This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3MJ-YT Part 3

for the current year.

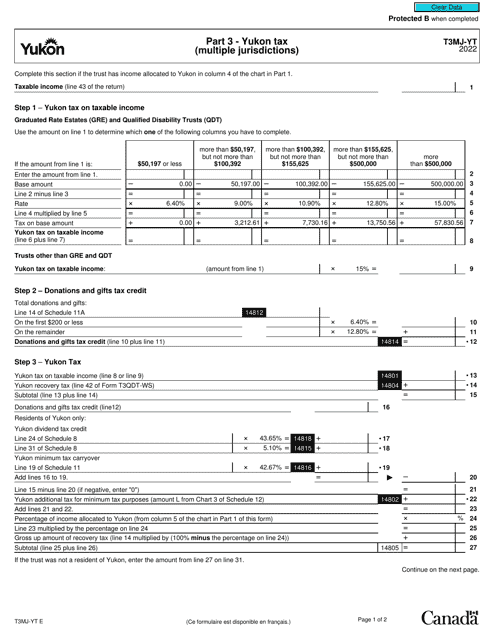

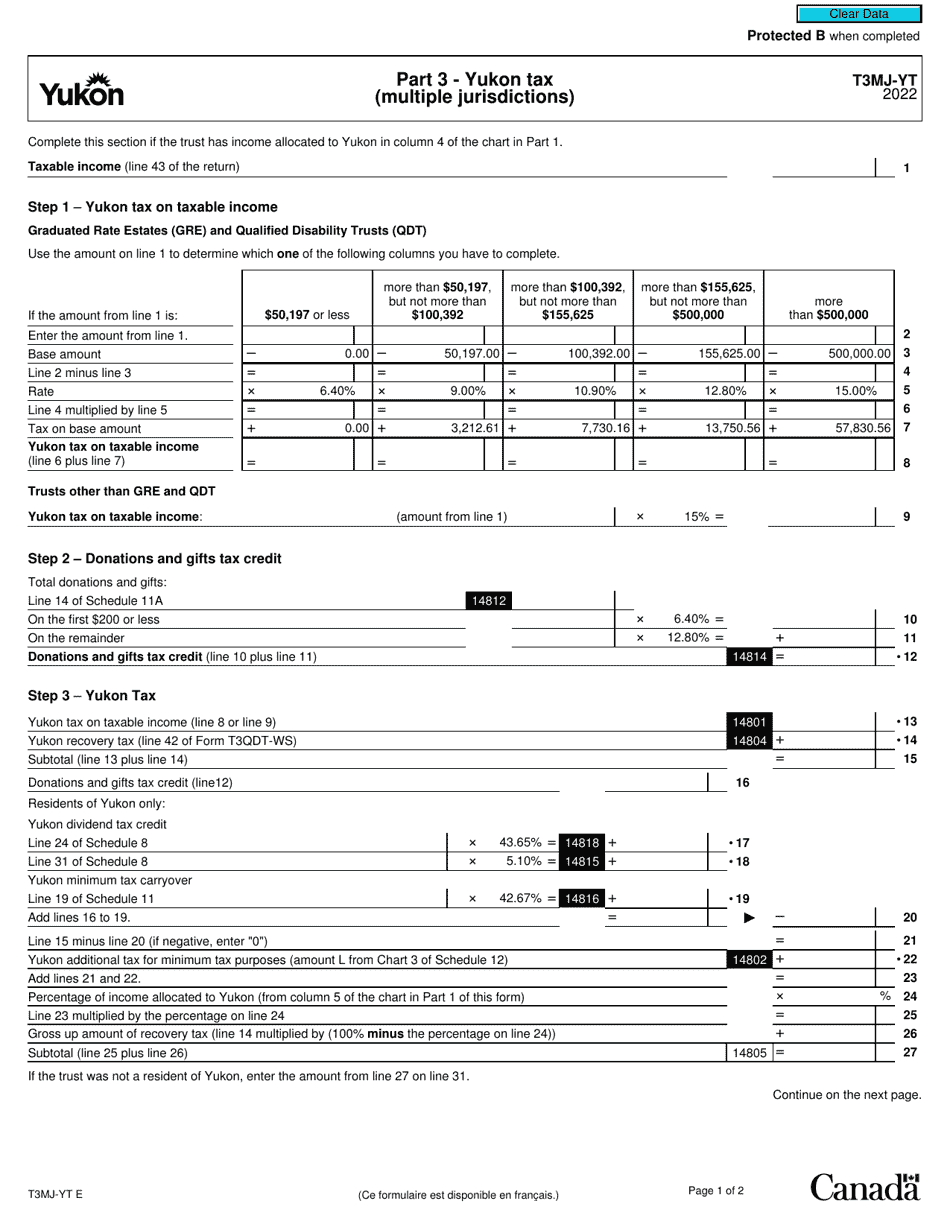

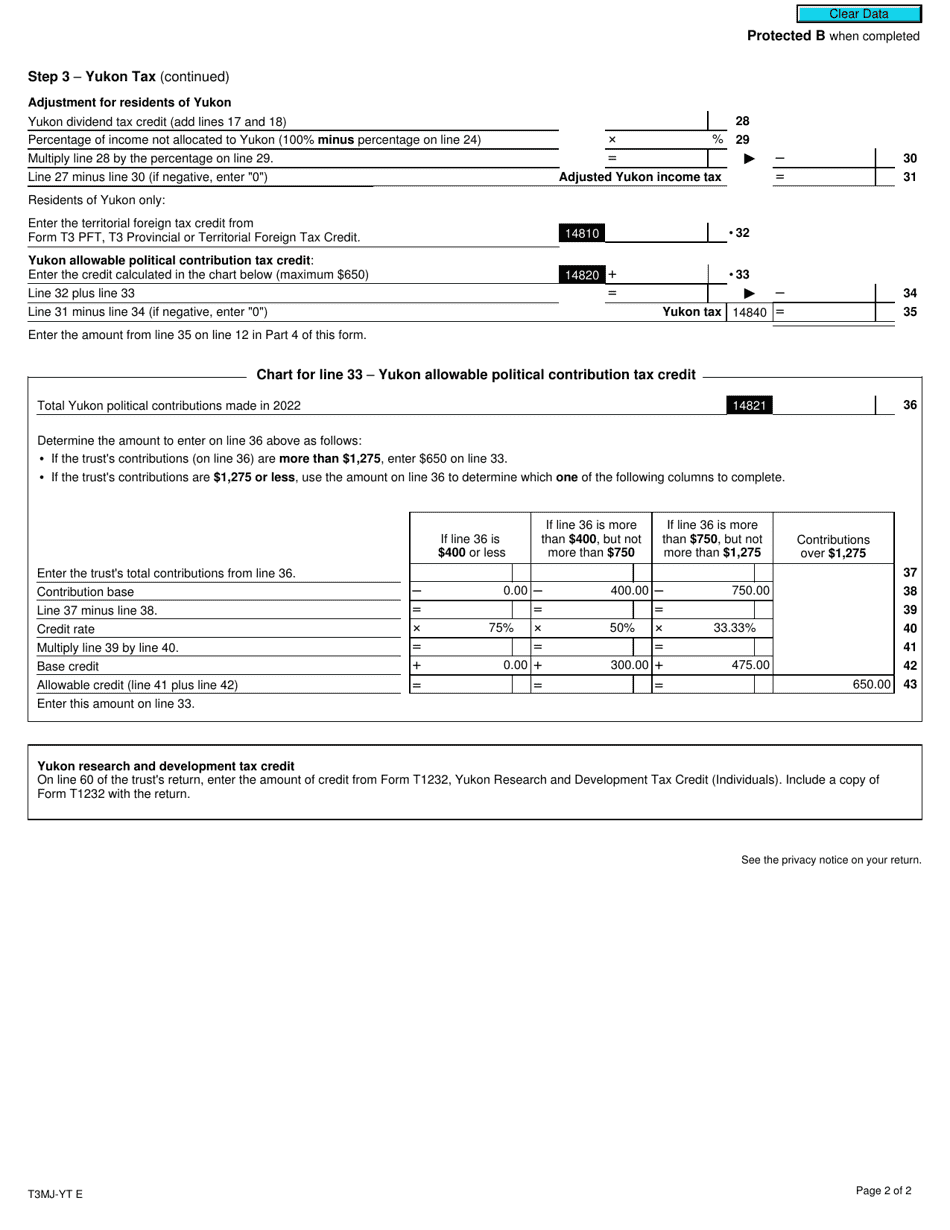

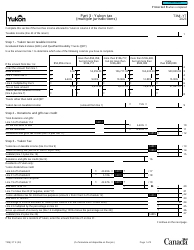

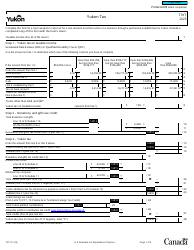

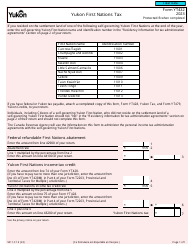

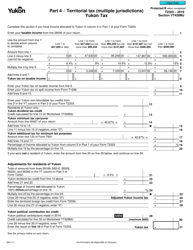

Form T3MJ-YT Part 3 Yukon Tax (Multiple Jurisdictions) - Canada

Form T3MJ-YT Part 3 is used in Canada for filing taxes in Yukon when you have income from multiple jurisdictions. It helps you report your income, deductions, and credits specific to Yukon.

Individuals or businesses who are residents of Yukon and have income from multiple jurisdictions in Canada would file the Form T3MJ-YT Part 3 Yukon Tax (Multiple Jurisdictions).

FAQ

Q: What is Form T3MJ-YT?

A: Form T3MJ-YT is a tax form used in Canada.

Q: What is the purpose of Form T3MJ-YT?

A: Form T3MJ-YT is used to report and calculate Yukon tax for multiple jurisdictions in Canada.

Q: Who needs to fill out Form T3MJ-YT?

A: Individuals or businesses who have income from multiple jurisdictions in Canada and need to report and calculate Yukon tax.

Q: Is Form T3MJ-YT specific to the Yukon territory?

A: Yes, Form T3MJ-YT is specific to the Yukon territory in Canada.

Q: Is Form T3MJ-YT available in both English and French?

A: Yes, Form T3MJ-YT is available in both English and French.

Q: When is the deadline to file Form T3MJ-YT?

A: The deadline to file Form T3MJ-YT is the same as the deadline for filing your income tax return, which is generally April 30.

Q: Are there any special instructions for completing Form T3MJ-YT?

A: Yes, there may be specific instructions provided with the form. It is important to read and follow these instructions carefully.

Q: What should I do if I have questions about Form T3MJ-YT?

A: If you have questions about Form T3MJ-YT, you can contact the Canada Revenue Agency (CRA) directly for assistance.