This version of the form is not currently in use and is provided for reference only. Download this version of

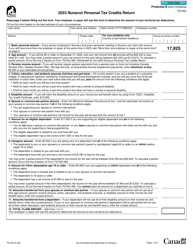

Form T3MJ-NU Part 3

for the current year.

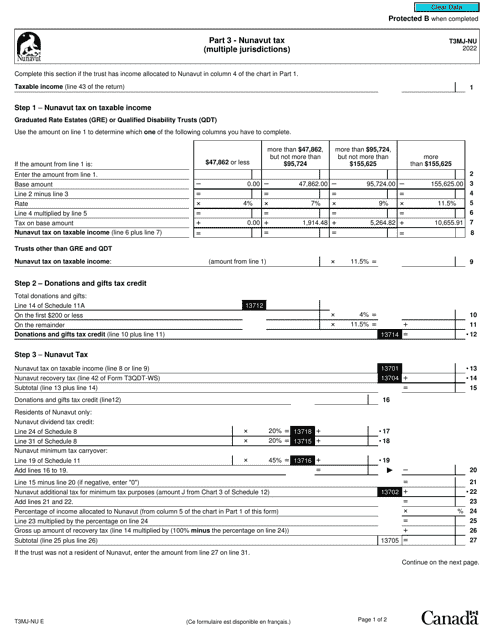

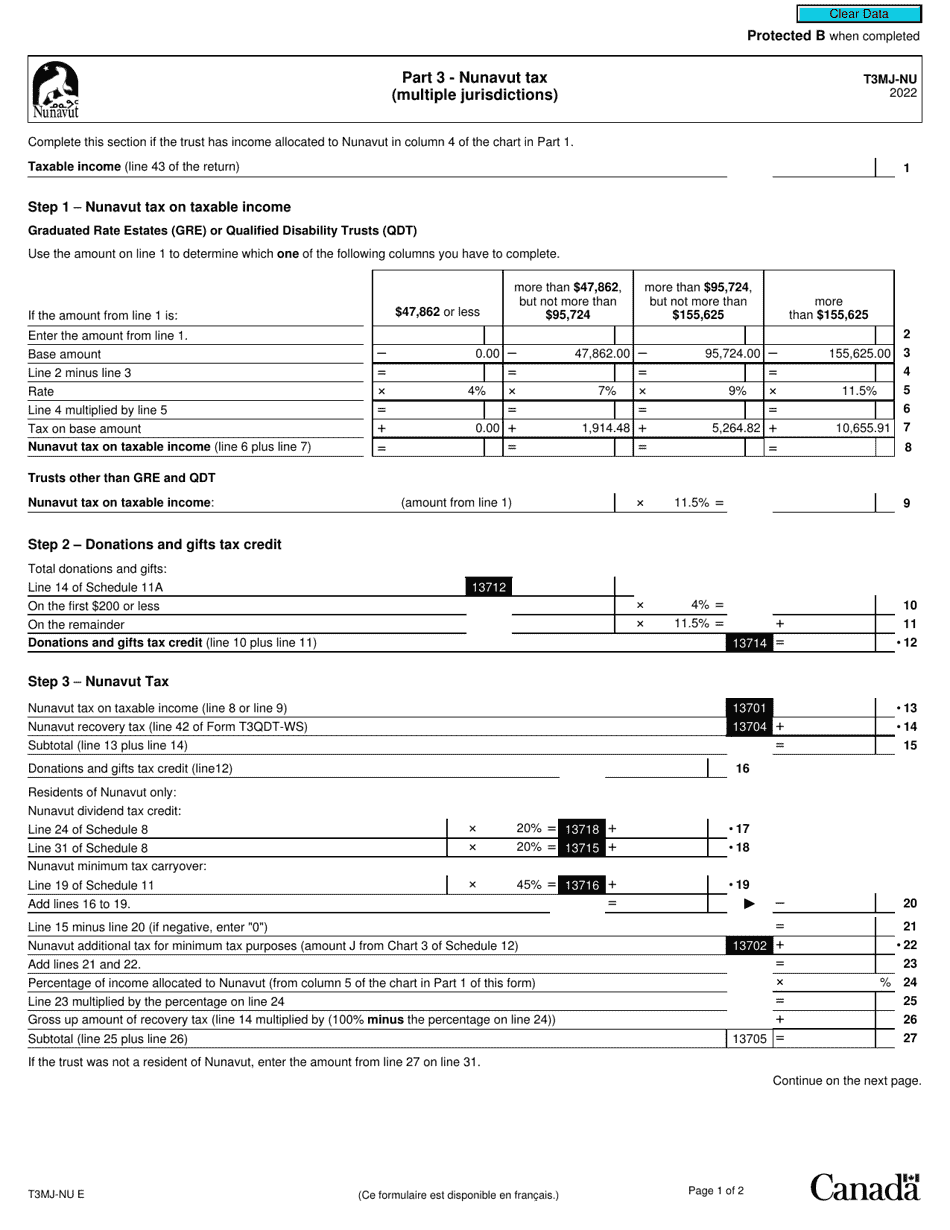

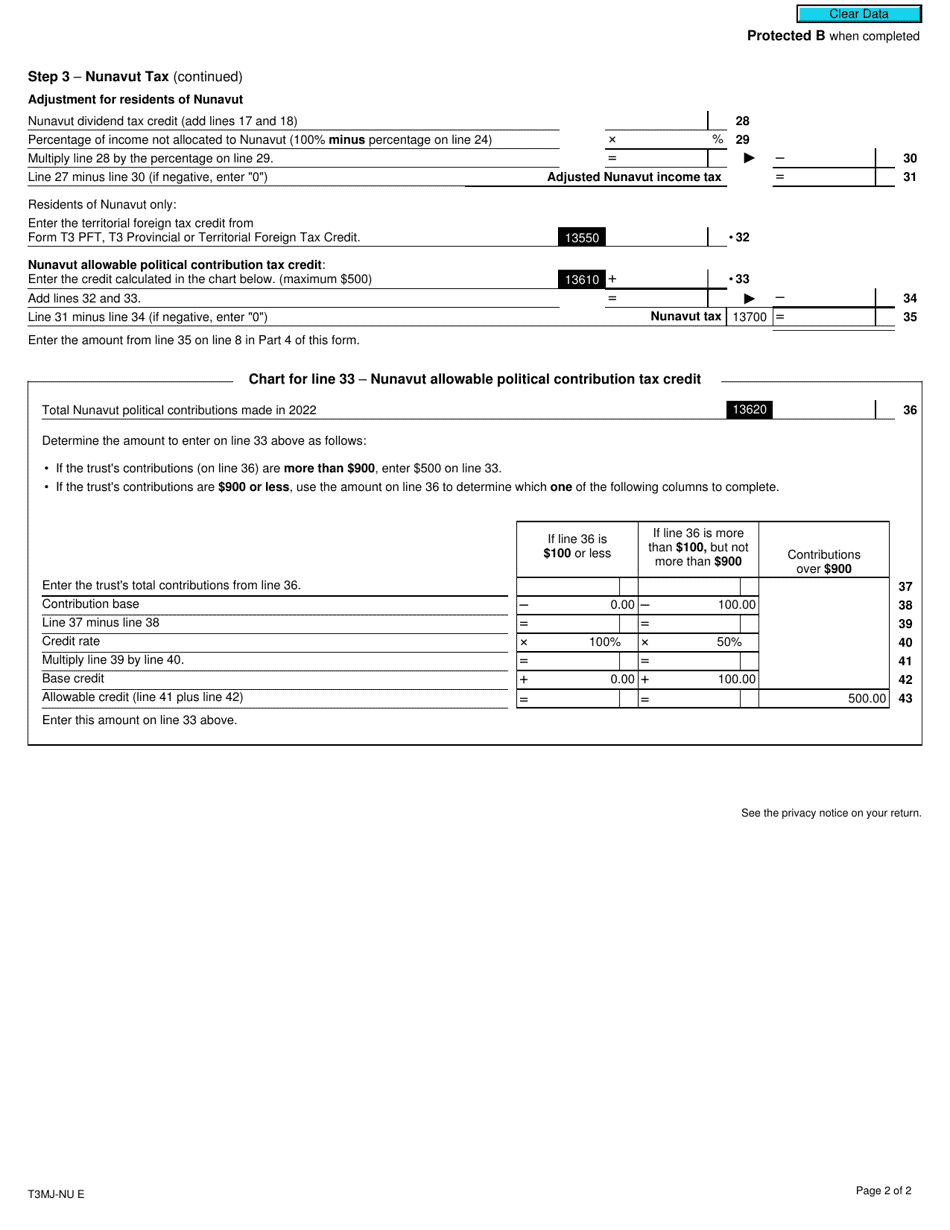

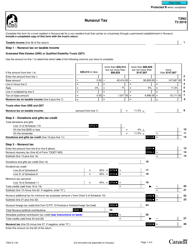

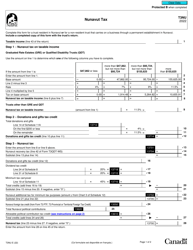

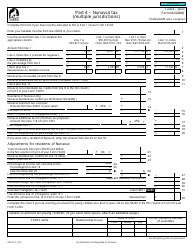

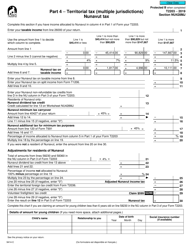

Form T3MJ-NU Part 3 Nunavut Tax (Multiple Jurisdictions) - Canada

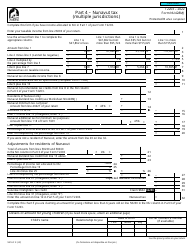

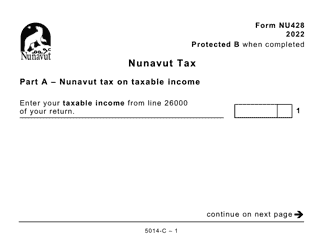

Form T3MJ-NU Part 3, Nunavut Tax (Multiple Jurisdictions) - Canada, is a tax form that is used in Nunavut, a territory in Canada, to calculate and report income taxes for individuals or corporations who have income from multiple jurisdictions. This form helps determine the amount of tax owed in Nunavut based on the taxpayer's income from both within and outside of the territory.

FAQ

Q: What is Form T3MJ-NU?

A: Form T3MJ-NU is a tax form used in Canada for reporting income and taxes in the Nunavut territory.

Q: What is Part 3 of Form T3MJ-NU?

A: Part 3 of Form T3MJ-NU is specifically for reporting taxes in multiple jurisdictions, such as Nunavut and other provinces or territories in Canada.

Q: Who needs to use Form T3MJ-NU?

A: Individuals or businesses that have income or tax obligations in Nunavut and one or more other jurisdictions in Canada should use Form T3MJ-NU.

Q: What information is required in Part 3 of Form T3MJ-NU?

A: Part 3 of Form T3MJ-NU requires you to provide details of your income, deductions, and taxes paid in Nunavut and the other jurisdictions.

Q: How do I fill out Form T3MJ-NU?

A: To fill out Form T3MJ-NU, you will need to gather information about your income, deductions, and taxes paid in Nunavut and the other jurisdictions, and then enter the relevant amounts in the appropriate sections of the form.

Q: When is Form T3MJ-NU due?

A: Form T3MJ-NU is generally due on or before your income tax filing deadline, which is typically April 30th for individuals and June 15th for self-employed individuals.

Q: Are there any penalties for late filing of Form T3MJ-NU?

A: Yes, late filing of Form T3MJ-NU may result in penalties and interest charges imposed by the Canada Revenue Agency.

Q: Can I file Form T3MJ-NU electronically?

A: Yes, Form T3MJ-NU can be filed electronically using the CRA's Netfile or EFILE services.

Q: Do I need to submit any supporting documents with Form T3MJ-NU?

A: You may be required to submit supporting documents, such as T4 slips, receipts, or other relevant documents, to substantiate the information reported on Form T3MJ-NU.

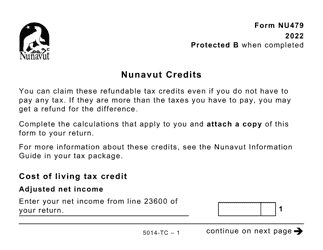

Q: Can I claim tax credits or deductions on Form T3MJ-NU?

A: Yes, you can claim tax credits and deductions on Form T3MJ-NU, subject to the specific rules and limitations of the Nunavut territory and the other jurisdictions involved.