This version of the form is not currently in use and is provided for reference only. Download this version of

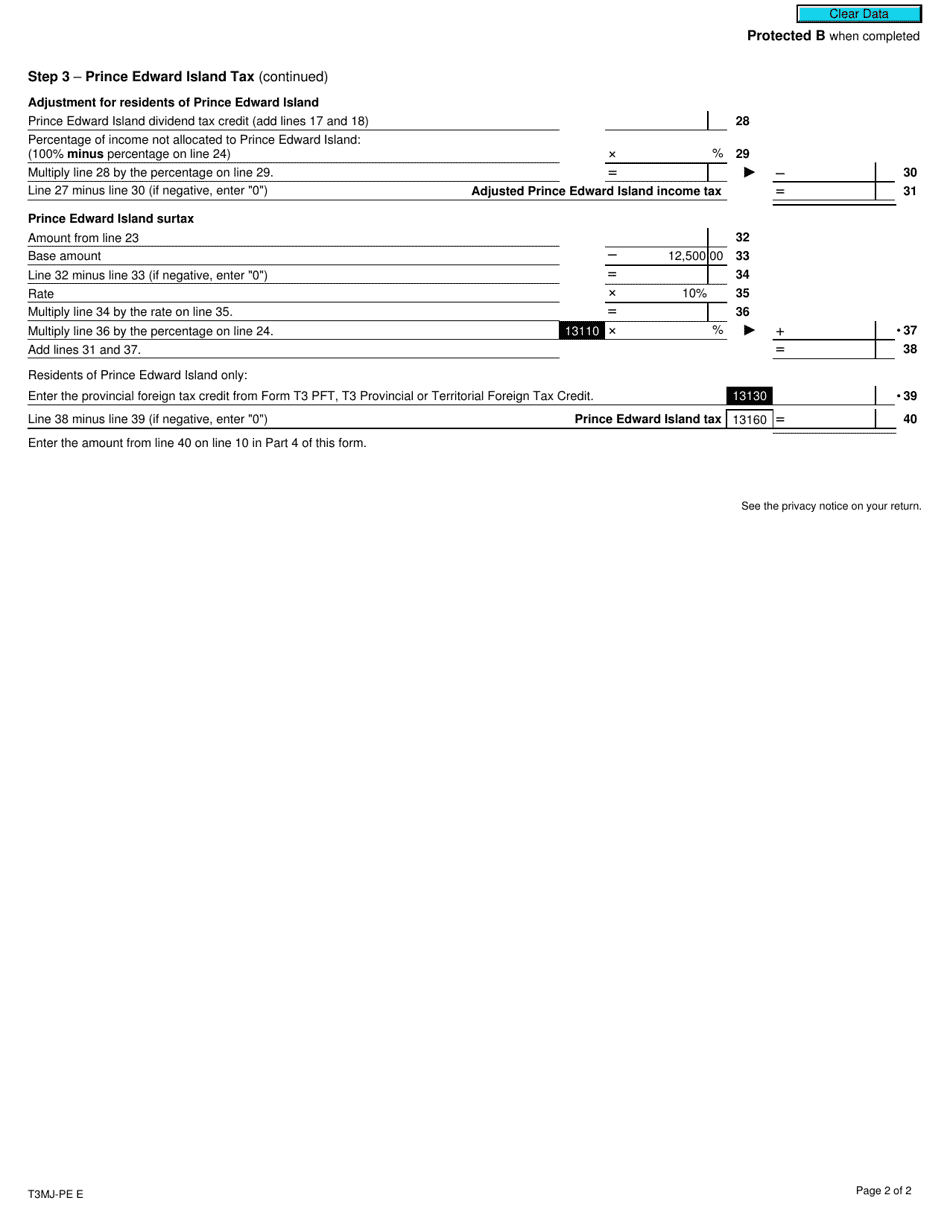

Form T3MJ-PE Part 3

for the current year.

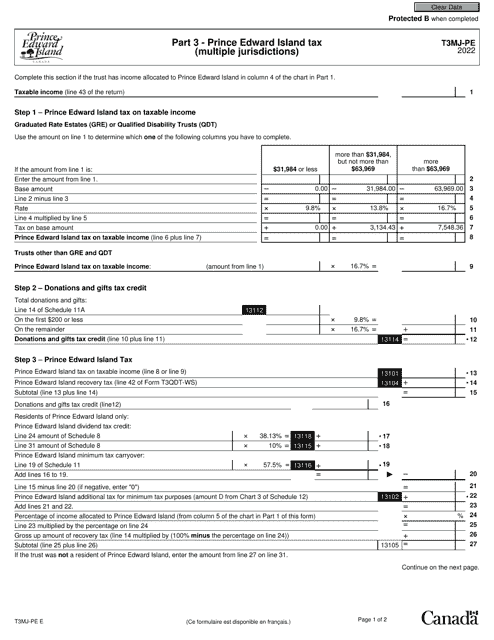

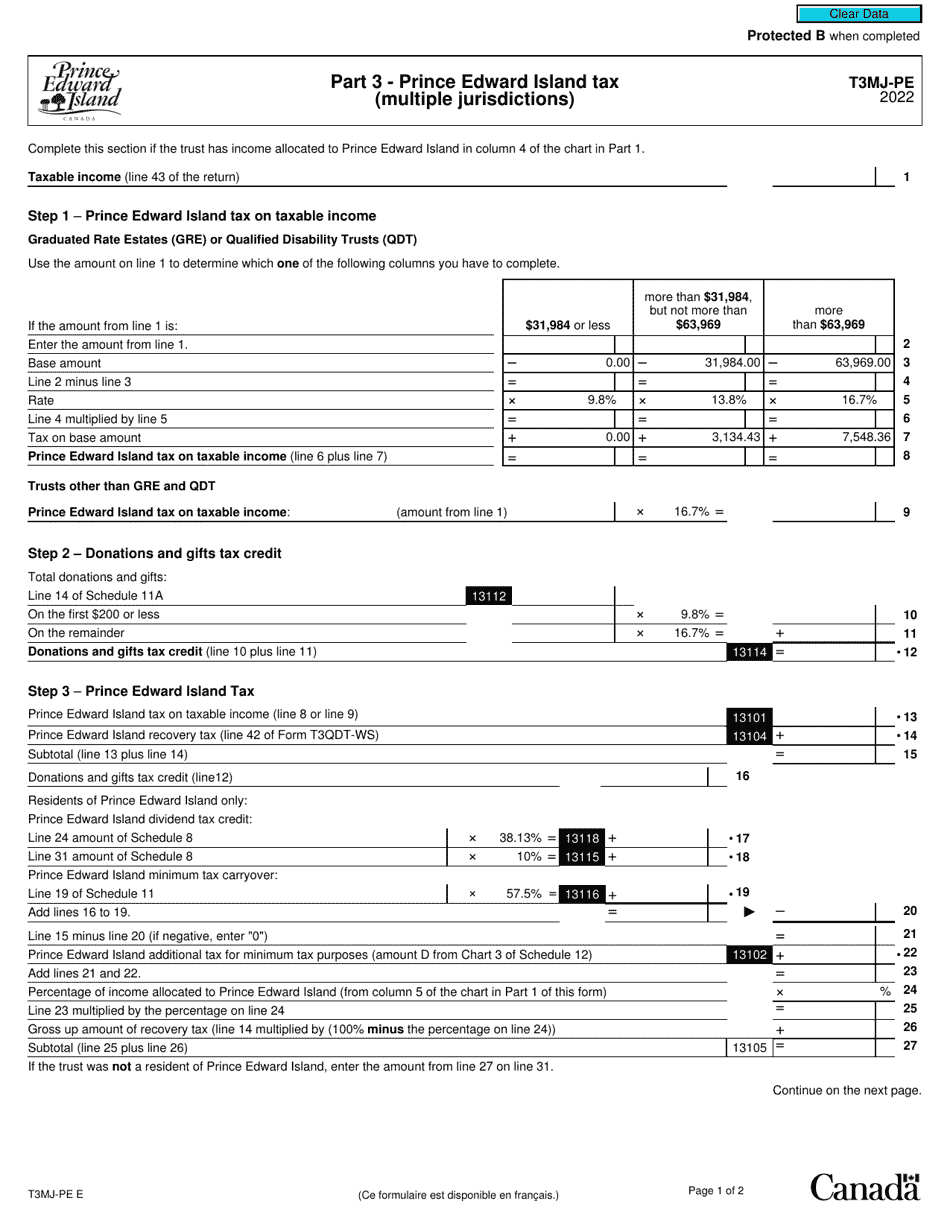

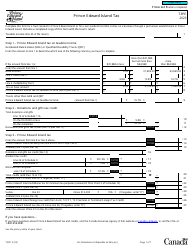

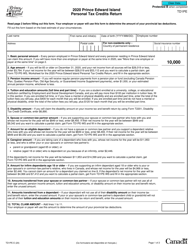

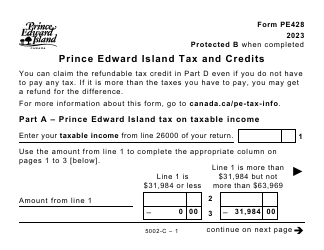

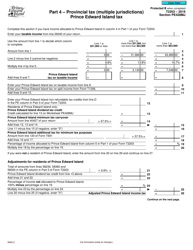

Form T3MJ-PE Part 3 Prince Edward Island Tax (Multiple Jurisdictions) - Canada

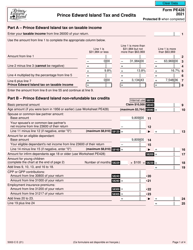

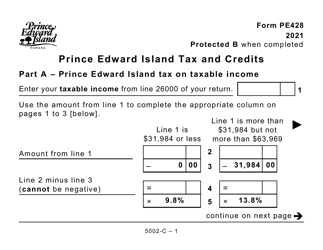

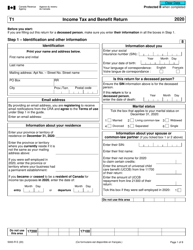

Form T3MJ-PE Part 3, Prince Edward Island Tax (Multiple Jurisdictions) - Canada, is a form used for reporting and calculating income taxes for individuals or businesses operating in Prince Edward Island (PEI), which is a province in Canada. This form is specifically designed for taxpayers who have income from multiple jurisdictions within Canada. It helps determine the amount of tax owed to the Prince Edward Island provincial government based on the taxpayer's total income and applicable tax rates in PEI. The form may require the taxpayer to provide details of their income, deductions, and credits to accurately calculate their tax liability in Prince Edward Island.

The Form T3MJ-PE Part 3 Prince Edward Island Tax (Multiple Jurisdictions) in Canada is primarily filed by individuals or businesses who have earned income or conducted business activities in Prince Edward Island and other jurisdictions within Canada. This form helps taxpayers report their income and calculate their tax liability for both Prince Edward Island and the other jurisdictions in which they have income.

FAQ

Q: What is Form T3MJ-PE?

A: Form T3MJ-PE is a tax form used in Prince Edward Island, Canada to calculate and report taxable income from multiple jurisdictions.

Q: Who needs to file Form T3MJ-PE?

A: Residents of Prince Edward Island, Canada who have taxable income from multiple jurisdictions need to file Form T3MJ-PE.

Q: What is the purpose of Form T3MJ-PE?

A: The purpose of Form T3MJ-PE is to calculate the amount of tax owed on income from multiple jurisdictions in Prince Edward Island, Canada.

Q: What information do I need to complete Form T3MJ-PE?

A: You will need information about your income from multiple jurisdictions, including details about income earned and taxes paid in each jurisdiction.

Q: When is the deadline to file Form T3MJ-PE?

A: The deadline to file Form T3MJ-PE is usually April 30th of the following year, but it may vary depending on individual circumstances.

Q: What happens if I don't file Form T3MJ-PE?

A: If you fail to file Form T3MJ-PE on time, you may be subject to penalties and interest charges on any unpaid tax amounts.

Q: Can I claim deductions and credits on Form T3MJ-PE?

A: Yes, you can claim deductions and credits on Form T3MJ-PE if you meet the eligibility criteria for each deduction or credit.

Q: How long should I keep a copy of Form T3MJ-PE?

A: It is recommended to keep a copy of Form T3MJ-PE and all supporting documents for at least six years in case of future audits or inquiries.