This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1232

for the current year.

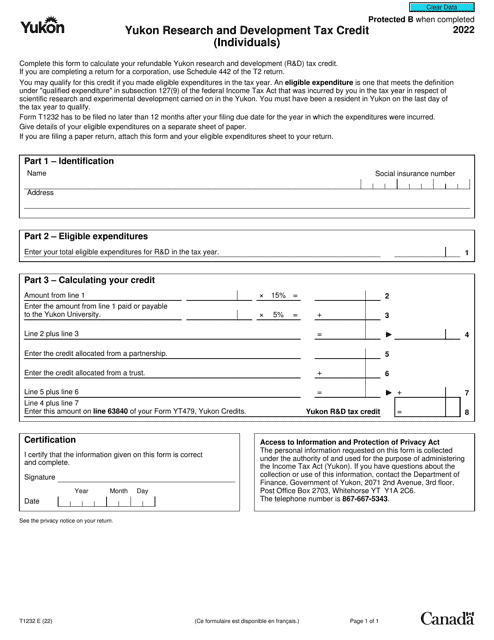

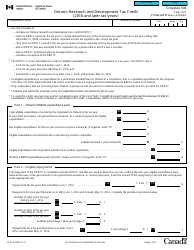

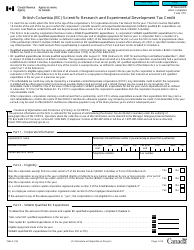

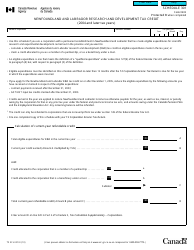

Form T1232 Yukon Research and Development Tax Credit (Individuals) - Canada

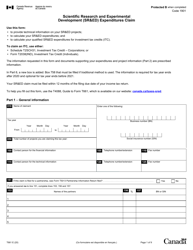

Form T1232 Yukon Research and Development Tax Credit is used by individuals in Canada to claim the research and development tax credit specific to the Yukon territory. This credit is designed to encourage and support research and development activities within the Yukon.

The Form T1232 Yukon Research and Development Tax Credit (Individuals) in Canada is filed by individuals who qualify for the tax credit in the Yukon territory.

FAQ

Q: What is Form T1232?

A: Form T1232 is the Yukon Research and Development Tax Credit form for individuals.

Q: What is the Yukon Research and Development Tax Credit?

A: The Yukon Research and Development Tax Credit is a tax credit that allows individuals in Yukon, Canada, to claim expenses related to research and development activities.

Q: Who is eligible to claim the Yukon Research and Development Tax Credit?

A: Individuals who have incurred eligible research and development expenses in Yukon are eligible to claim the tax credit.

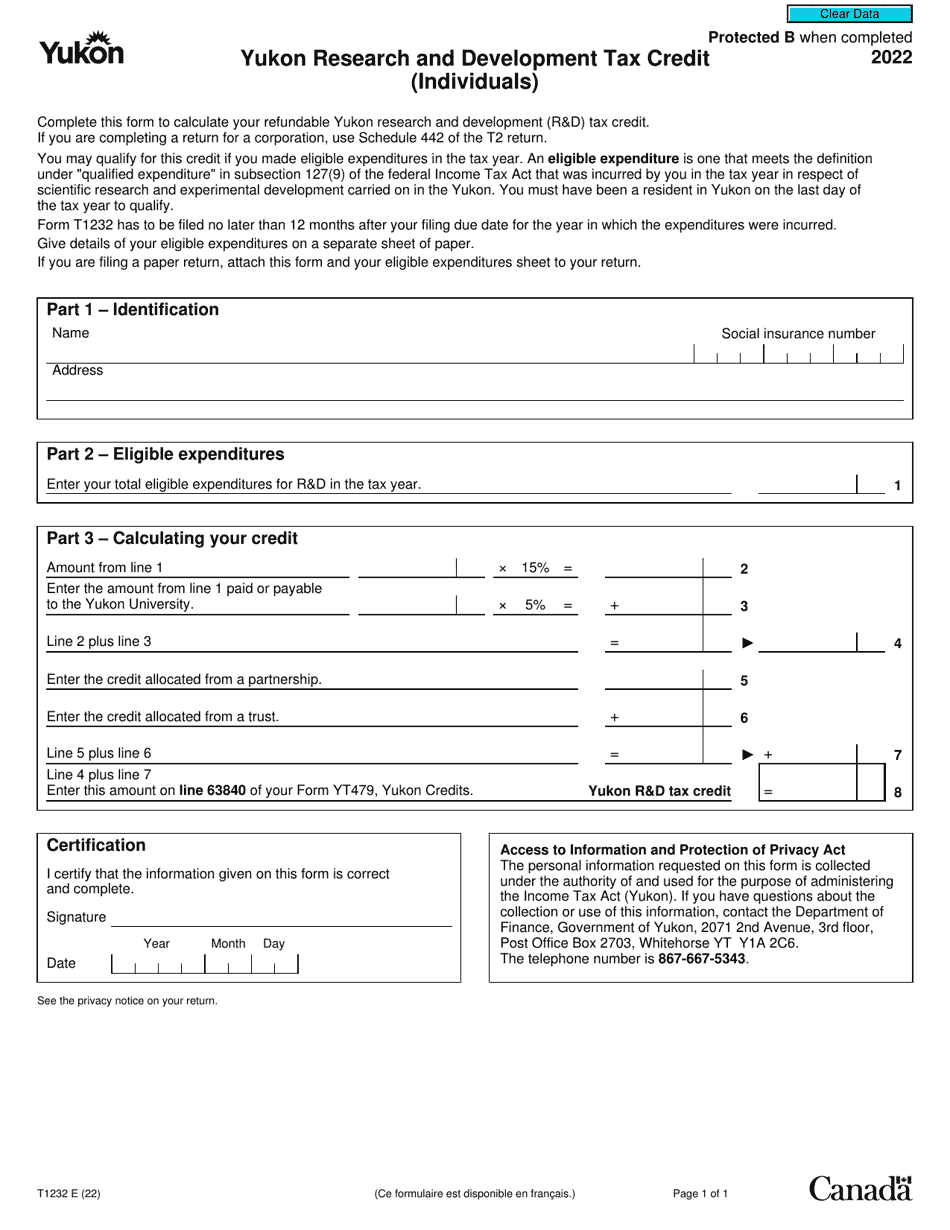

Q: What expenses are considered eligible for the Yukon Research and Development Tax Credit?

A: Expenses related to scientific research and experimental development activities, including wages, materials, and certain overhead costs, may be eligible for the tax credit.

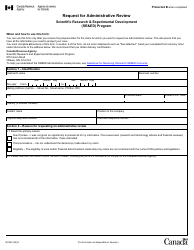

Q: How do I claim the Yukon Research and Development Tax Credit?

A: To claim the tax credit, you need to complete Form T1232 and include it with your annual tax return. You should also keep supporting documentation and receipts in case of review or audit.

Q: Is there a deadline for claiming the Yukon Research and Development Tax Credit?

A: Yes, the tax credit must be claimed within 18 months from the end of the tax year in which the eligible expenses were incurred.