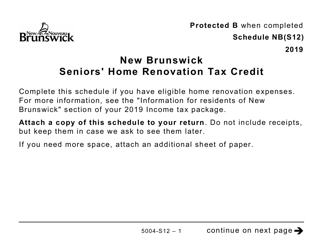

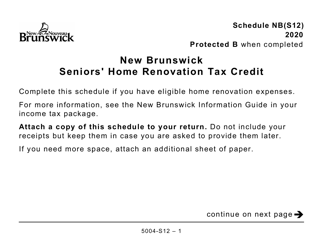

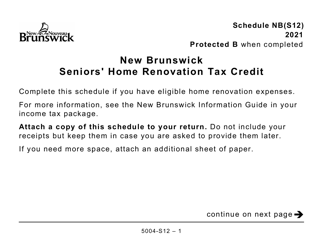

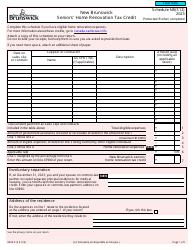

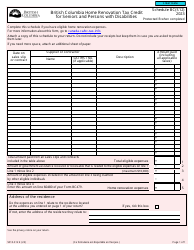

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Large Print - Canada

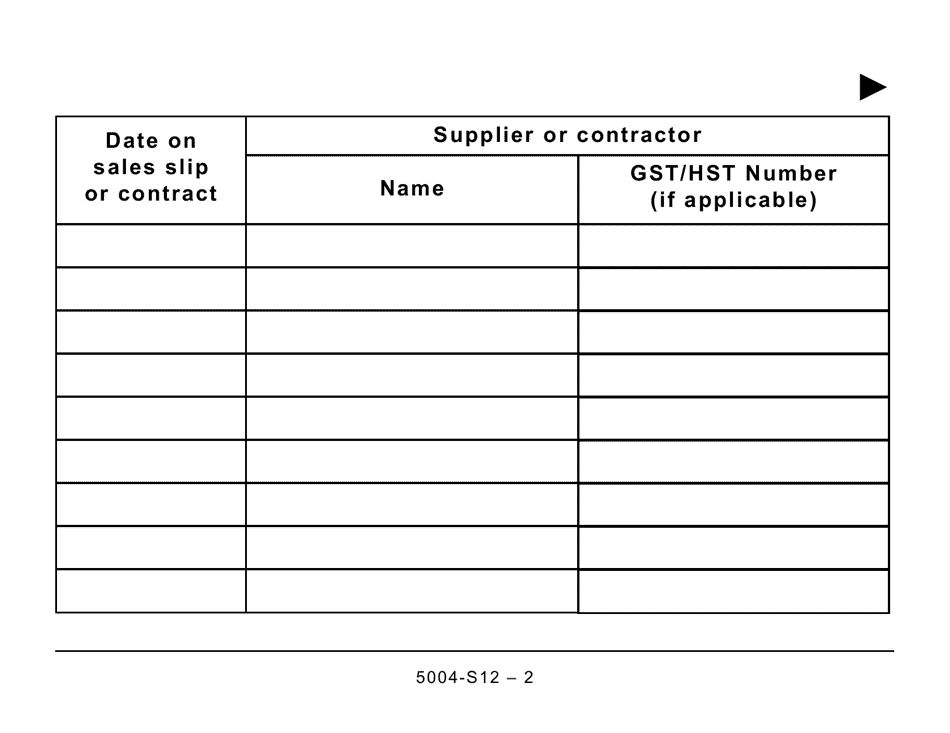

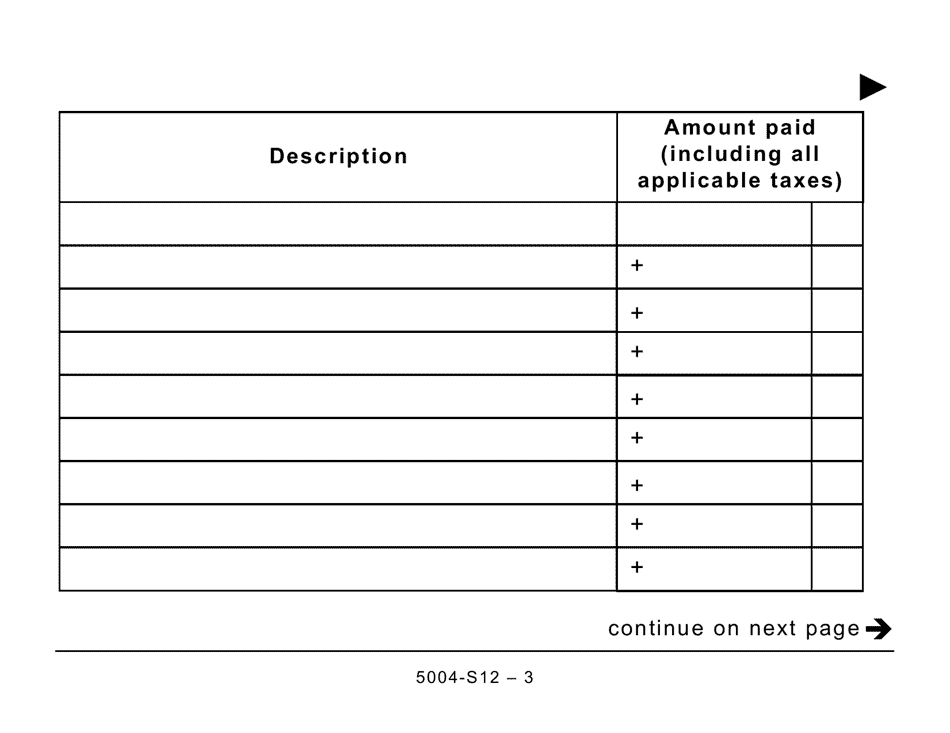

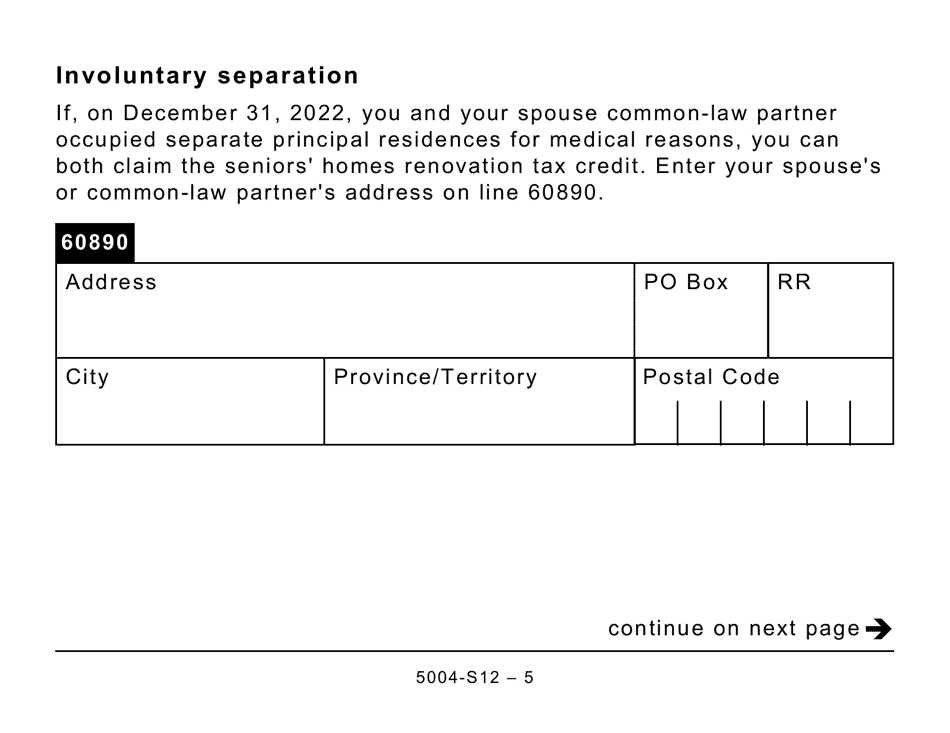

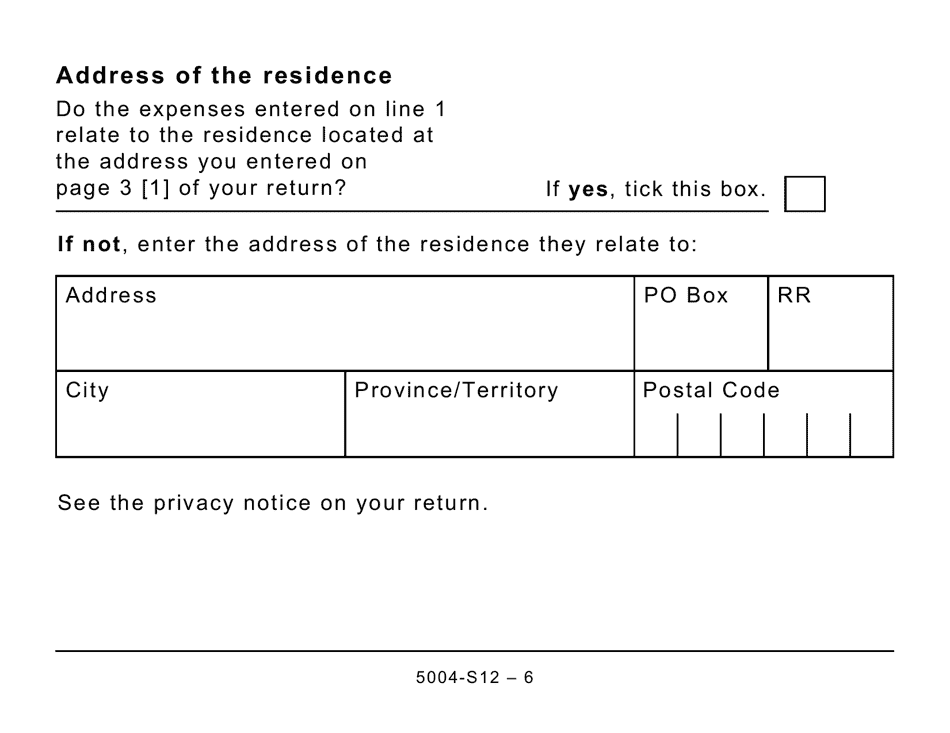

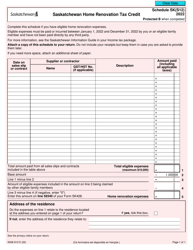

Form 5004-S12 Schedule NB(S12) is used in Canada for reporting the New Brunswick Seniors' Home Renovation Tax Credit. This credit is available to senior citizens in New Brunswick who have made eligible home renovations to make their homes safer and more accessible. The schedule is used to calculate the amount of credit that can be claimed.

FAQ

Q: What is the Form 5004-S12 Schedule NB(S12)?

A: Form 5004-S12 Schedule NB(S12) is a tax form specifically for claiming the New Brunswick Seniors' Home Renovation Tax Credit.

Q: What does the New Brunswick Seniors' Home Renovation Tax Credit do?

A: The New Brunswick Seniors' Home Renovation Tax Credit provides a tax credit for eligible expenses related to home renovations.

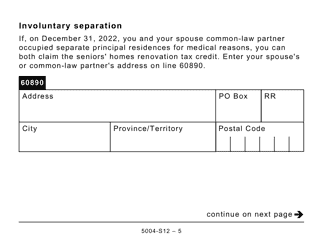

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: To be eligible for the tax credit, you must be a resident of New Brunswick and be 65 years of age or older.

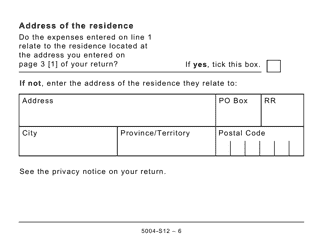

Q: What expenses are eligible for the tax credit?

A: Eligible expenses include those for renovations and alterations that improve the safety or accessibility of a senior's principal residence.

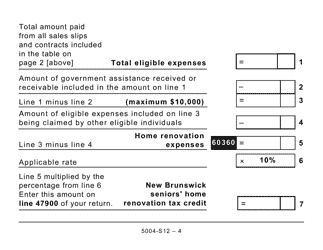

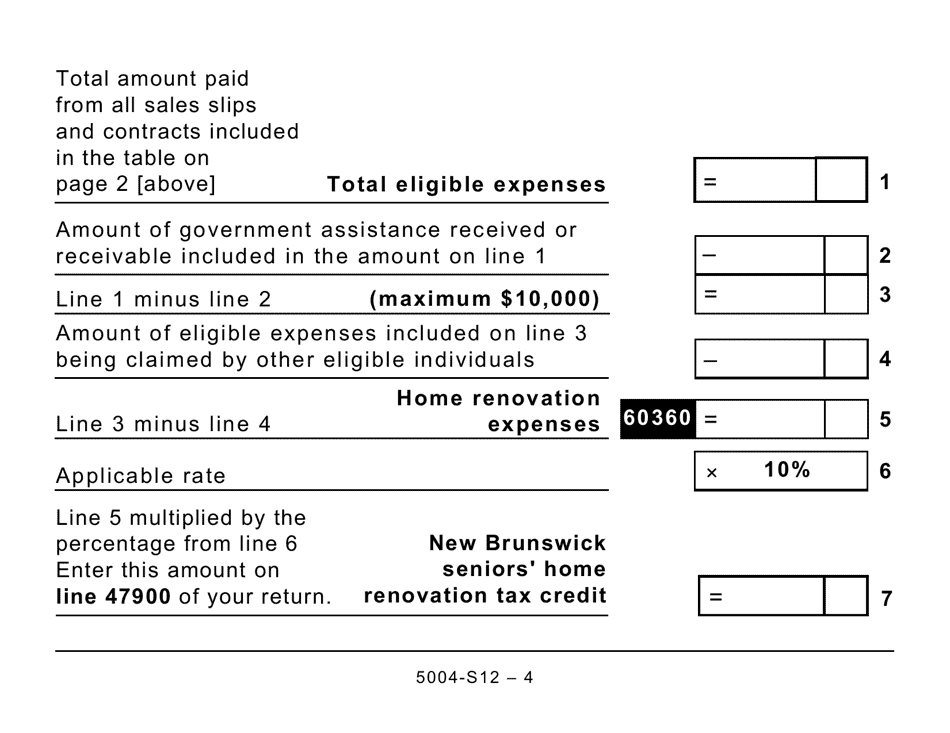

Q: How much is the tax credit?

A: The tax credit is equal to 10% of eligible expenses, up to a maximum of $10,000 per year.

Q: How do I claim the New Brunswick Seniors' Home Renovation Tax Credit?

A: You can claim the tax credit by completing and submitting Form 5004-S12 Schedule NB(S12) along with your income tax return.

Q: Is the New Brunswick Seniors' Home Renovation Tax Credit refundable?

A: No, the tax credit is non-refundable, meaning it can only offset taxes payable.

Q: Is the New Brunswick Seniors' Home Renovation Tax Credit available in the United States?

A: No, the tax credit is specific to residents of New Brunswick in Canada.