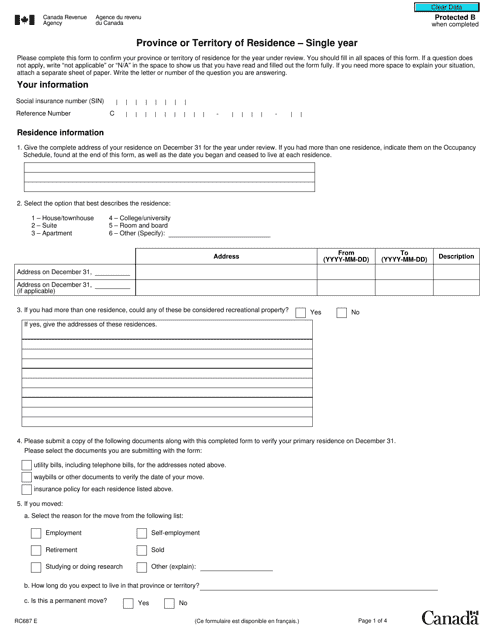

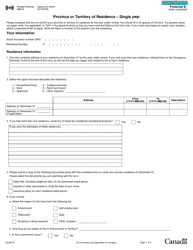

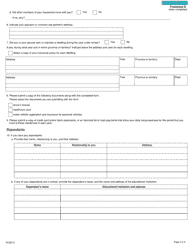

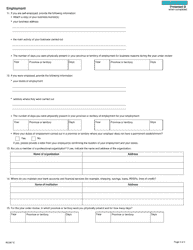

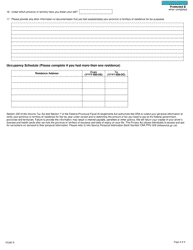

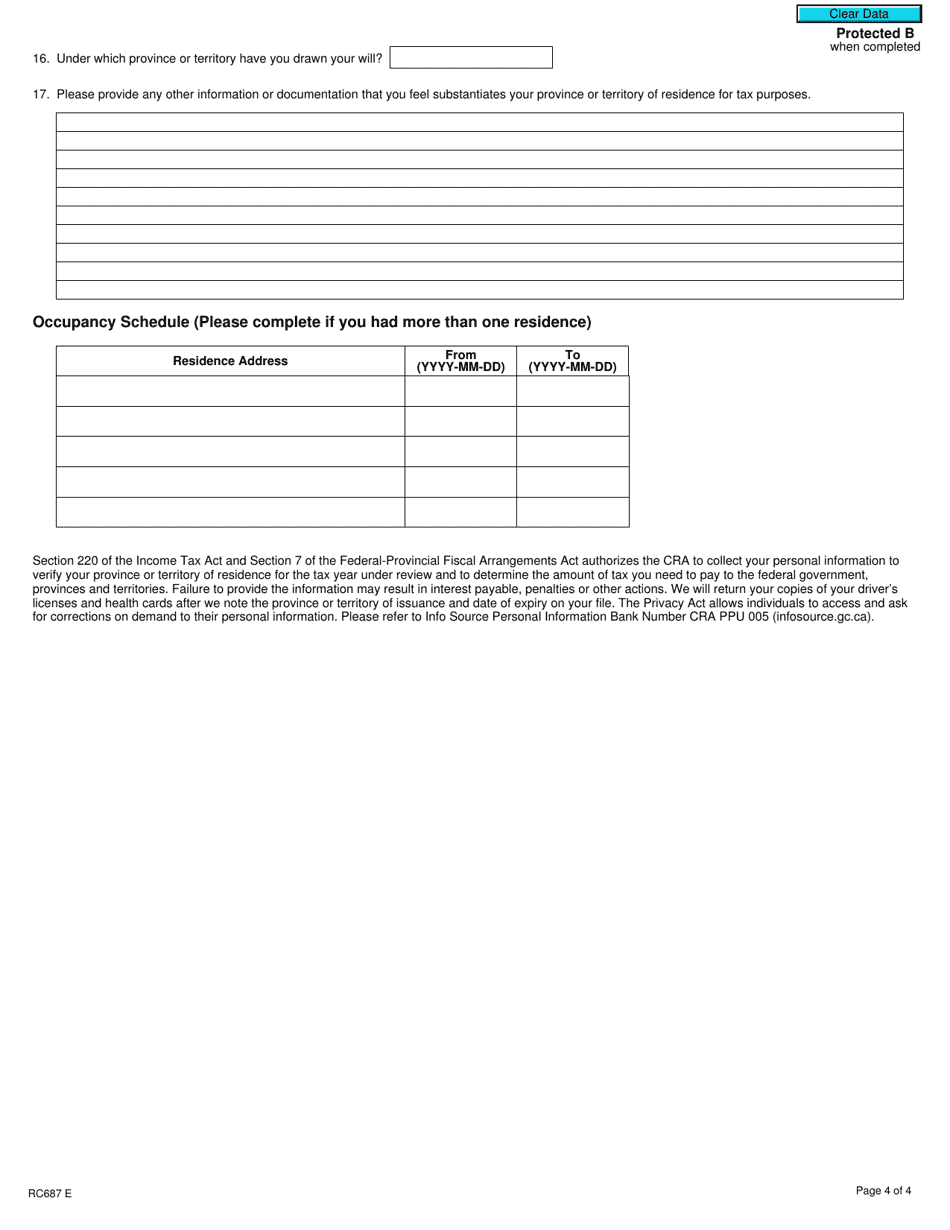

Form RC687 Province or Territory of Residence - Single Year - Refund Examination Program - Canada

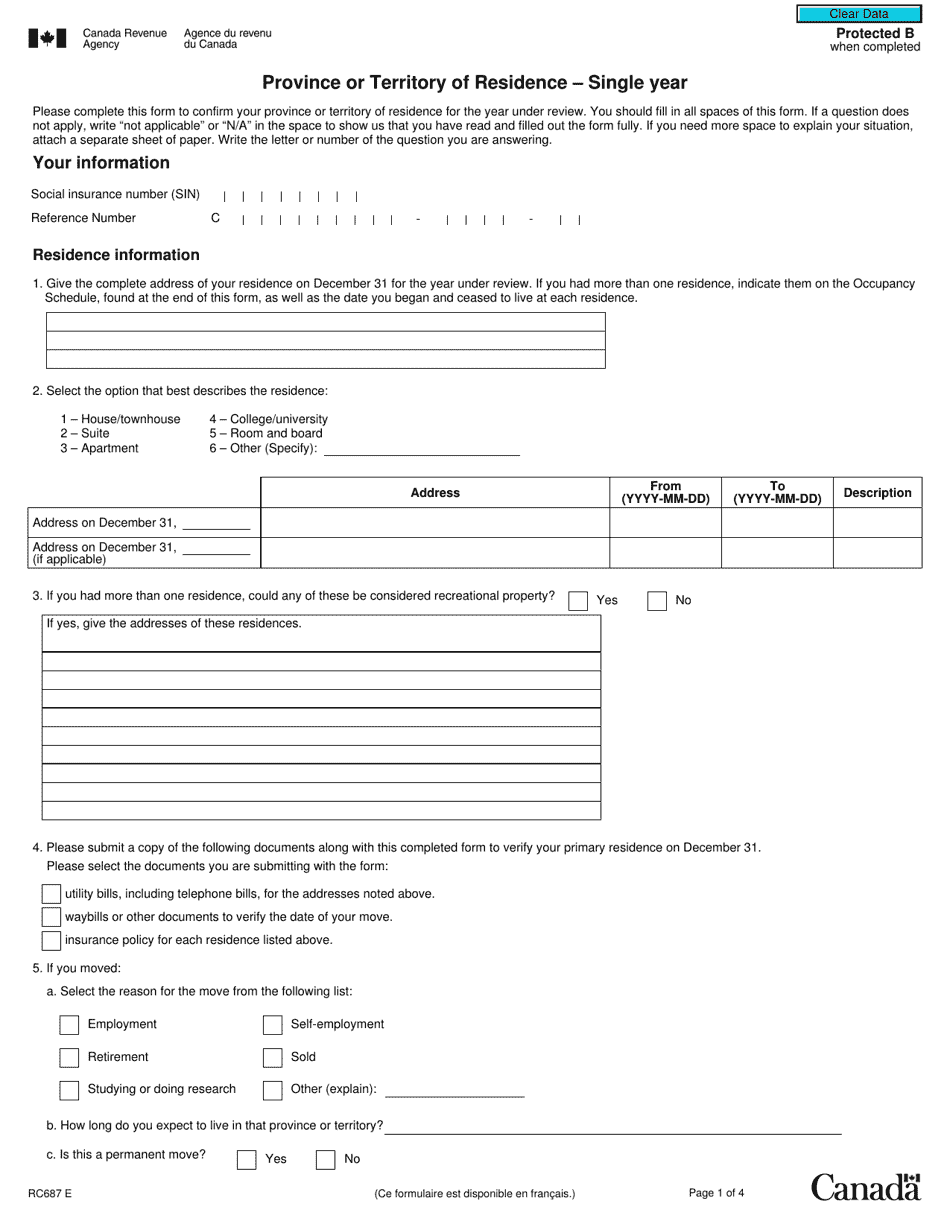

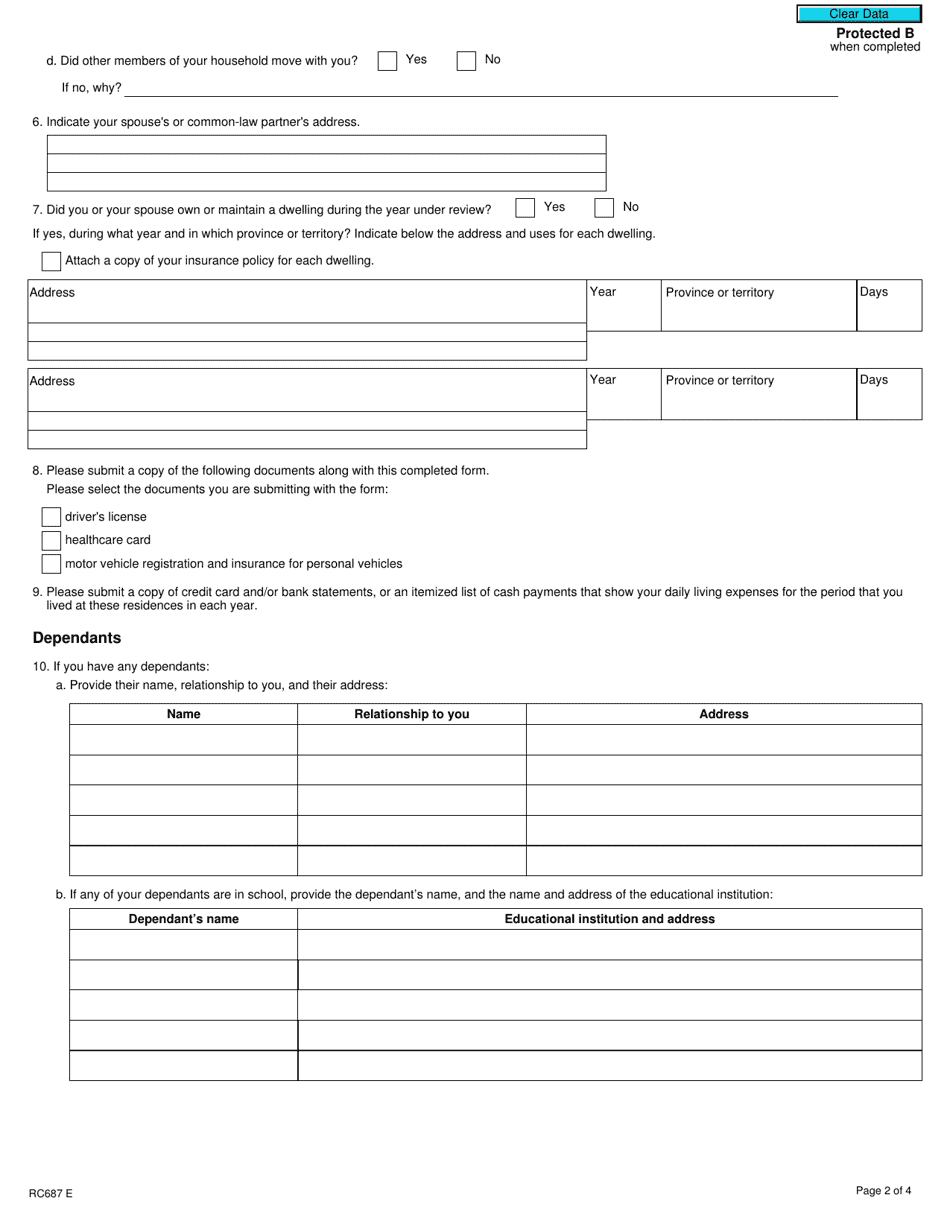

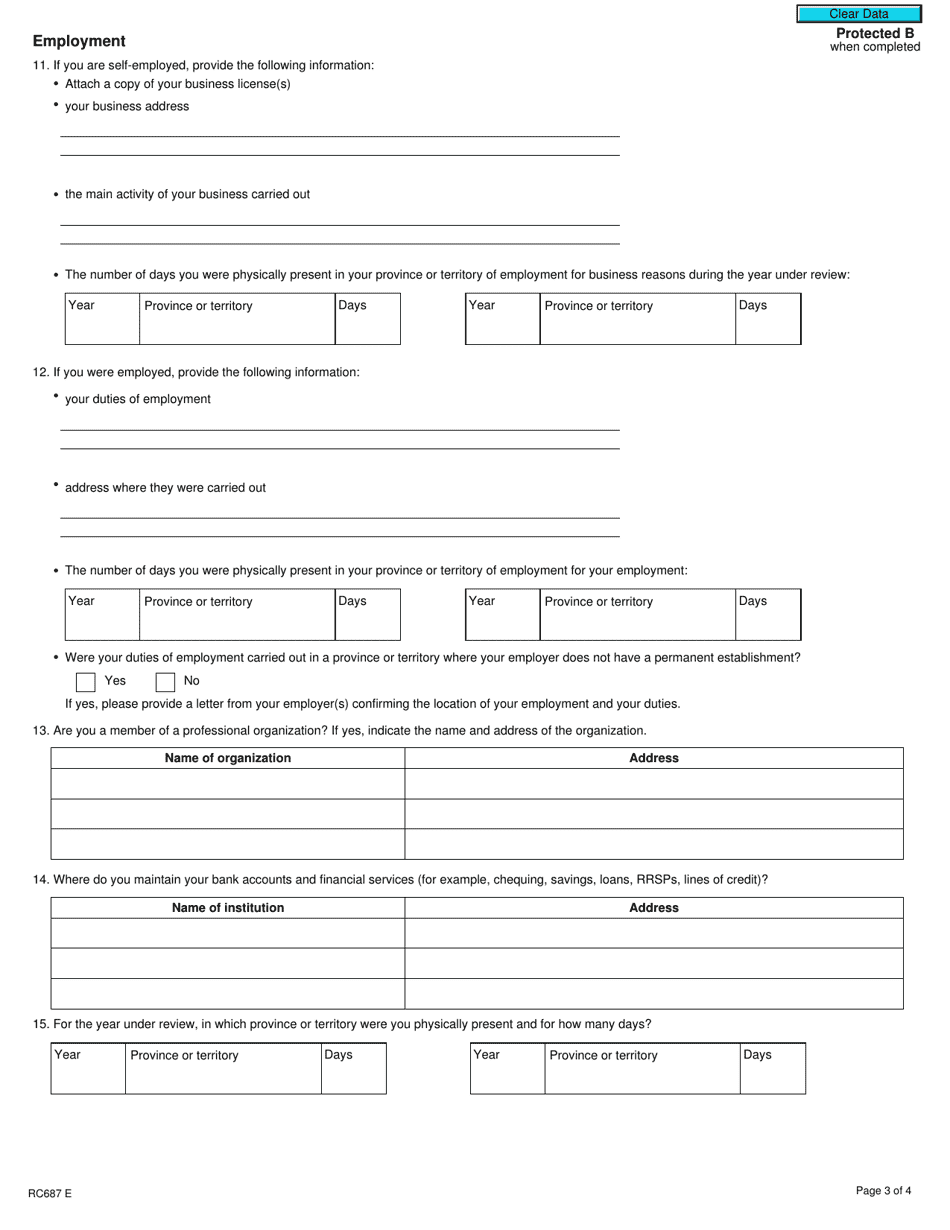

Form RC687, also known as "Province or Territory of Residence - Single Year - Refund Examination Program", is used in Canada for the purpose of determining the province or territory of residence for taxation purposes. It is specifically related to the Refund Examination Program, which is conducted by the Canada Revenue Agency (CRA) to ensure the accuracy of refund claims.

The Form RC687 Province or Territory of Residence - Single Year - Refund Examination Program is filed by individuals who are residents of a province or territory in Canada.

FAQ

Q: What is Form RC687?

A: Form RC687 is a tax form used in Canada.

Q: What does Form RC687 ask for?

A: Form RC687 asks for your province or territory of residence.

Q: Who is required to complete Form RC687?

A: Taxpayers participating in the Refund Examination Program in Canada are required to complete Form RC687.

Q: What is the Refund Examination Program?

A: The Refund Examination Program is a program in Canada that examines tax returns to verify eligibility for tax refunds.

Q: How often does Form RC687 need to be completed?

A: Form RC687 needs to be completed annually for a single year.