This version of the form is not currently in use and is provided for reference only. Download this version of

Form T101A

for the current year.

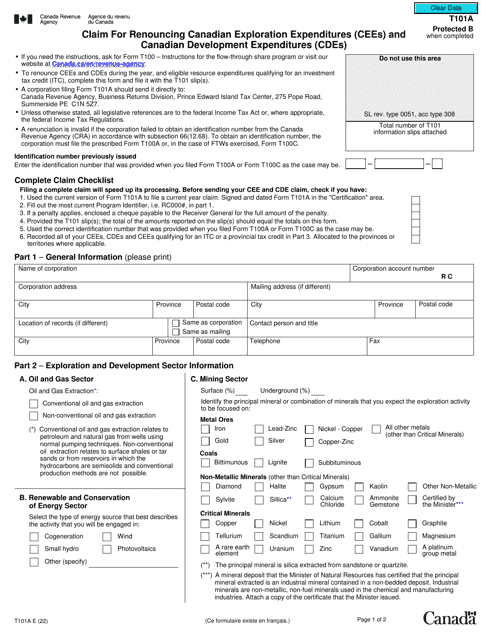

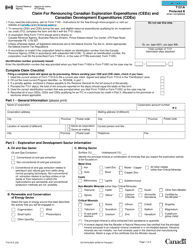

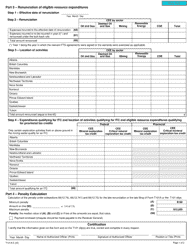

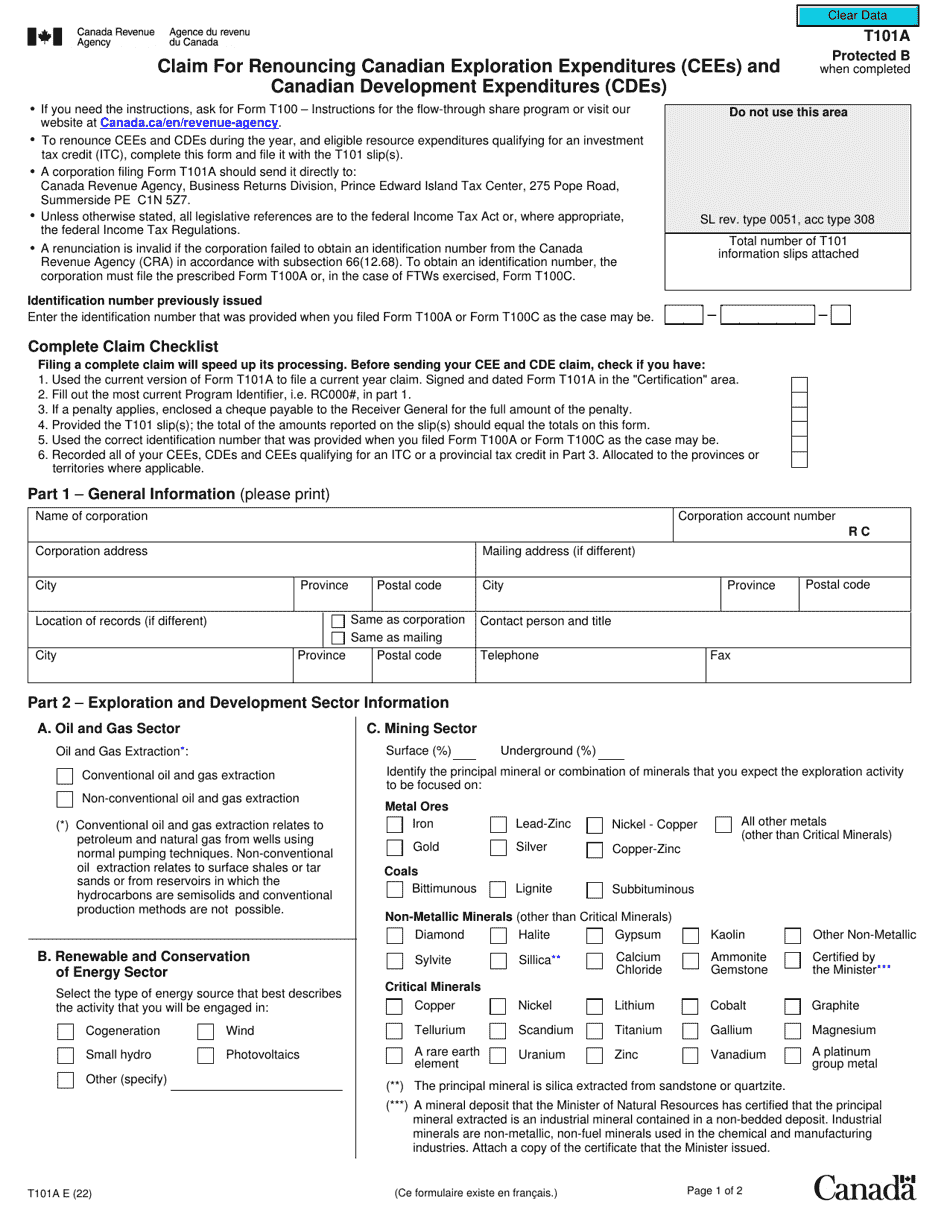

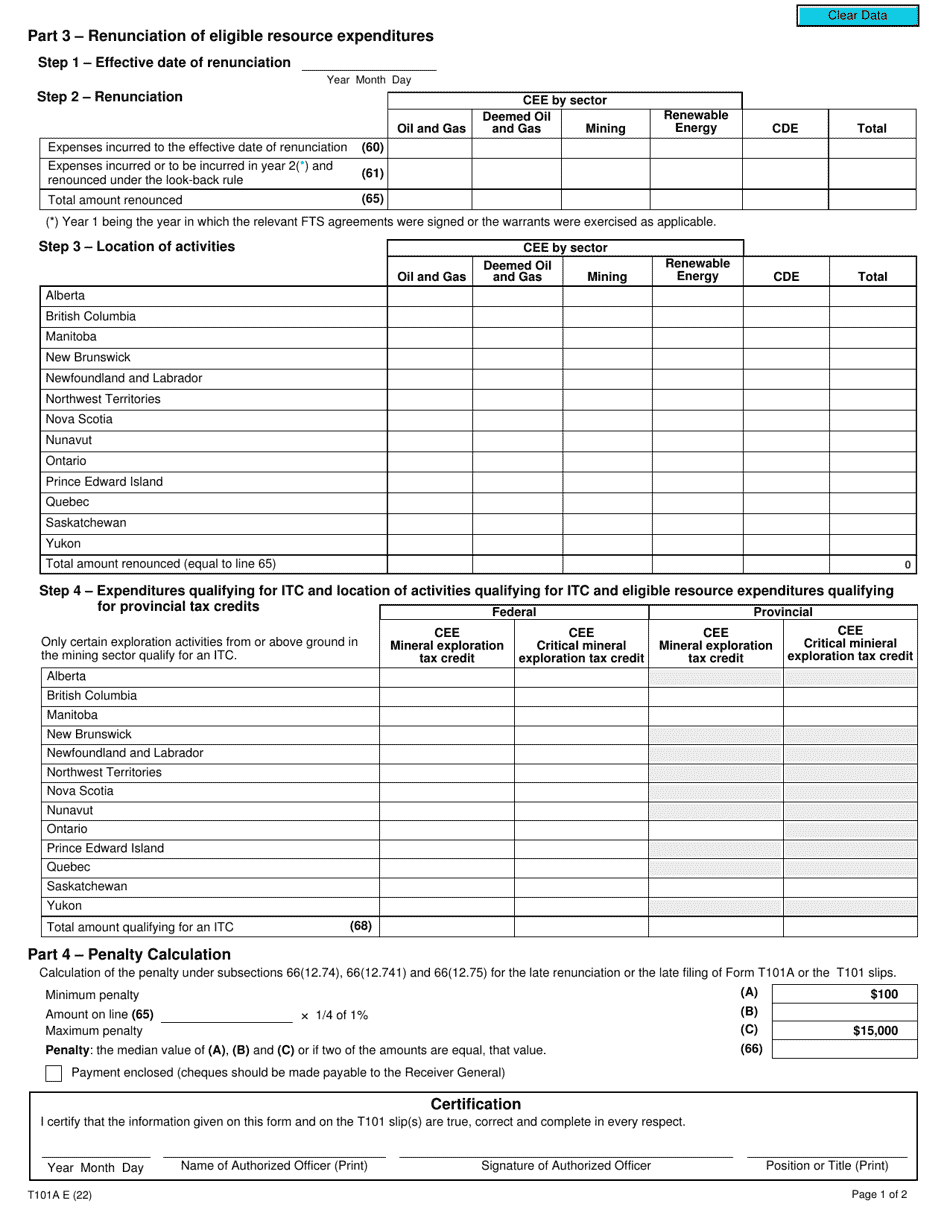

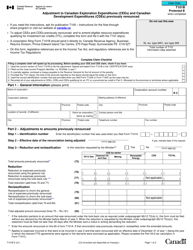

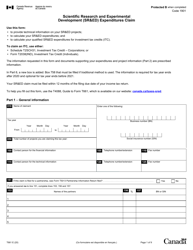

Form T101A Claim for Renouncing Canadian Exploration Expenditures (Cees) and Canadian Development Expenditures (Cdes) - Canada

Form T101A Claim for Renouncing Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs) in Canada is used to renounce or transfer certain eligible expenses made in the exploration and development activities of Canadian resource properties. This form allows individuals or corporations to transfer these expenses to other parties who can benefit from them for tax purposes.

The Canadian exploration expenditures (CEEs) and Canadian development expenditures (CDEs) are claimed by the resource company or taxpayer that incurred them.

FAQ

Q: What is Form T101A?

A: Form T101A is a claim form for renouncing Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs) in Canada.

Q: What are Canadian Exploration Expenditures (CEEs)?

A: Canadian Exploration Expenditures (CEEs) are expenses incurred for exploring mineral resources in Canada.

Q: What are Canadian Development Expenditures (CDEs)?

A: Canadian Development Expenditures (CDEs) are expenses incurred for developing mineral resources in Canada.

Q: Who can use Form T101A?

A: Form T101A can be used by individuals, partnerships, and corporations who want to renounce their CEEs and CDEs.

Q: What is the purpose of renouncing CEEs and CDEs?

A: Renouncing CEEs and CDEs allows taxpayers to transfer unused tax deductions to other entities.

Q: Are there any restrictions on renouncing CEEs and CDEs?

A: Yes, there are restrictions on how much can be renounced and to whom it can be transferred. The specific rules are outlined in the tax legislation.

Q: Is there a deadline to submit Form T101A?

A: Yes, the deadline for submitting Form T101A is generally within 18 months after the end of the taxation year for which the expenditures were incurred.

Q: What supporting documents are required for Form T101A?

A: The CRA may require supporting documents such as exploration reports, maps, and financial statements to verify the claimed CEEs and CDEs.

Q: Can I amend a previously filed Form T101A?

A: Yes, you can amend a previously filed Form T101A within certain time limits and by following the CRA's guidelines for amending tax returns.