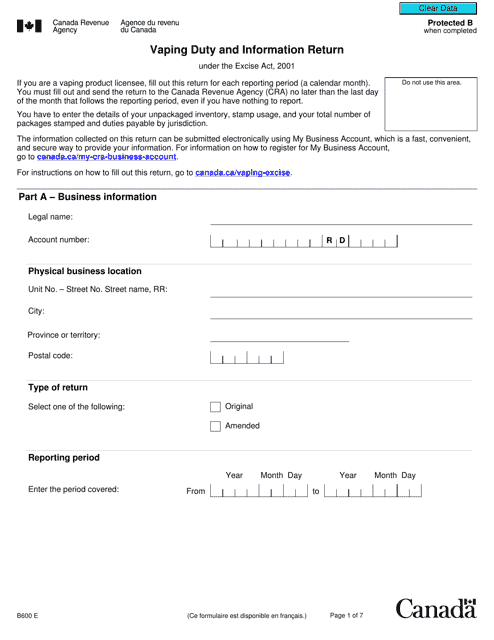

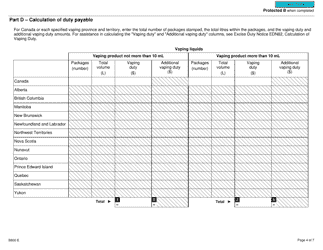

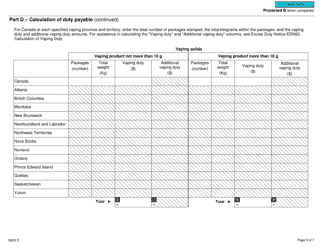

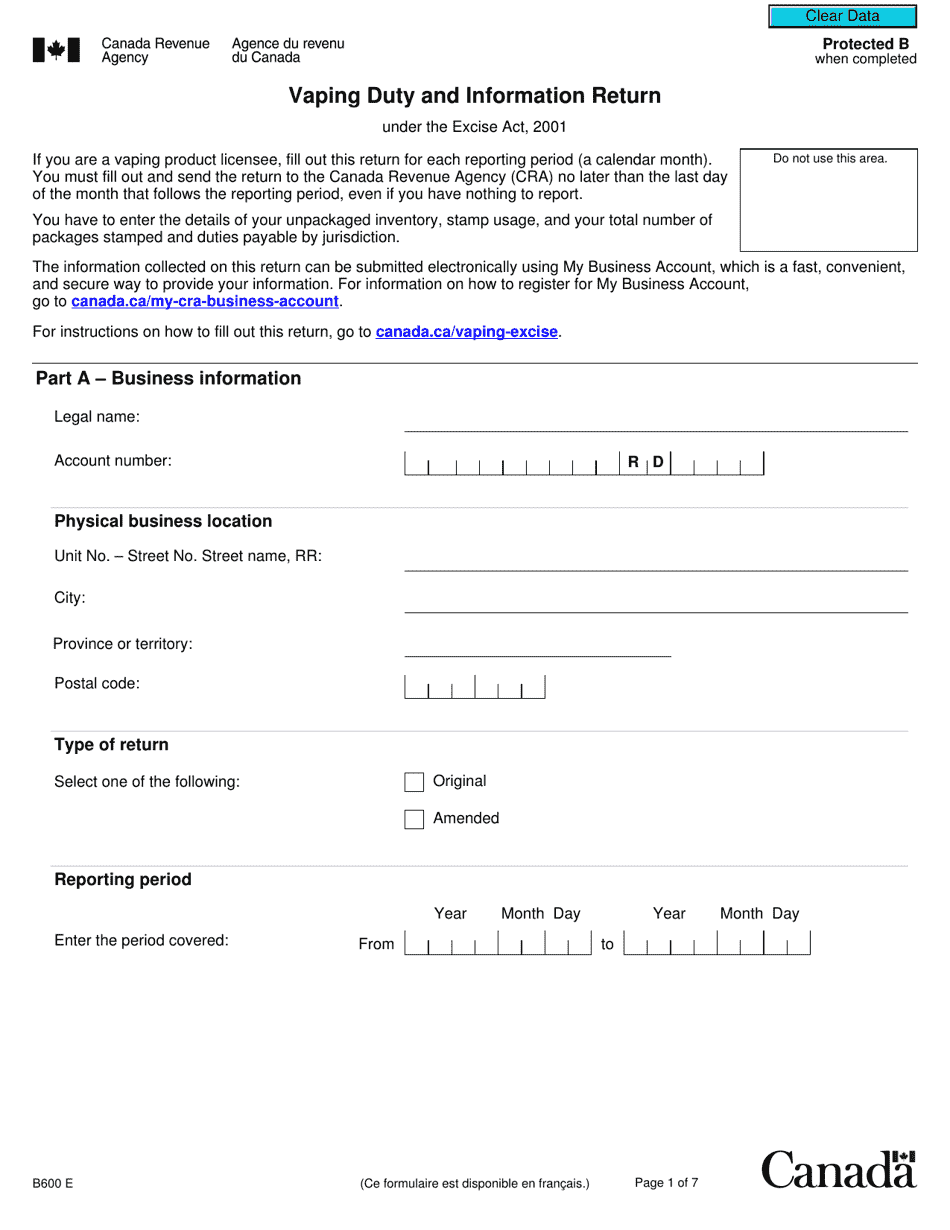

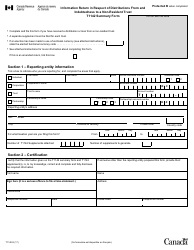

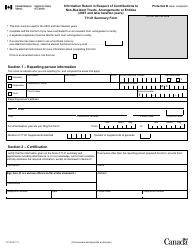

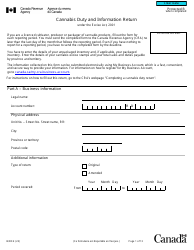

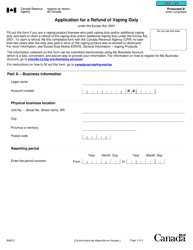

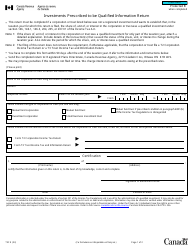

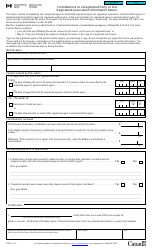

Form B600 Vaping Duty and Information Return - Canada

Form B600 Vaping Duty and Information Return in Canada is used to report and pay the duty on vaping products. It is required for businesses engaged in the production, packaging or retail sale of vaping products in Canada.

The Form B600 Vaping Duty and Information Return in Canada should be filed by businesses that are engaged in the vaping industry.

FAQ

Q: What is the B600 Vaping Duty and Information Return?

A: The B600 Vaping Duty and Information Return is a form used in Canada to report and pay duty on vaping products.

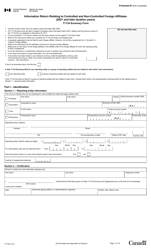

Q: Who needs to file the B600 Vaping Duty and Information Return?

A: Importers and manufacturers of vaping products in Canada need to file this return.

Q: What is the purpose of the B600 Vaping Duty and Information Return?

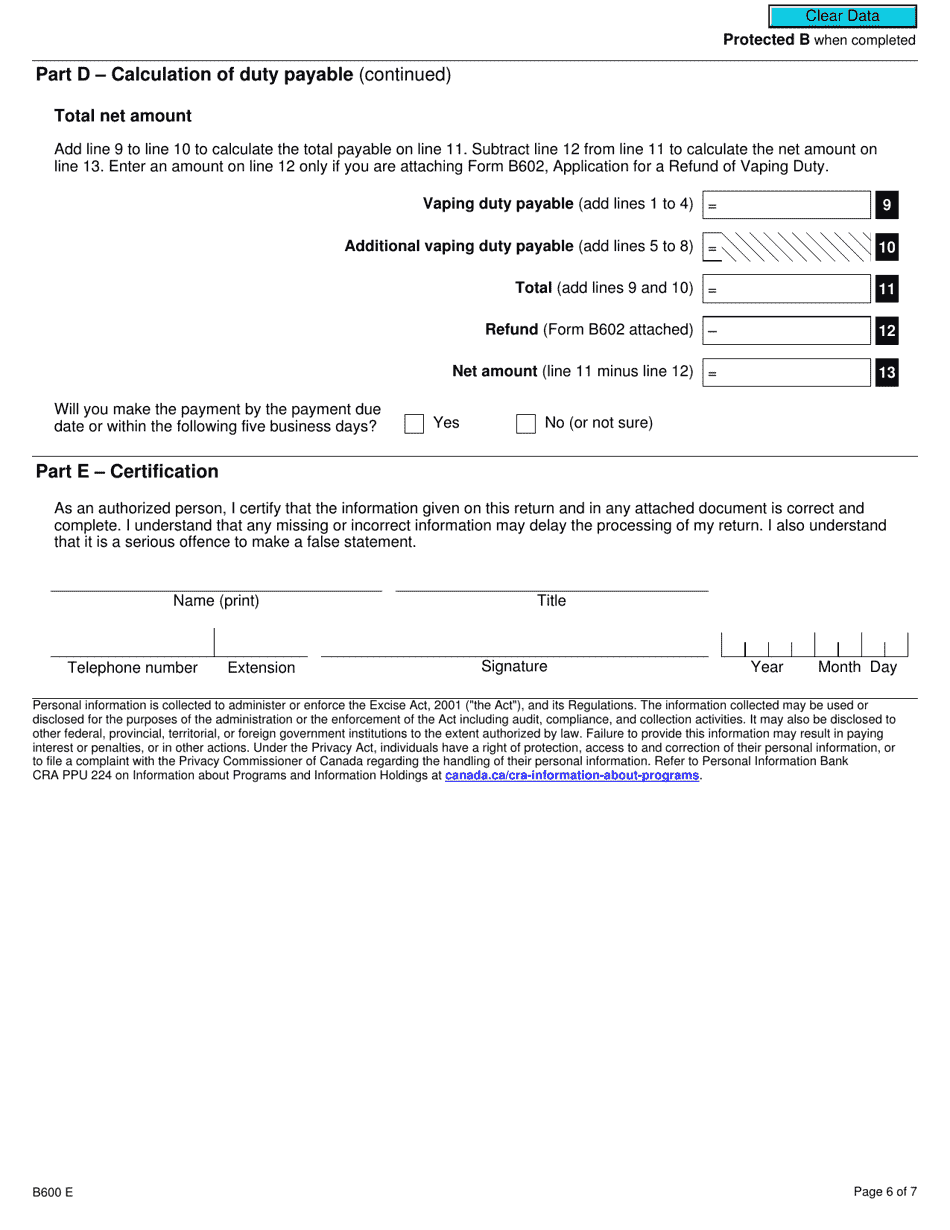

A: The purpose is to report and pay duty on vaping products imported or manufactured in Canada.

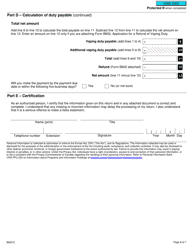

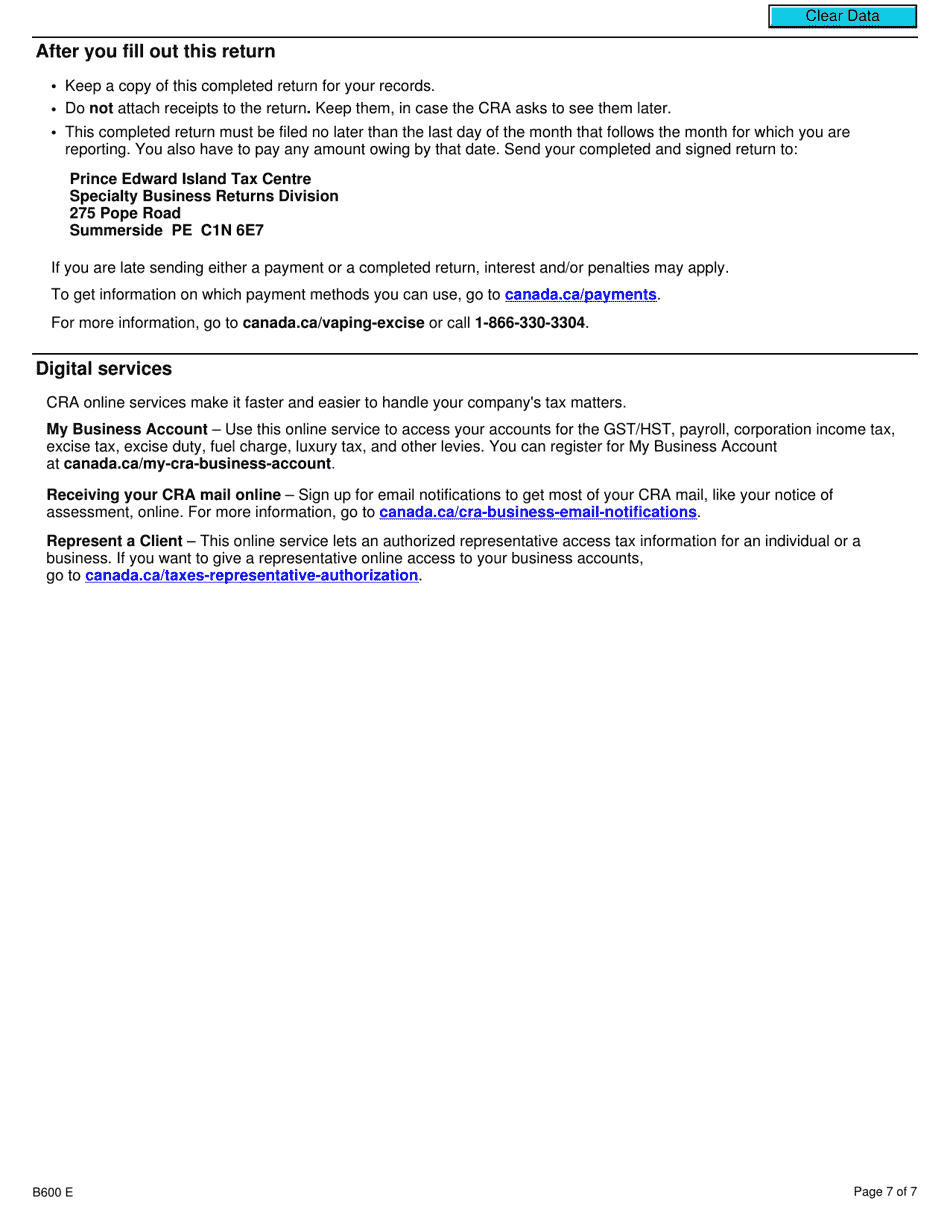

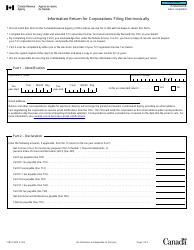

Q: When is the deadline to file the B600 Vaping Duty and Information Return?

A: The deadline for filing is within one month after the end of each calendar month.

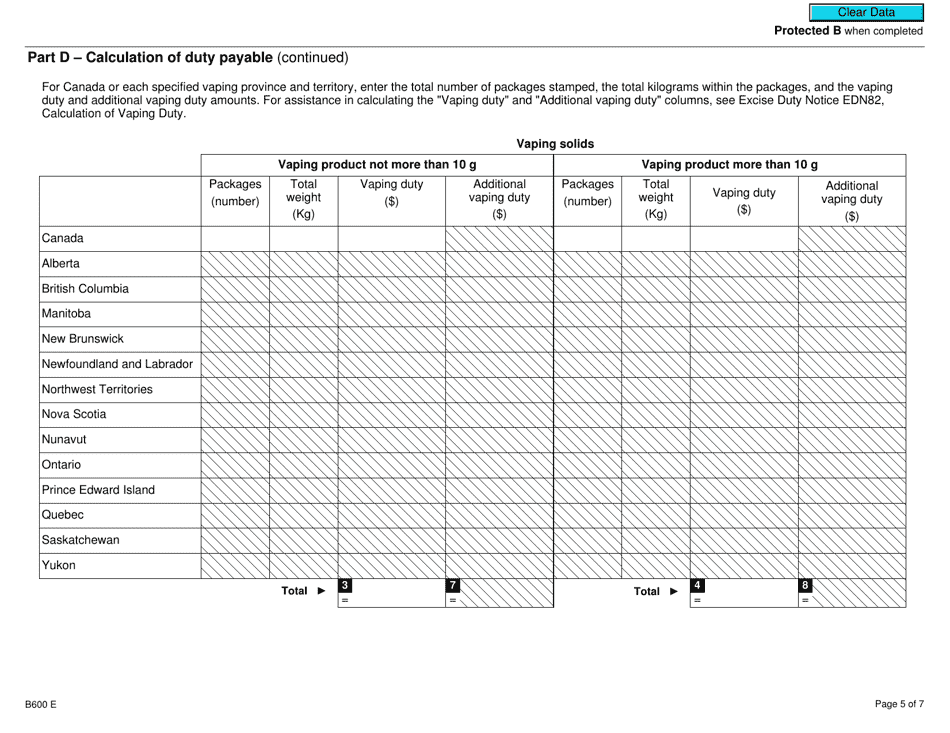

Q: What information is required to complete the B600 Vaping Duty and Information Return?

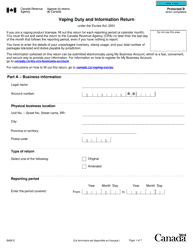

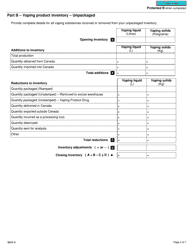

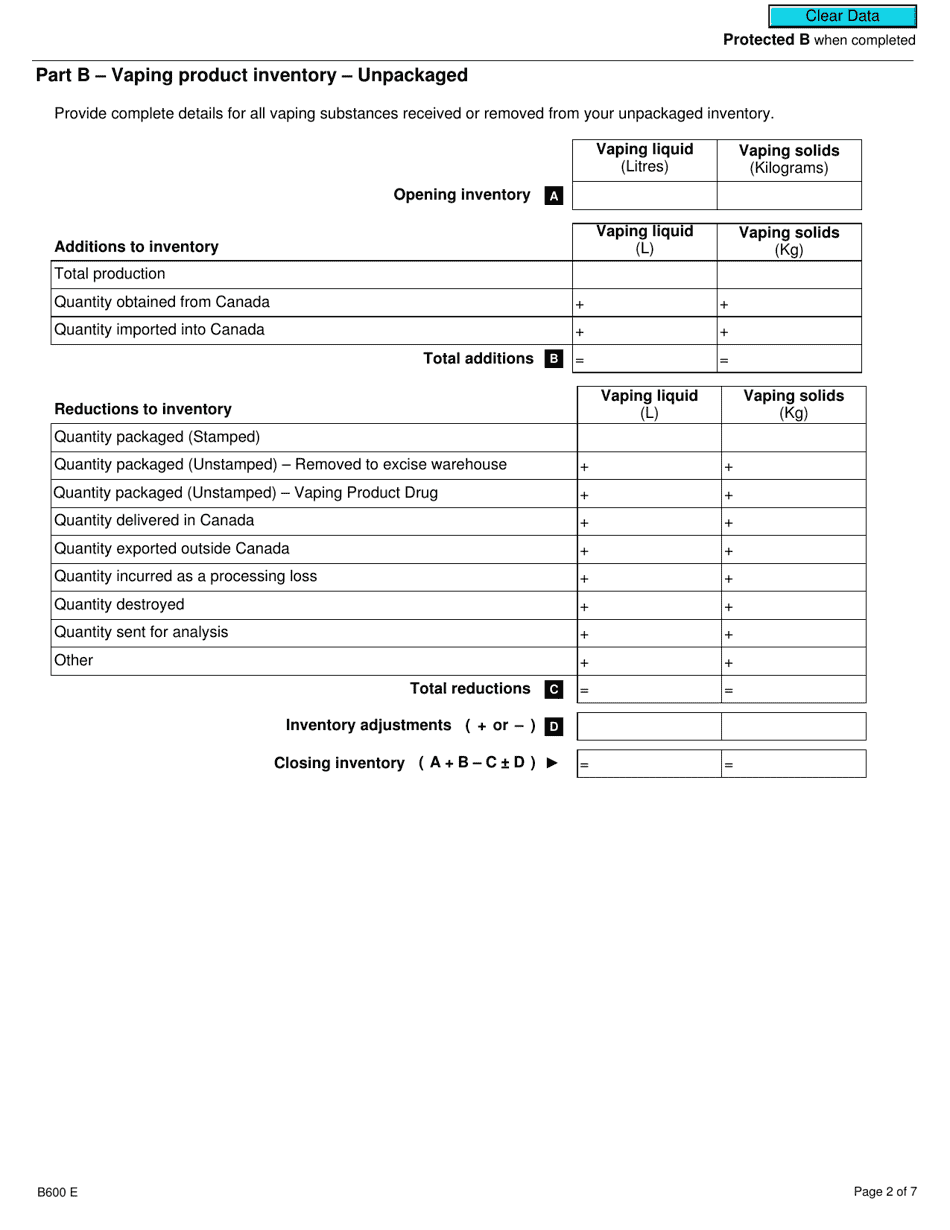

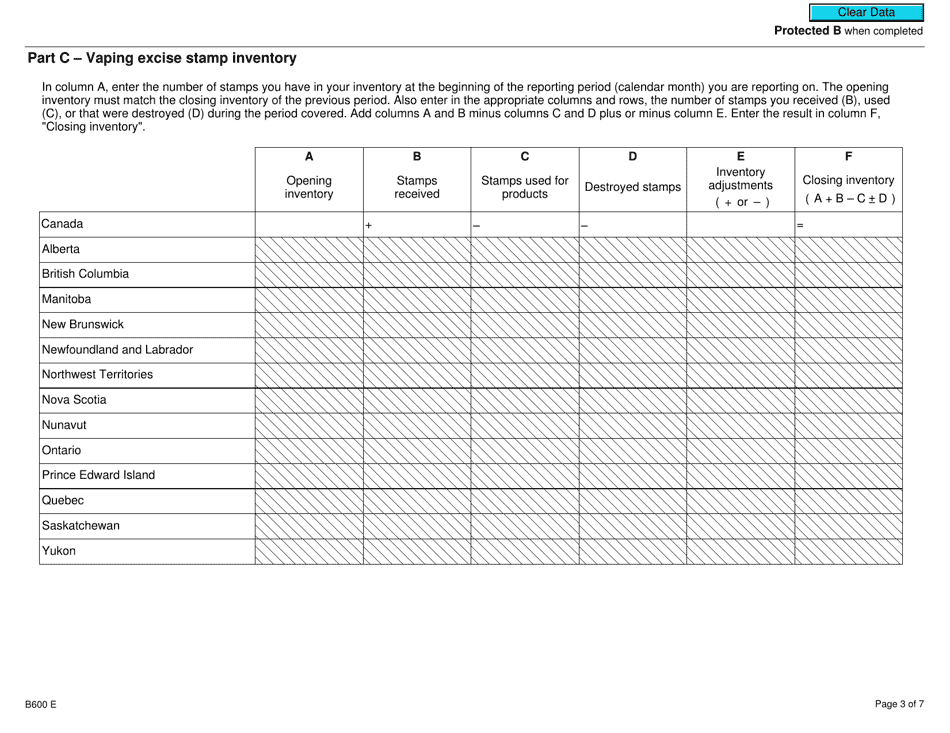

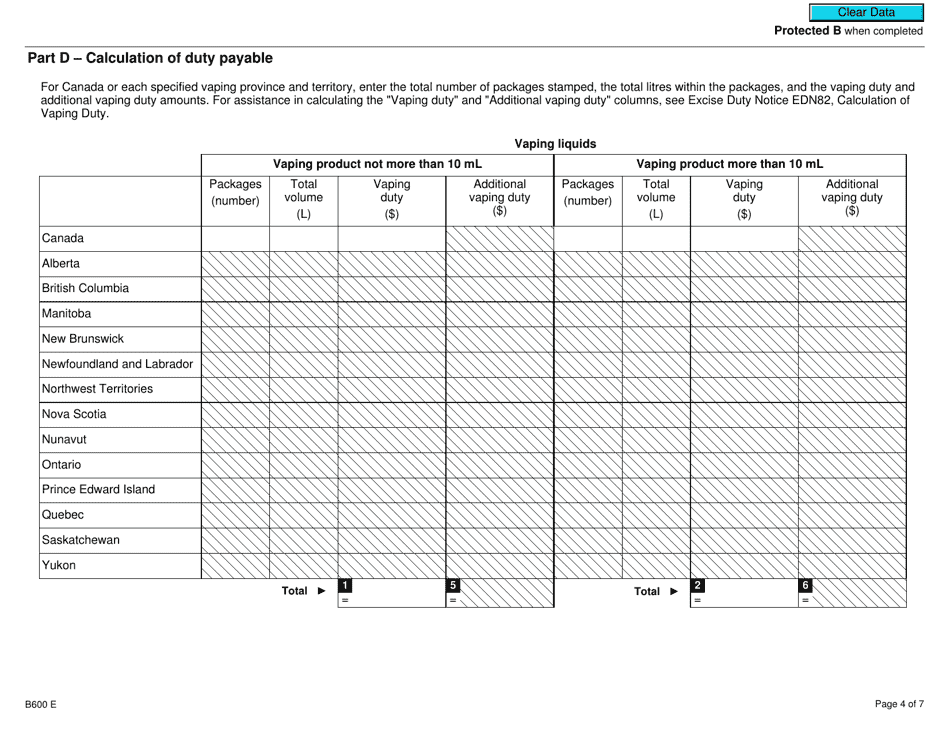

A: Information such as the quantity and value of vaping products imported or manufactured needs to be provided.

Q: What happens if the B600 Vaping Duty and Information Return is not filed?

A: Failure to file the return may result in penalties and interest charges.