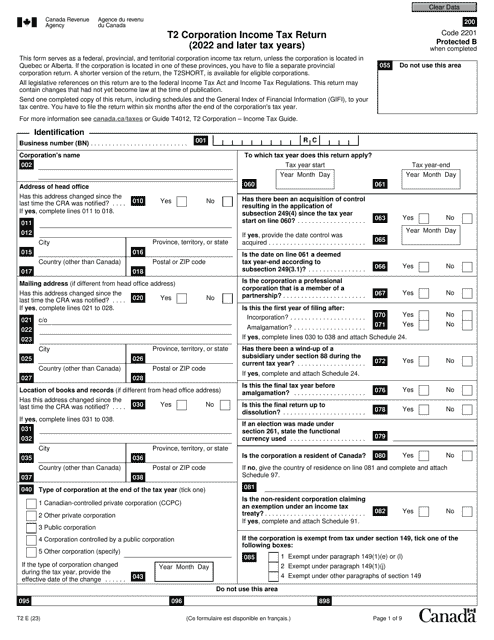

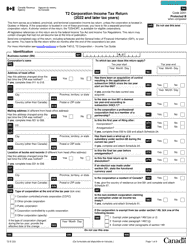

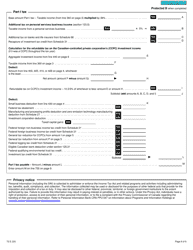

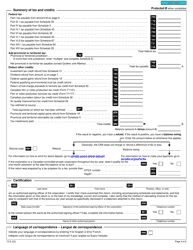

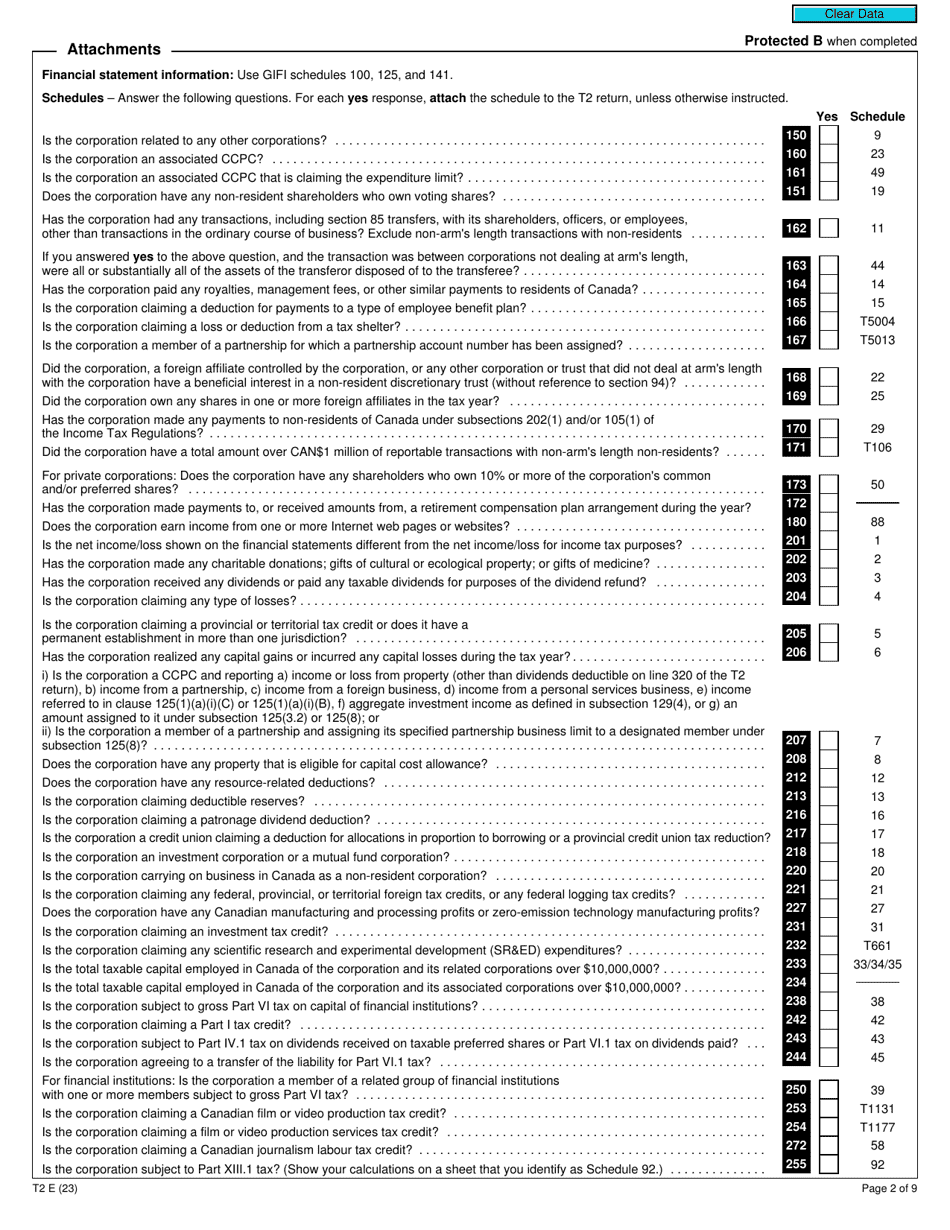

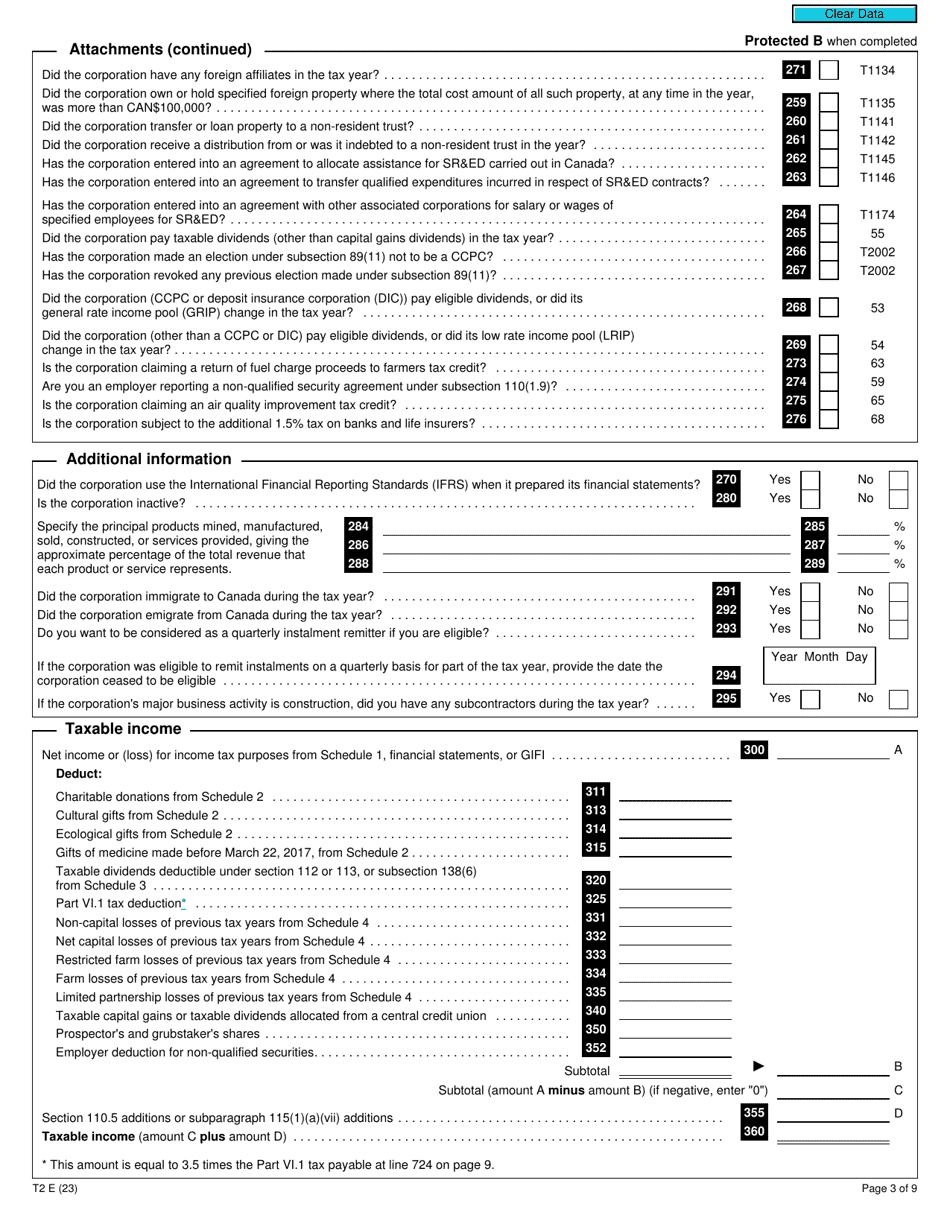

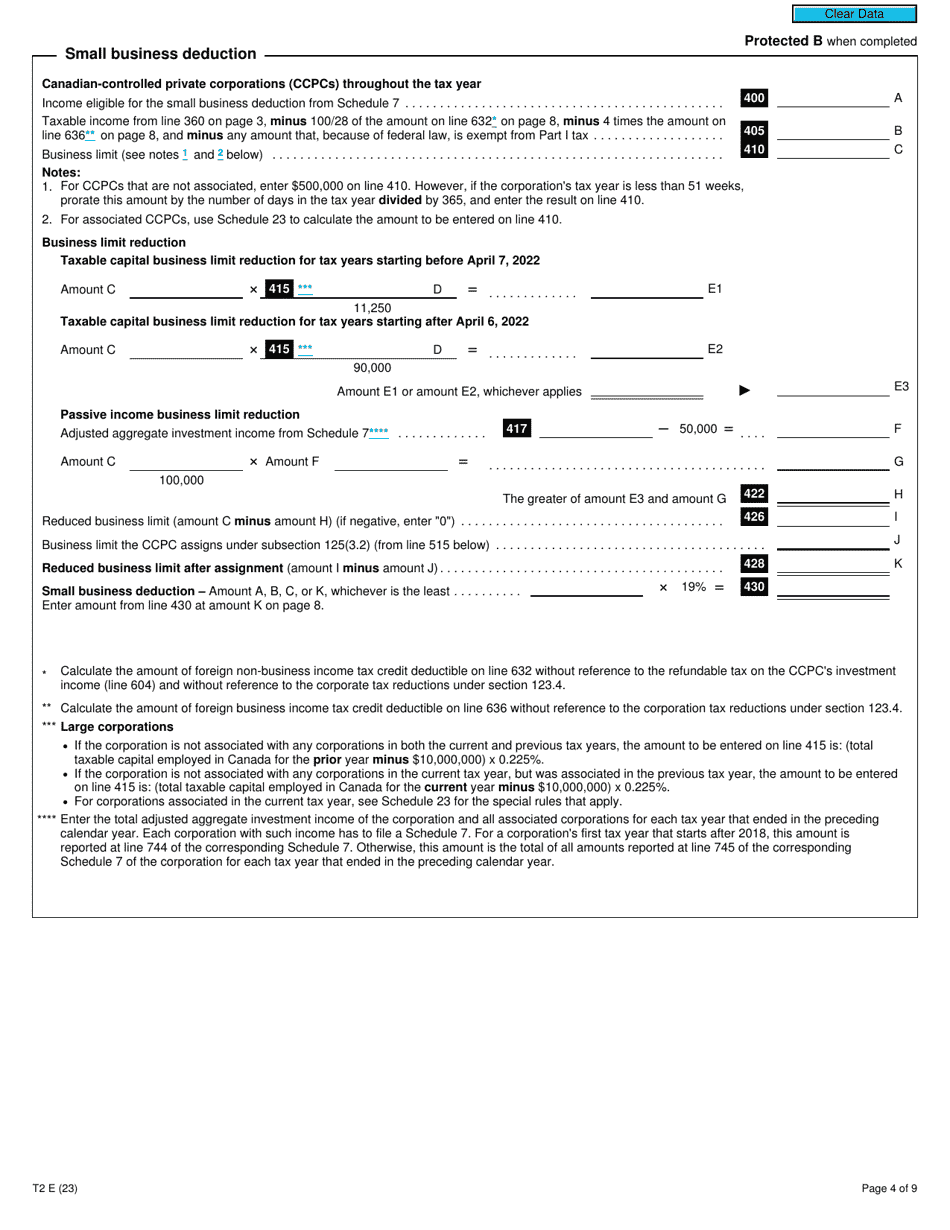

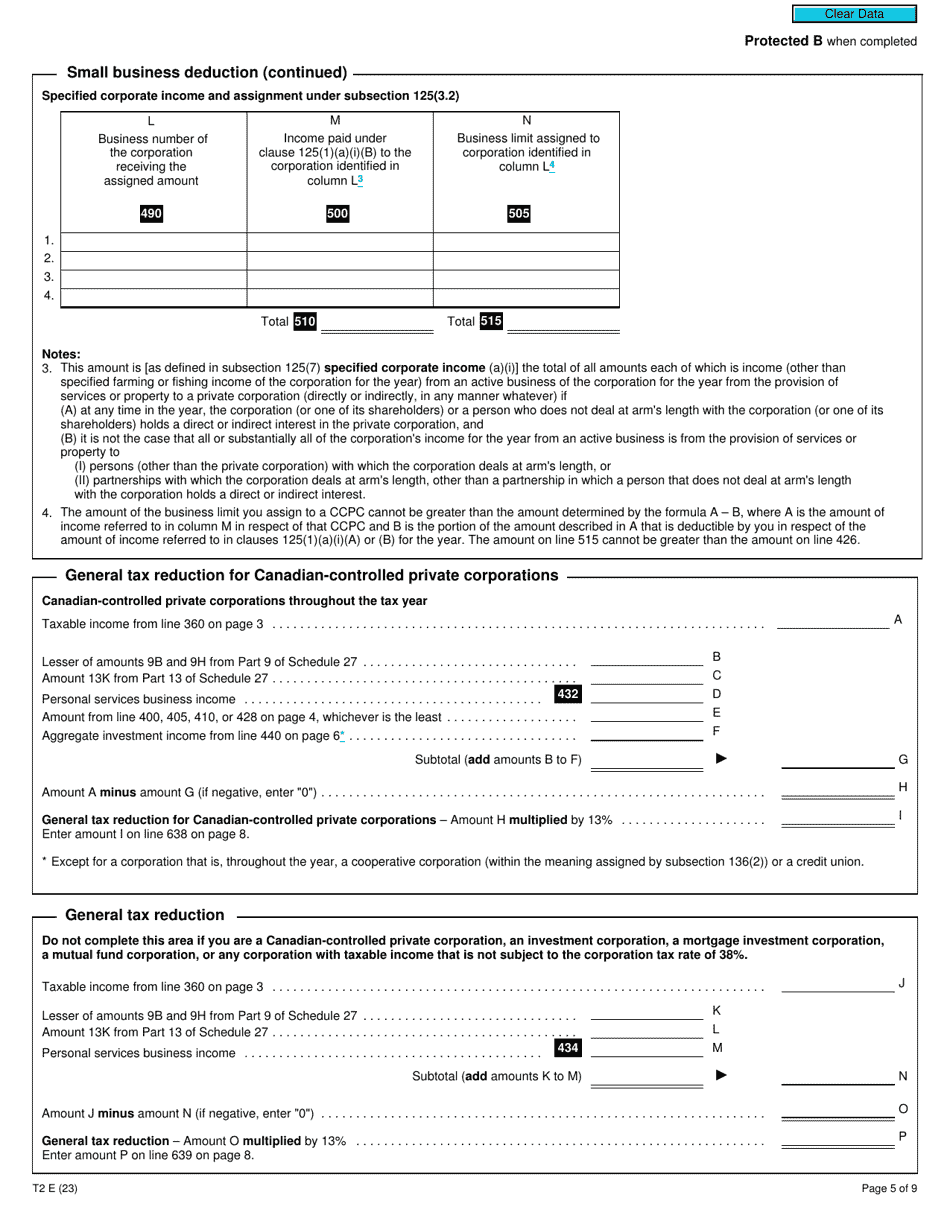

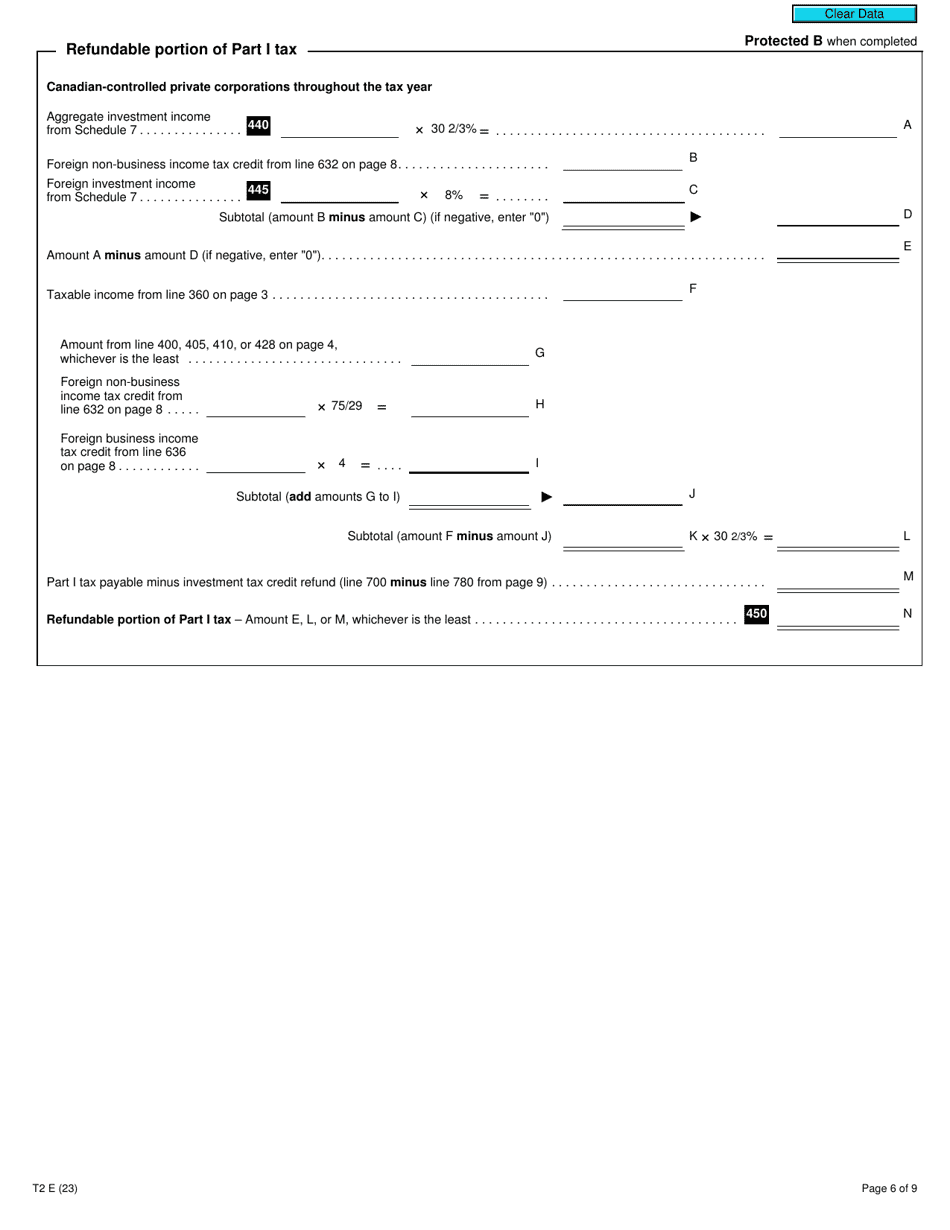

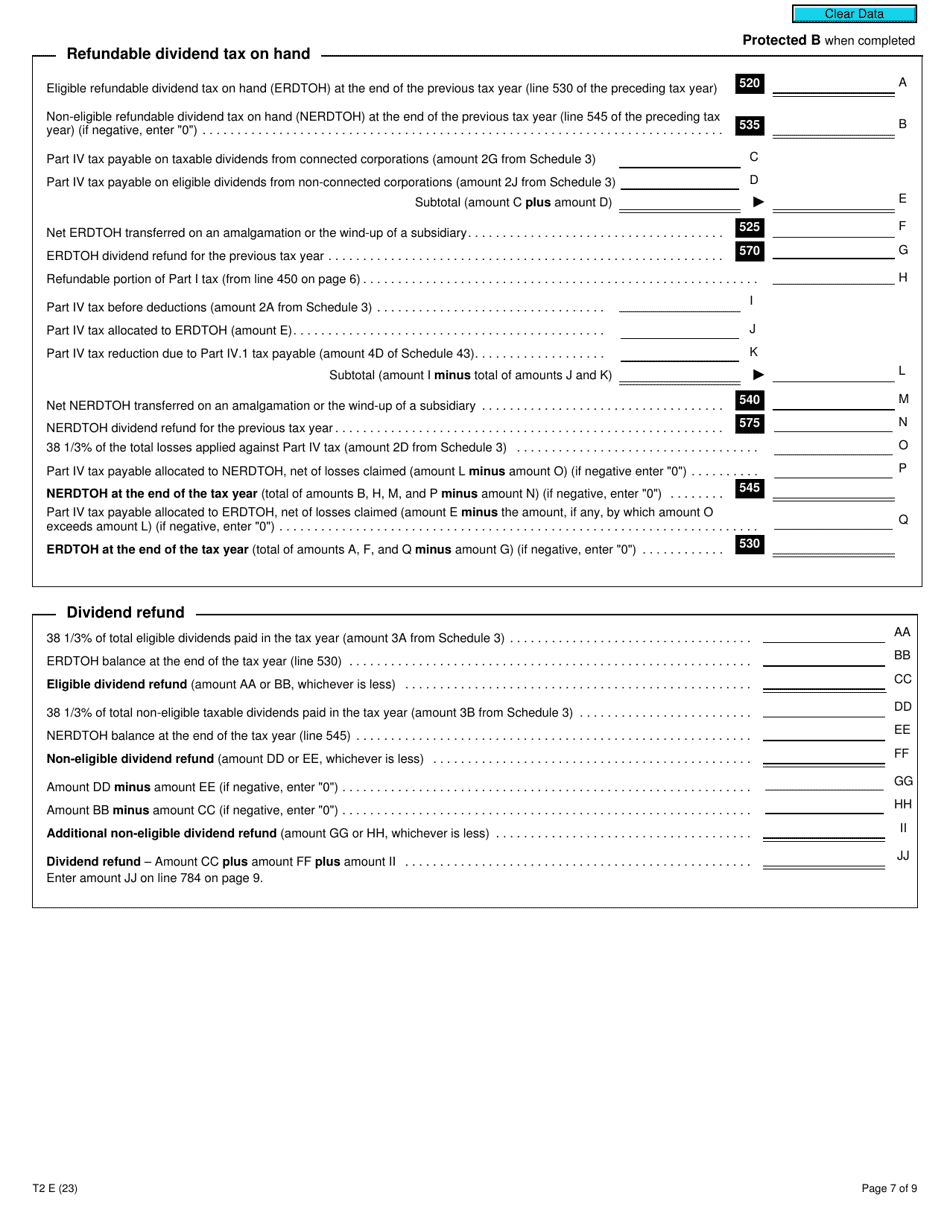

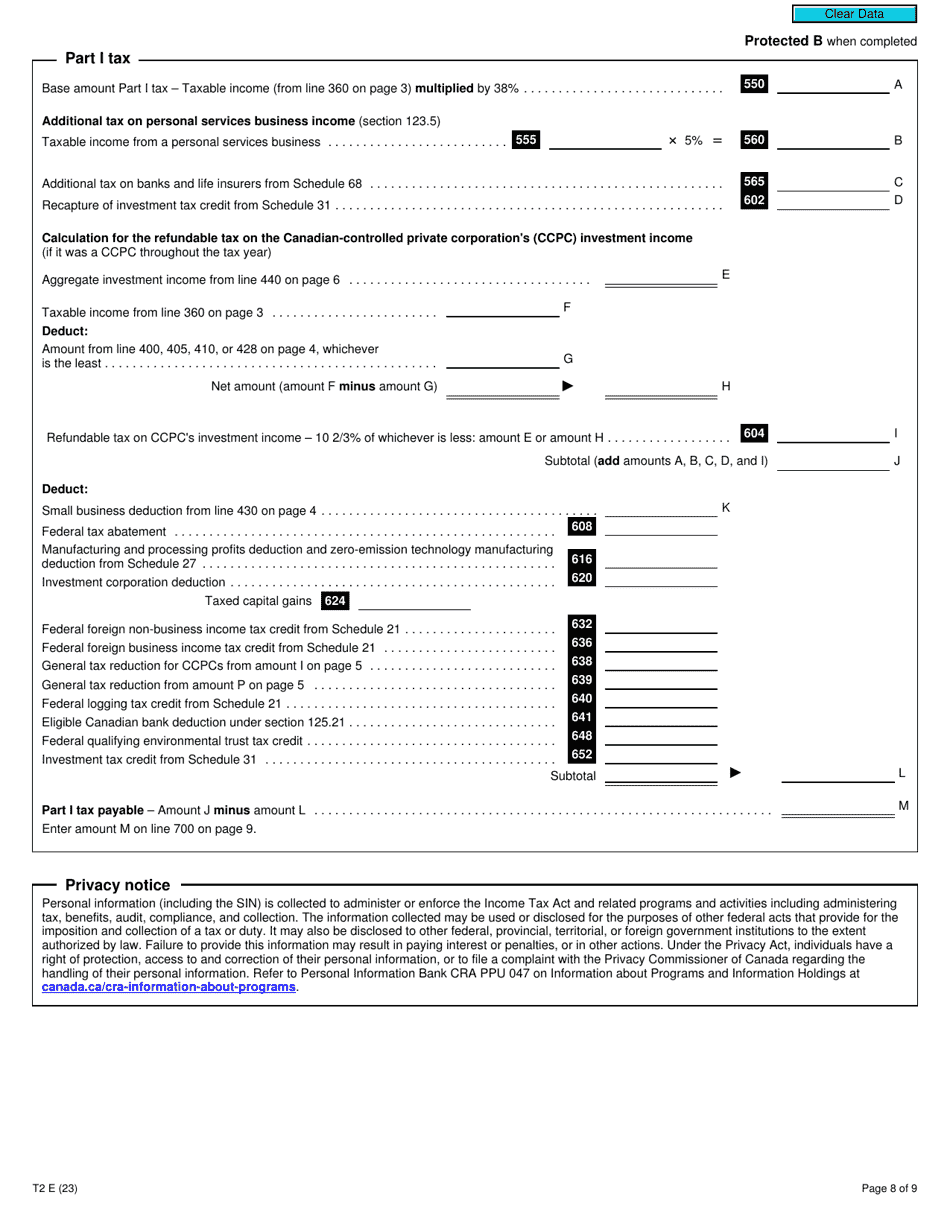

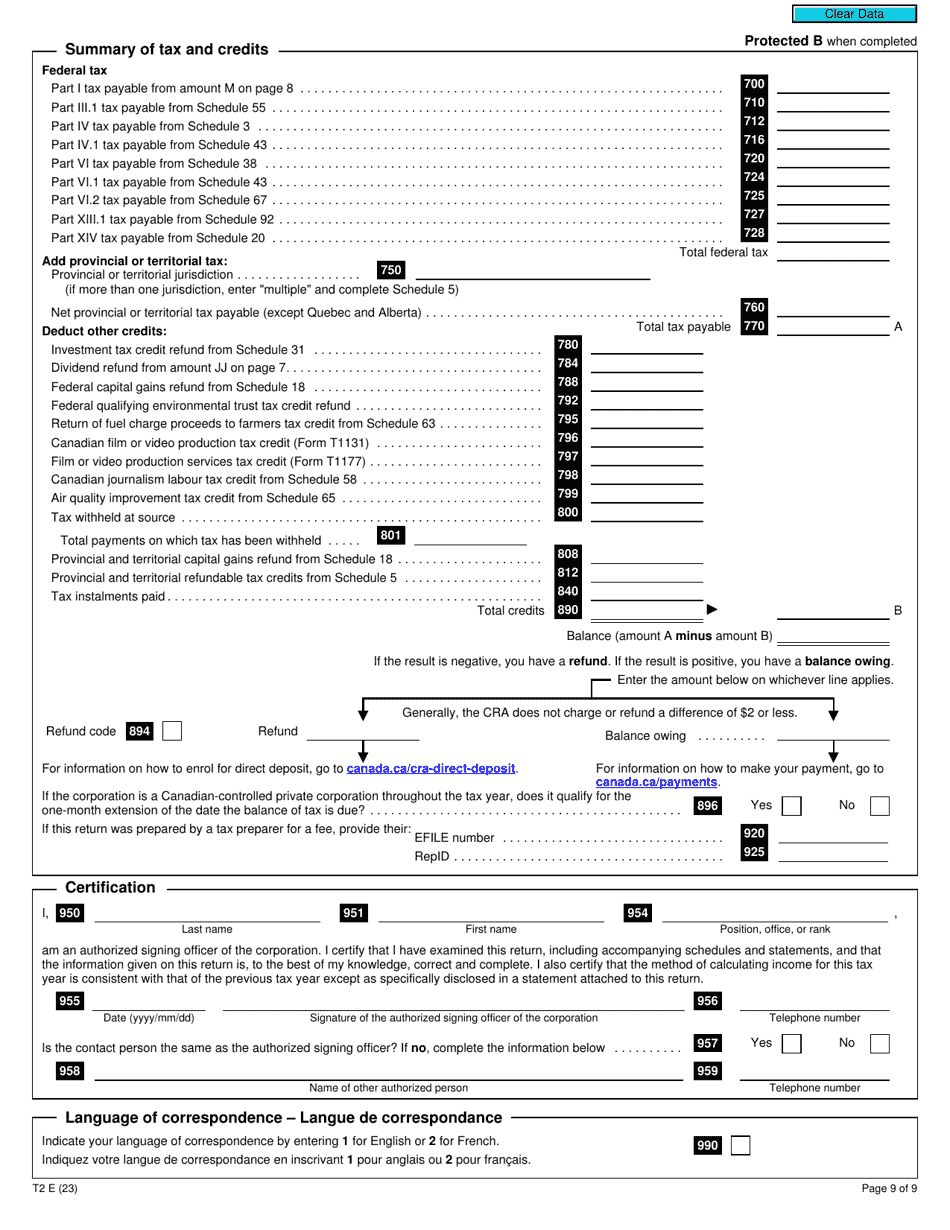

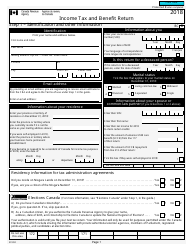

Form T2 Corporation Income Tax Return (2022 and Later Tax Years) - Canada

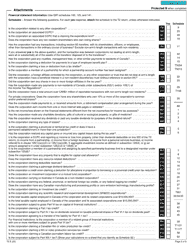

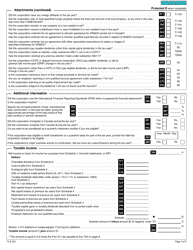

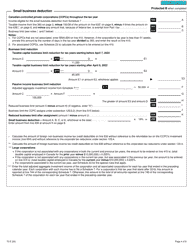

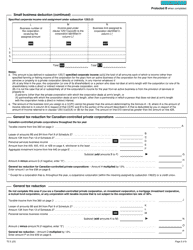

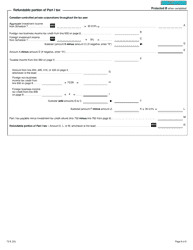

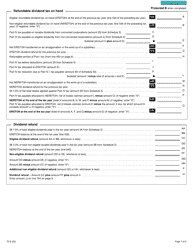

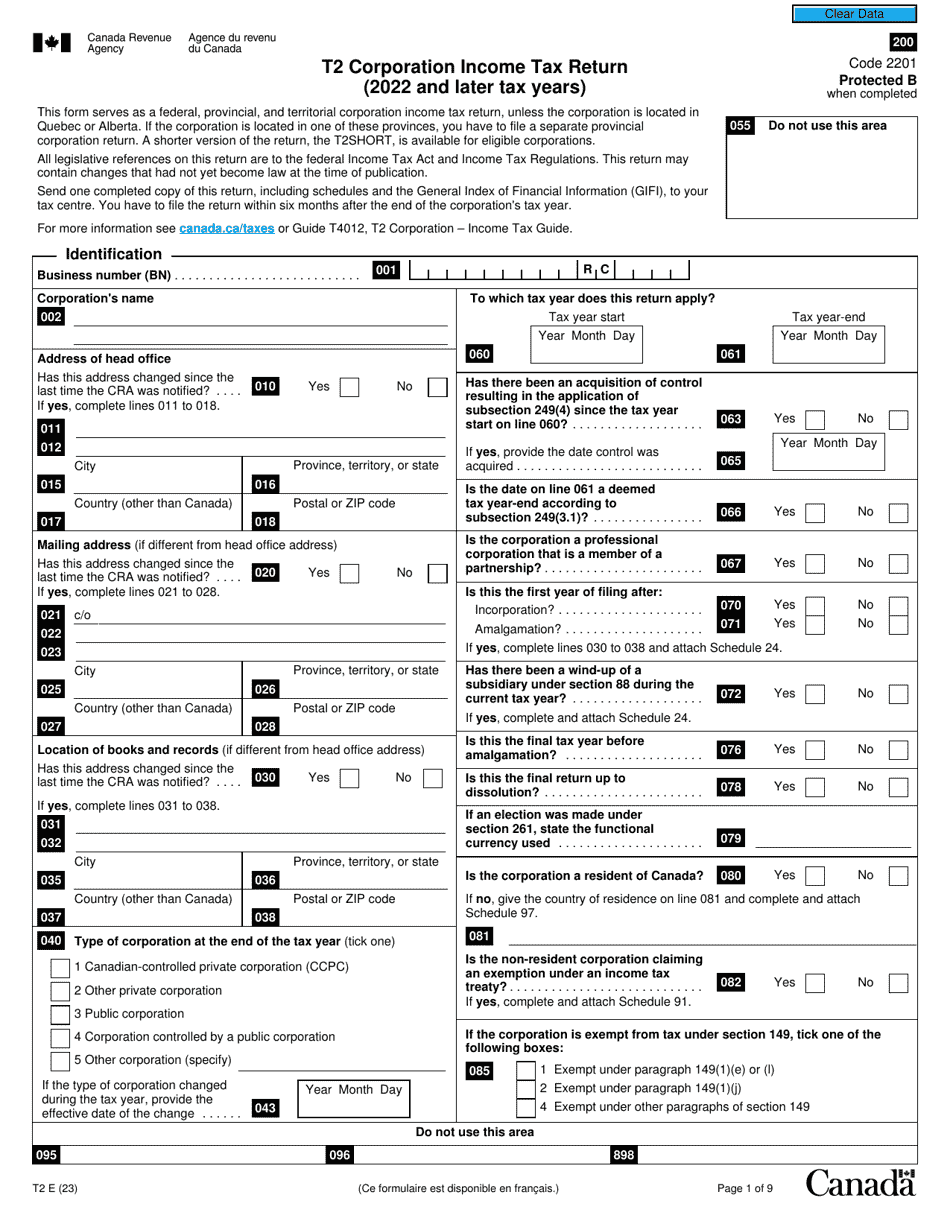

Form T2 Corporation Income Tax Return is used by Canadian corporations to report their income, expenses, and deductions for a specific tax year (2022 and later). It is a way for corporations to fulfill their tax obligations to the Canada Revenue Agency (CRA).

The Form T2 Corporation Income Tax Return in Canada is filed by corporations, including non-profit organizations, for the 2022 and later tax years.

FAQ

Q: What is the T2 Corporation Income Tax Return?

A: The T2 Corporation Income Tax Return is a form used by Canadian corporations to report their income and calculate the taxes owed.

Q: Who needs to file the T2 Corporation Income Tax Return?

A: All Canadian corporations, except those that are exempt, need to file the T2 Corporation Income Tax Return.

Q: When is the deadline to file the T2 Corporation Income Tax Return?

A: The deadline to file the T2 Corporation Income Tax Return is generally six months after the end of the corporation's tax year.

Q: What information is required to complete the T2 Corporation Income Tax Return?

A: To complete the T2 Corporation Income Tax Return, you will need information about the corporation's income, expenses, assets, liabilities, and other financial details.

Q: Are there any penalties for late filing or errors on the T2 Corporation Income Tax Return?

A: Yes, there can be penalties for late filing or errors on the T2 Corporation Income Tax Return. It is important to ensure accurate and timely filing to avoid penalties.

Q: Can I amend the T2 Corporation Income Tax Return if I made a mistake?

A: Yes, you can file an amended T2 Corporation Income Tax Return if you made a mistake or need to make changes to your original filing.

Q: Are there any tax credits or deductions available for corporations on the T2 Corporation Income Tax Return?

A: Yes, there are various tax credits and deductions available for corporations on the T2 Corporation Income Tax Return. These can reduce the amount of taxes owed.

Q: What should I do if I have further questions about the T2 Corporation Income Tax Return?

A: If you have further questions about the T2 Corporation Income Tax Return, you can contact the Canada Revenue Agency (CRA) or consult a tax professional.