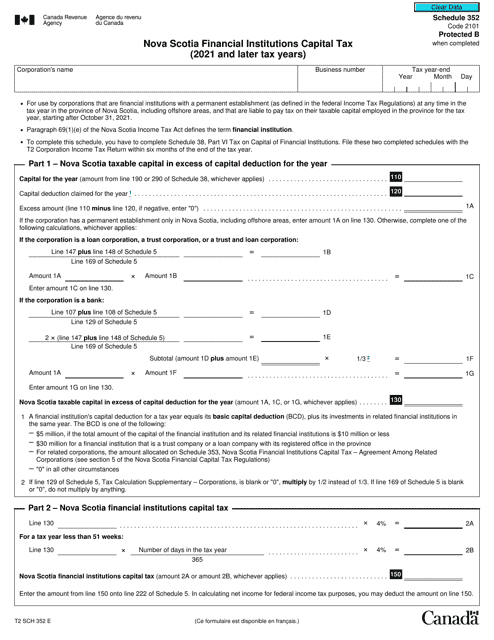

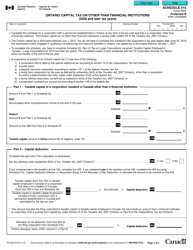

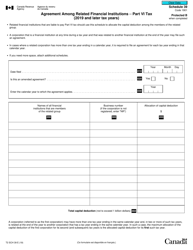

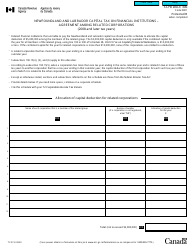

Form T2 Schedule 352 Nova Scotia Financial Institutions Capital Tax (2021 and Later Tax Years) - Canada

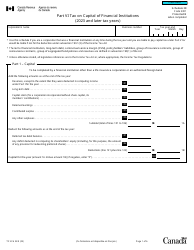

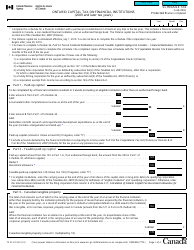

Form T2 Schedule 352 is used by financial institutions in Nova Scotia, Canada, to calculate their capital tax for the tax years 2021 and onwards.

The financial institutions in Nova Scotia file the Form T2 Schedule 352 Nova Scotia Financial Institutions Capital Tax.

FAQ

Q: What is the T2 Schedule 352?

A: The T2 Schedule 352 is a form used to report the Nova Scotia Financial Institutions Capital Tax for tax years starting in 2021.

Q: Who needs to file the T2 Schedule 352?

A: Financial institutions operating in Nova Scotia are required to file the T2 Schedule 352.

Q: What is the Nova Scotia Financial Institutions Capital Tax?

A: The Nova Scotia Financial Institutions Capital Tax is a tax imposed on financial institutions based on their capital.

Q: What tax years does the T2 Schedule 352 apply to?

A: The T2 Schedule 352 applies to tax years starting in 2021 and later.

Q: Are there any penalties for not filing the T2 Schedule 352?

A: Yes, there are penalties for not filing the T2 Schedule 352, including late filing penalties and interest charges on unpaid taxes.

Q: How do I calculate the Nova Scotia Financial Institutions Capital Tax?

A: The calculation of the Nova Scotia Financial Institutions Capital Tax is based on specific rules and rates outlined in the tax legislation.

Q: What should I do if I need help with the T2 Schedule 352?

A: If you need assistance with the T2 Schedule 352, you can contact the CRA directly or consult a tax professional for guidance.