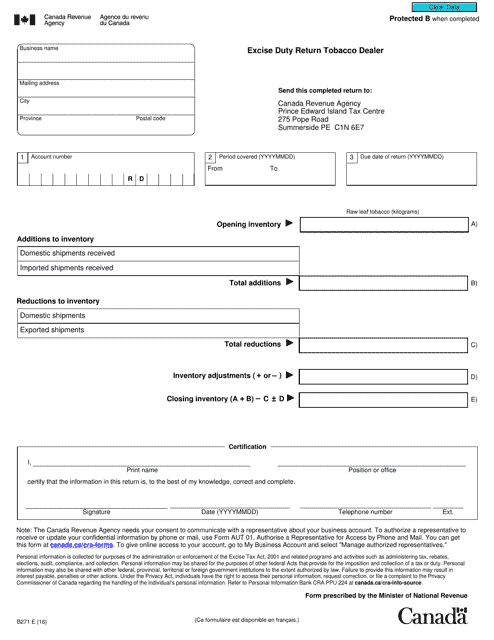

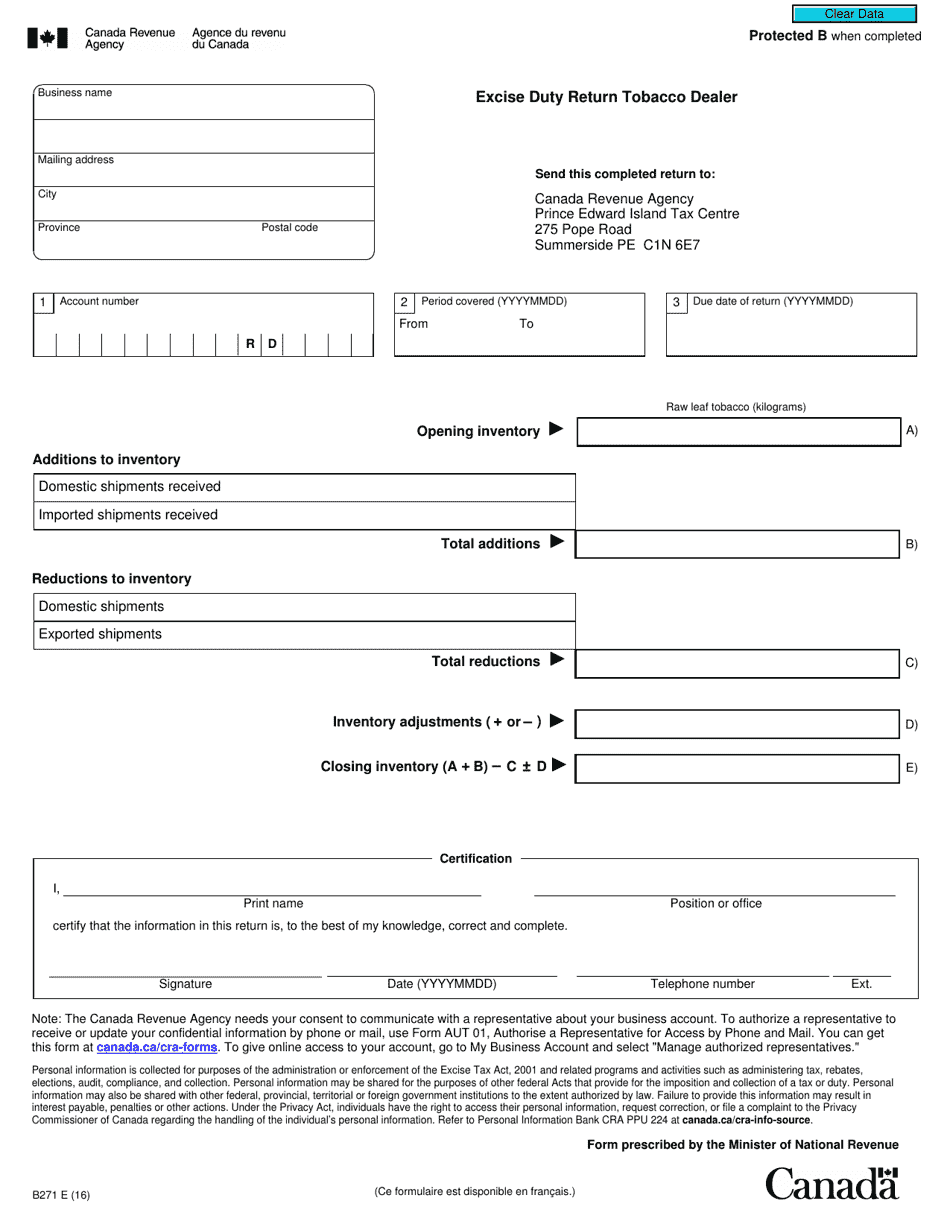

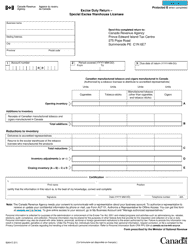

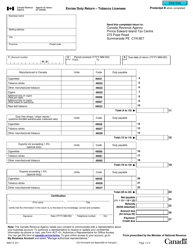

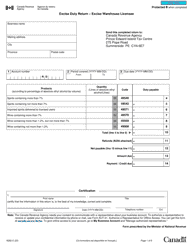

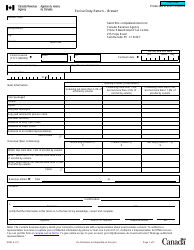

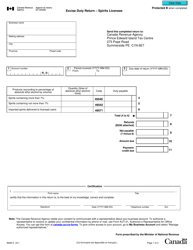

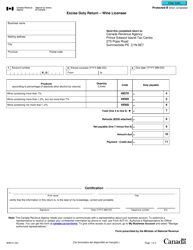

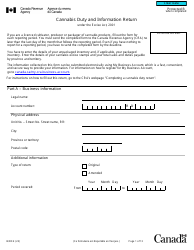

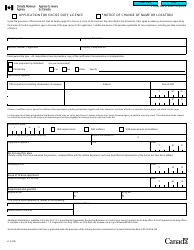

Form B271 Excise Duty Return Tobacco Dealer - Canada

Form B271 Excise Duty Return Tobacco Dealer is used in Canada for reporting and paying excise duty on tobacco products by tobacco dealers. It helps the Canadian government in monitoring and regulating the production, sale, and distribution of tobacco products and ensures compliance with tax laws.

The Form B271 Excise Duty Return for Tobacco Dealers in Canada is filed by the tobacco dealer themselves.

FAQ

Q: What is the Form B271 Excise Duty Return Tobacco Dealer?

A: The Form B271 Excise Duty Return Tobacco Dealer is a tax form used by tobacco dealers in Canada to report and remit excise duty on tobacco products.

Q: Who needs to file the Form B271 Excise Duty Return Tobacco Dealer?

A: Tobacco dealers in Canada who sell tobacco products subject to excise duty need to file the Form B271 Excise Duty Return Tobacco Dealer.

Q: What information is required on the Form B271 Excise Duty Return Tobacco Dealer?

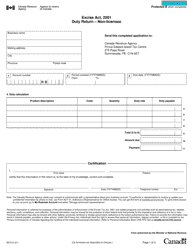

A: The Form B271 Excise Duty Return Tobacco Dealer requires information such as the quantity of tobacco products sold, the amount of excise duty owed, and the dealer's contact information.

Q: When is the deadline for filing the Form B271 Excise Duty Return Tobacco Dealer?

A: The deadline for filing the Form B271 Excise Duty Return Tobacco Dealer is usually the last day of the month following the reporting period.