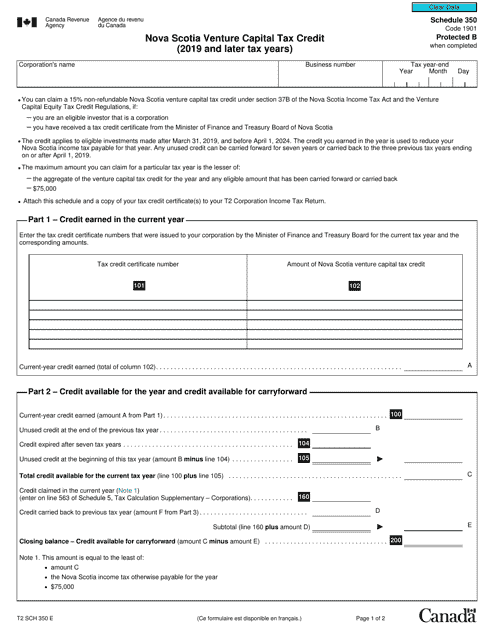

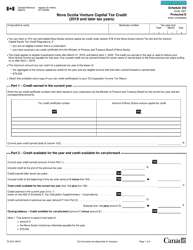

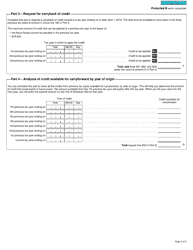

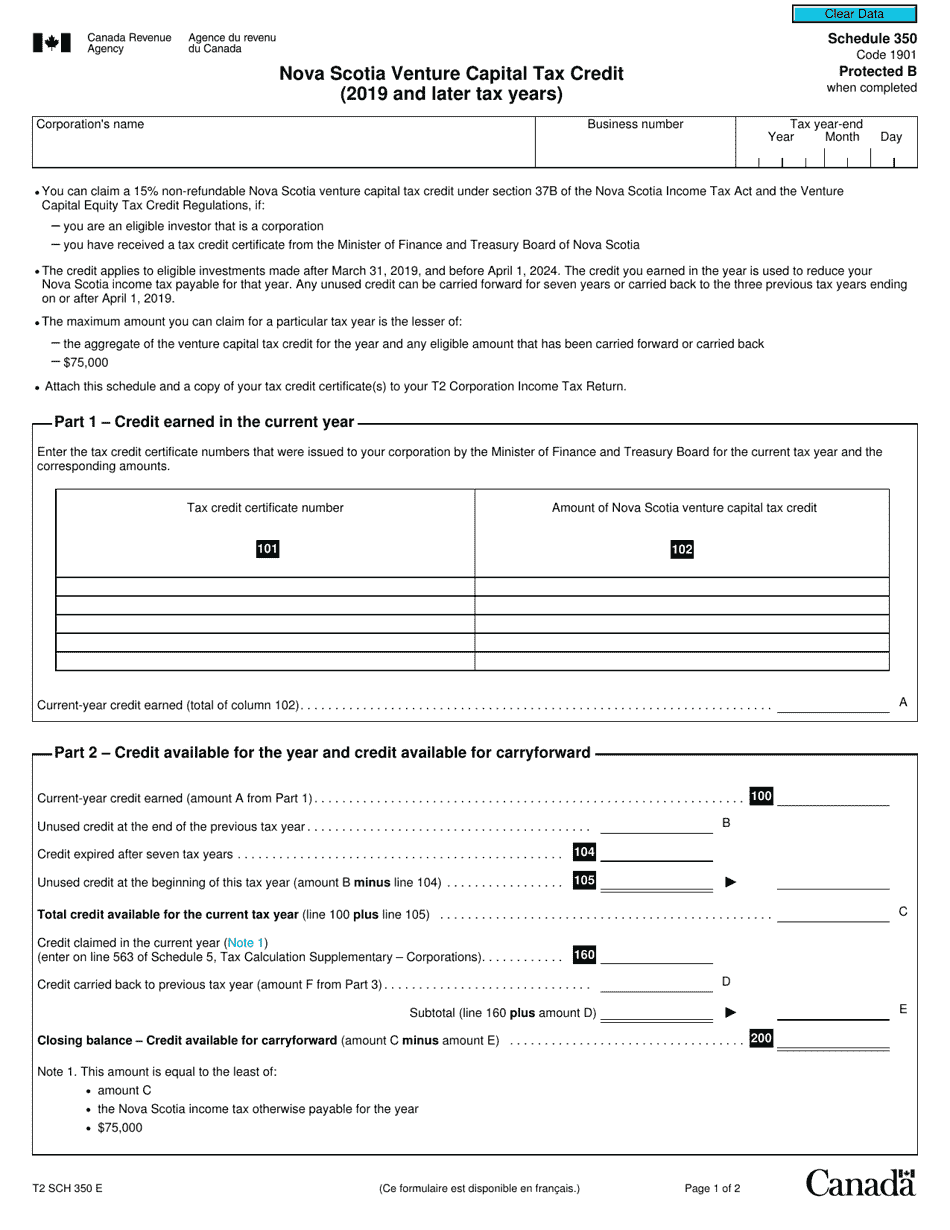

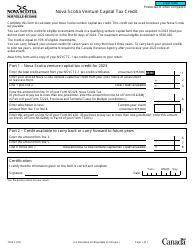

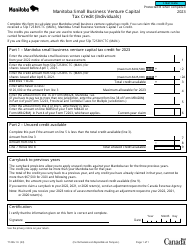

Form T2 Schedule 350 Nova Scotia Venture Capital Tax Credit (2019 and Later Tax Years) - Canada

Form T2 Schedule 350 is used in Canada for claiming the Nova Scotia Venture CapitalTax Credit. This credit is available for eligible corporations in Nova Scotia that have invested in eligible businesses to promote economic growth in the province.

The Form T2 Schedule 350 Nova Scotia Venture Capital Tax Credit is filed by corporations in Nova Scotia, Canada.

FAQ

Q: What is Form T2 Schedule 350?

A: Form T2 Schedule 350 is a tax form used in Canada to claim the Nova Scotia Venture Capital Tax Credit.

Q: What is the Nova Scotia Venture Capital Tax Credit?

A: The Nova Scotia Venture Capital Tax Credit is a tax credit available to individuals and corporations who invest in eligible Nova Scotia small businesses.

Q: Who can claim the Nova Scotia Venture Capital Tax Credit?

A: Both individuals and corporations can claim the Nova Scotia Venture Capital Tax Credit.

Q: What is the purpose of the Nova Scotia Venture Capital Tax Credit?

A: The purpose of the Nova Scotia Venture Capital Tax Credit is to encourage investment in small businesses in Nova Scotia.

Q: What are the eligibility criteria for the Nova Scotia Venture Capital Tax Credit?

A: To be eligible for the Nova Scotia Venture Capital Tax Credit, the investment must be made in an eligible Nova Scotia small business and meet certain other criteria.

Q: How much tax credit can be claimed through the Nova Scotia Venture Capital Tax Credit?

A: The tax credit amount is 35% of the total eligible investment, up to a maximum of $25,000 per tax year.

Q: How do I claim the Nova Scotia Venture Capital Tax Credit?

A: To claim the Nova Scotia Venture Capital Tax Credit, you need to complete Form T2 Schedule 350 and include it with your annual tax return.

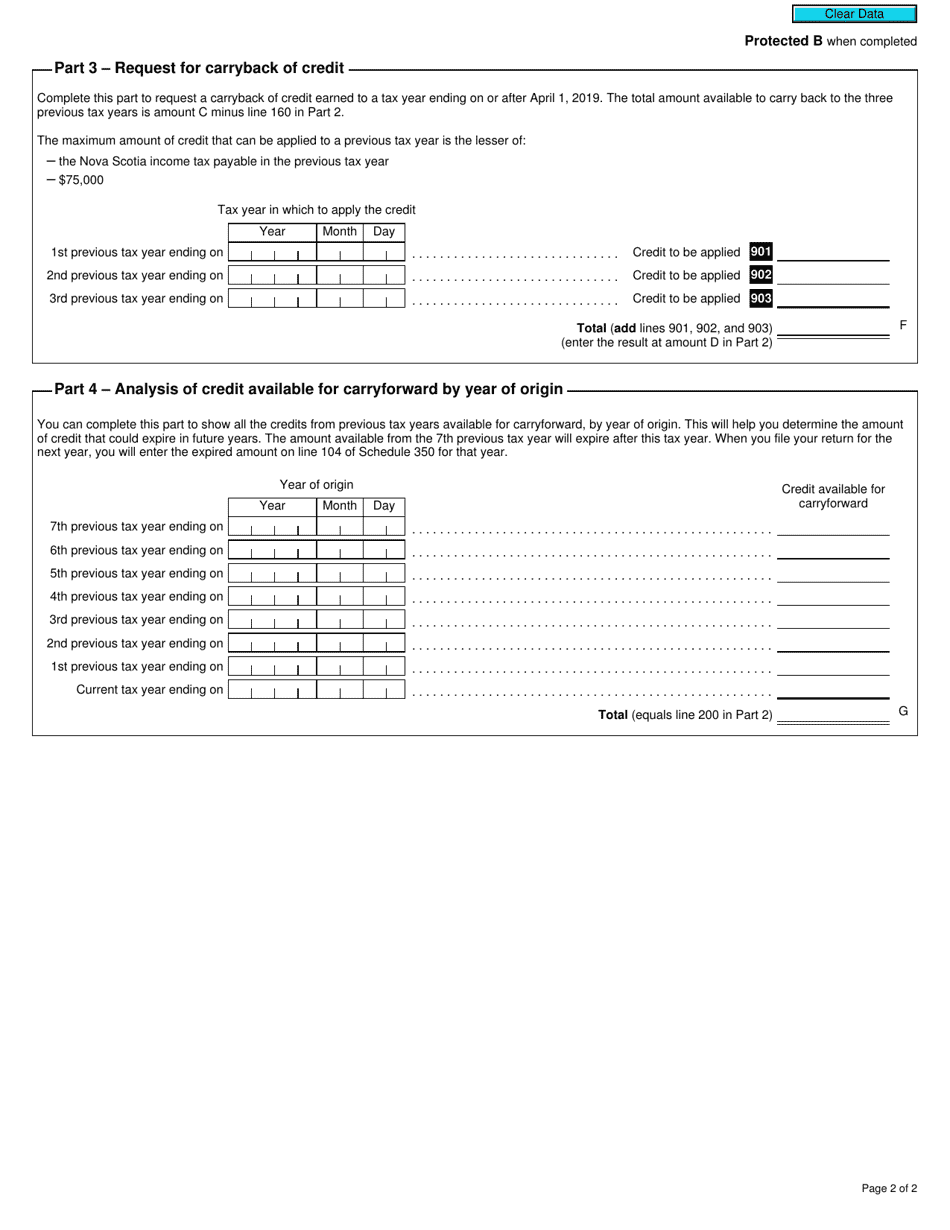

Q: Can the Nova Scotia Venture Capital Tax Credit be carried forward or back?

A: Yes, unused portions of the tax credit can be carried forward for up to 10 years or back for up to 3 years.

Q: Is there a deadline for claiming the Nova Scotia Venture Capital Tax Credit?

A: Yes, the tax credit must be claimed within 3 years from the end of the taxation year in which the investment was made.