This version of the form is not currently in use and is provided for reference only. Download this version of

Form RE856

for the current year.

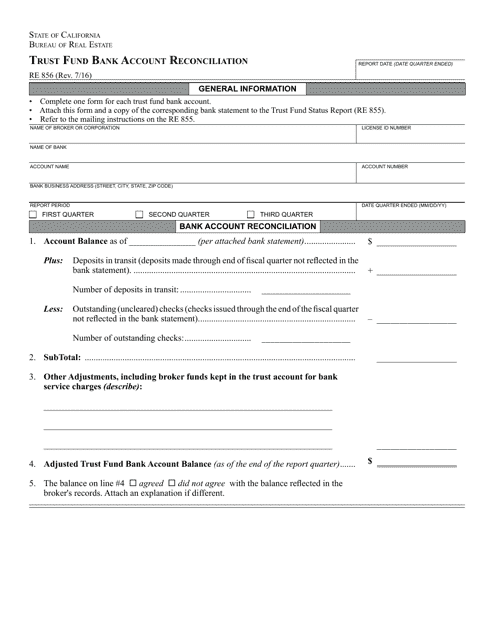

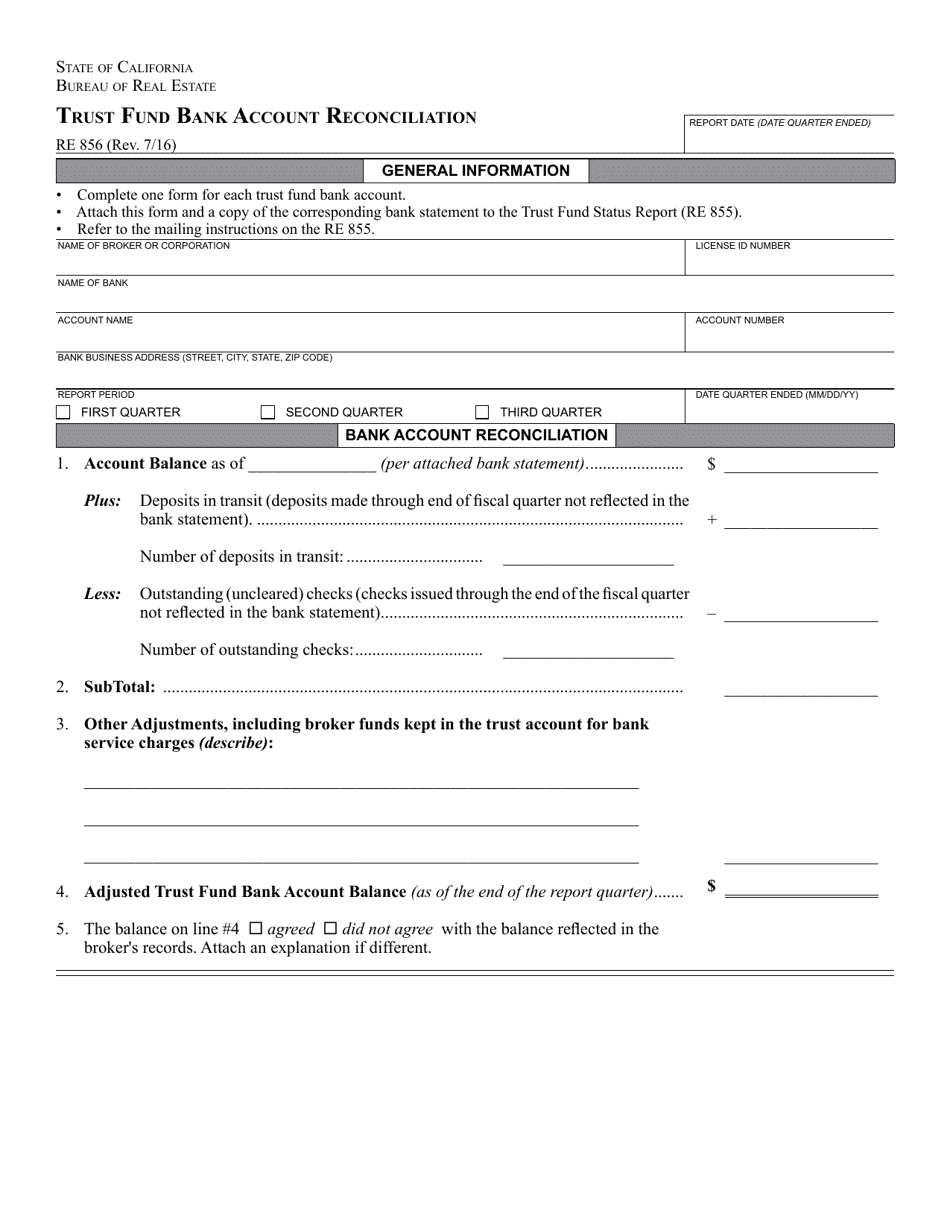

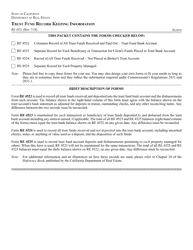

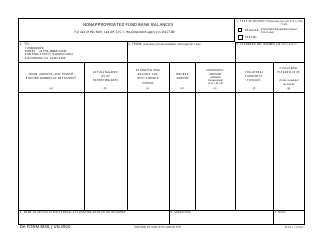

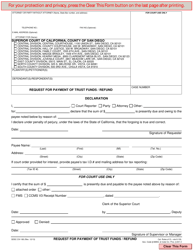

Form RE856 Trust Fund Bank Account Reconciliation - California

What Is Form RE856?

This is a legal form that was released by the California Department of Real Estate - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RE856 Trust Fund Bank Account Reconciliation?

A: Form RE856 Trust Fund Bank Account Reconciliation is a document used in California for reconciling trust fund bank accounts.

Q: Who is required to file Form RE856?

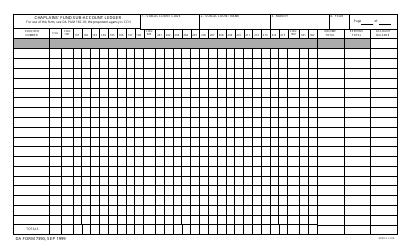

A: Form RE856 is required to be filed by individuals or entities that hold and manage trust funds in California.

Q: What is the purpose of filing Form RE856?

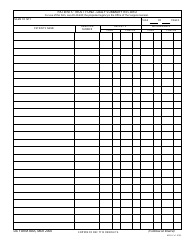

A: The purpose of filing Form RE856 is to ensure that trust fund bank accounts are accurately reconciled and to maintain proper accounting records.

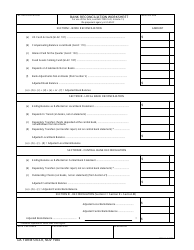

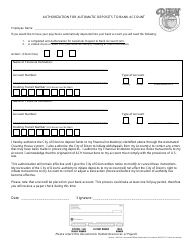

Q: What information is required to complete Form RE856?

A: To complete Form RE856, you will need information such as bank statements, canceled checks, and accounting records for the trust fund bank account.

Q: When is Form RE856 due?

A: Form RE856 is typically due on a quarterly basis, with specific due dates outlined by the California Department of Real Estate.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the California Department of Real Estate;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RE856 by clicking the link below or browse more documents and templates provided by the California Department of Real Estate.