This version of the form is not currently in use and is provided for reference only. Download this version of

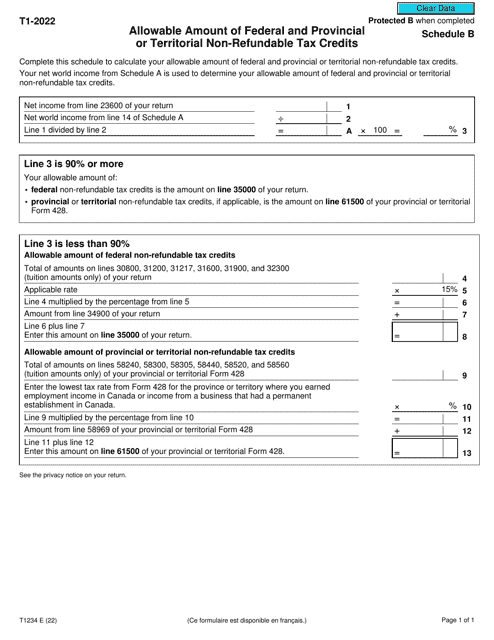

Form T1234 Schedule B

for the current year.

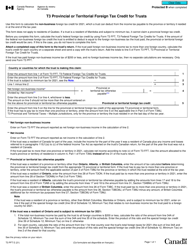

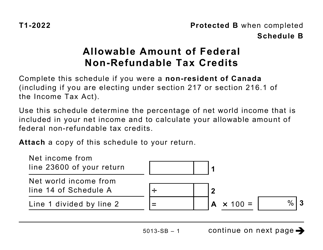

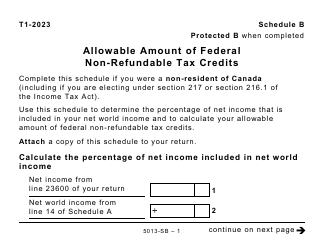

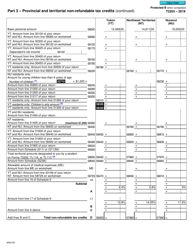

Form T1234 Schedule B Allowable Amount of Federal and Provincial or Territorial Non-refundable Tax Credits - Canada

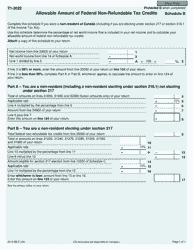

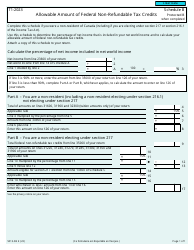

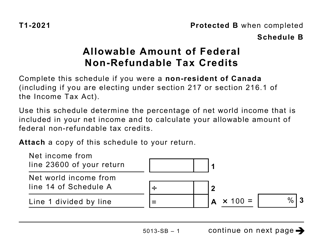

Form T1234 Schedule B Allowable Amount of Federal and Provincial or Territorial Non-refundable Tax Credits is used in Canada for calculating and reporting the amount of non-refundable tax credits that can be claimed at the federal and provincial or territorial levels. These tax credits can help reduce the amount of taxes owed.

The individual taxpayer files Form T1234 Schedule B for the allowable amount of federal and provincial or territorial non-refundable tax credits in Canada.

FAQ

Q: What is Form T1234?

A: Form T1234 is a schedule used in Canada to calculate the allowable amount of federal and provincial or territorial non-refundable tax credits.

Q: What is the purpose of Schedule B on Form T1234?

A: The purpose of Schedule B on Form T1234 is to determine the amount of federal and provincial or territorial non-refundable tax credits that can be claimed.

Q: What are federal non-refundable tax credits?

A: Federal non-refundable tax credits are tax credits that can be claimed to reduce the amount of federal incometax owed.

Q: What are provincial or territorial non-refundable tax credits?

A: Provincial or territorial non-refundable tax credits are tax credits that can be claimed to reduce the amount of provincial or territorial income tax owed.

Q: How is the allowable amount of tax credits calculated on Schedule B?

A: The allowable amount of tax credits is calculated on Schedule B by adding up the amounts for each eligible tax credit and applying any limitations or restrictions.

Q: Are non-refundable tax credits refundable?

A: No, non-refundable tax credits are not refundable. They can only be used to reduce the amount of tax owed.

Q: Do I need to file Schedule B with my tax return?

A: Yes, if you are claiming federal and provincial or territorial non-refundable tax credits, you need to complete and file Schedule B along with your tax return.

Q: Can I claim both federal and provincial non-refundable tax credits?

A: Yes, you can claim both federal and provincial non-refundable tax credits if you are eligible.

Q: What types of expenses can be eligible for non-refundable tax credits?

A: Eligible expenses for non-refundable tax credits vary depending on the specific tax credit, but common examples include medical expenses, tuition fees, and charitable donations.