This version of the form is not currently in use and is provided for reference only. Download this version of

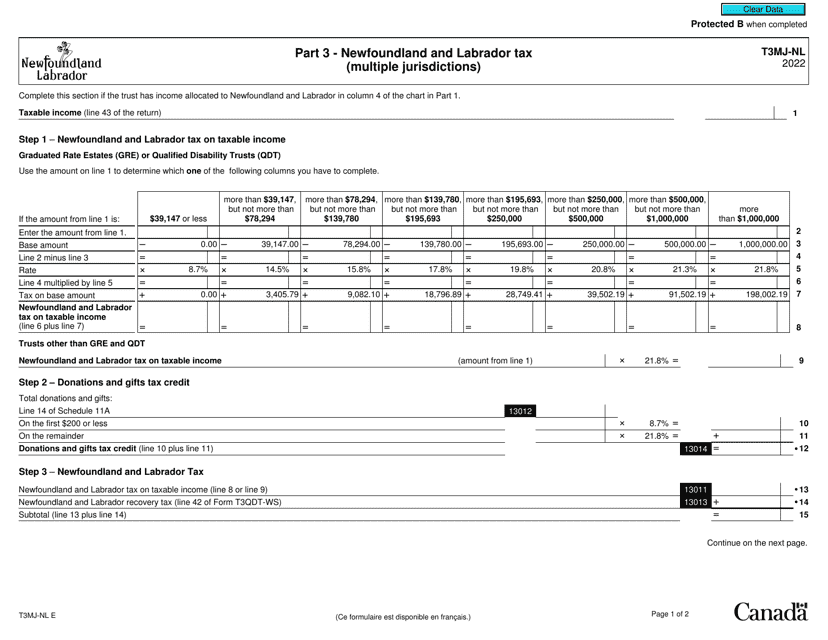

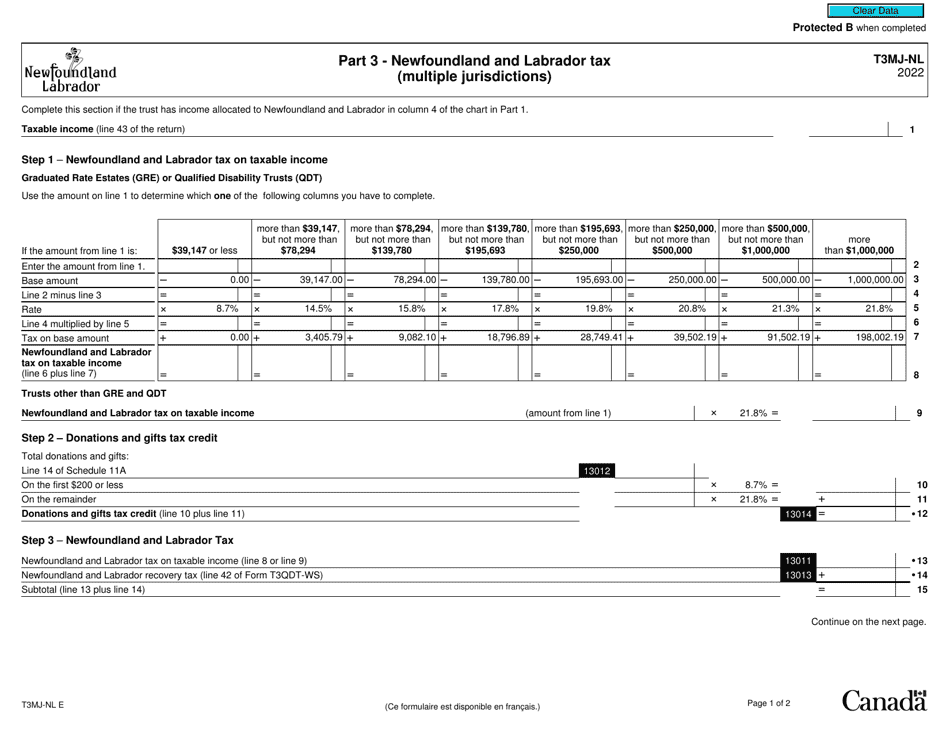

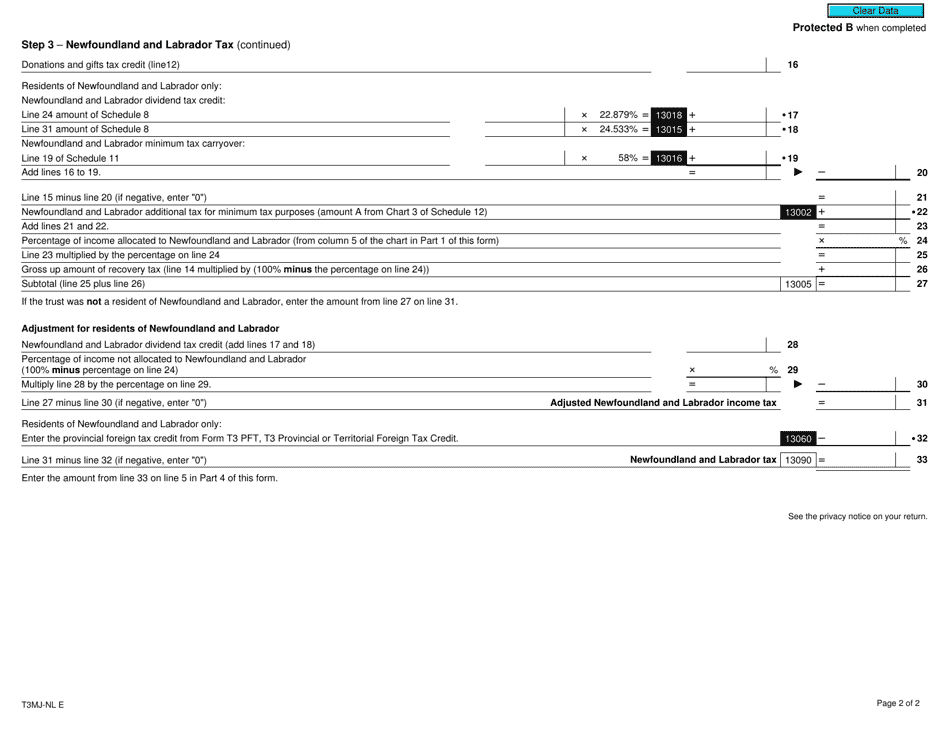

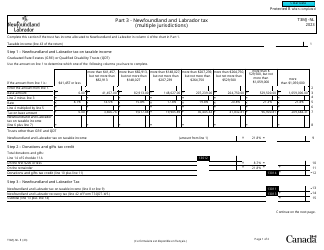

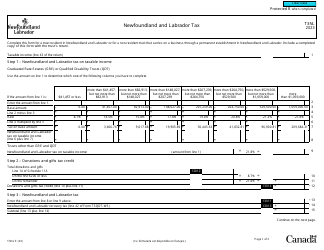

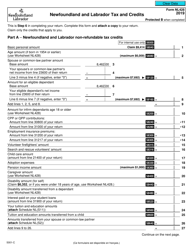

Form T3MJ-NL Part 3

for the current year.

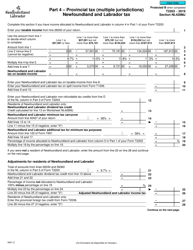

Form T3MJ-NL Part 3 Newfoundland and Labrador Tax (Multiple Jurisdictions) - Canada

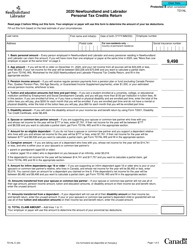

Form T3MJ-NL Part 3 Newfoundland and Labrador Tax (Multiple Jurisdictions) - Canada is used for reporting and calculating taxes owed by individuals or businesses in Newfoundland and Labrador, a province in Canada. It is specifically designed for situations where a taxpayer has income or investments in multiple jurisdictions within Newfoundland and Labrador.

The form T3MJ-NL is filed by individuals or businesses who are required to pay taxes in Newfoundland and Labrador, Canada.

FAQ

Q: What is Form T3MJ-NL?

A: Form T3MJ-NL is a tax form specifically for Newfoundland and Labrador taxpayers.

Q: What is Part 3 of Form T3MJ-NL?

A: Part 3 of Form T3MJ-NL is related to the Newfoundland and Labrador tax.

Q: Who should fill out Form T3MJ-NL?

A: Residents of Newfoundland and Labrador who have multiple jurisdictions should fill out Form T3MJ-NL.

Q: What is the purpose of Form T3MJ-NL?

A: The purpose of Form T3MJ-NL is to calculate taxes owed and credits available for residents of Newfoundland and Labrador with multiple jurisdictions.

Q: Is Form T3MJ-NL applicable only in Newfoundland and Labrador?

A: Yes, Form T3MJ-NL is applicable only in Newfoundland and Labrador.

Q: Is Form T3MJ-NL part of the overall Canadian tax system?

A: Yes, Form T3MJ-NL is a part of the overall Canadian tax system, specifically for Newfoundland and Labrador taxpayers.