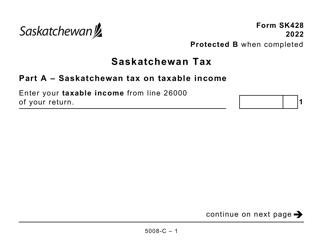

This version of the form is not currently in use and is provided for reference only. Download this version of

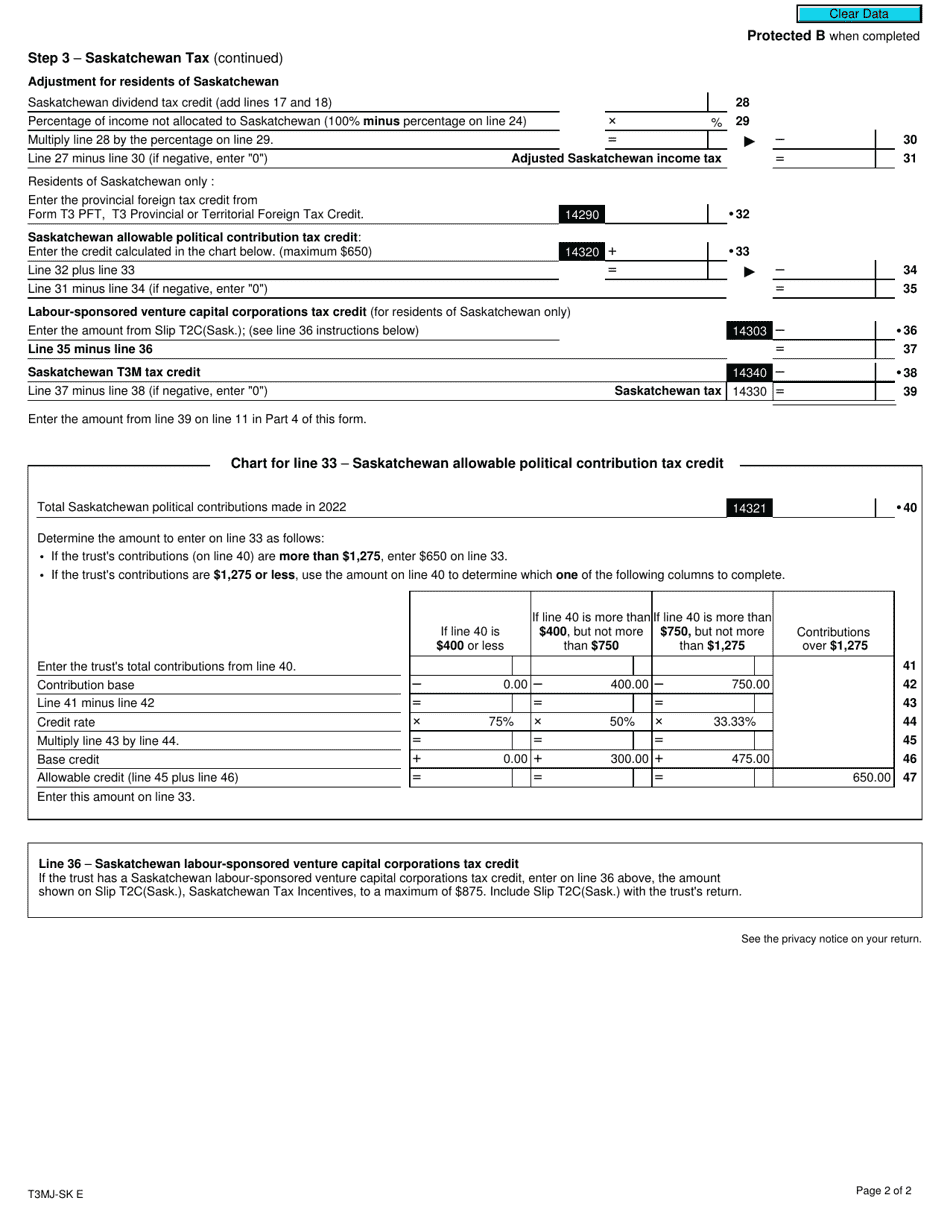

Form T3MJ-SK Part 3

for the current year.

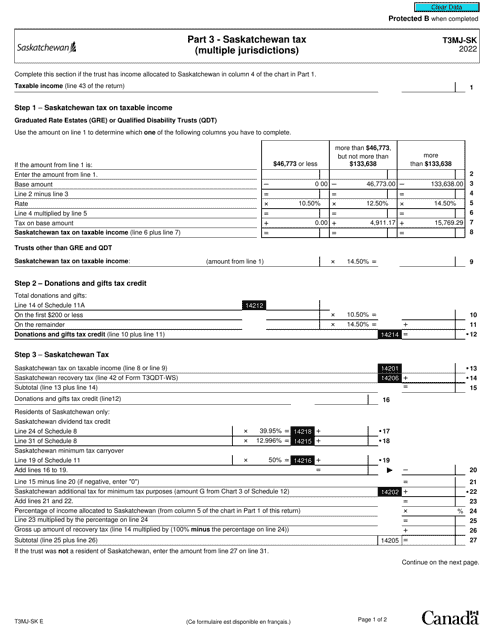

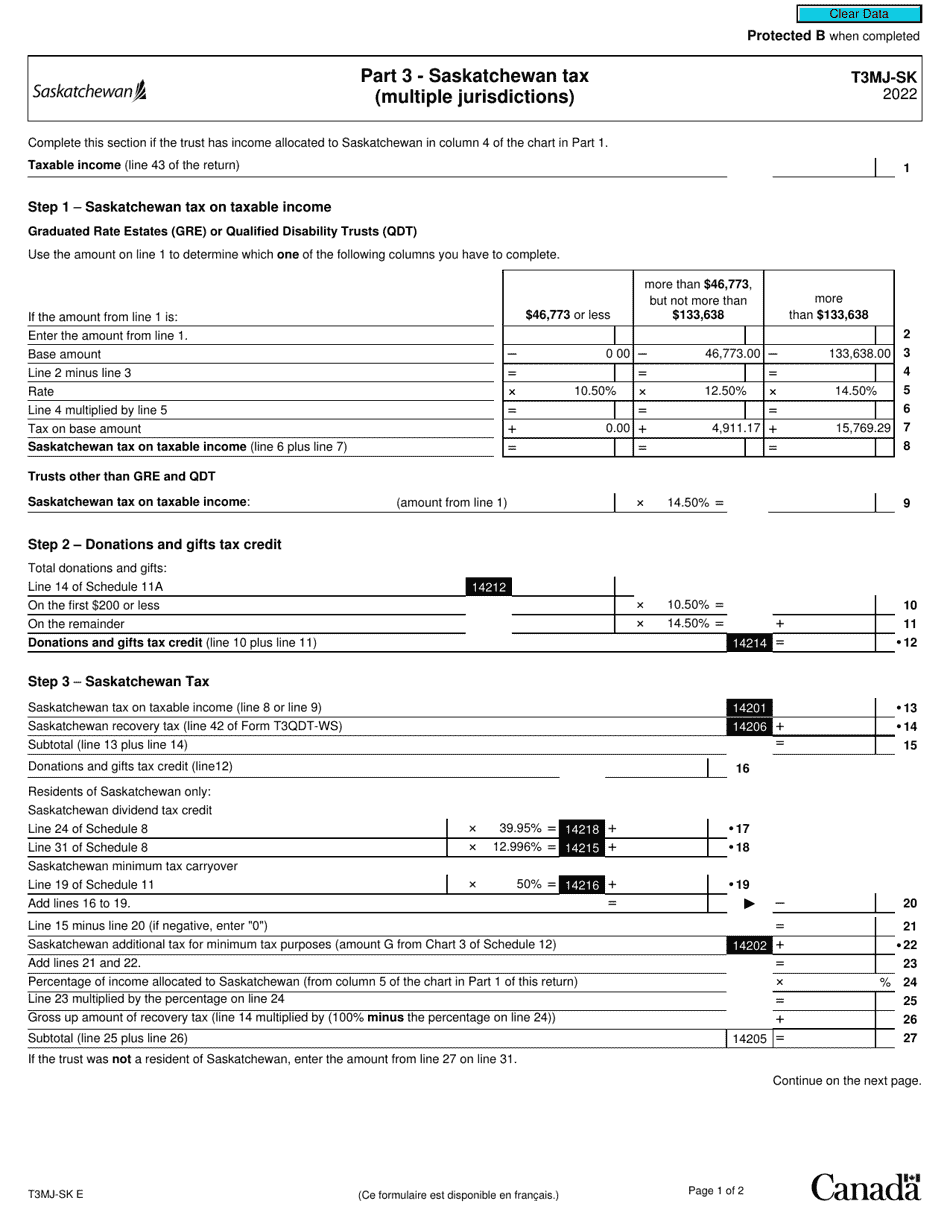

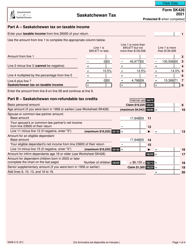

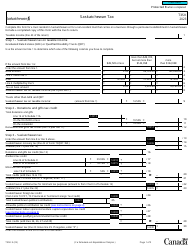

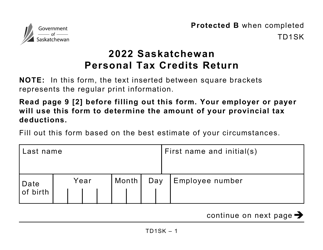

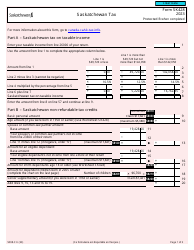

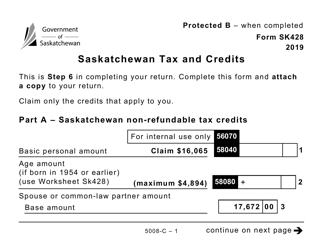

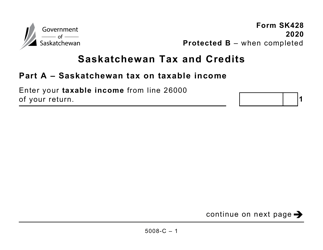

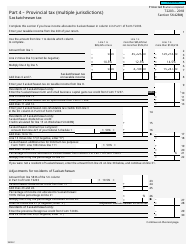

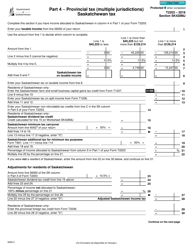

Form T3MJ-SK Part 3 Saskatchewan Tax (Multiple Jurisdictions) - Canada

Form T3MJ-SK Part 3 is for reporting Saskatchewan tax information for multiple jurisdictions in Canada. This form is used to declare the income, deductions, and other relevant details related to Saskatchewan taxes specifically for multiple jurisdictions within Canada.

The Form T3MJ-SK, Part 3 Saskatchewan Tax (Multiple Jurisdictions), in Canada is typically filed by individuals or businesses who have income or assets in both Saskatchewan and other Canadian provinces or territories.

FAQ

Q: What is Form T3MJ-SK?

A: Form T3MJ-SK is a tax form used for reporting Saskatchewan Tax (Multiple Jurisdictions) in Canada.

Q: What is Saskatchewan Tax (Multiple Jurisdictions)?

A: Saskatchewan Tax (Multiple Jurisdictions) is a tax that applies to residents of Saskatchewan who have income from multiple jurisdictions in Canada.

Q: Who needs to file Form T3MJ-SK?

A: Residents of Saskatchewan who have income from multiple jurisdictions in Canada need to file Form T3MJ-SK.

Q: What information do I need to complete Form T3MJ-SK?

A: You'll need your income from each jurisdiction, as well as any tax credits or deductions related to Saskatchewan tax.

Q: When is the deadline to file Form T3MJ-SK?

A: The deadline to file Form T3MJ-SK is usually April 30th of the following year, but it may vary.

Q: Are there any penalties for not filing Form T3MJ-SK?

A: Yes, there may be penalties for not filing Form T3MJ-SK or for filing late. It's important to file on time to avoid penalties.

Q: Do I need to keep a copy of Form T3MJ-SK for my records?

A: Yes, it's important to keep a copy of Form T3MJ-SK for your records in case you need to reference it later or in case of an audit by the CRA.