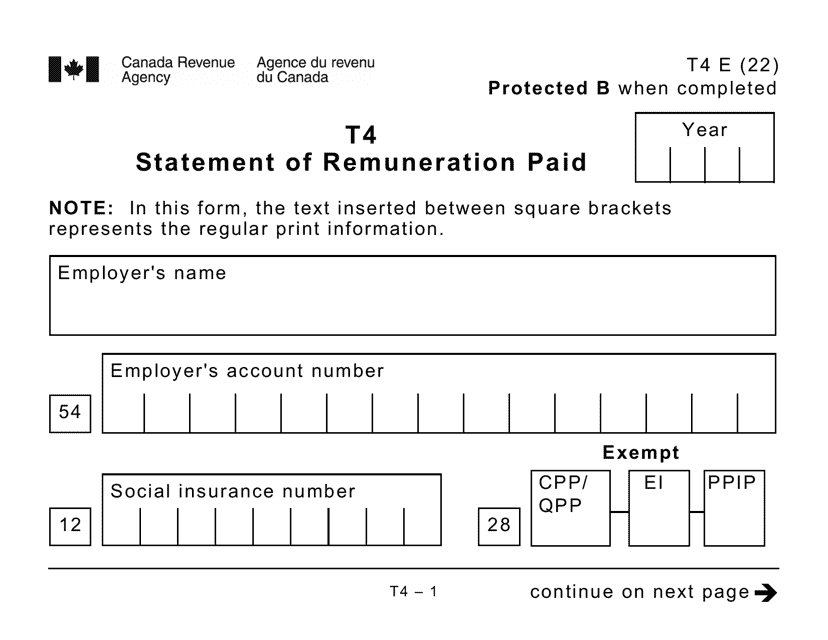

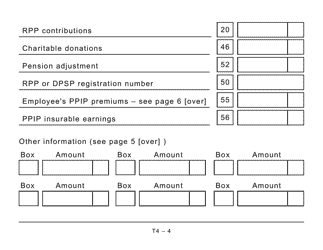

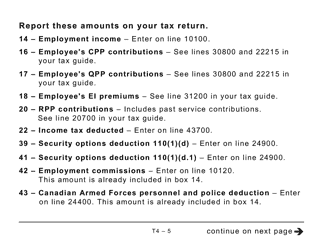

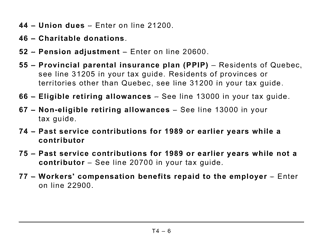

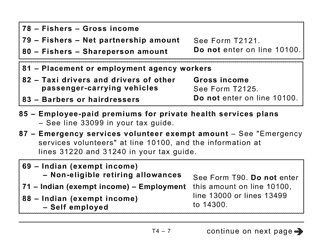

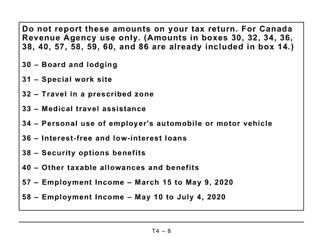

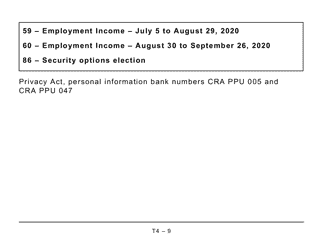

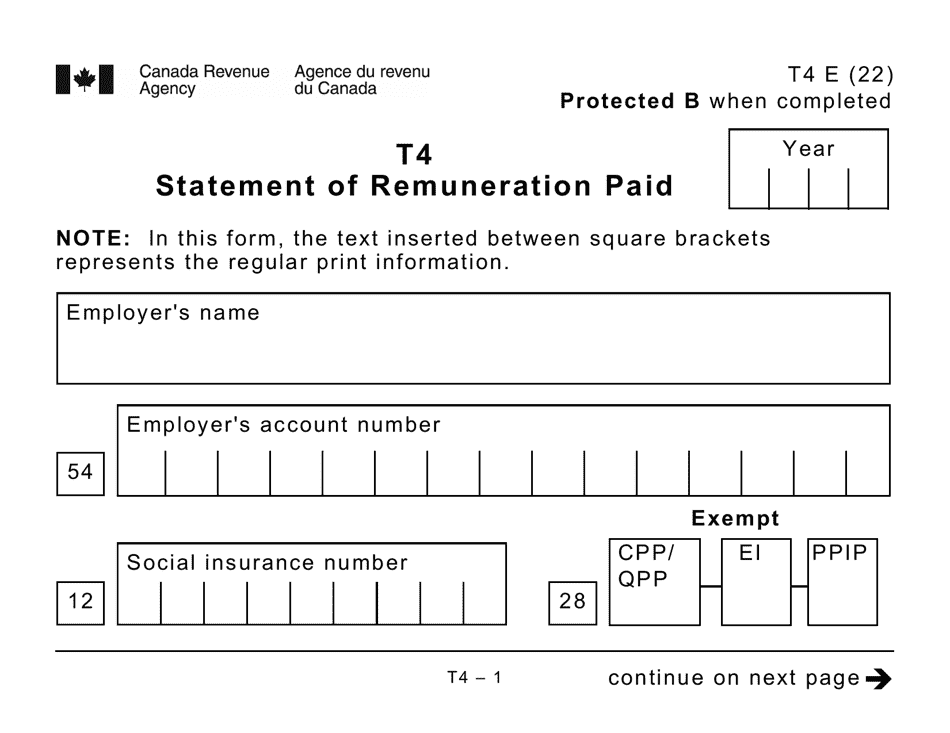

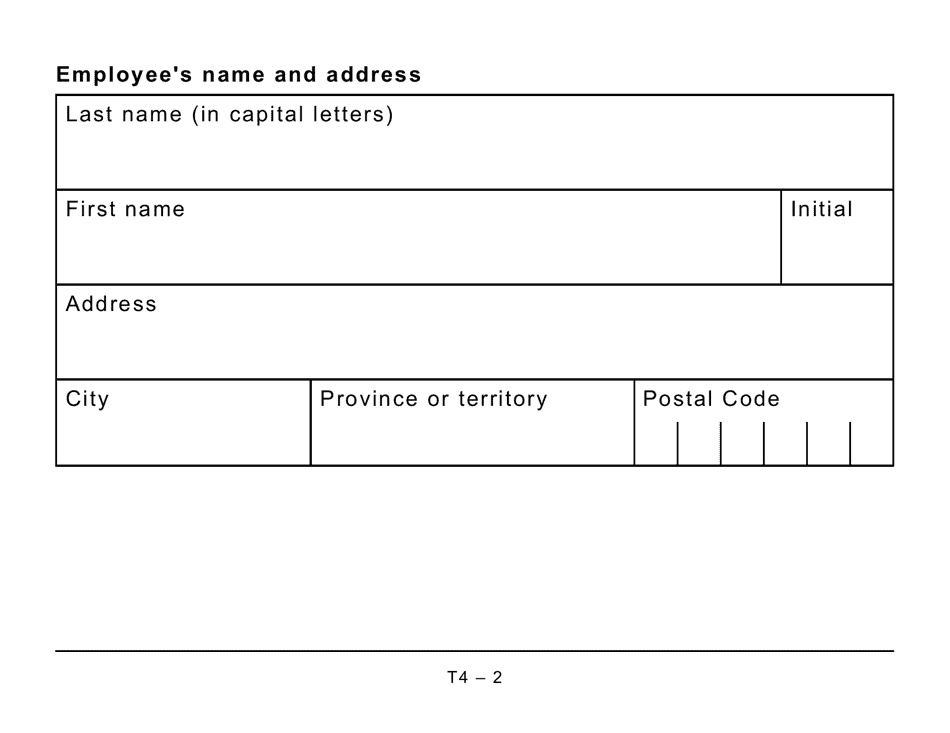

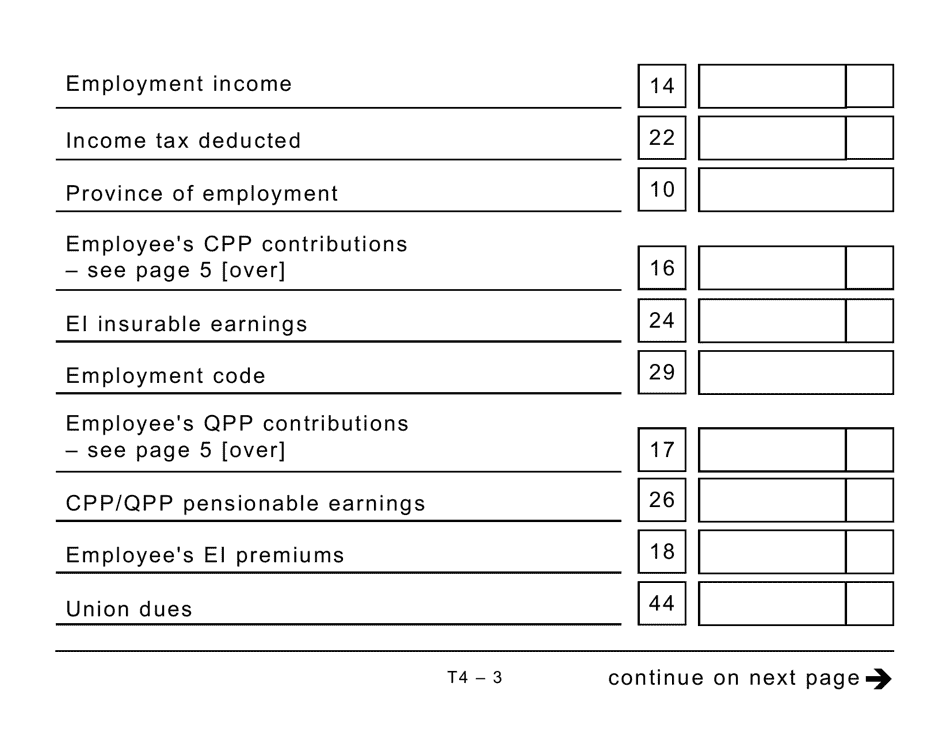

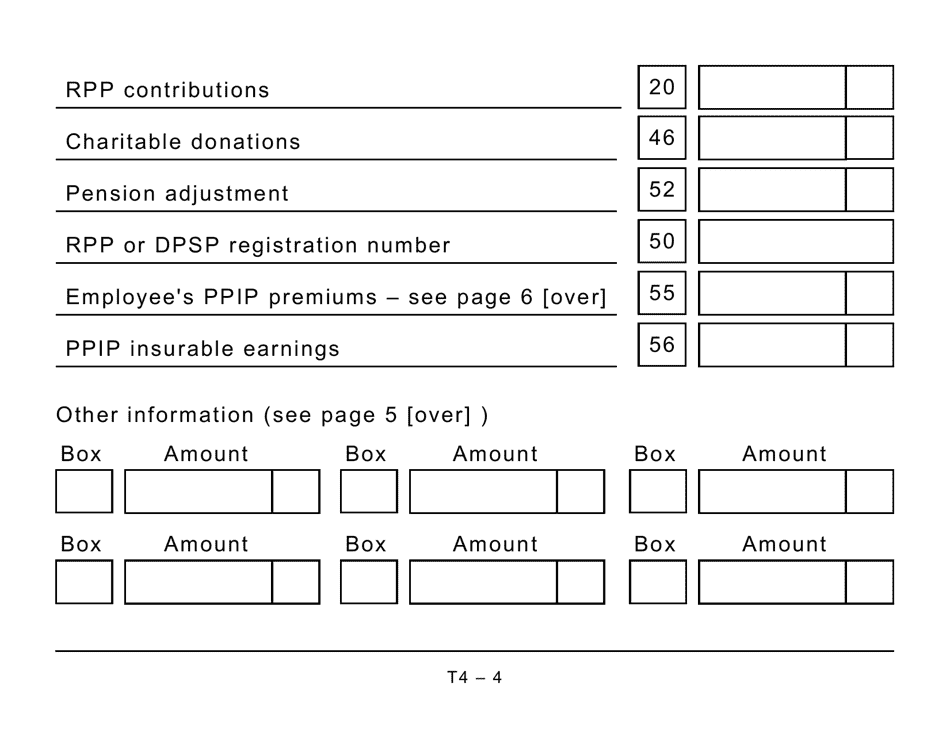

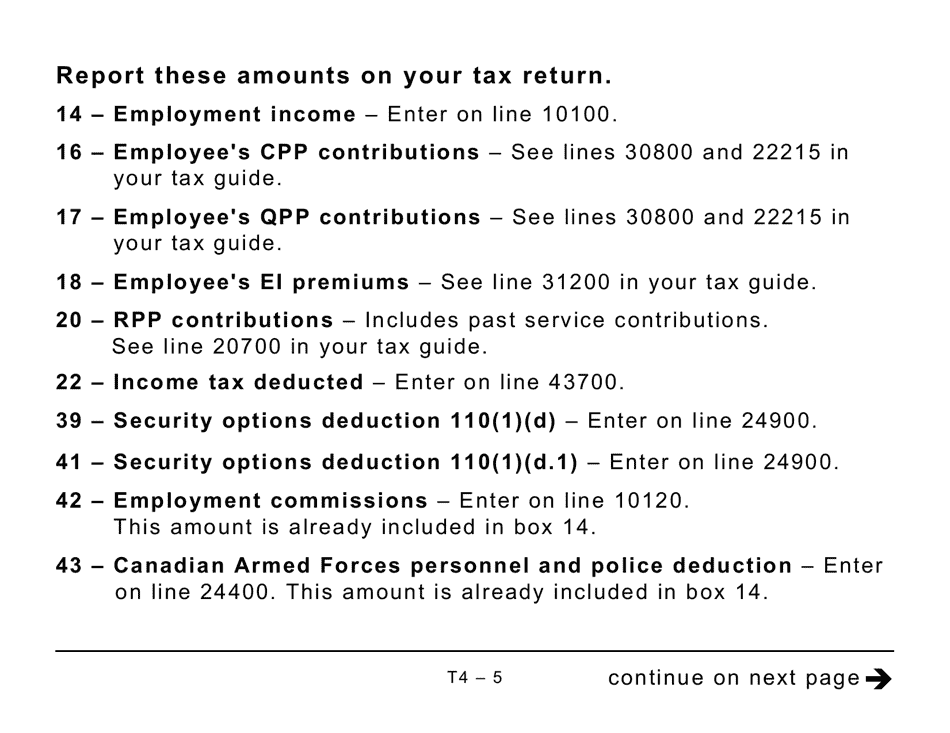

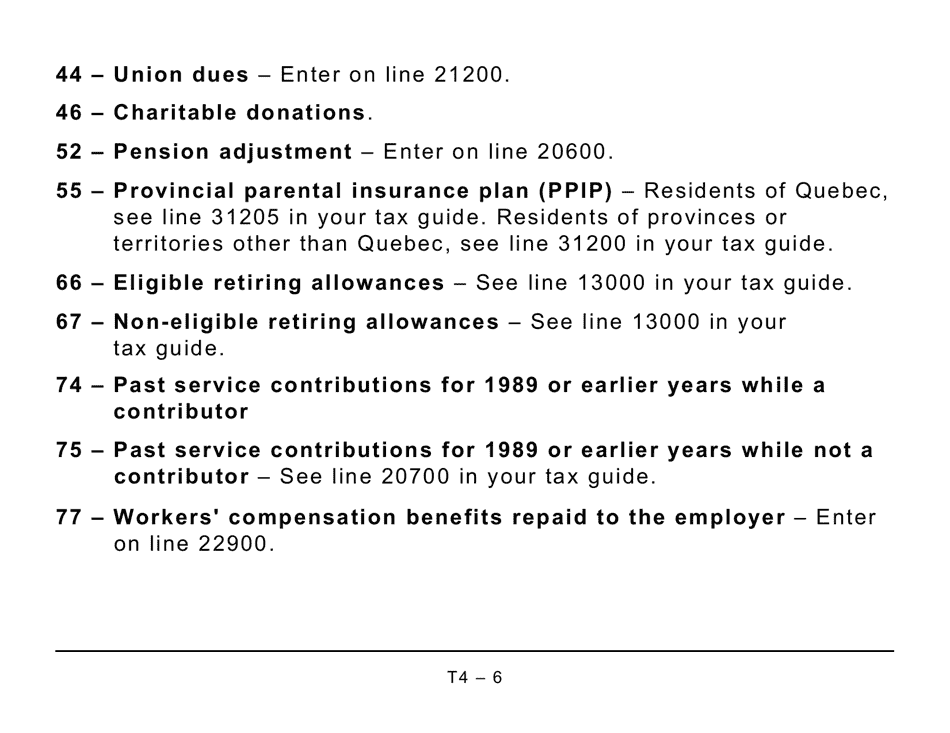

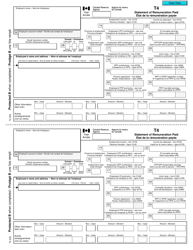

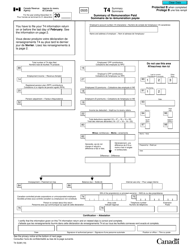

Form T4 Statement of Remuneration Paid - Large Print - Canada

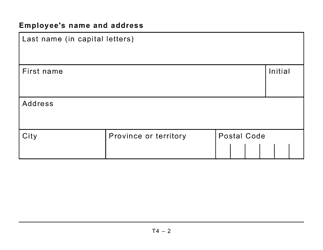

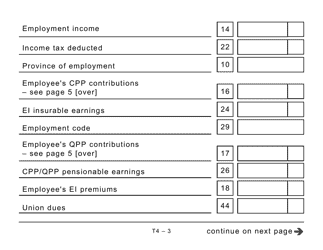

Form T4 Statement of Remuneration Paid - Large Print - Canada is used by employers to report the wages, salary, commissions, bonuses, and other remuneration paid to their employees during the tax year. It provides a summary of the employee's income and deductions, which is needed for filing their personal income tax return.

The employer files the Form T4 Statement of Remuneration Paid - Large Print in Canada.

FAQ

Q: What is Form T4?

A: Form T4 is a statement of remuneration paid to an employee in Canada.

Q: Why is there a large print version of Form T4?

A: The large print version of Form T4 is available to accommodate individuals with visual impairments or difficulties reading small print.

Q: Who uses Form T4?

A: Employers in Canada use Form T4 to report the income and deductions of their employees to the Canada Revenue Agency (CRA).

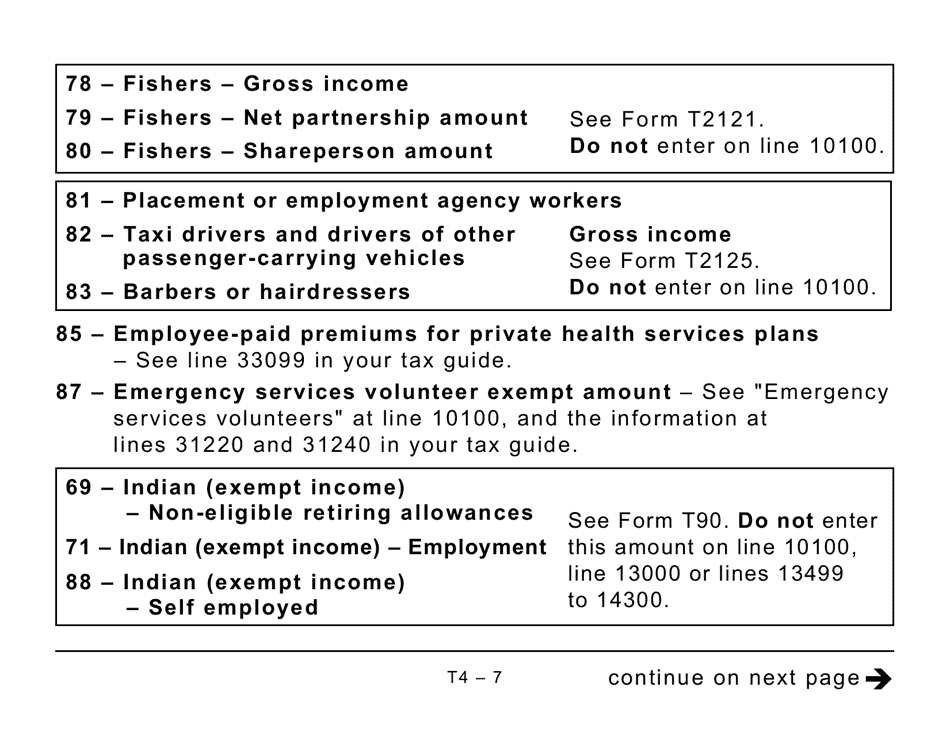

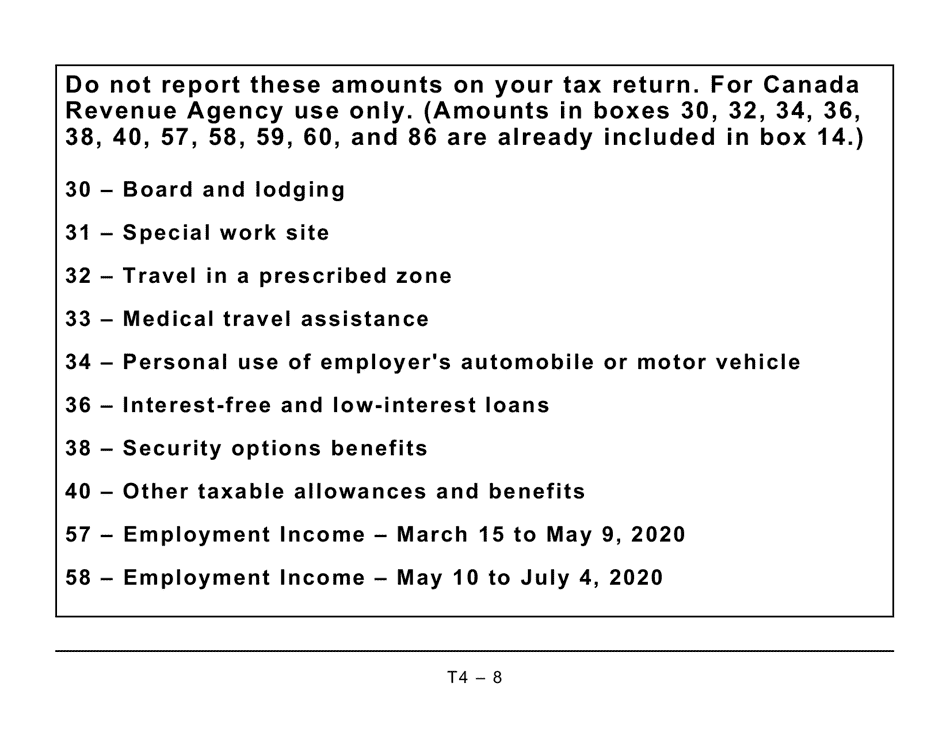

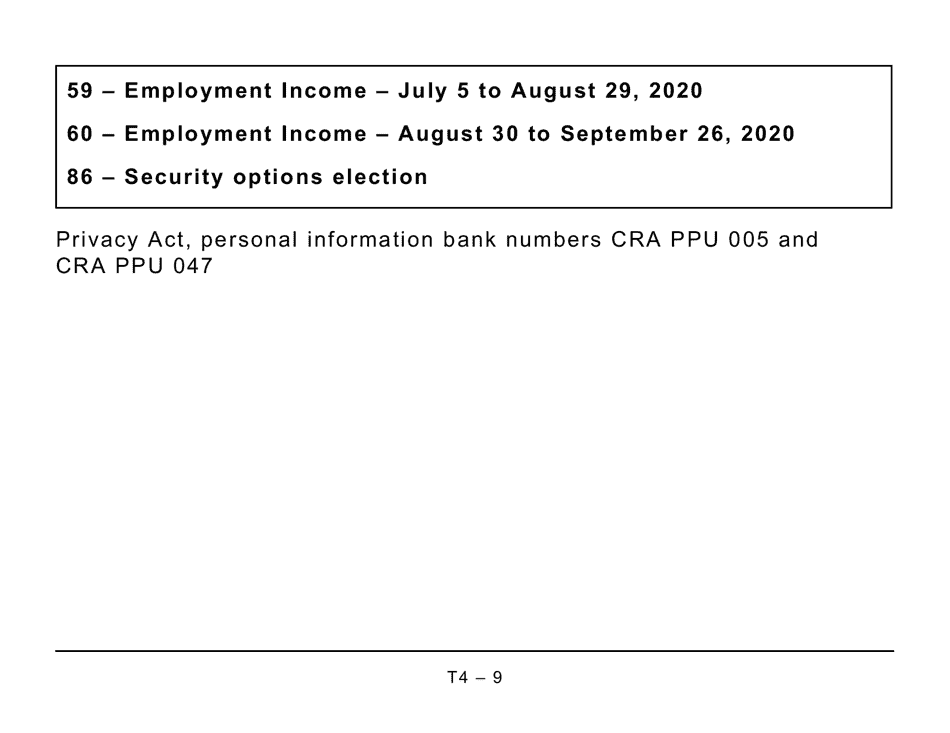

Q: What information is included in Form T4?

A: Form T4 includes information about the employee's income, deductions, and taxes withheld during the tax year.