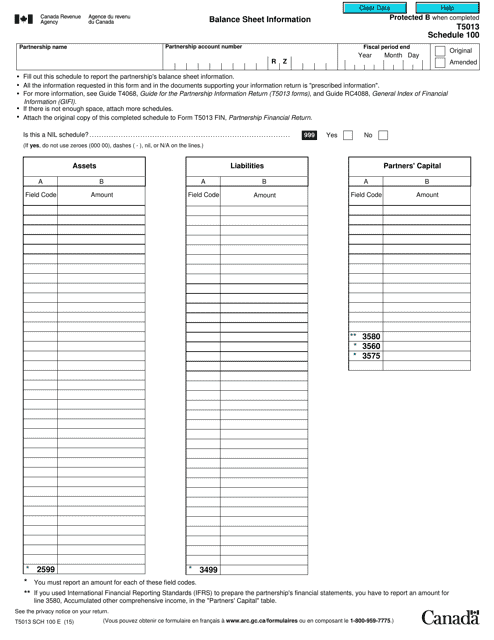

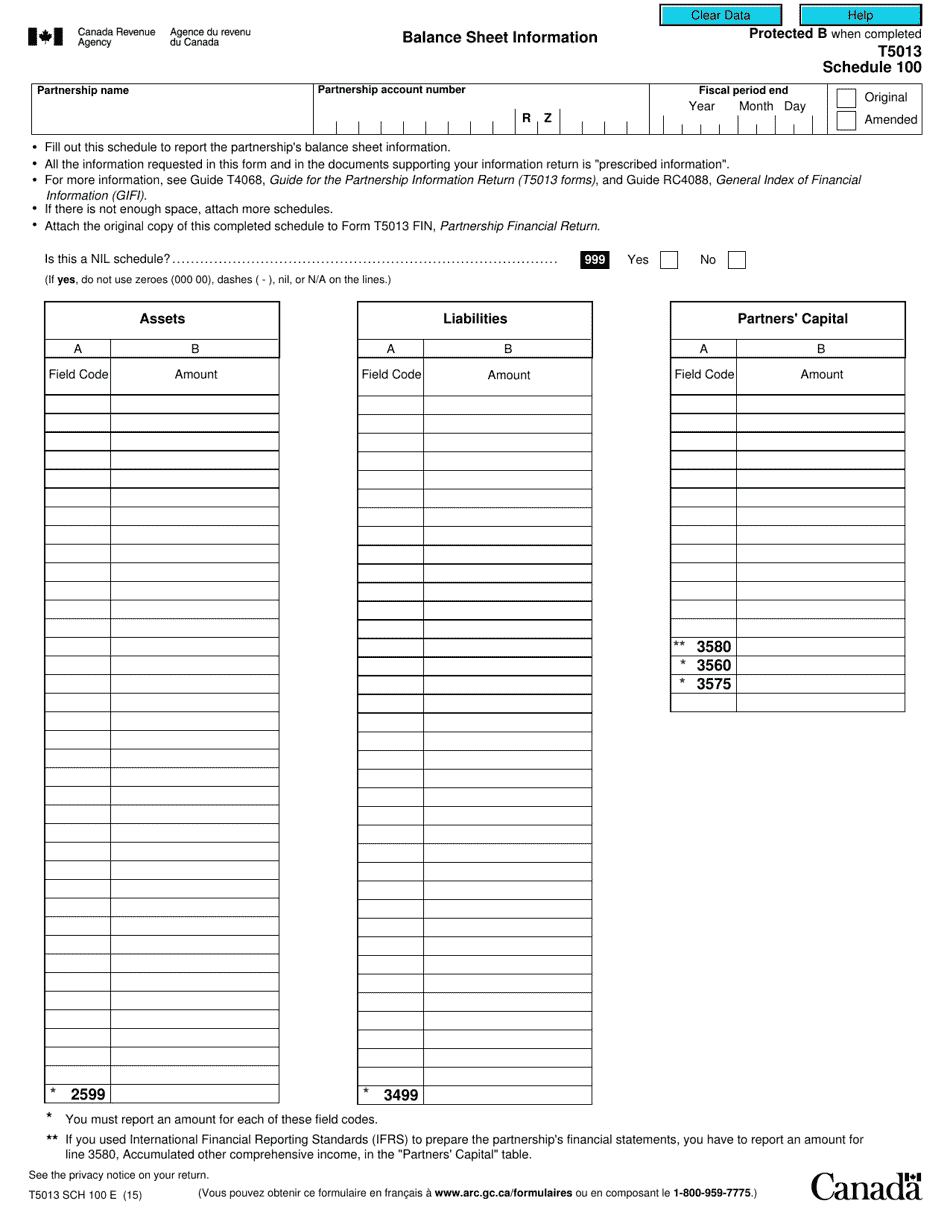

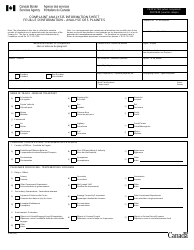

Form T5013 Schedule 100 Balance Sheet Information - Canada

Form T5013 Schedule 100 Balance Sheet Information is a document used in Canada to provide detailed financial information about a partnership. It includes details about the partnership's assets, liabilities, and equity.

The Form T5013 Schedule 100 Balance Sheet Information in Canada is filed by partnerships that are required to provide detailed financial information to the Canada Revenue Agency (CRA).

FAQ

Q: What is Form T5013?

A: Form T5013 is a tax form used in Canada to report partnership income and expenses.

Q: What is Schedule 100?

A: Schedule 100 is a part of Form T5013 that provides balance sheet information for partnerships.

Q: What does the balance sheet show?

A: The balance sheet shows the financial position of a partnership at a specific point in time.

Q: What information is included in Schedule 100?

A: Schedule 100 includes details about the partnership's assets, liabilities, and equity.

Q: Why is Schedule 100 important?

A: Schedule 100 is important for calculating the partnership's net worth and determining its financial health.

Q: Who needs to file Form T5013?

A: Partnerships in Canada are required to file Form T5013 if they meet certain criteria.

Q: Are there any penalties for not filing Form T5013?

A: Yes, there are penalties for not filing Form T5013 or for filing it late. It is important to meet the filing deadlines to avoid these penalties.