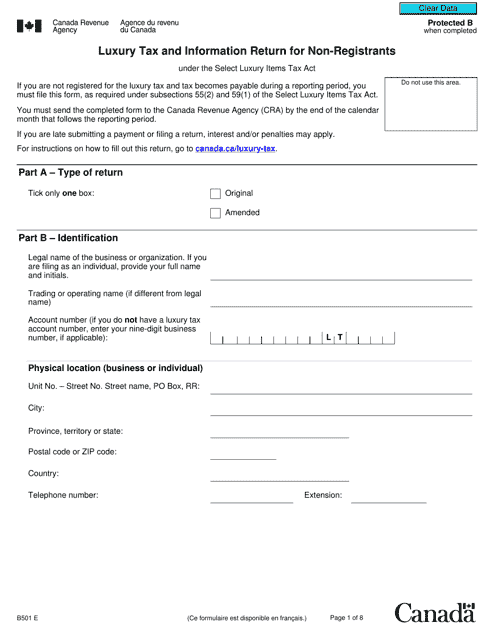

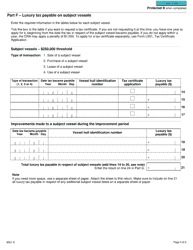

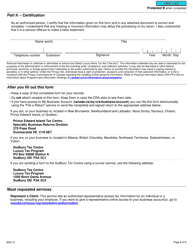

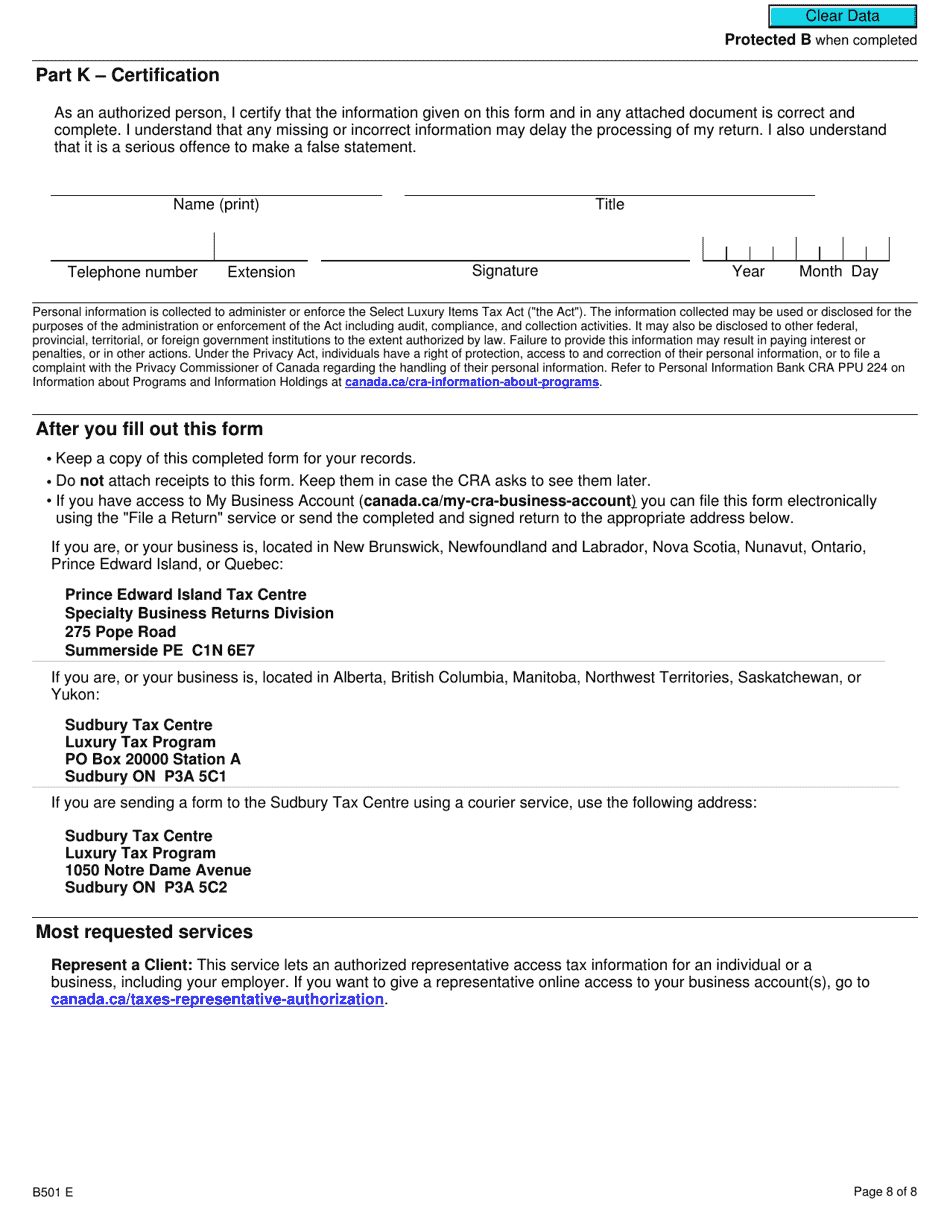

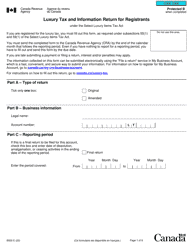

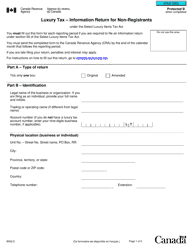

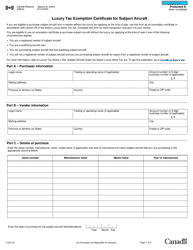

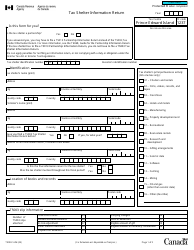

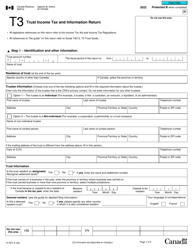

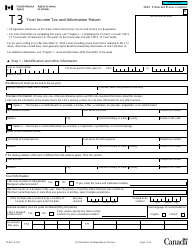

Form B501 Luxury Tax and Information Return for Non-registrants - Canada

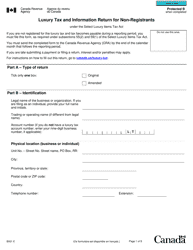

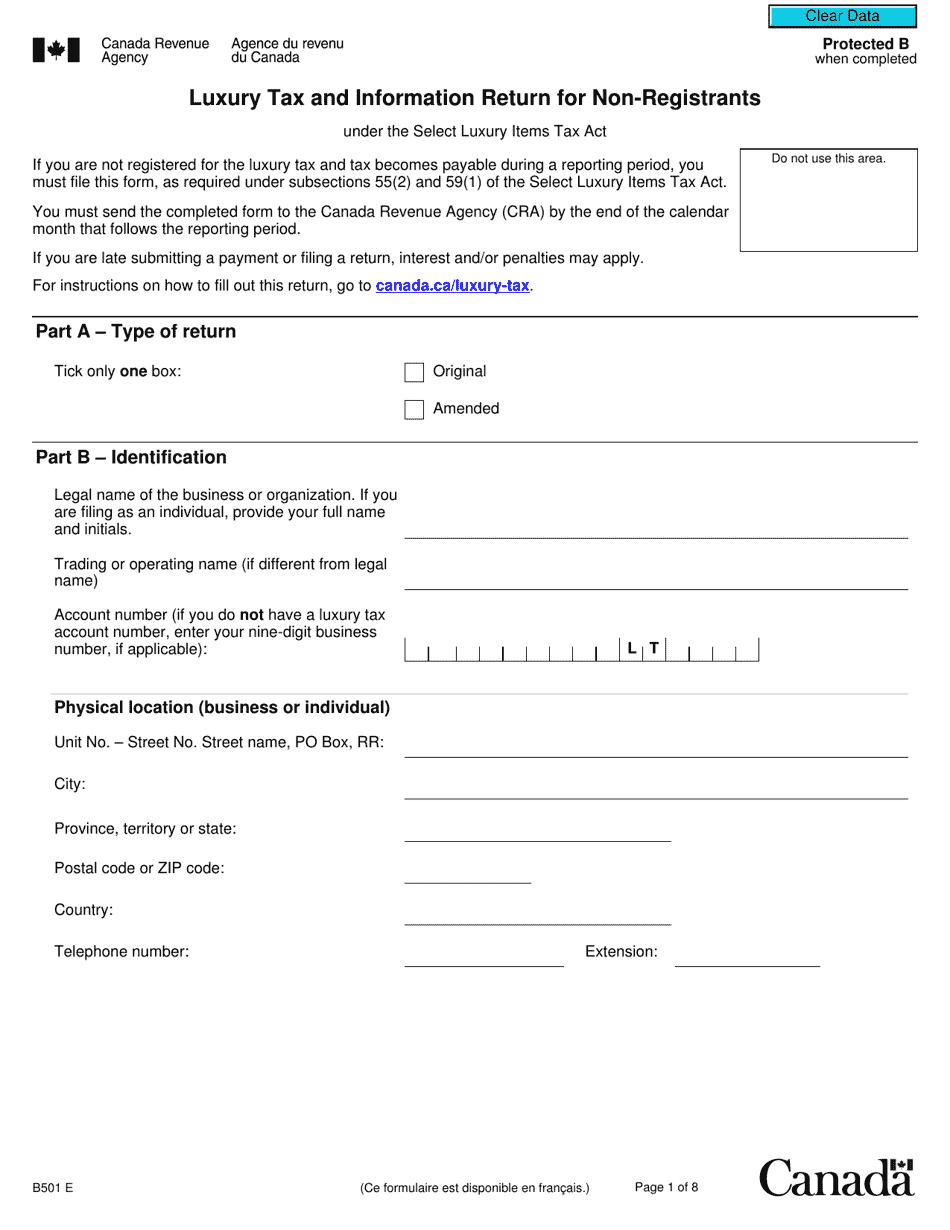

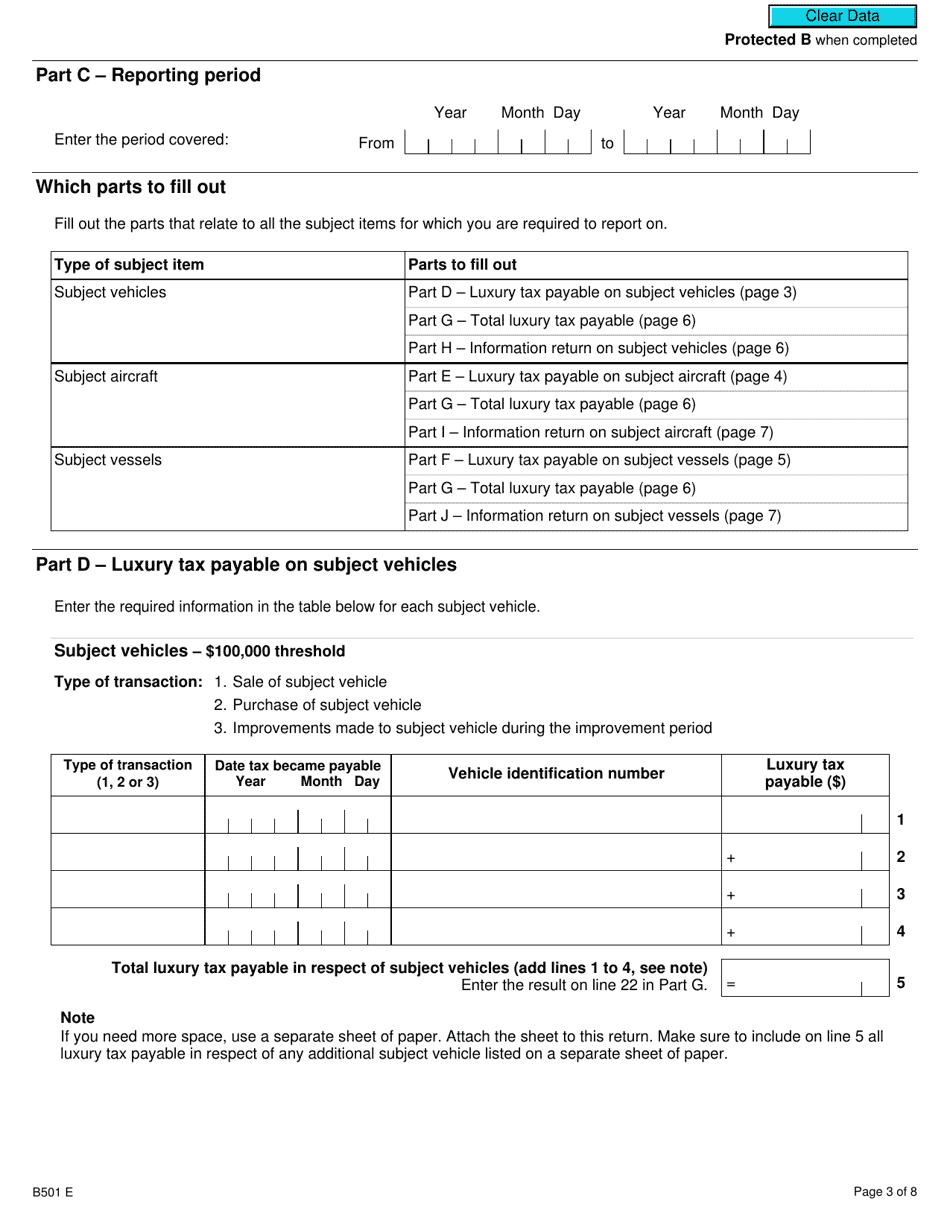

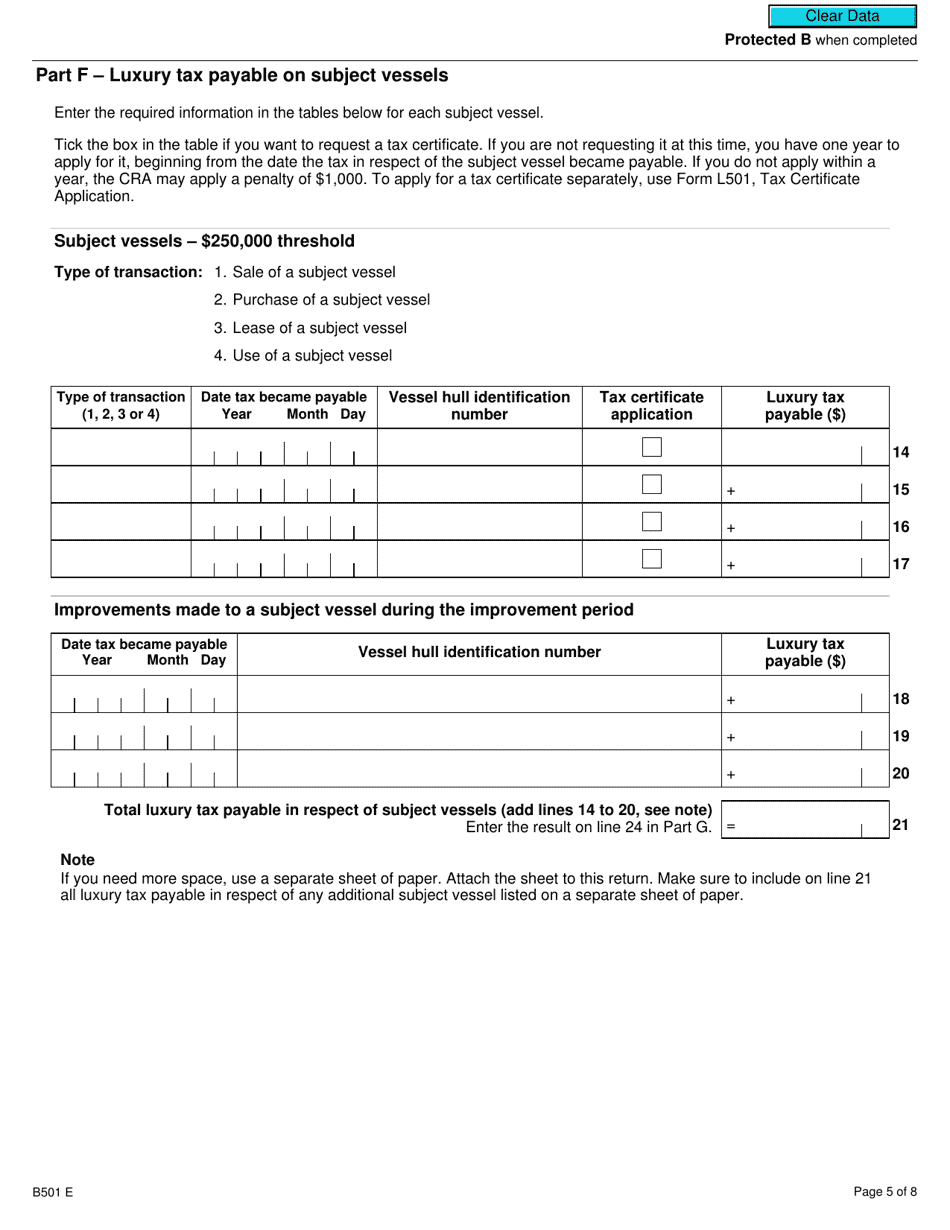

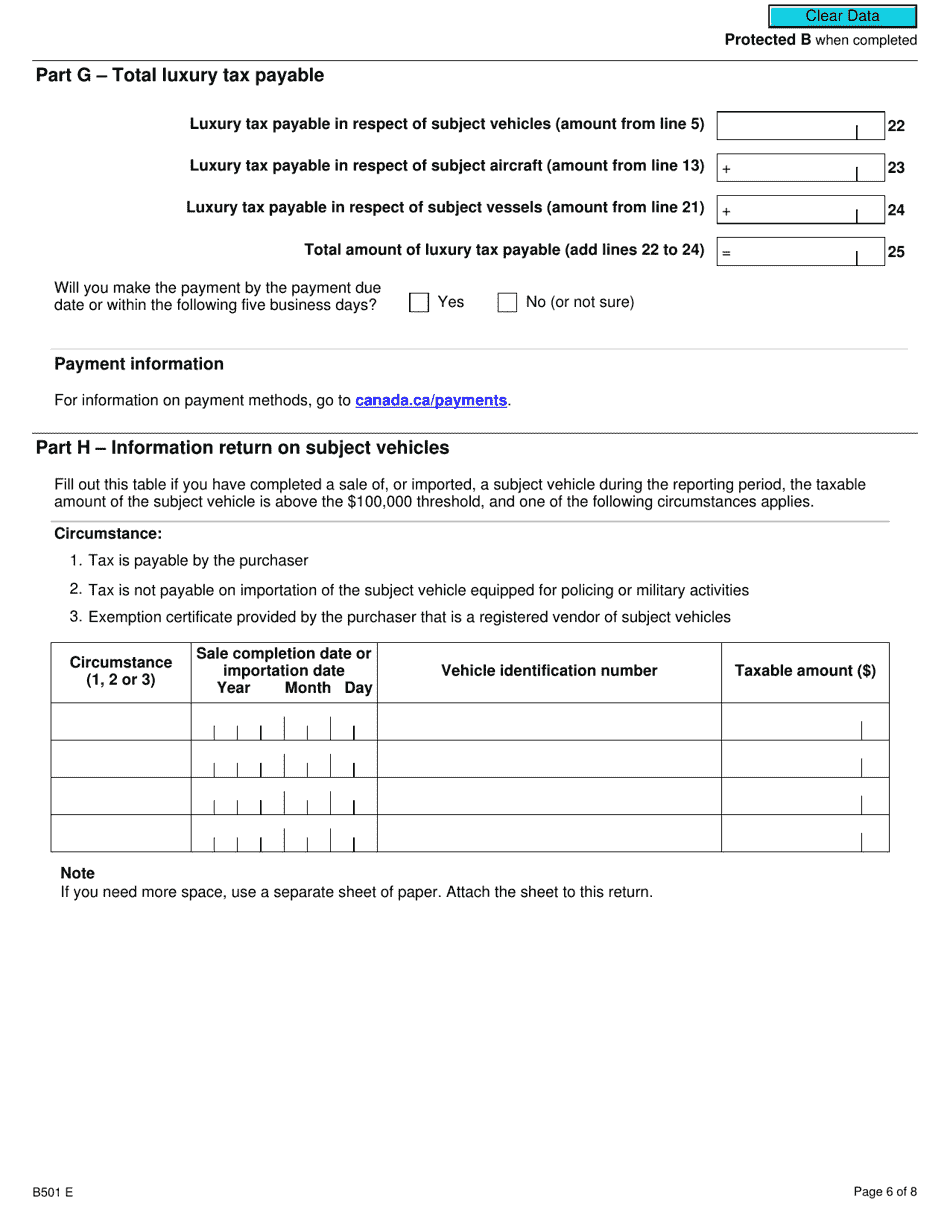

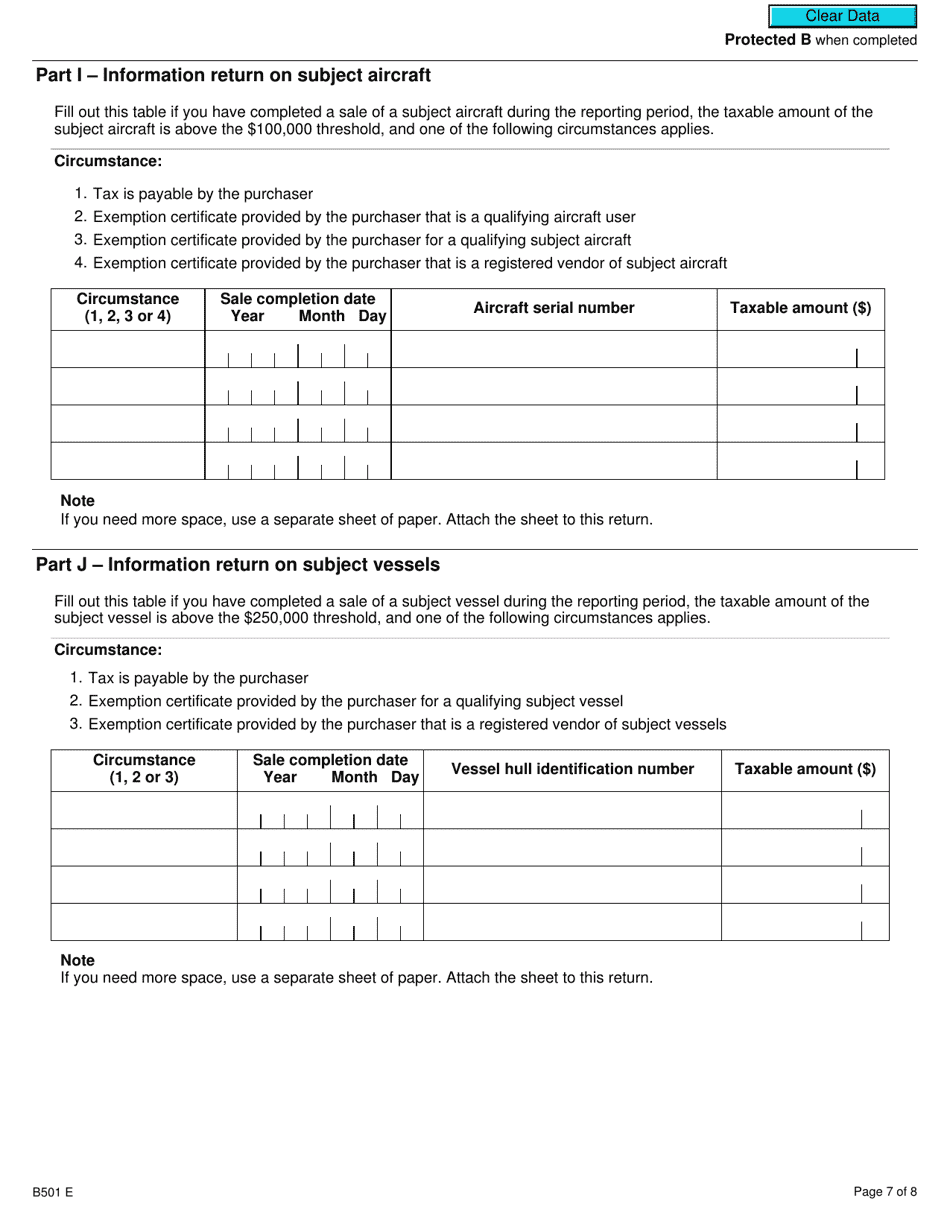

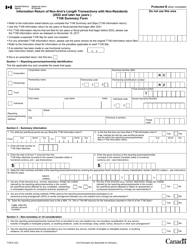

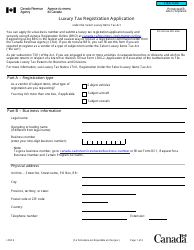

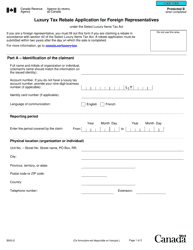

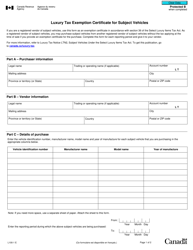

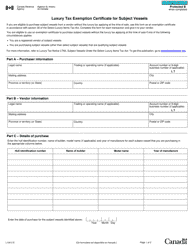

Form B501 Luxury Tax and Information Return for Non-registrants in Canada is used to report and remit luxury taxes for those who are not registered for the Goods and Services Tax/Harmonized Sales Tax (GST/HST). This form is specifically designed for businesses or individuals engaged in the sale, lease, or importation of certain luxury goods in Canada. It is used to declare the total value of luxury goods sold or imported and calculate the applicable luxury tax owed to the Canada Revenue Agency (CRA).

In Canada, the Form B501 Luxury Tax and Information Return for Non-registrants is typically filed by individuals or businesses who are non-registrants for the goods and services tax/harmonized sales tax (GST/HST). This form is used to report and remit any luxury tax payable on certain specified goods. However, it is important to note that the luxury tax has been abolished in Canada since 2007. Therefore, as of now, there is no requirement to file the Form B501 Luxury Tax and Information Return for Non-registrants.

FAQ

Q: What is the B501 Luxury Tax and Information Return for Non-registrants?

A: The B501 Luxury Tax and Information Return for Non-registrants is a tax return form used by Canadian non-registrant businesses to report their luxury tax liabilities.

Q: Who needs to file the B501 Luxury Tax and Information Return for Non-registrants?

A: Non-registrant businesses in Canada that are liable for luxury tax need to file the B501 form.

Q: What is luxury tax?

A: Luxury tax is a tax imposed on the perceived luxury or high-value goods and services. In Canada, luxury tax is levied on specific items like jewelry, boats, aircraft, and certain motor vehicles.

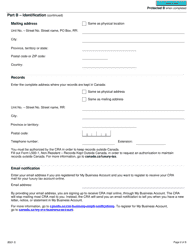

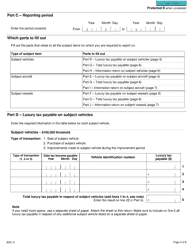

Q: How often do you need to file the B501 Luxury Tax and Information Return for Non-registrants?

A: The B501 form should be filed on a quarterly basis. The deadlines for filing are typically within one month following the end of each calendar quarter.

Q: What information do you need to complete the B501 Luxury Tax and Information Return for Non-registrants?

A: To complete the B501 form, you will need to provide details about your luxury tax liabilities, including the total value of luxury goods sold or imported into Canada during the reporting period.

Q: Are there any penalties for late filing of the B501 Luxury Tax and Information Return for Non-registrants?

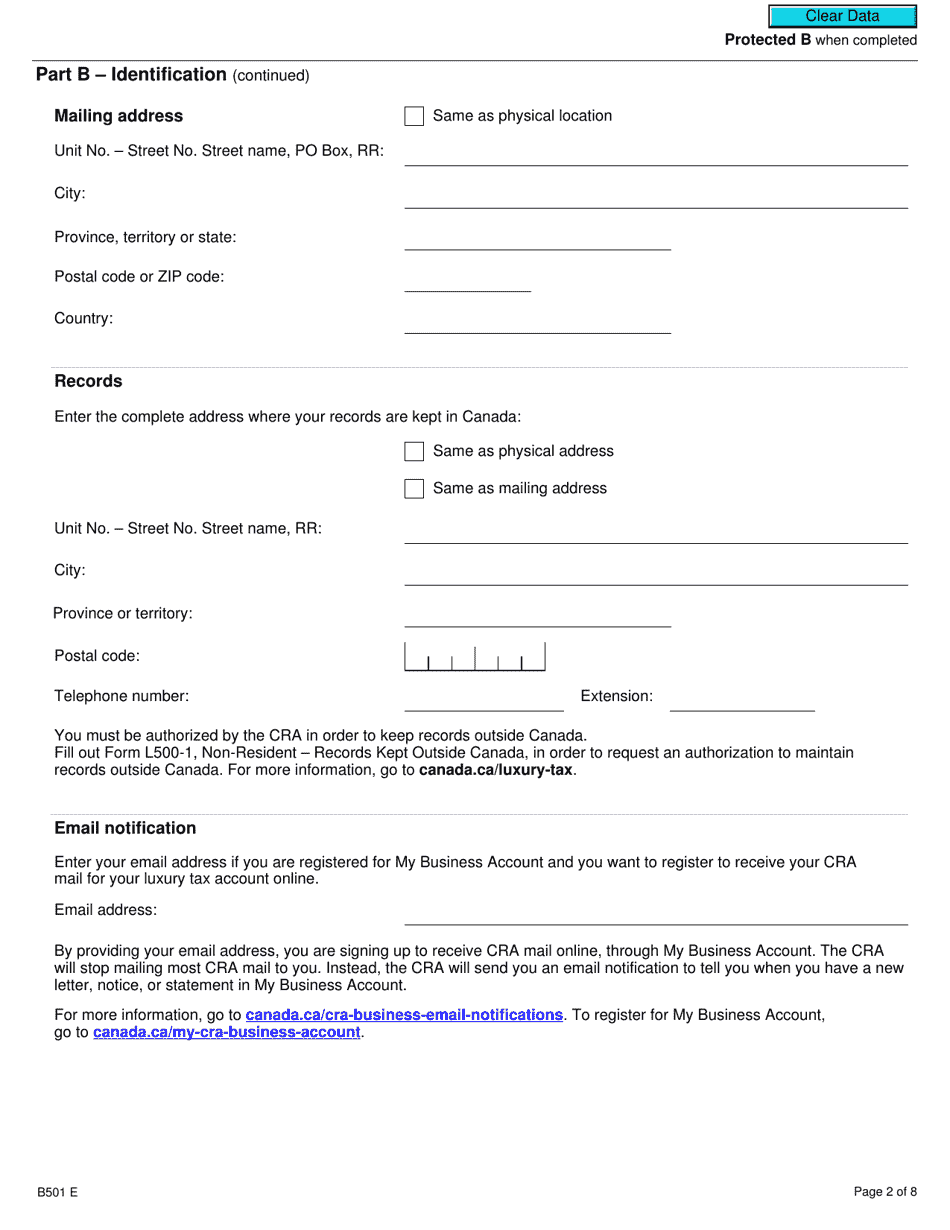

A: Yes, there are penalties for late filing. If you fail to file the B501 form by the due date, you may be subject to penalties and interest charges on any outstanding tax amounts.

Q: Do I need to pay the luxury tax if I'm a non-registrant business?

A: Yes, non-registrant businesses are still required to pay luxury tax if they meet the eligibility criteria for this tax. The B501 form helps calculate the tax liability.

Q: Can I claim any deductions or exemptions on the B501 Luxury Tax and Information Return for Non-registrants?

A: The B501 form does not provide for deductions or exemptions specifically. However, certain businesses may be eligible for rebates or refunds under other tax provisions. Consulting with a tax professional is recommended.

Q: What should I do if I am unsure about how to complete the B501 Luxury Tax and Information Return for Non-registrants?

A: If you are unsure about how to complete the B501 form or have any specific questions, it is advisable to seek guidance from a tax professional or contact the Canada Revenue Agency (CRA) for assistance.