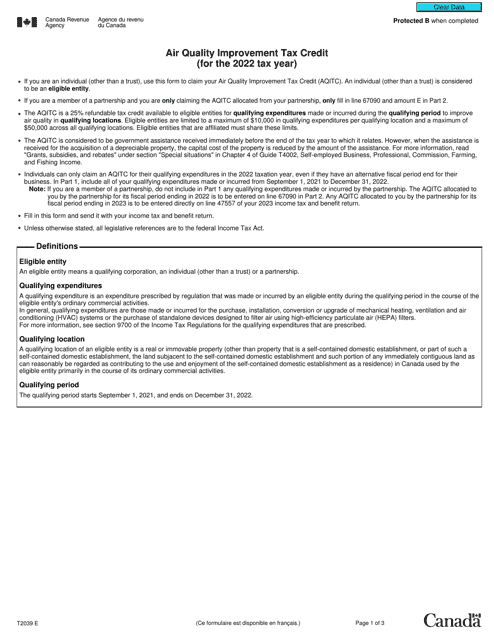

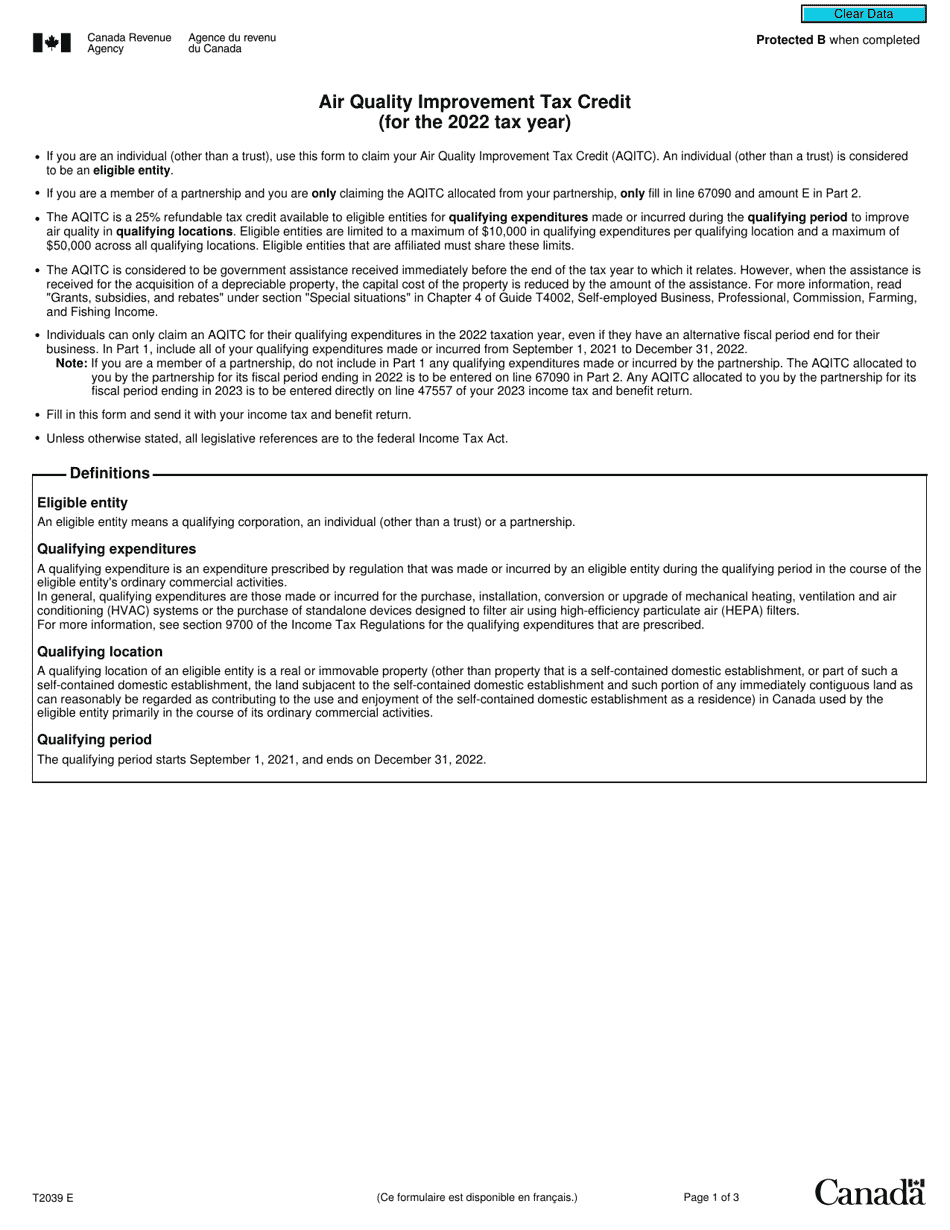

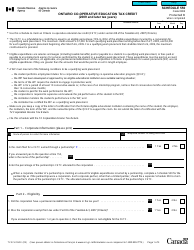

Form T2039 Air Quality Improvement Tax Credit - Canada

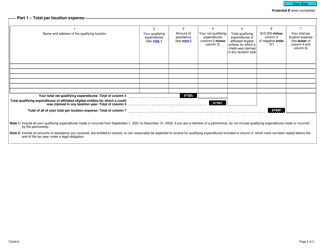

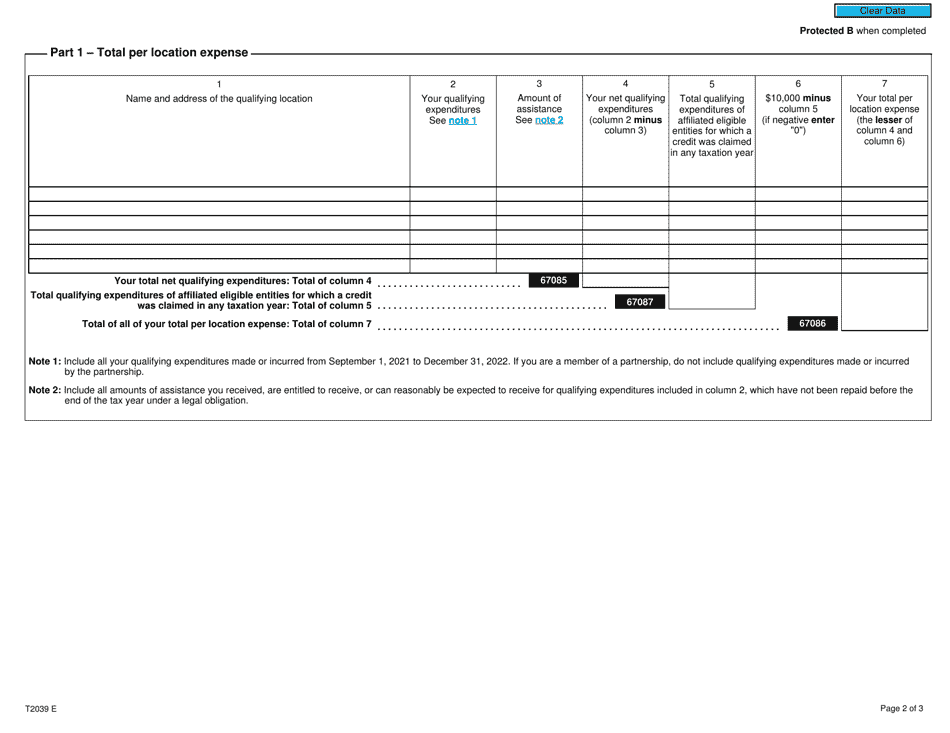

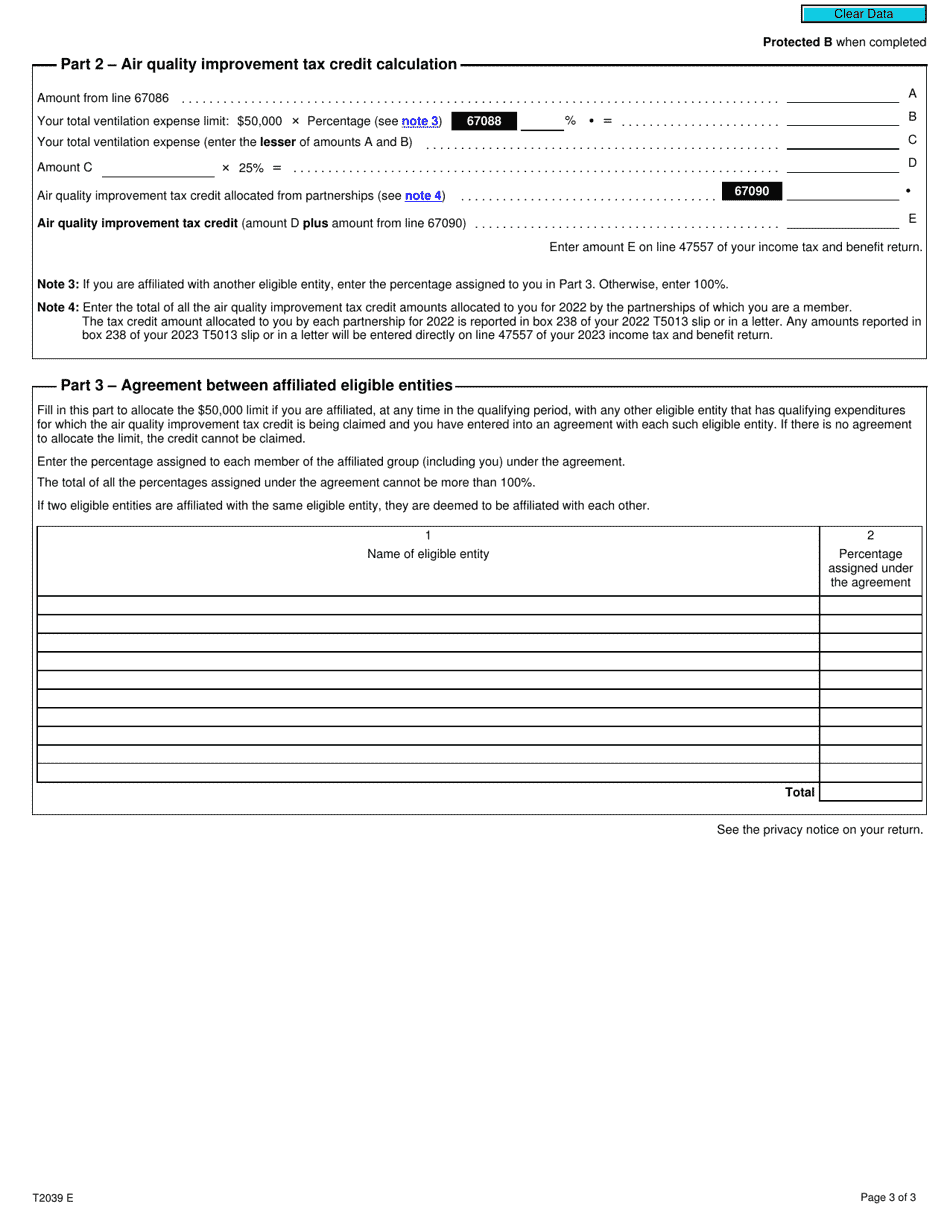

Form T2039 Air Quality Improvement Tax Credit is used to claim the tax credit for expenses incurred to improve air quality in eligible Canadian provinces or territories. The tax credit is available for individuals and corporations who have made qualifying expenses related to eligible equipment and technology.

The Form T2039 Air Quality Improvement Tax Credit in Canada should be filed by individuals or businesses who qualify for the tax credit.

FAQ

Q: What is Form T2039?

A: Form T2039 is a tax form specific to Canada that is used to claim the Air Quality Improvement Tax Credit.

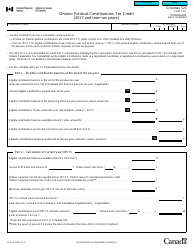

Q: What is the purpose of the Air Quality Improvement Tax Credit?

A: The Air Quality Improvement Tax Credit is designed to encourage businesses in Canada to invest in eligible air quality improvement equipment.

Q: Who is eligible to claim the Air Quality Improvement Tax Credit?

A: Canadian businesses that have purchased eligible air quality improvement equipment may be eligible to claim this tax credit.

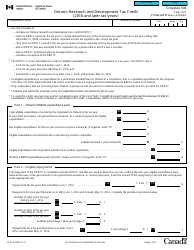

Q: What qualifies as eligible air quality improvement equipment?

A: Eligible equipment includes equipment designed to primarily reduce the emission of pollutants into the air.

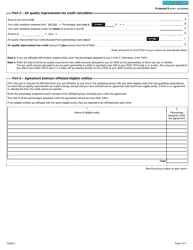

Q: What is the amount of the tax credit?

A: The tax credit is equal to a specified percentage of the cost of eligible equipment, up to a maximum amount set by the Canadian government.

Q: How do I claim the Air Quality Improvement Tax Credit?

A: To claim the tax credit, you must complete Form T2039 and include it with your Canadian tax return.

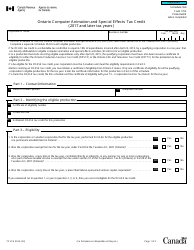

Q: Is there a deadline for claiming the Air Quality Improvement Tax Credit?

A: Yes, the tax credit must be claimed within a specific time frame as determined by the Canadian government.

Q: Are there any restrictions or limitations on the tax credit?

A: Yes, there may be certain restrictions and limitations on the tax credit, so it is advisable to consult the official guidelines or seek professional advice.

Q: Can individuals claim the Air Quality Improvement Tax Credit?

A: No, the tax credit is only available to businesses in Canada.