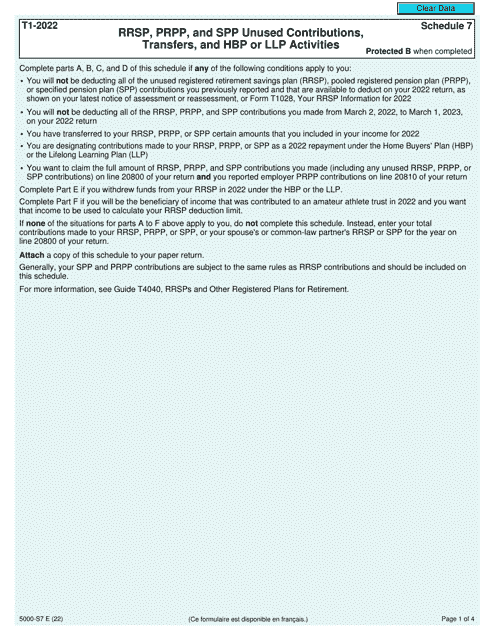

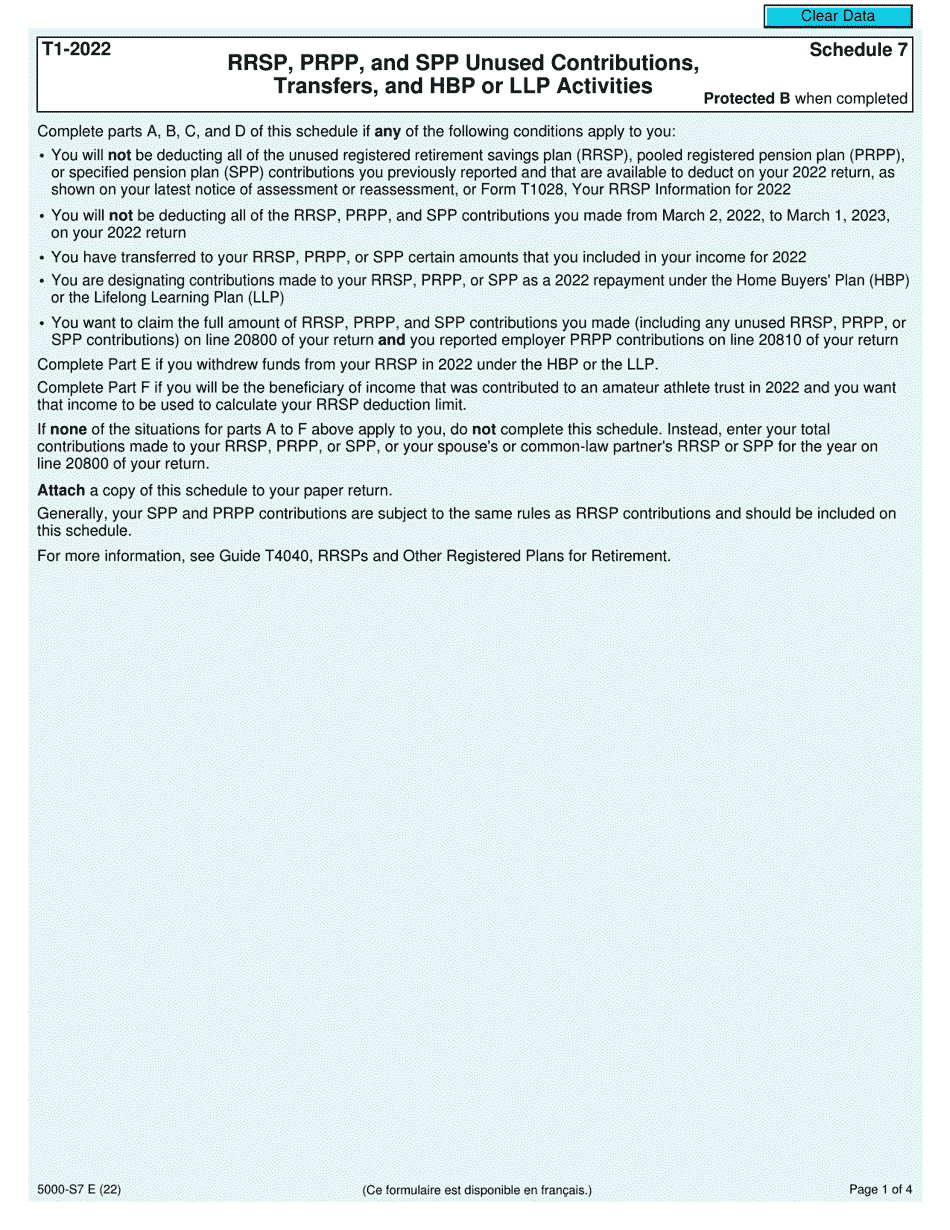

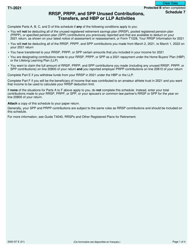

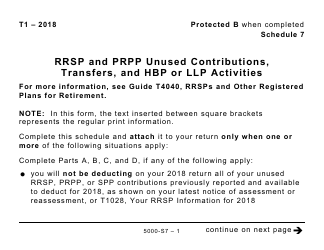

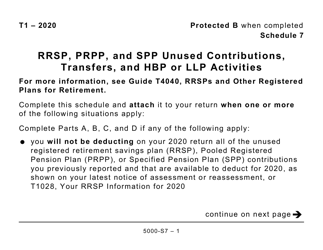

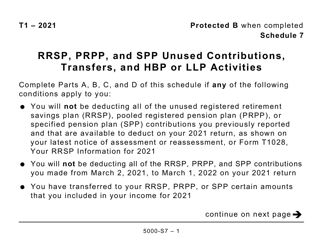

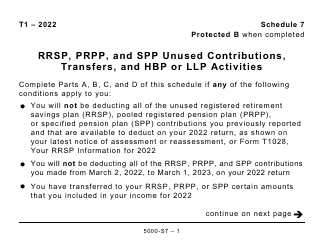

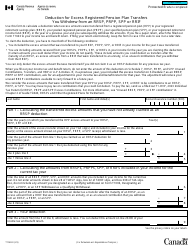

Form 5000 Schedule 7 Rrsp, Prpp, and Spp Unused Contributions, Transfers, and Hbp or LLP Activities - Canada

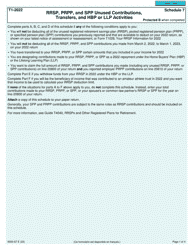

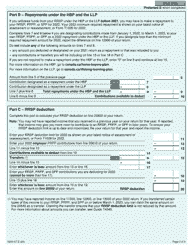

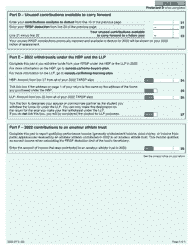

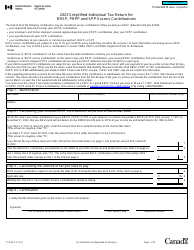

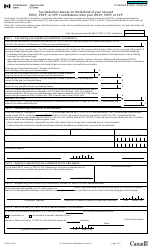

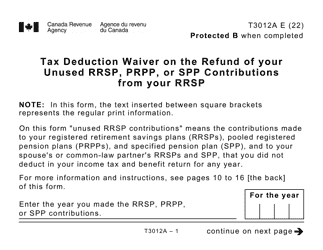

Form 5000 Schedule 7 in Canada is used to report RRSP (Registered Retirement Savings Plan), PRPP (Pooled Registered Pension Plan), and SPP (Specified Pension Plan) unused contributions, transfers, and HBP (Home Buyer's Plan) or LLP (Lifelong Learning Plan) activities.

The individual taxpayer or their authorized representative files the Form 5000 Schedule 7 RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities in Canada.

FAQ

Q: What is Form 5000 Schedule 7?

A: Form 5000 Schedule 7 is a tax form used in Canada to report unused contributions, transfers, and activities related to RRSP, PRPP, and SPP.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan. It is a government-approved savings plan in Canada that helps individuals save for their retirement.

Q: What does PRPP stand for?

A: PRPP stands for Pooled Registered Pension Plan. It is a retirement savings option for individuals in Canada who do not have access to a workplace pension.

Q: What does SPP stand for?

A: SPP stands for Specified Pension Plan. It is a type of retirement savings plan that is offered by certain employers and is registered with the Canadian government.

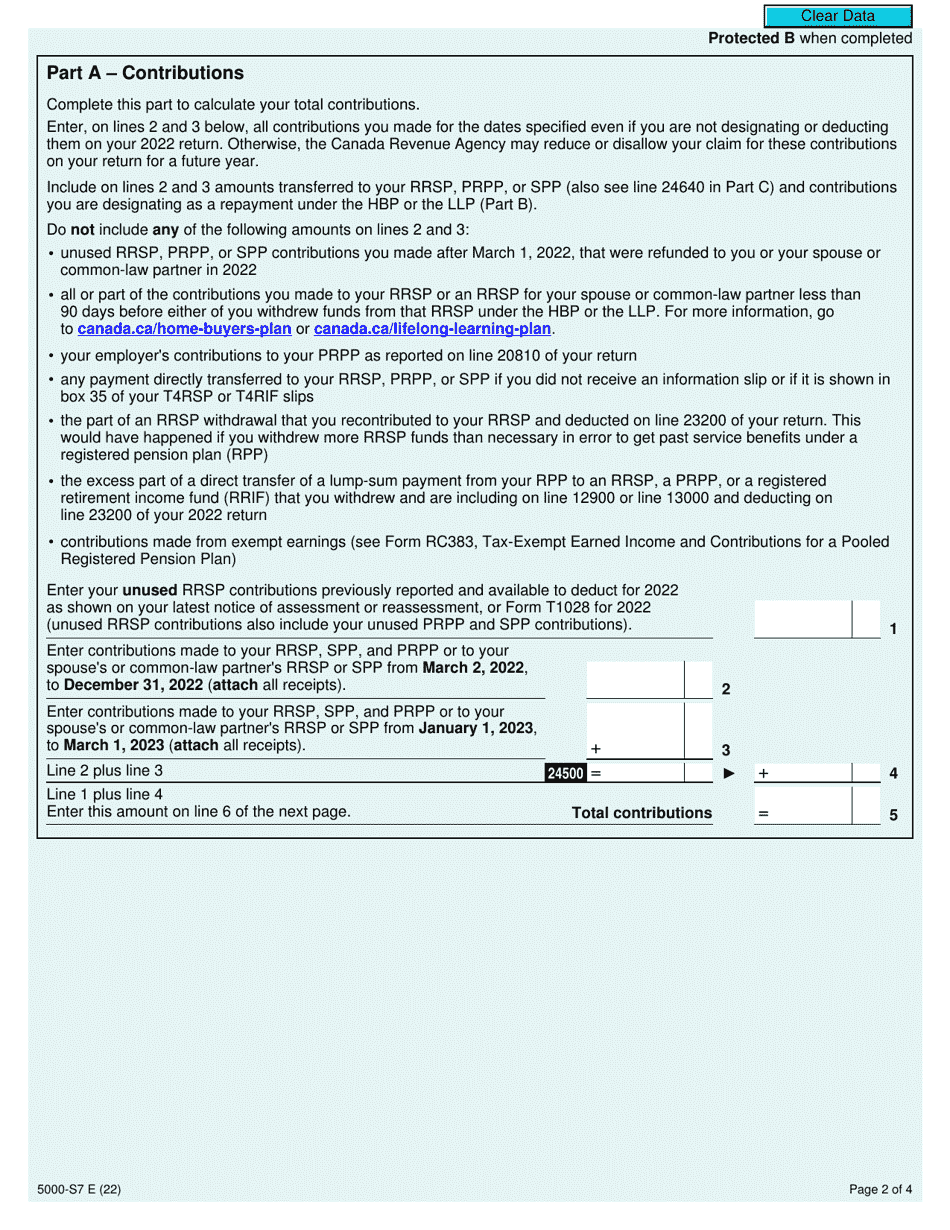

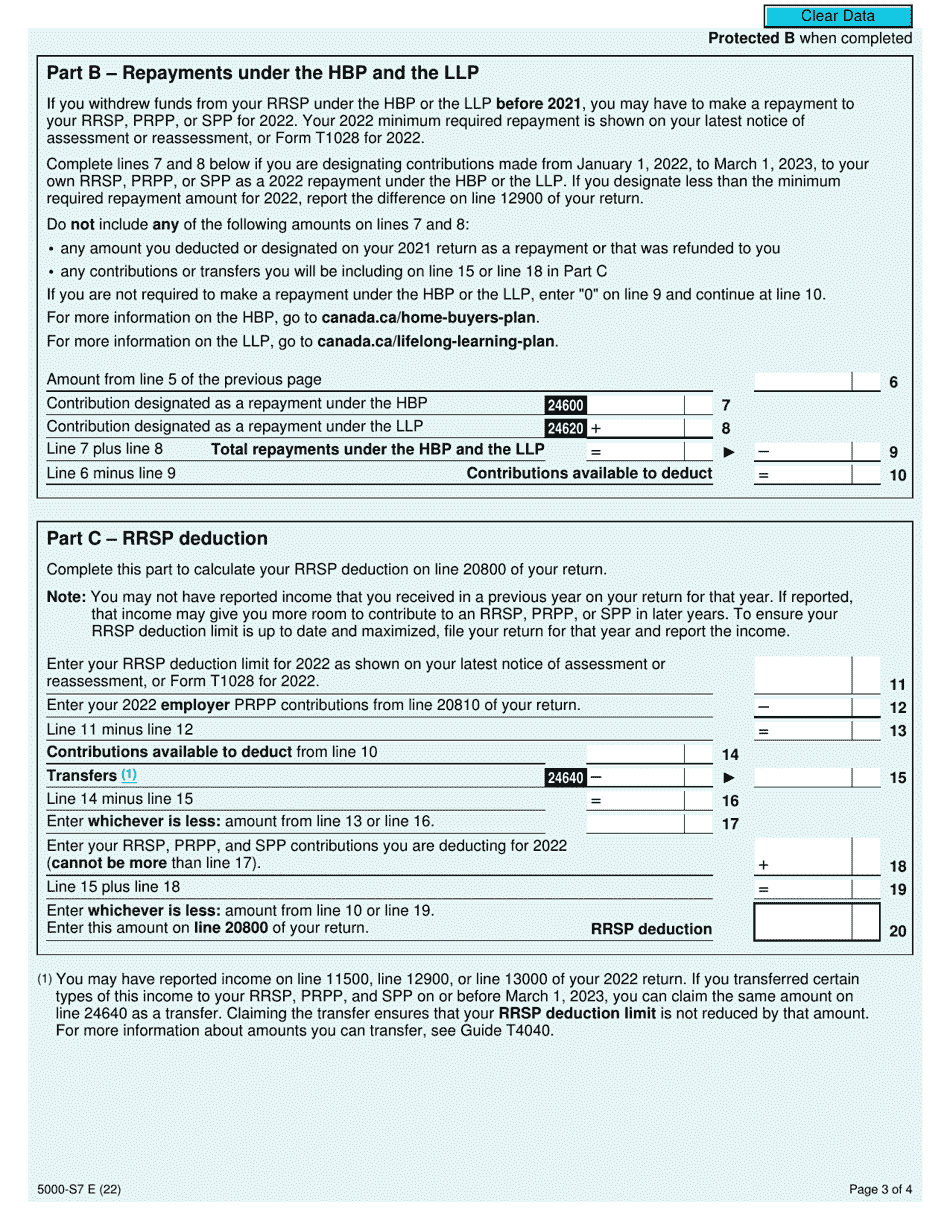

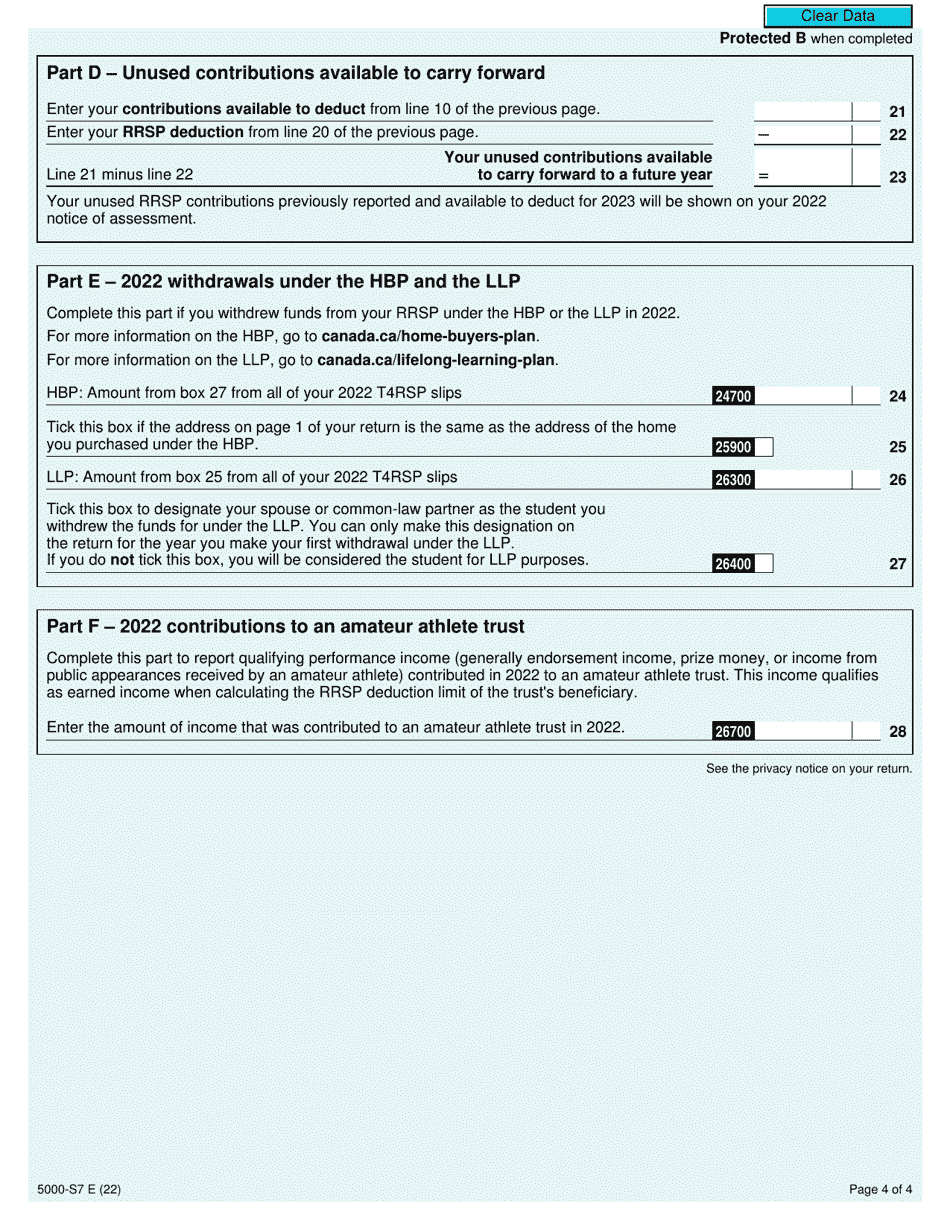

Q: What information does Form 5000 Schedule 7 require?

A: Form 5000 Schedule 7 requires information on unused contributions, transfers, and activities related to RRSP, PRPP, and SPP, such as contributions made, withdrawals, and transfers between plans.

Q: Is Form 5000 Schedule 7 mandatory?

A: Form 5000 Schedule 7 is mandatory for individuals who have unused contributions, transfers, or activities related to RRSP, PRPP, and SPP during the tax year.