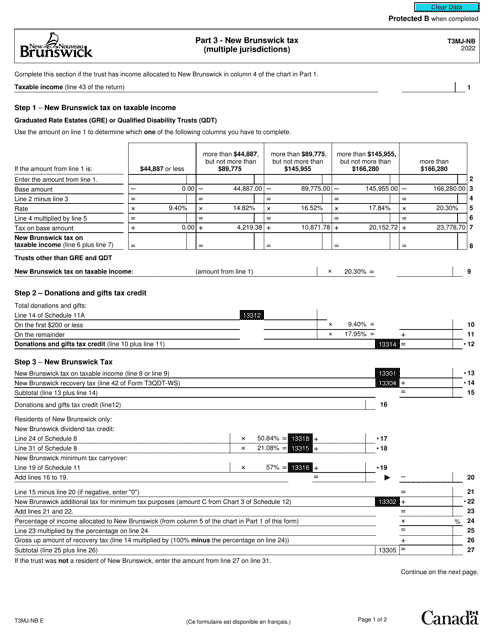

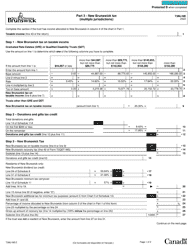

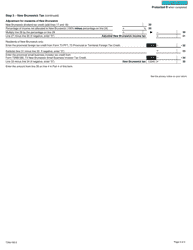

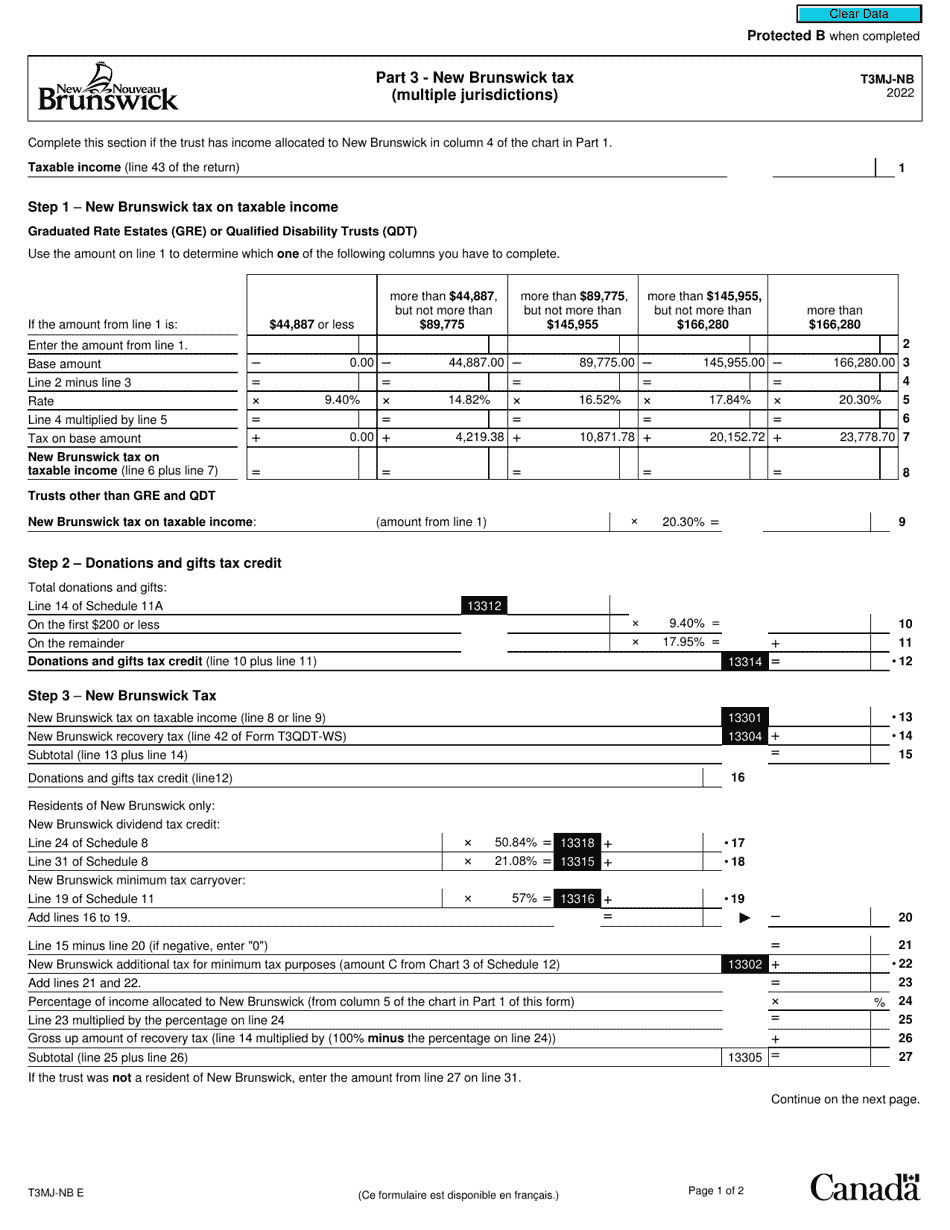

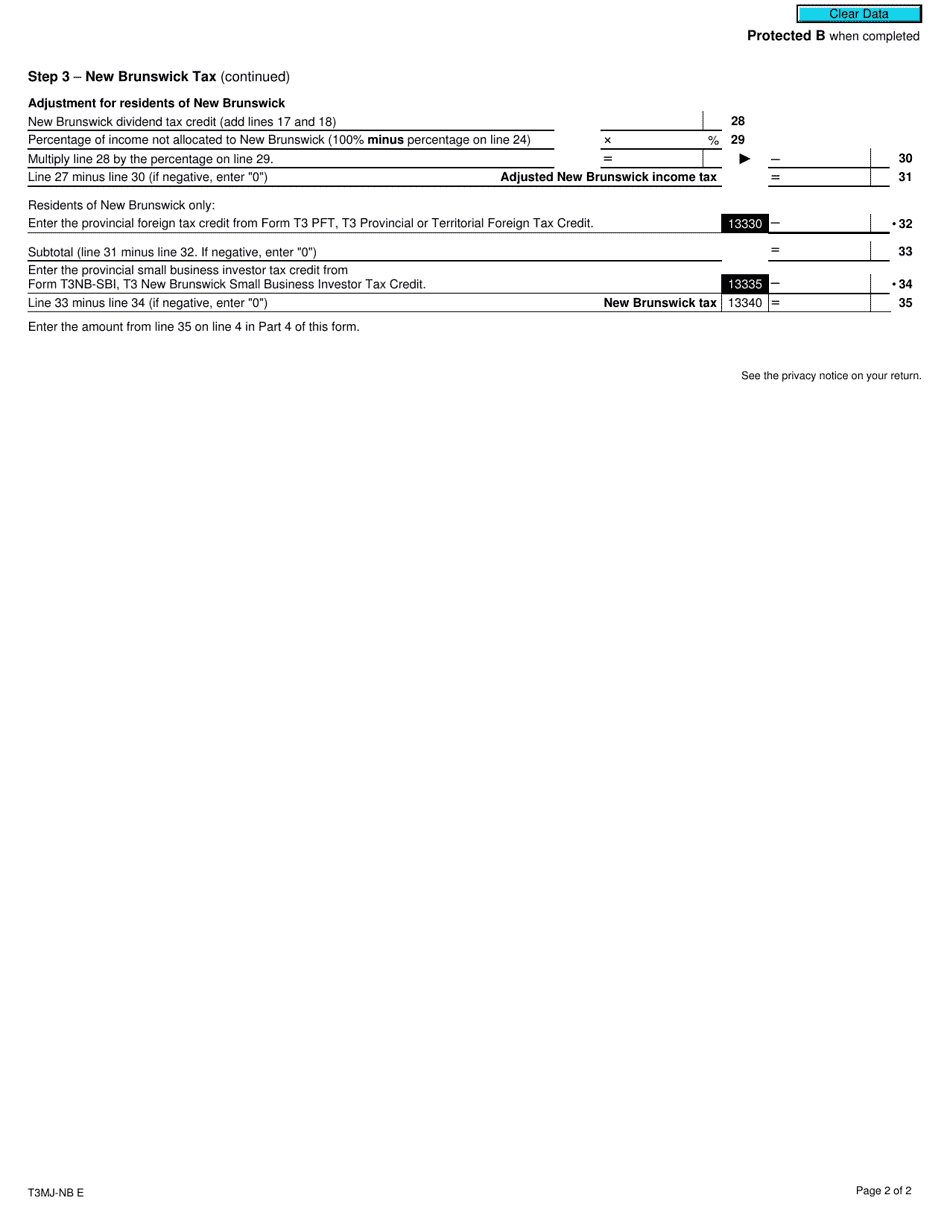

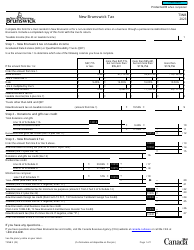

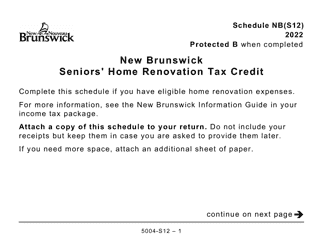

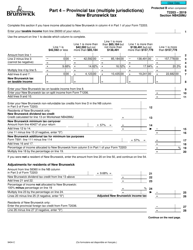

Form T3MJ-NB Part 3 New Brunswick Tax (Multiple Jurisdictions) - Canada

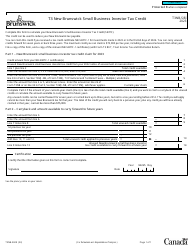

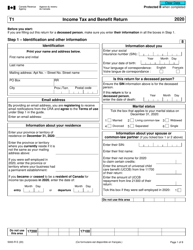

Form T3MJ-NB Part 3 is used for reporting New Brunswick tax information for trusts that have multiple jurisdictions within Canada. It helps ensure that the appropriate amount of tax is paid to the New Brunswick provincial government.

The Form T3MJ-NB Part 3 New Brunswick Tax (Multiple Jurisdictions) in Canada is filed by individuals or corporations who have income or property located in New Brunswick along with other provinces or territories.

FAQ

Q: What is Form T3MJ-NB?

A: Form T3MJ-NB is a tax form specific to New Brunswick in Canada.

Q: What is the purpose of Form T3MJ-NB?

A: Form T3MJ-NB is used to calculate the tax liability for individuals or businesses in New Brunswick, taking into account multiple jurisdictions.

Q: Who is required to file Form T3MJ-NB?

A: Individuals or businesses who have income or property in New Brunswick and are subject to taxation in multiple jurisdictions may be required to file Form T3MJ-NB.

Q: When is the deadline to file Form T3MJ-NB?

A: The deadline to file Form T3MJ-NB is typically the same as the deadline for filing your income tax return, which is April 30th for most individuals.

Q: Are there any penalties for not filing Form T3MJ-NB?

A: Yes, there may be penalties for not filing Form T3MJ-NB or filing it late. It is important to meet the filing deadline to avoid any penalties.

Q: Do I need to include any supporting documents with Form T3MJ-NB?

A: Yes, you may be required to include supporting documents such as income statements, property assessments, or other relevant documentation to support the information provided on Form T3MJ-NB.

Q: How do I know if I need to file Form T3MJ-NB?

A: You should consult with a tax professional or refer to the CRA guidelines to determine if you need to file Form T3MJ-NB based on your specific tax situation.

Q: What if I made a mistake on my Form T3MJ-NB?

A: If you made a mistake on your Form T3MJ-NB, you should contact the CRA as soon as possible to rectify the error and provide accurate information.