This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1 (5000-S9) Schedule 9

for the current year.

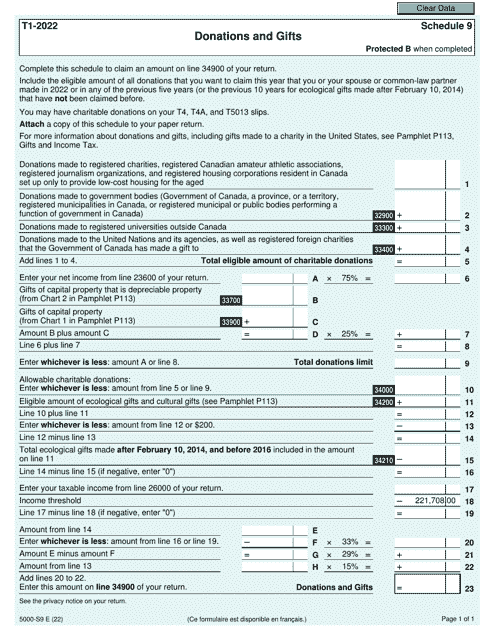

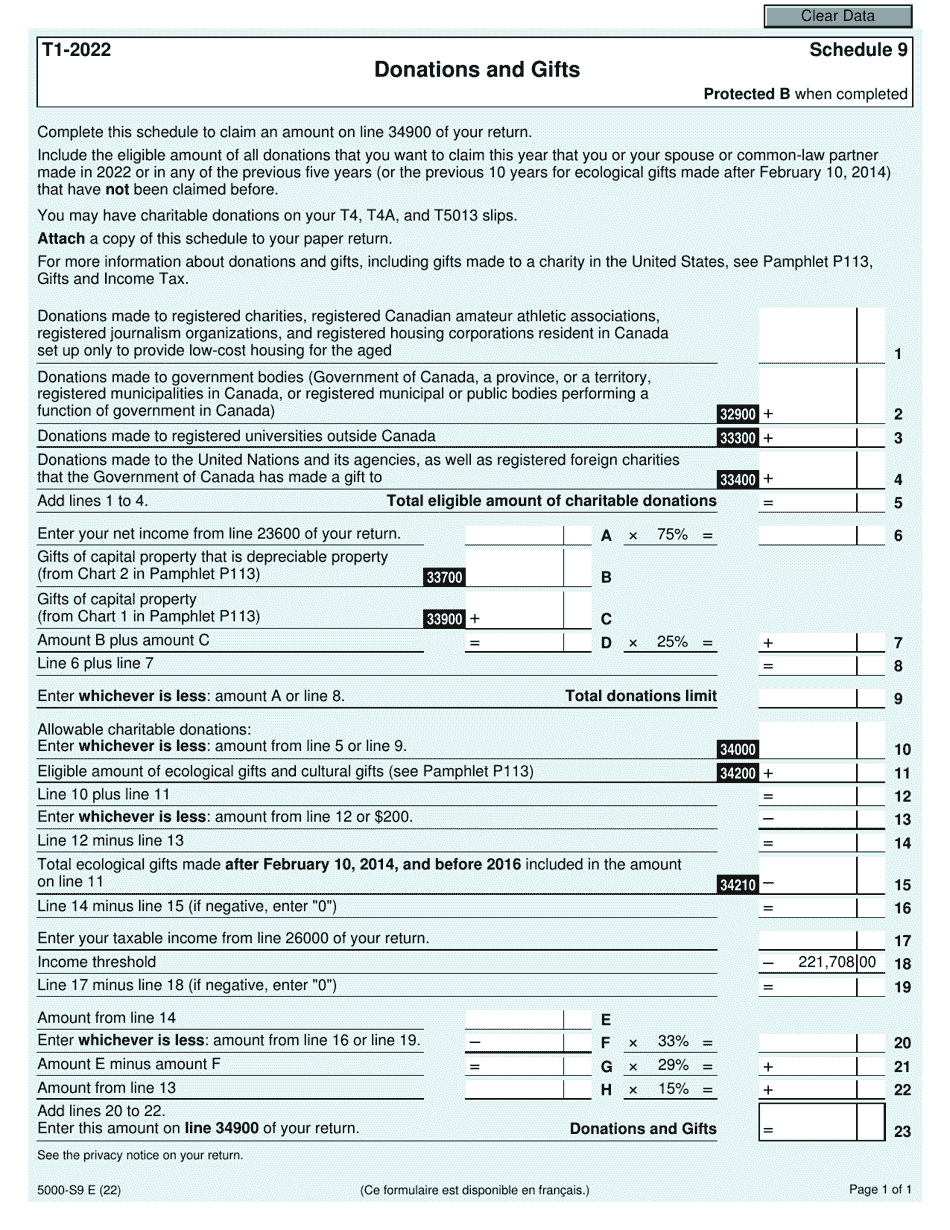

Form T1 (5000-S9) Schedule 9 Donations and Gifts - Canada

Form T1 (5000-S9) Schedule 9 Donations and Gifts is used to report donations and gifts made by individuals who are residents of Canada. This form is used to claim tax credits for the donations and gifts made to registered charities and other qualified donees.

The Form T1 (5000-S9) Schedule 9 Donations and Gifts in Canada is typically filed by individual taxpayers who wish to claim tax credits for donations and gifts made throughout the year.

FAQ

Q: What is Form T1?

A: Form T1 is the income tax return form for individuals in Canada.

Q: What is Schedule 9?

A: Schedule 9 is a form that is used to report donations and gifts made by individuals.

Q: What is the purpose of Schedule 9?

A: The purpose of Schedule 9 is to claim tax credits for eligible donations and gifts.

Q: Who needs to fill out Schedule 9?

A: Individuals who have made eligible donations and gifts during the tax year need to fill out Schedule 9.

Q: What types of donations and gifts can be claimed on Schedule 9?

A: Charitable donations, gifts to registered Canadian amateur athletic associations, and certain other types of gifts can be claimed on Schedule 9.

Q: How do I complete Schedule 9?

A: You need to enter the details of your donations and gifts, such as the name of the organization, the amount donated, and the eligible amount, on Schedule 9.

Q: Is there a maximum amount that can be claimed on Schedule 9?

A: Yes, there is a limit on the amount that can be claimed as a tax credit for donations and gifts.