This version of the form is not currently in use and is provided for reference only. Download this version of

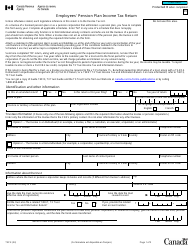

Form T3D

for the current year.

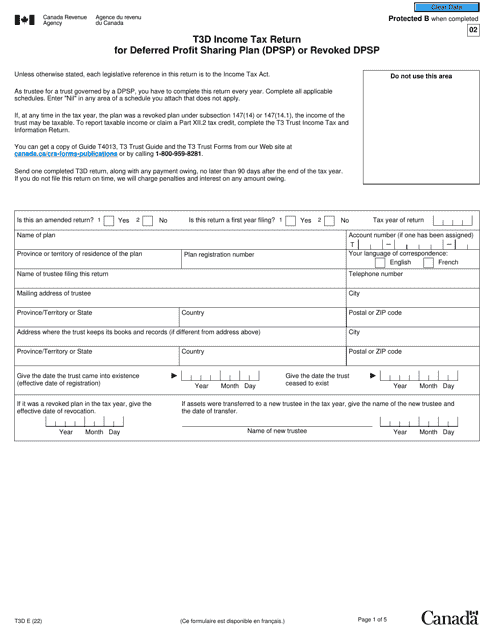

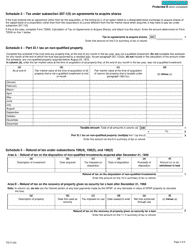

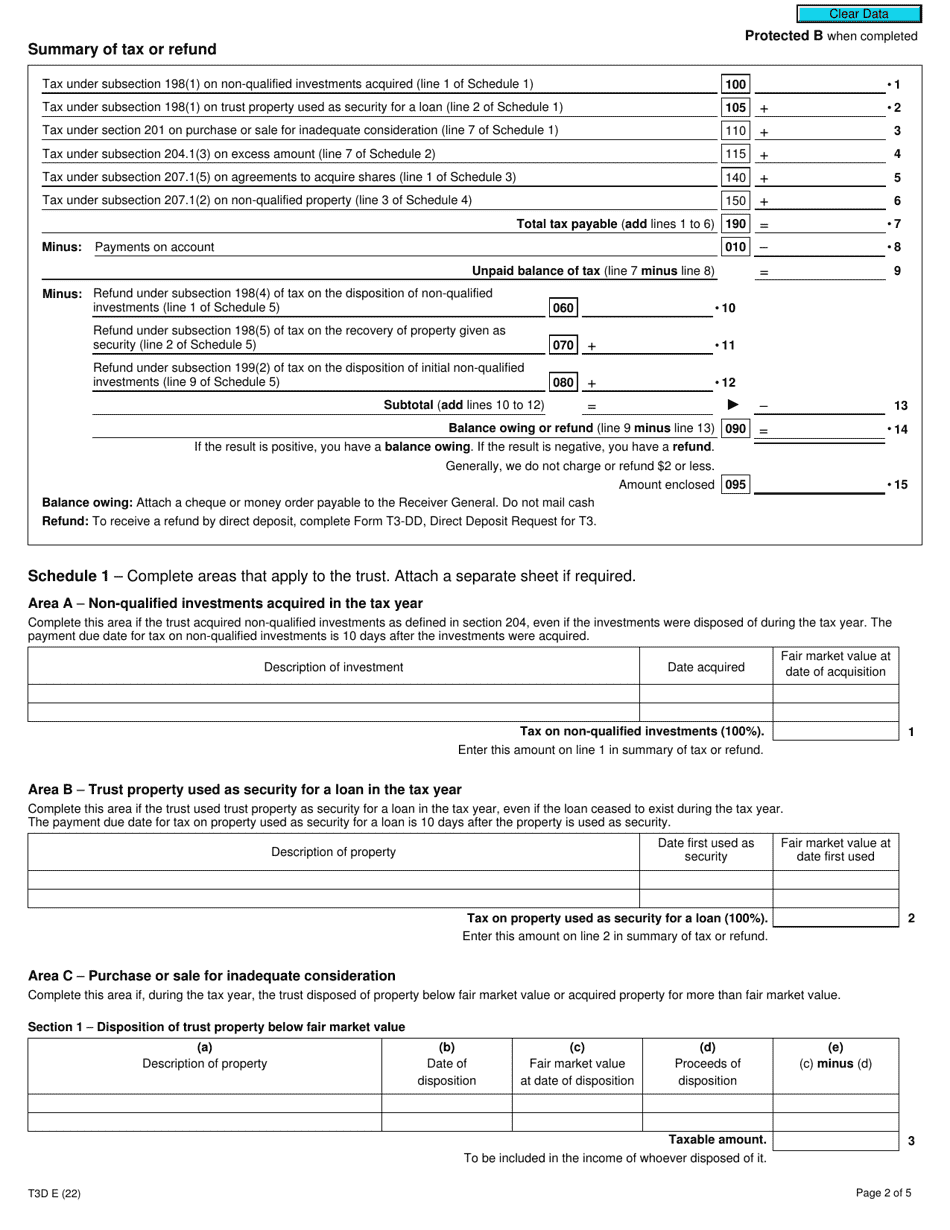

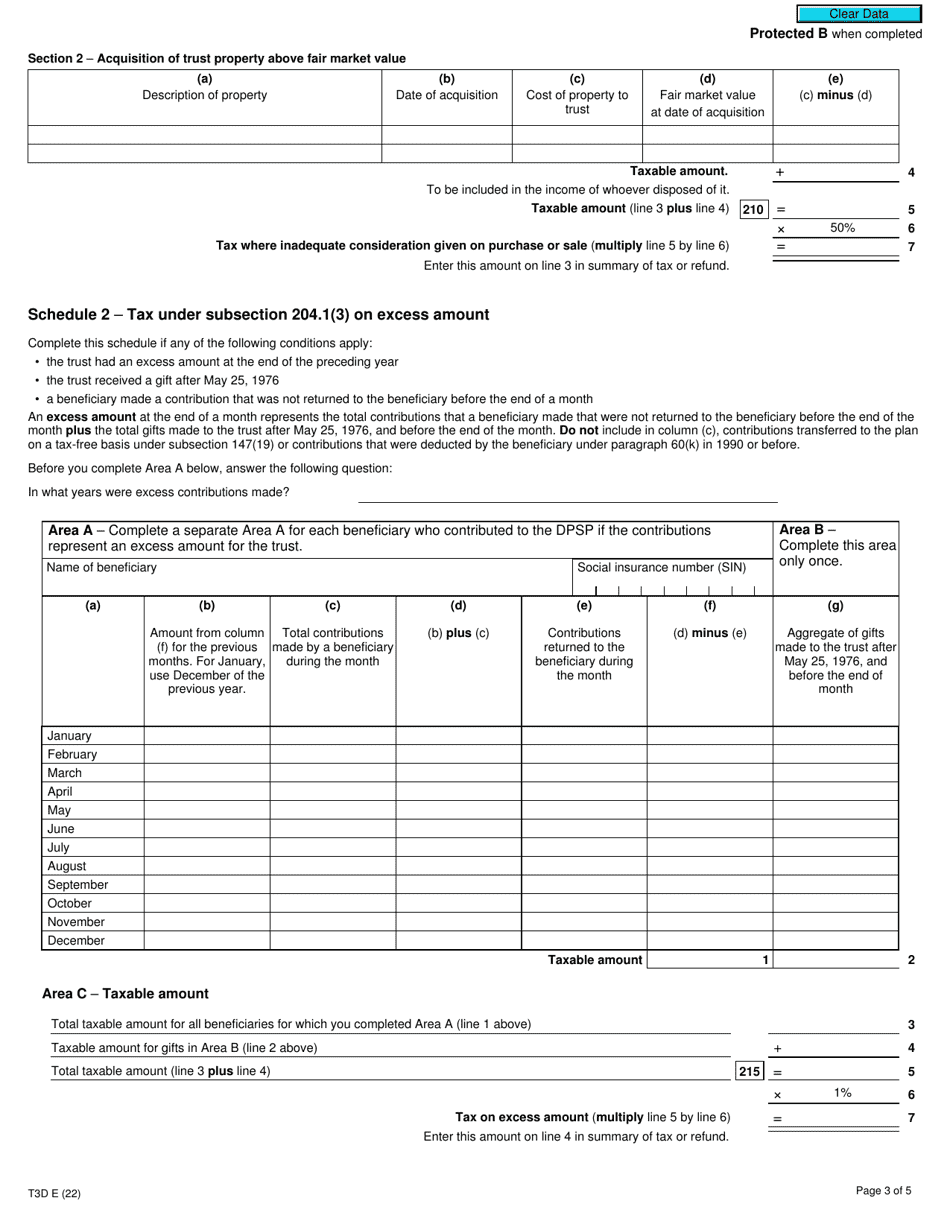

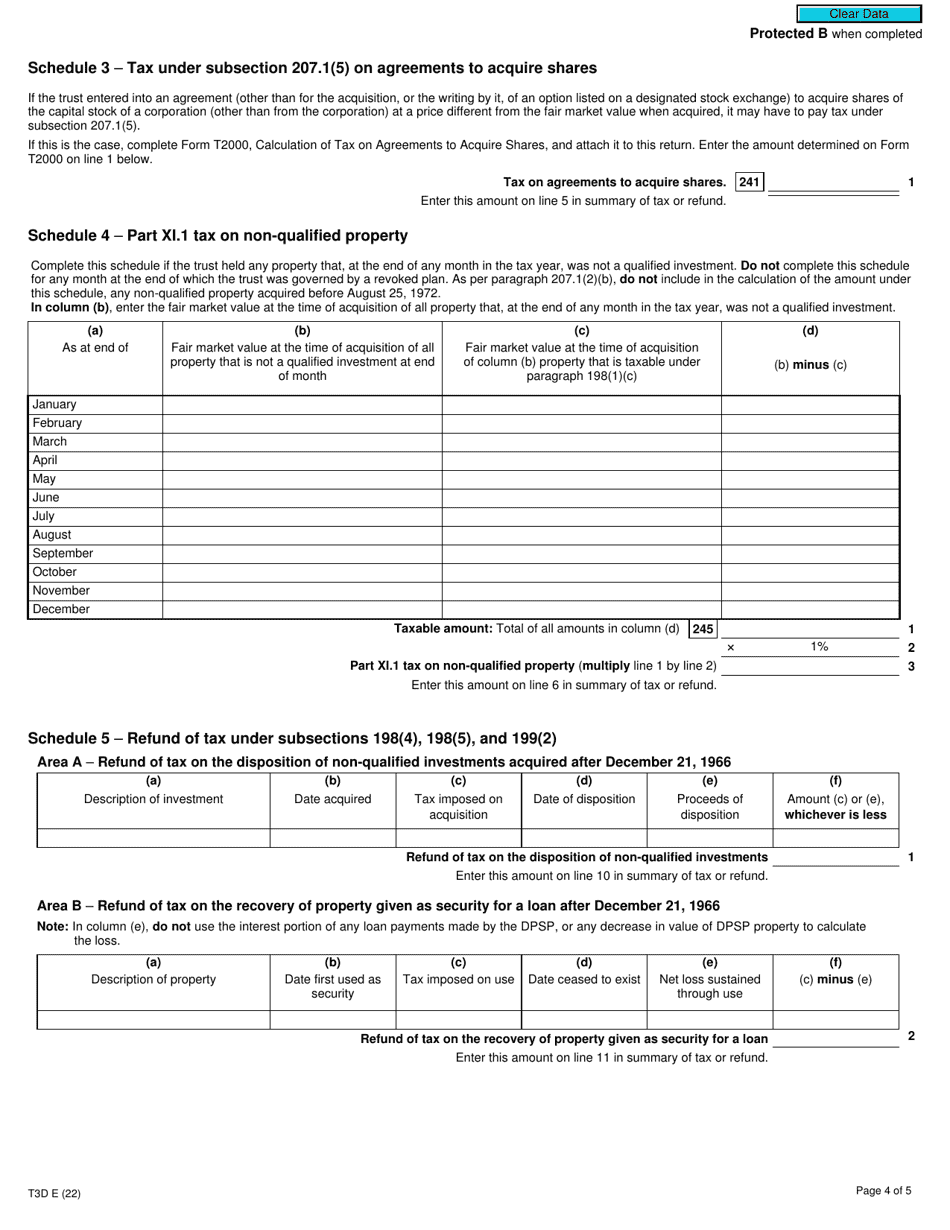

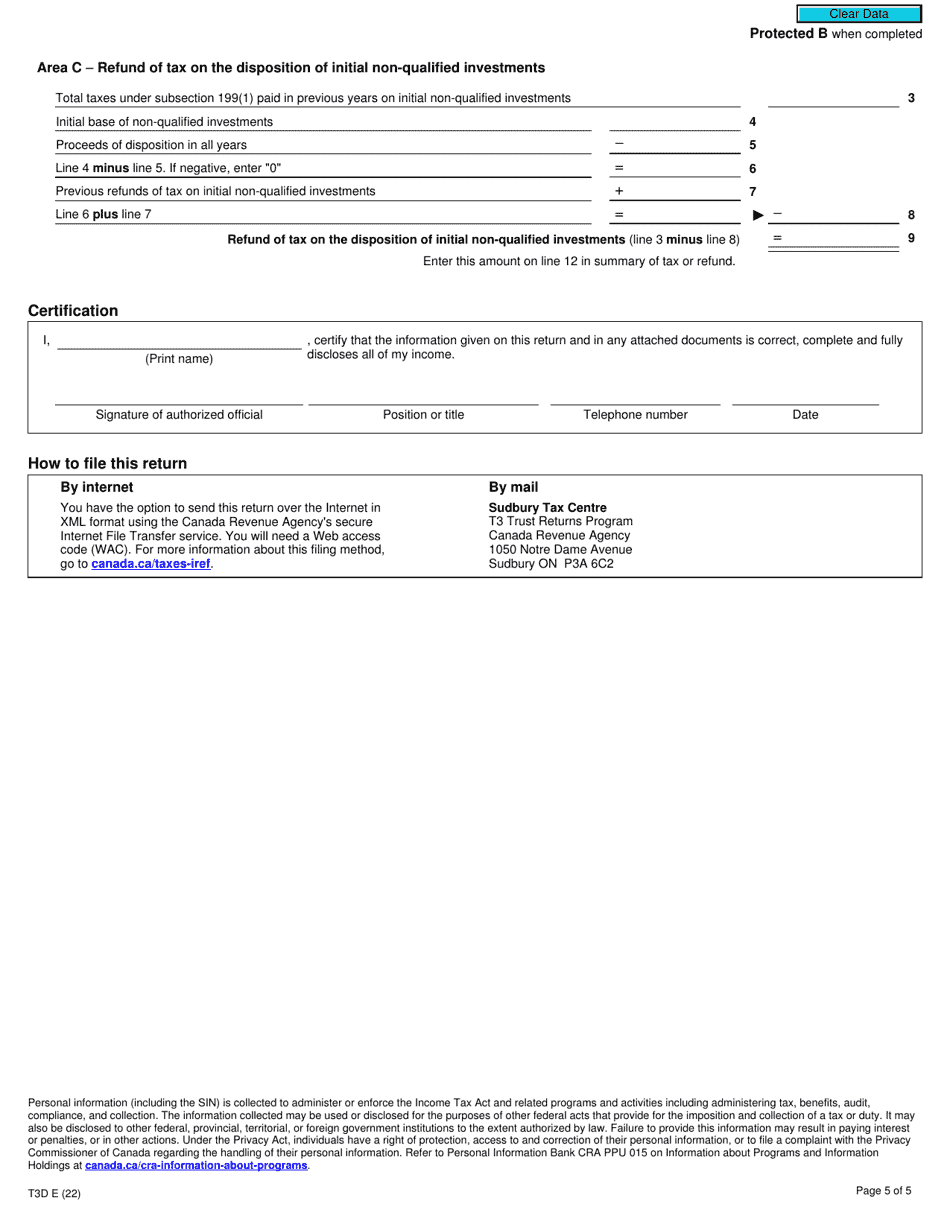

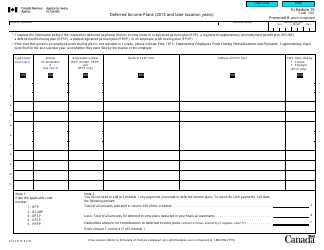

Form T3D Income Tax Return for Deferred Profit Sharing Plan (Dpsp) or Revoked Dpsp - Canada

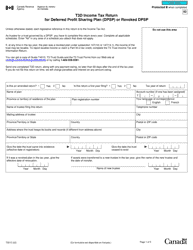

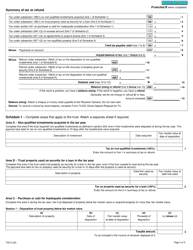

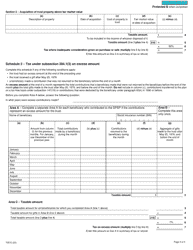

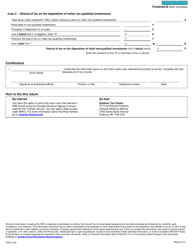

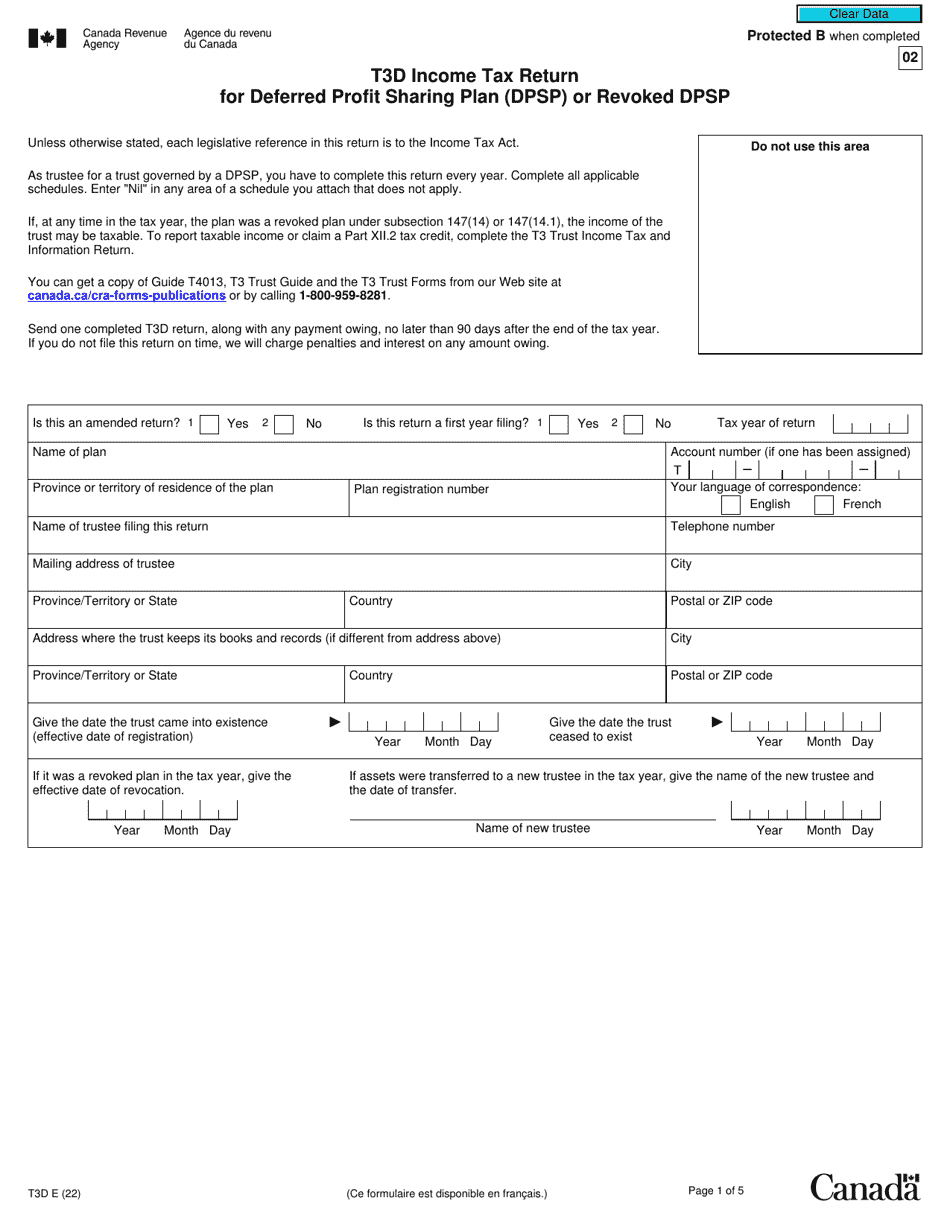

Form T3D is an income tax return form used in Canada for reporting income from a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP. It is used to report and calculate the tax payable on the income earned from these types of plans.

The employer or plan administrator is responsible for filing the Form T3D Income Tax Return for a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP in Canada.

FAQ

Q: What is a Form T3D?

A: Form T3D is an income tax return specifically for a Deferred Profit Sharing Plan (DPSP) or a revoked DPSP in Canada.

Q: What is a Deferred Profit Sharing Plan?

A: A Deferred Profit Sharing Plan (DPSP) is a type of registered pension plan in Canada that allows employees to receive a share of their employer's profits.

Q: Who should file a Form T3D?

A: Anyone who has a Deferred Profit Sharing Plan or had a revoked DPSP in Canada should file a Form T3D.

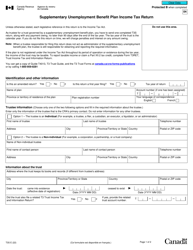

Q: What information is required on Form T3D?

A: Form T3D requires information about the plan administrator, plan members, contributions, distributions, and taxes withheld.

Q: When is the deadline for filing Form T3D?

A: The deadline for filing Form T3D is within 90 days after the end of the tax year of the DPSP or the date of revocation.