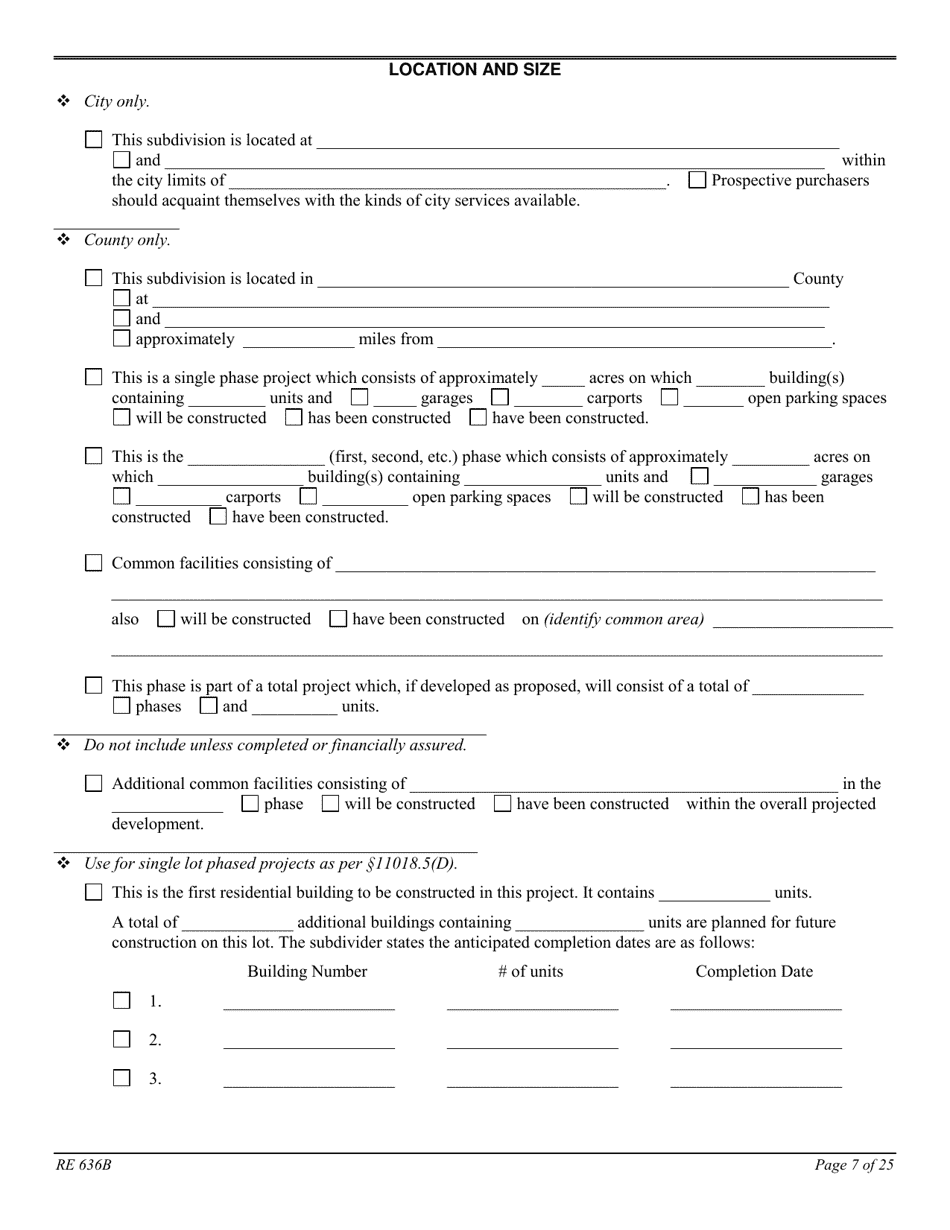

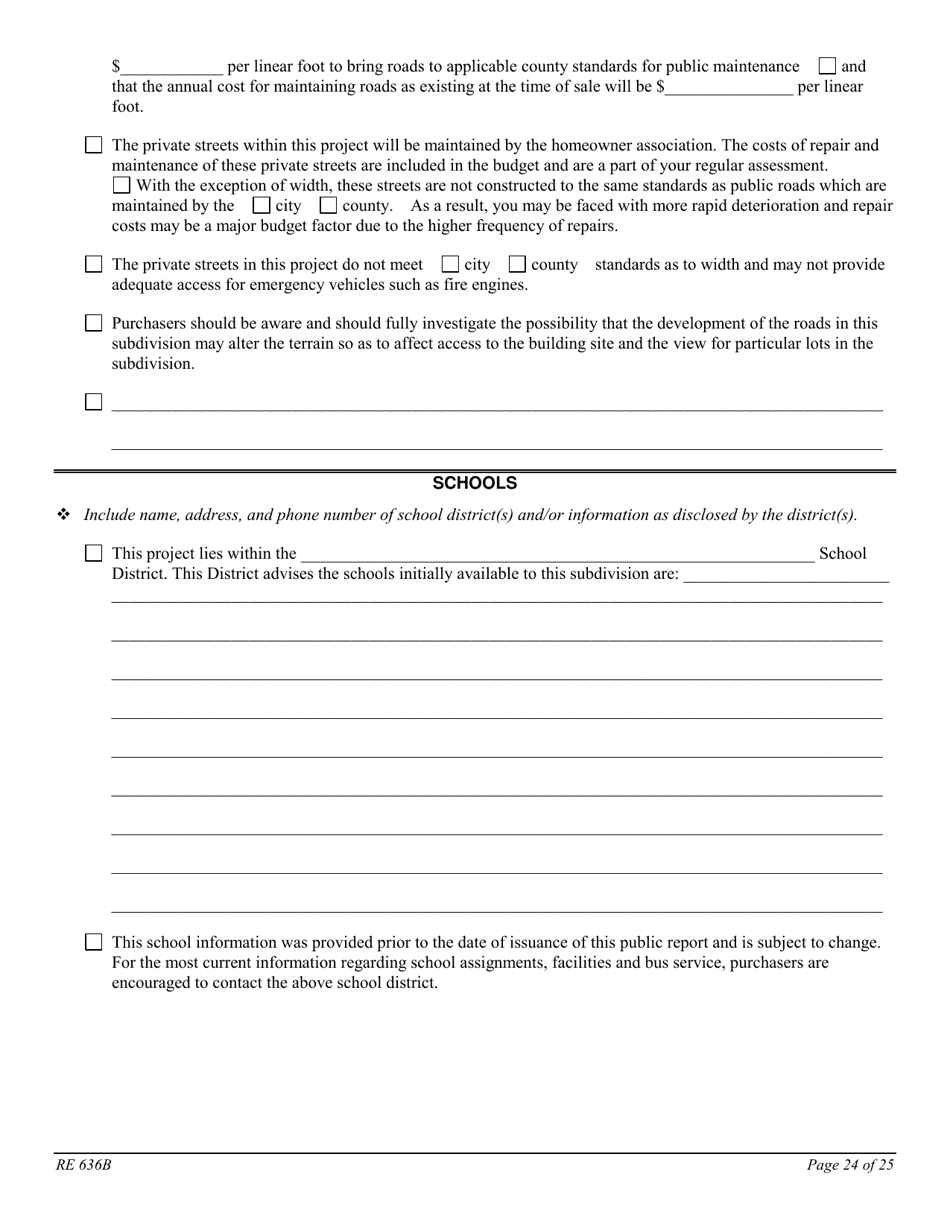

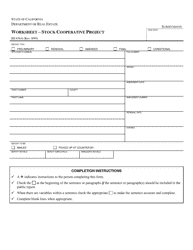

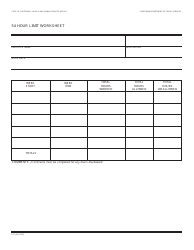

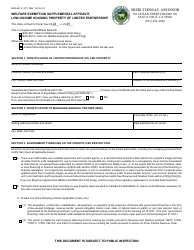

Form RE636B Worksheet - Limited Equity Housing Cooperative (Lehc) - California

What Is Form RE636B?

This is a legal form that was released by the California Department of Real Estate - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RE636B?

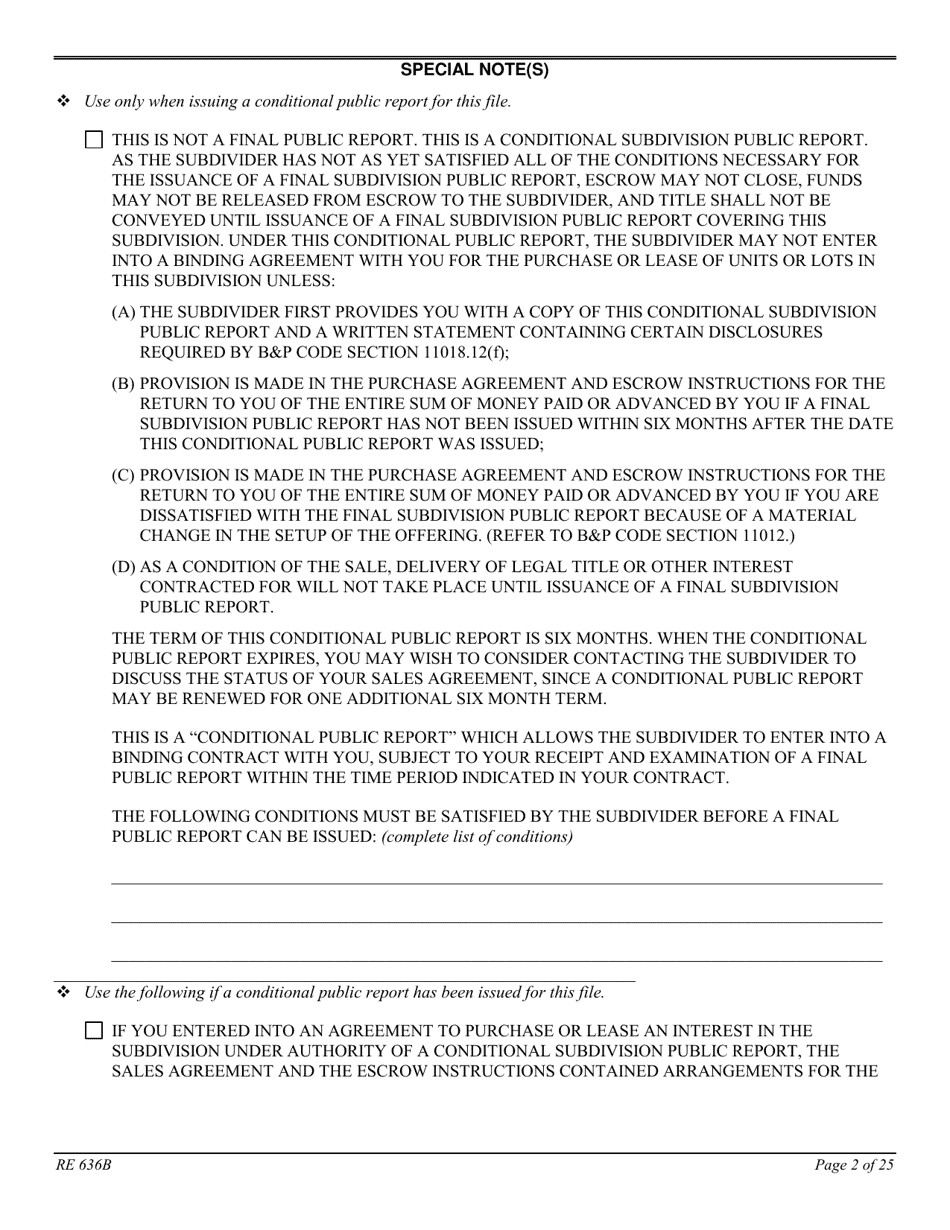

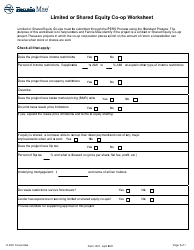

A: Form RE636B is a worksheet for Limited Equity Housing Cooperative (LEHC) in California.

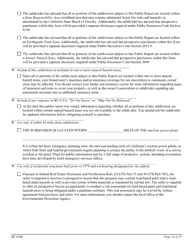

Q: What is a Limited Equity Housing Cooperative (LEHC)?

A: A Limited Equity Housing Cooperative (LEHC) is a type of housing where residents own shares in the cooperative and have limited equity in the property.

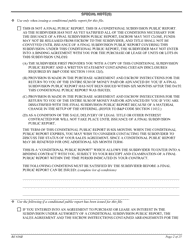

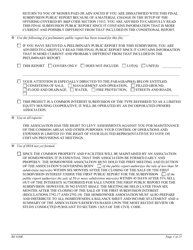

Q: What is the purpose of Form RE636B?

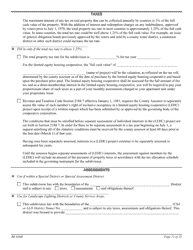

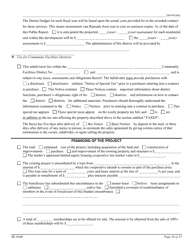

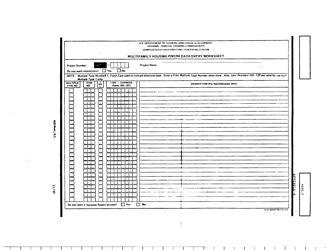

A: The purpose of Form RE636B is to provide a worksheet to calculate the limited equity housing cooperative's property tax allocation.

Q: Who uses Form RE636B?

A: Limited Equity Housing Cooperatives (LEHCs) in California use Form RE636B.

Q: What information is required on Form RE636B?

A: Form RE636B requires information about the LEHC's property value, unit share value, and property tax rate.

Q: Are there any filing fees for Form RE636B?

A: No, there are no filing fees for Form RE636B.

Q: When is Form RE636B due?

A: Form RE636B is due annually by March 1st.

Form Details:

- Released on September 1, 1999;

- The latest edition provided by the California Department of Real Estate;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RE636B by clicking the link below or browse more documents and templates provided by the California Department of Real Estate.