This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4625

for the current year.

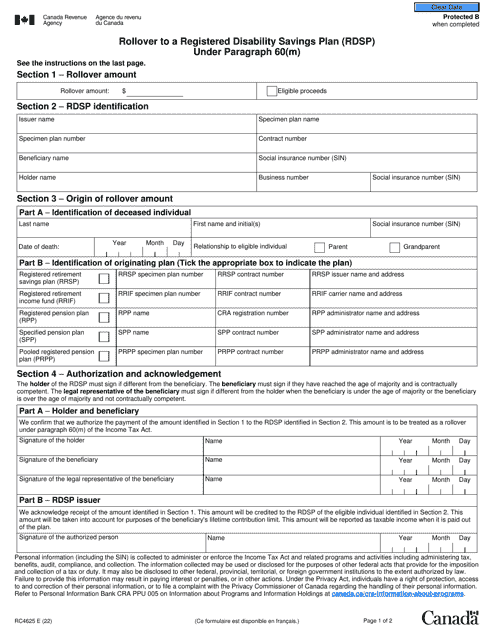

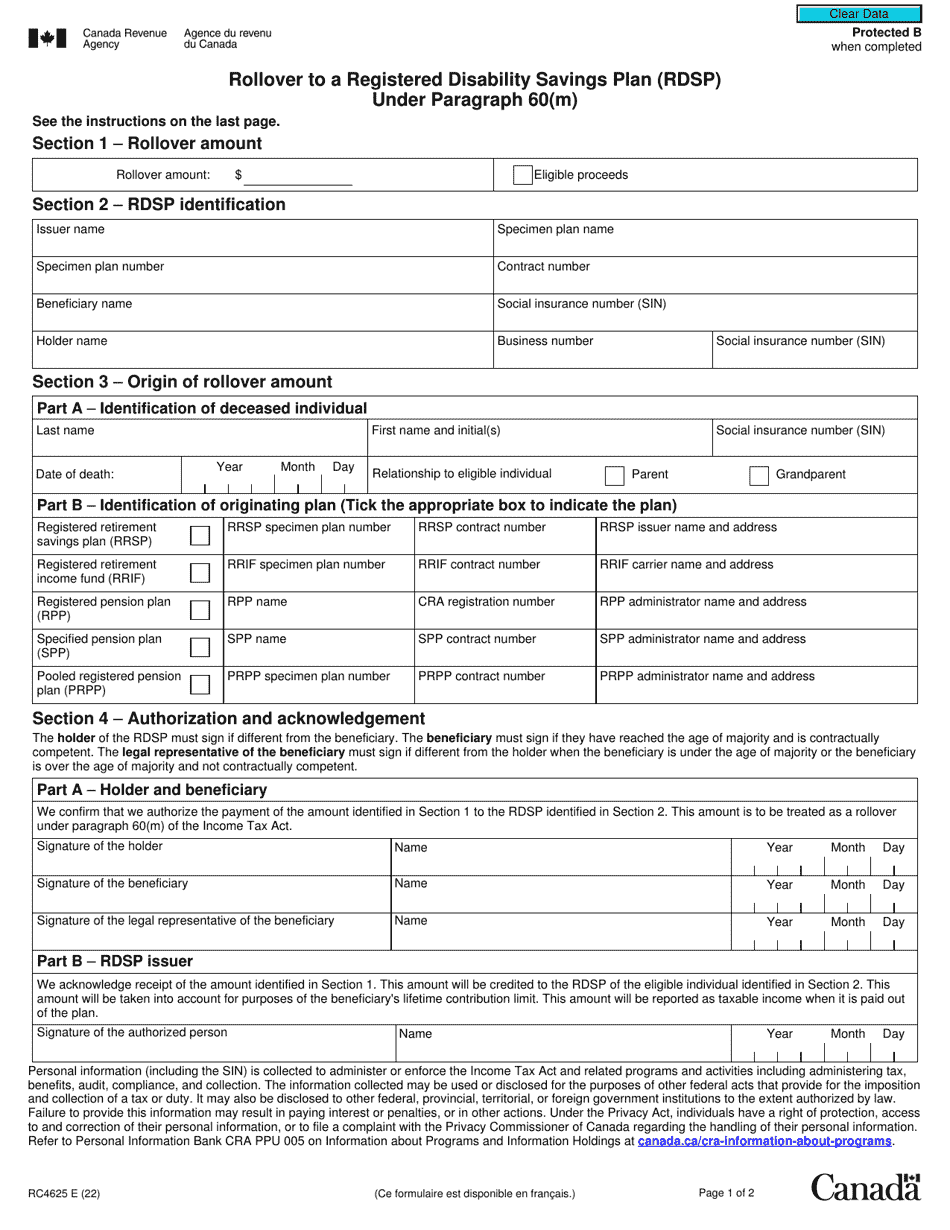

Form RC4625 Rollover to a Registered Disability Savings Plan (Rdsp) Under Paragraph 60(M) - Canada

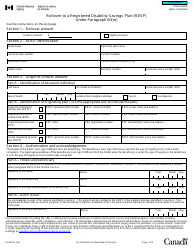

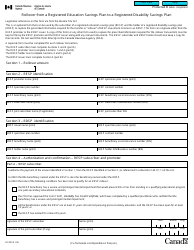

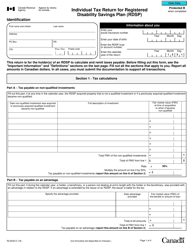

Form RC4625 is used in Canada for requesting a tax-deferred transfer of funds from a Registered Retirement Savings Plan (RRSP) to a Registered Disability Savings Plan (RDSP) under paragraph 60(m) of the Canadian tax code. This form facilitates the rollover process and helps individuals with disabilities save for their future financial needs.

The individual with a disability or their legal representative typically files the Form RC4625 for a Rollover to a Registered Disability Savings Plan (RDSP) under paragraph 60(M) in Canada.

FAQ

Q: What is Form RC4625?

A: Form RC4625 is a form used to request a rollover of funds to a Registered Disability Savings Plan (RDSP) in Canada.

Q: What is a Registered Disability Savings Plan (RDSP)?

A: A Registered Disability Savings Plan (RDSP) is a savings plan available to individuals with disabilities in Canada.

Q: What is a rollover?

A: A rollover is the transfer of funds from one account to another, often for tax purposes or to maintain the same investment.

Q: What is Paragraph 60(M)?

A: Paragraph 60(M) refers to the section in the Canadian Income Tax Act that allows for certain tax provisions related to Registered Disability Savings Plans (RDSPs).

Q: Who can submit Form RC4625?

A: Individuals who are eligible for a rollover to a Registered Disability Savings Plan (RDSP) can submit Form RC4625.

Q: What information is required on Form RC4625?

A: Form RC4625 requires the individual's personal and contact information, as well as details about the rollover and the Registered Disability Savings Plan (RDSP) that will receive the funds.

Q: Is there a deadline to submit Form RC4625?

A: There is no specific deadline to submit Form RC4625, but it is recommended to submit it as soon as possible to ensure timely processing.

Q: Are there any fees associated with Form RC4625?

A: There are generally no fees associated with submitting Form RC4625; however, there may be administrative fees or charges related to the establishment and maintenance of a Registered Disability Savings Plan (RDSP).