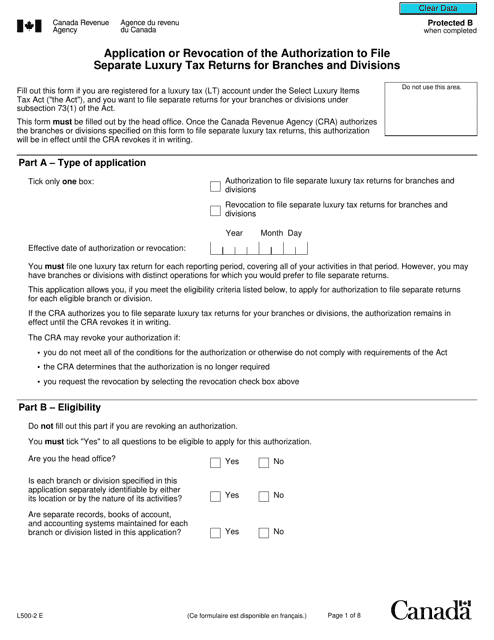

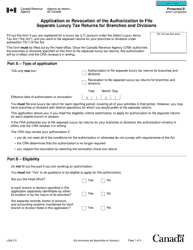

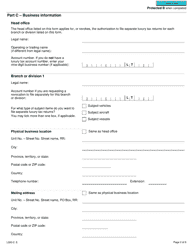

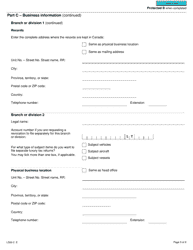

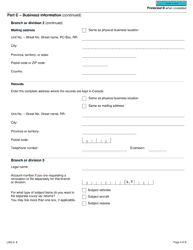

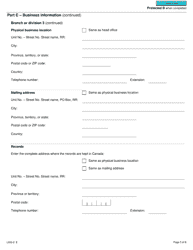

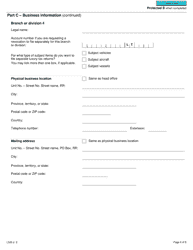

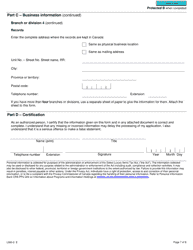

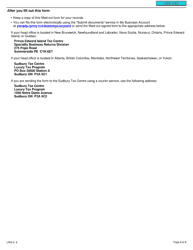

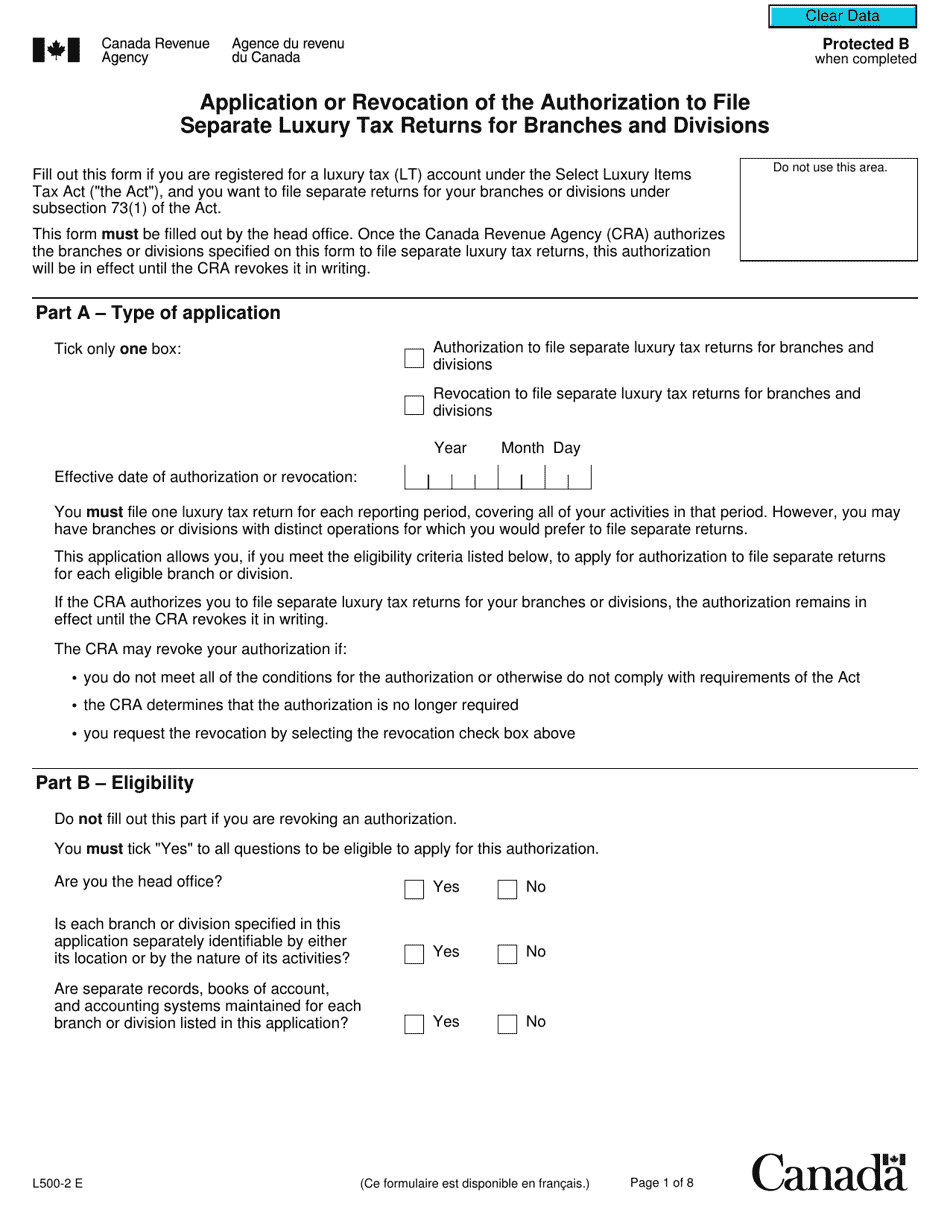

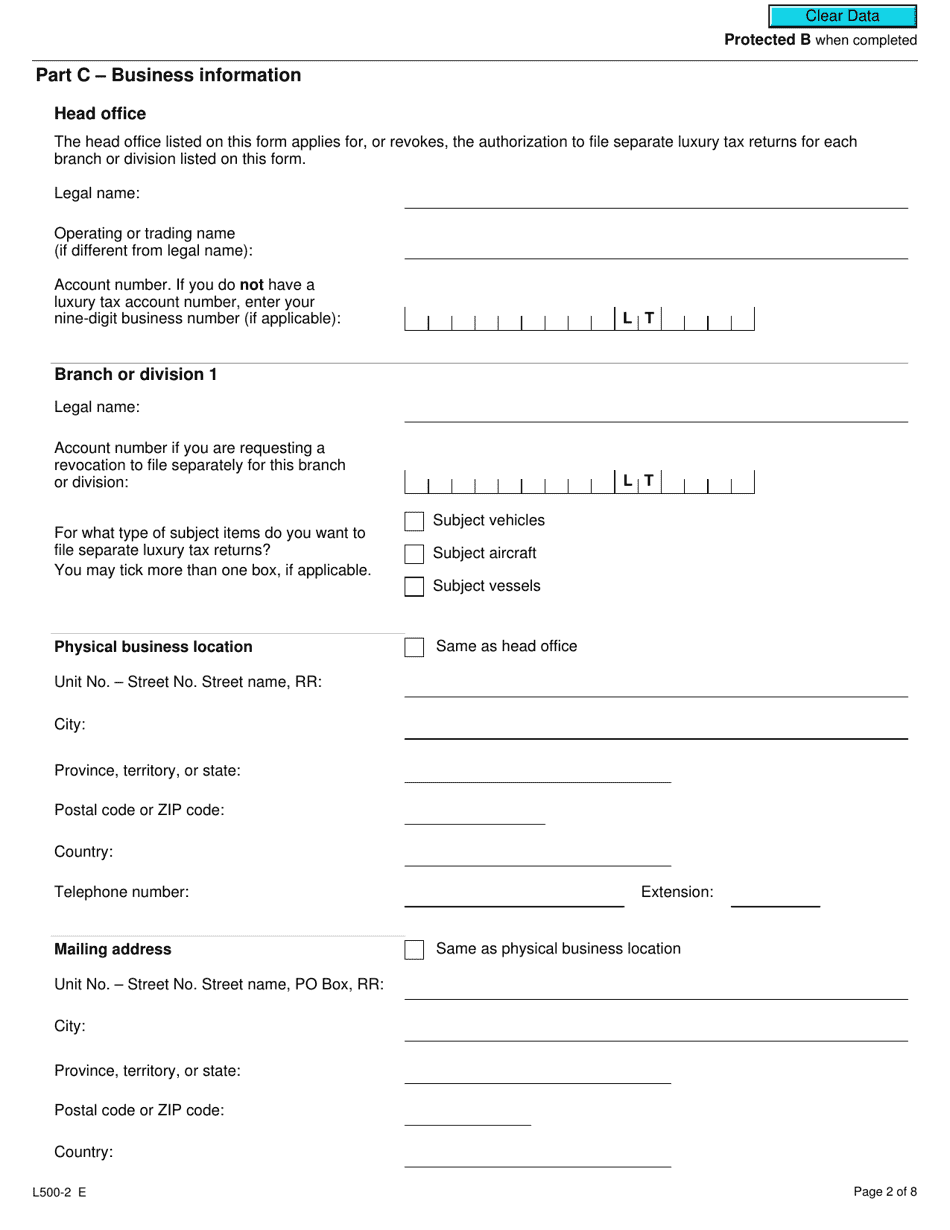

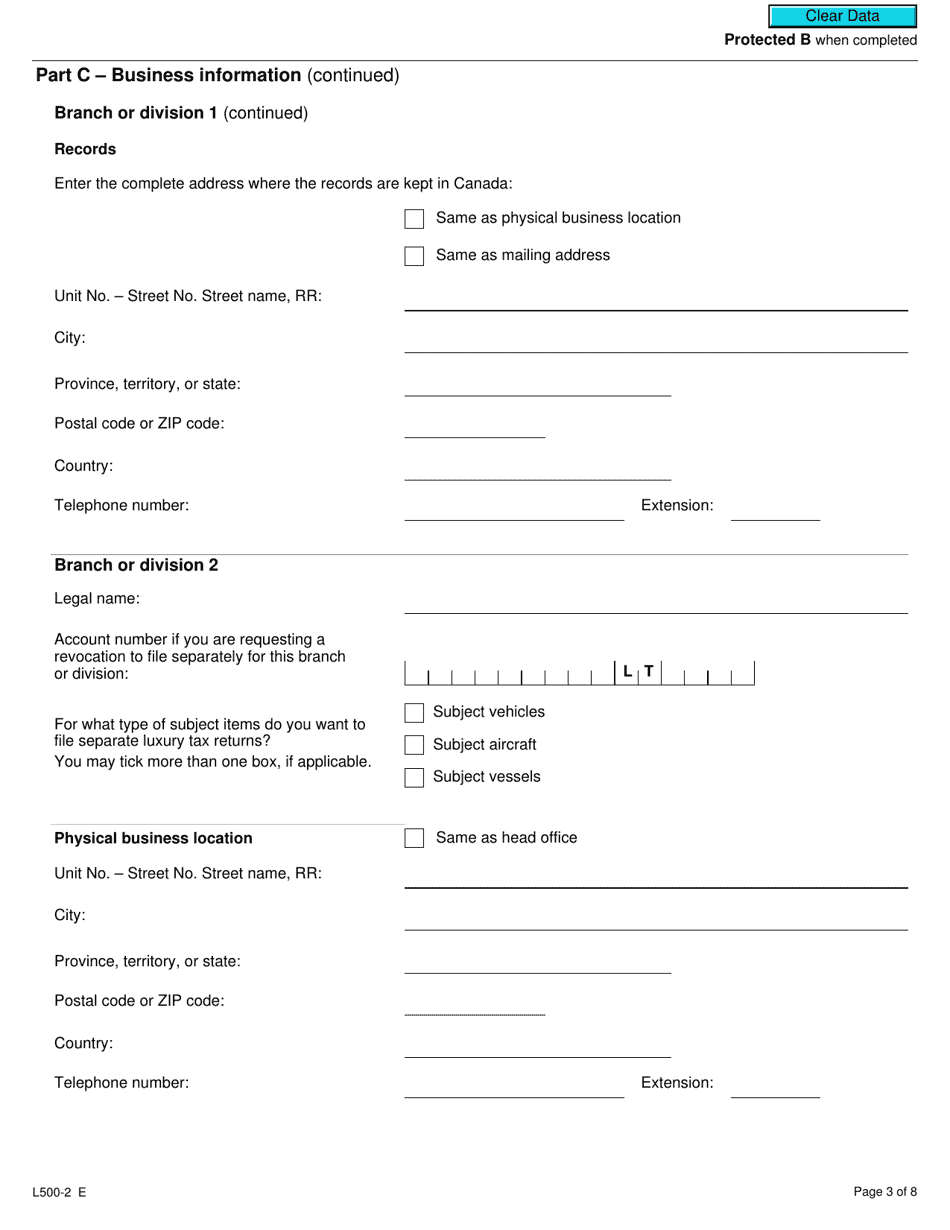

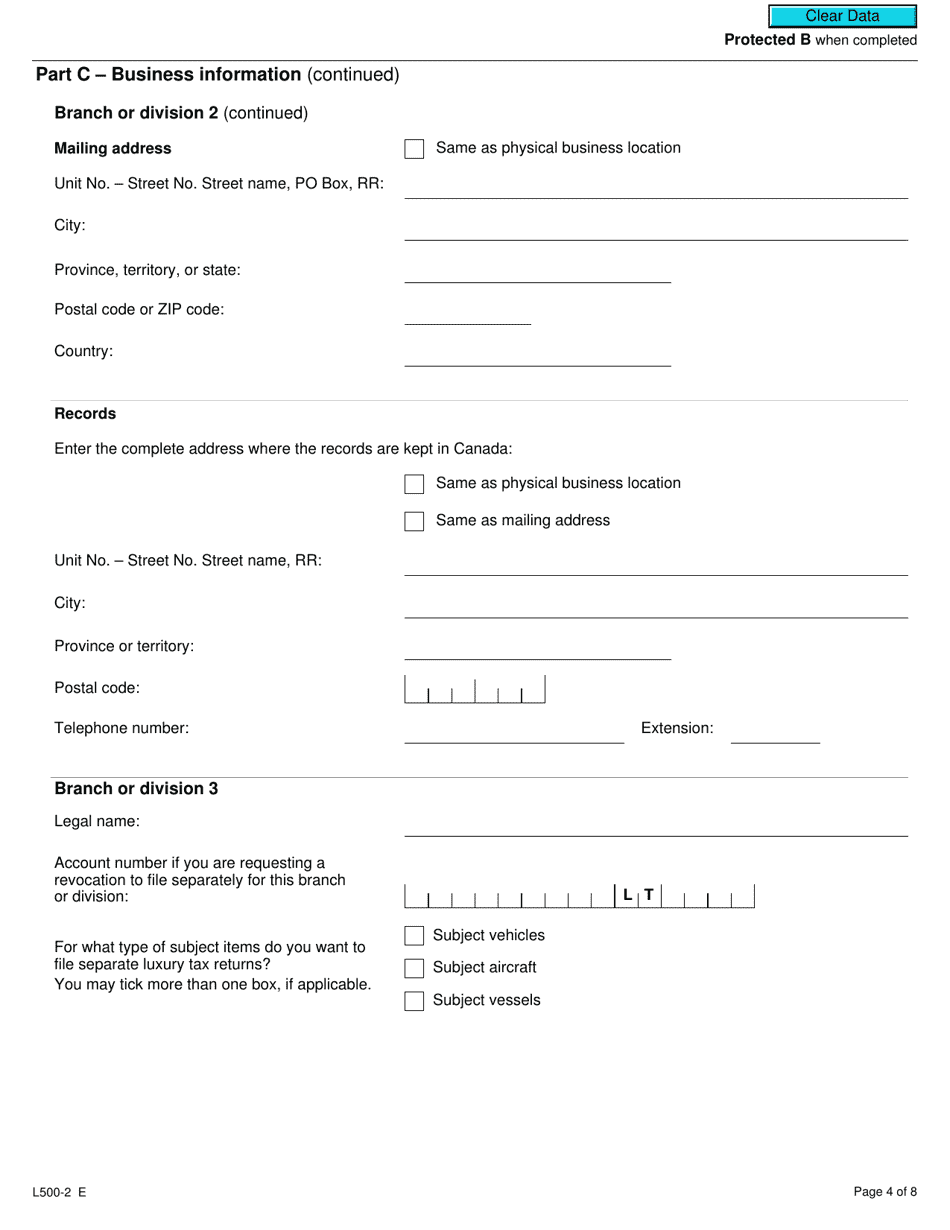

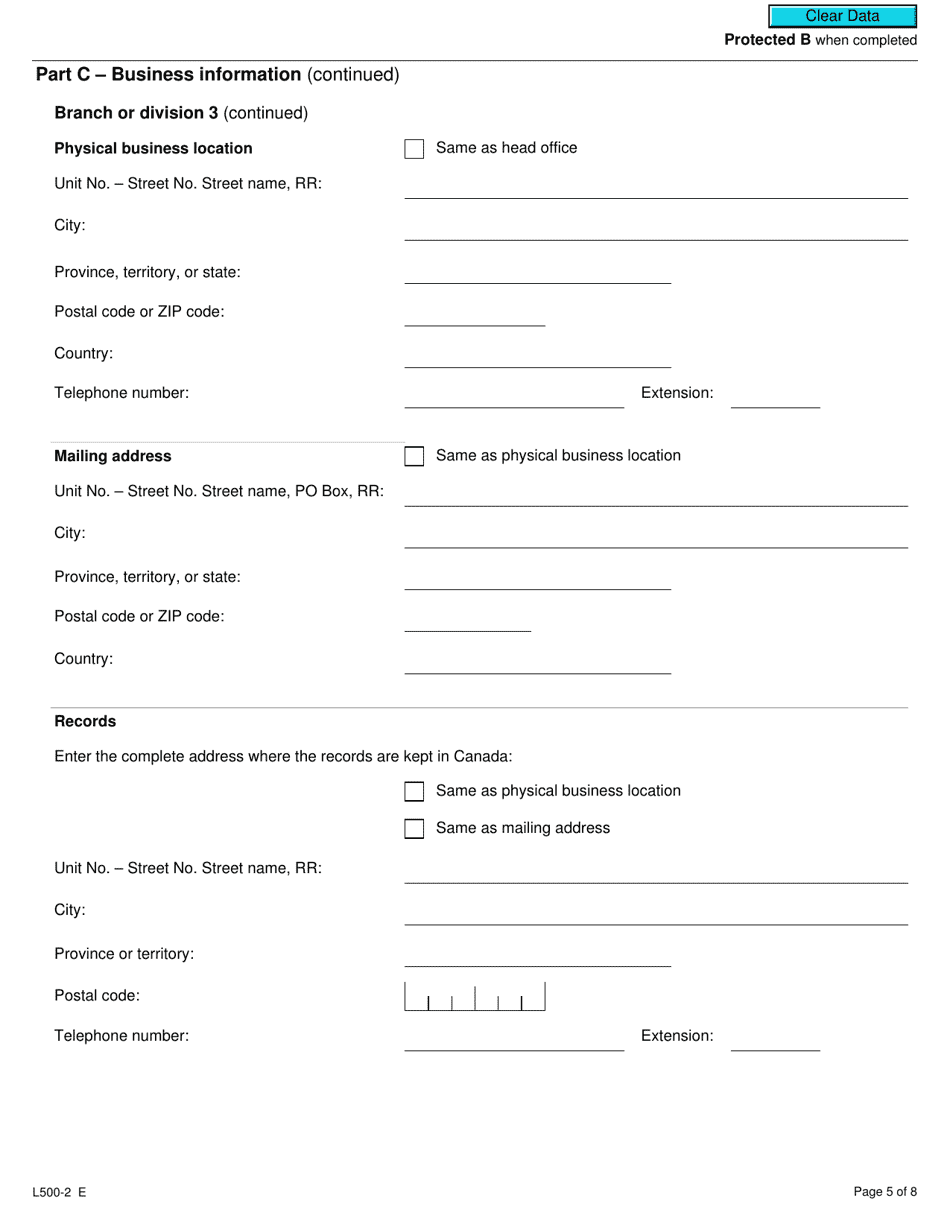

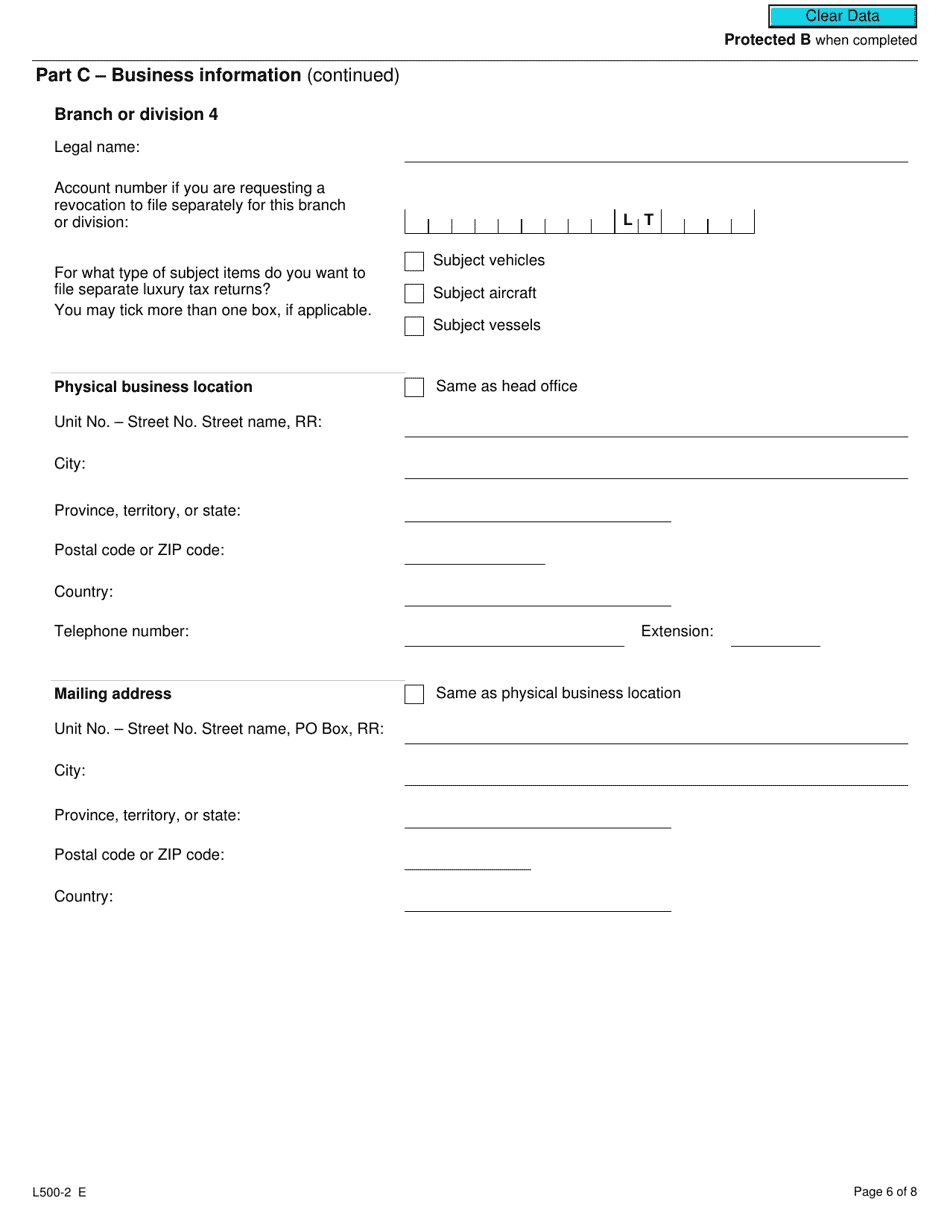

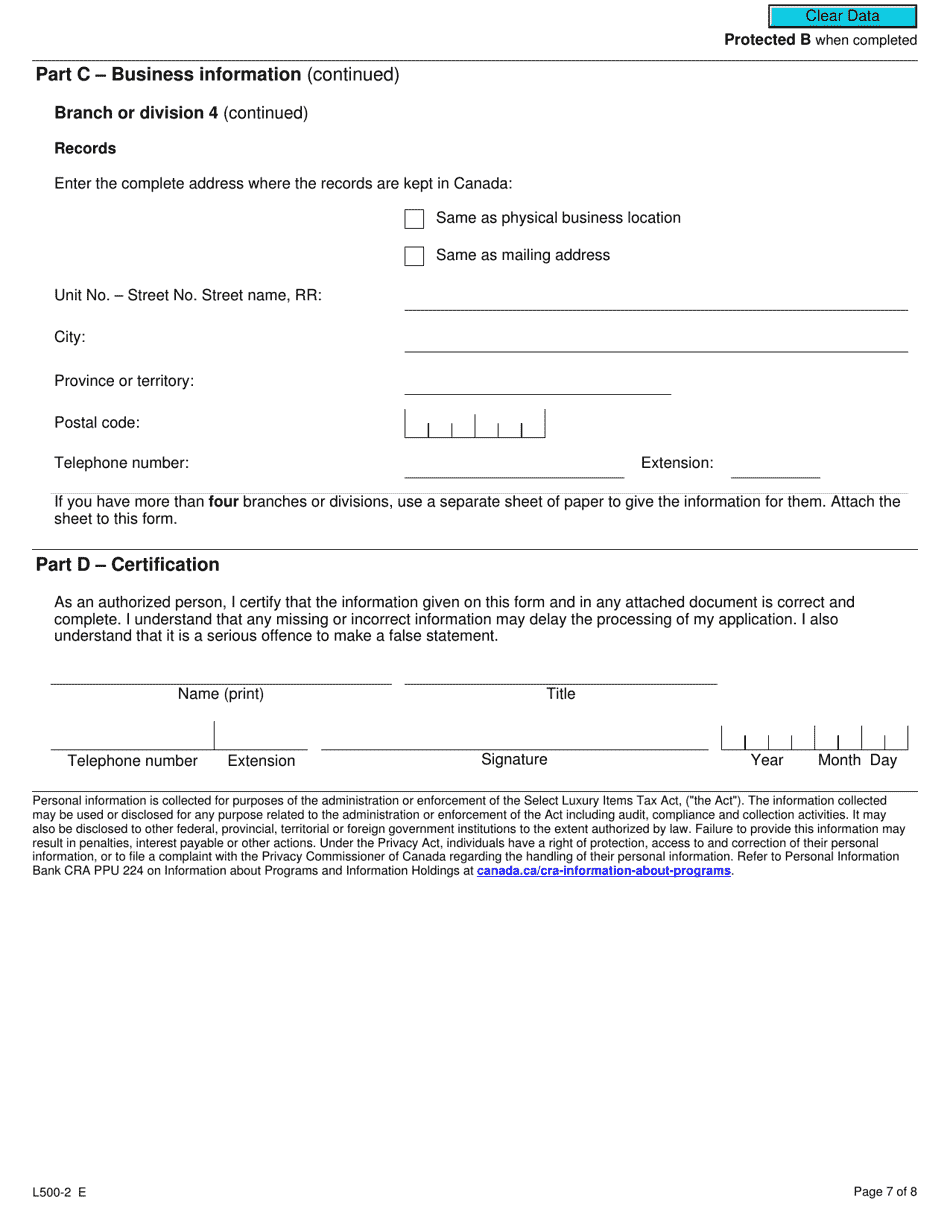

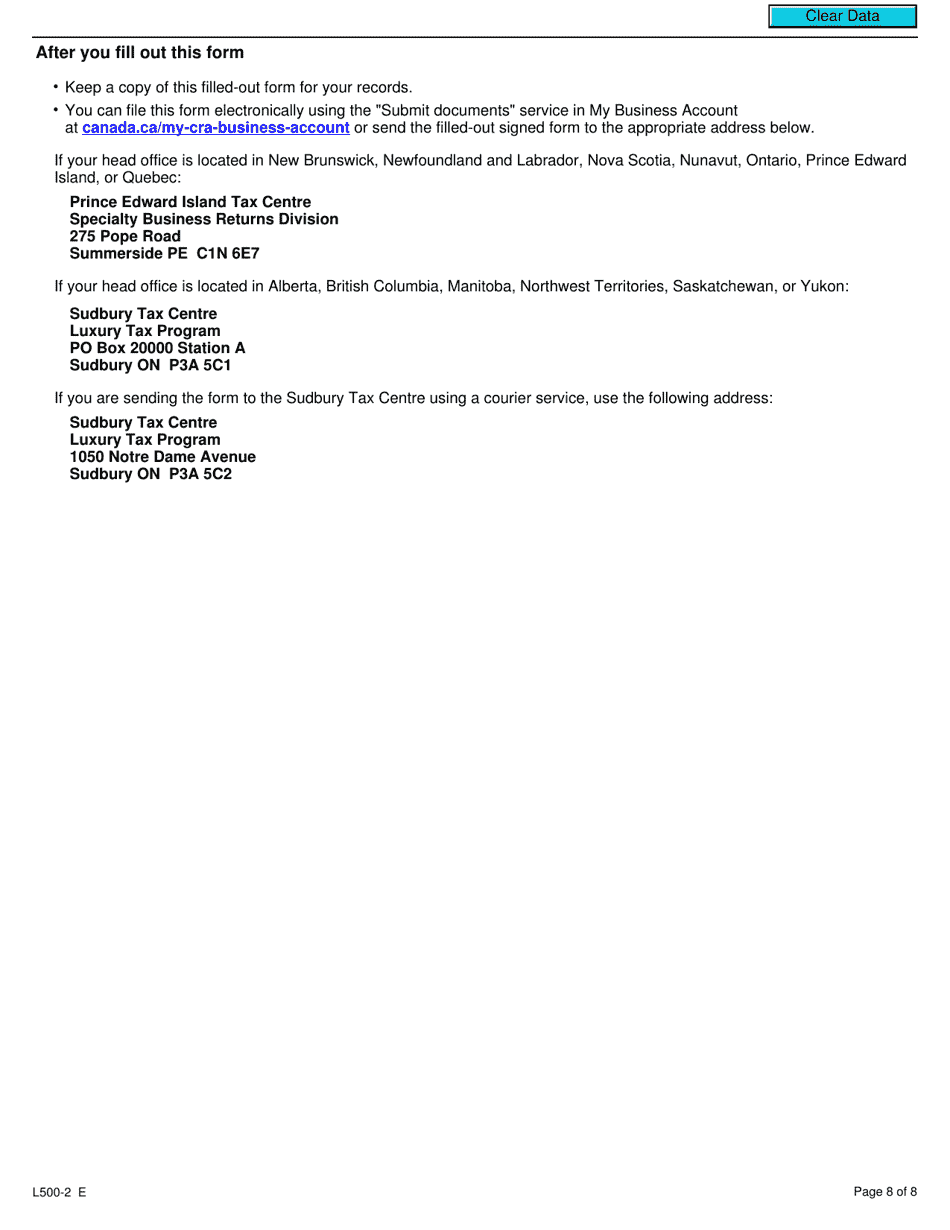

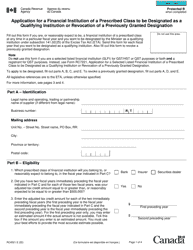

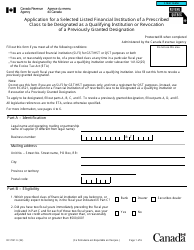

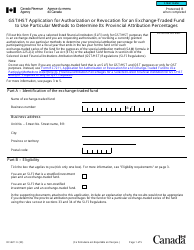

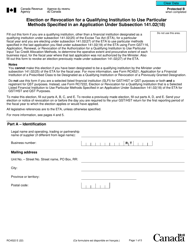

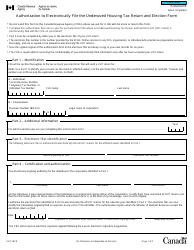

Form L500-2 Application or Revocation of the Authorization to File Separate Luxury Tax Returns for Branches and Divisions - Canada

Form L500-2 Application or Revocation of the Authorization to File Separate Luxury Tax Returns for Branches and Divisions - Canada is used for applying or revoking the authorization to file separate luxury tax returns for branches and divisions in Canada.

The form L500-2 for the Application or Revocation of the Authorization to File Separate Luxury Tax Returns for Branches and Divisions in Canada is filed by businesses with separate branches or divisions.

FAQ

Q: What is Form L500-2?

A: Form L500-2 is an application or revocation of the authorization to file separate luxury tax returns for branches and divisions in Canada.

Q: What is the purpose of Form L500-2?

A: The purpose of Form L500-2 is to apply for or revoke the authorization to file separate luxury tax returns for branches and divisions.

Q: Who should use Form L500-2?

A: Form L500-2 should be used by businesses or organizations that have branches and divisions in Canada and want to file separate luxury tax returns for them.

Q: Is there a fee to file Form L500-2?

A: No, there is no fee to file Form L500-2.