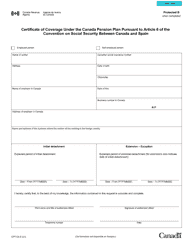

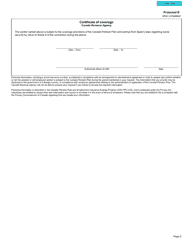

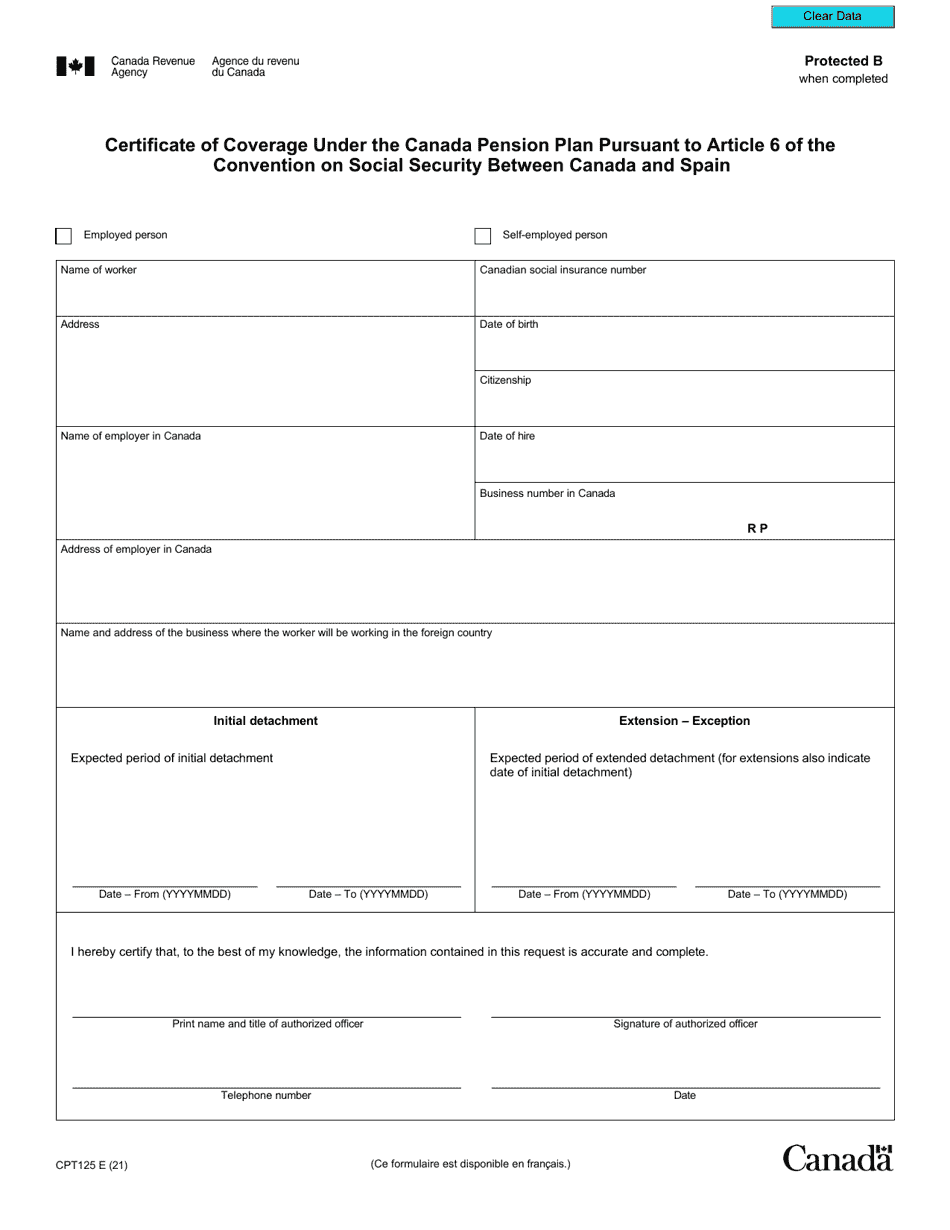

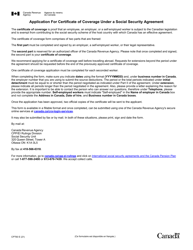

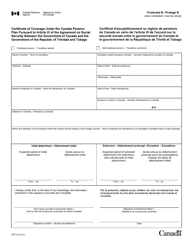

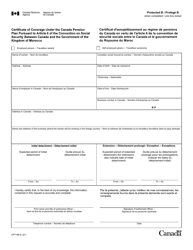

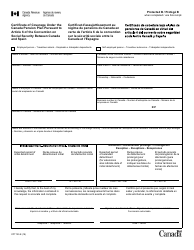

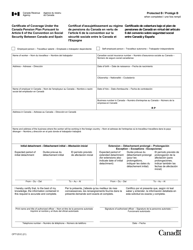

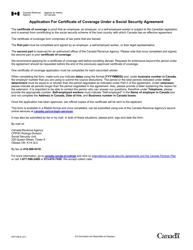

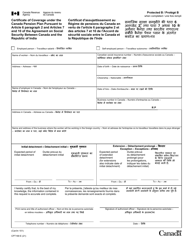

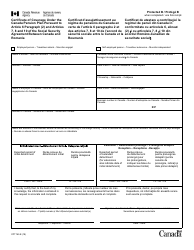

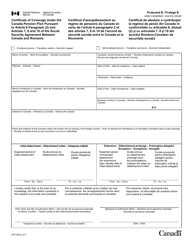

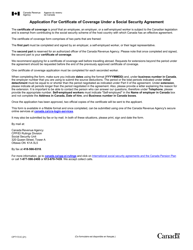

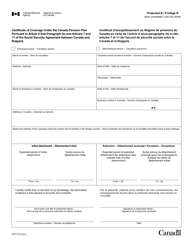

Form CPT125 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article 6 of the Convention on Social Security Between Canada and Spain - Canada

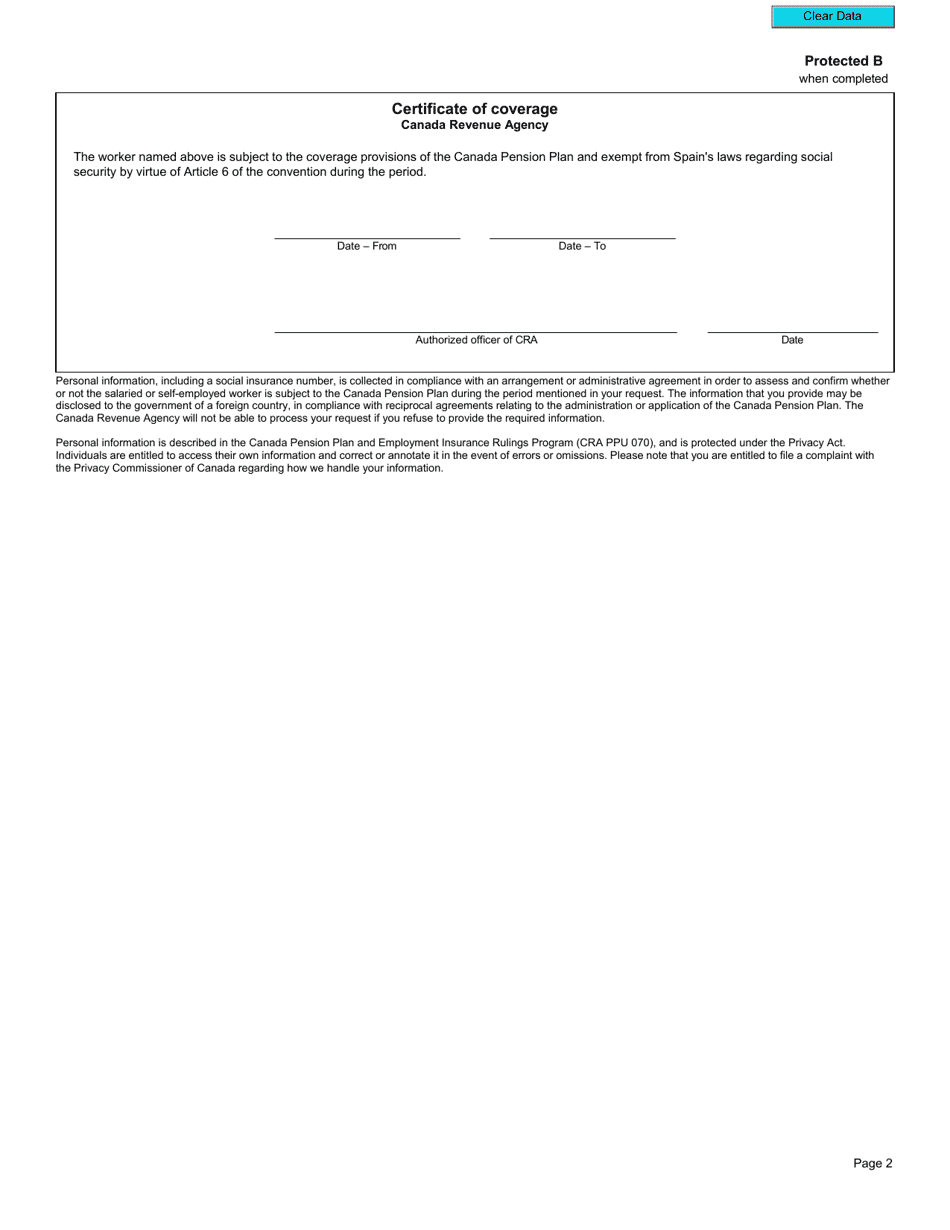

Form CPT125 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article 6 of the Convention on Social Security Between Canada and Spain is used to certify an individual's coverage under the Canada Pension Plan (CPP) in relation to their employment in Spain. This form ensures that the individual's contributions to the CPP are properly recognized and accounted for, allowing them to receive the benefits they are entitled to when they retire or become disabled. It serves as proof of their social security coverage under both the Canadian and Spanish systems.

The Form CPT125 Certificate of Coverage Under the Canada Pension Plan pursuant to Article 6 of the Convention on Social Security between Canada and Spain is filed by the Canadian government.

FAQ

Q: What is Form CPT125?

A: Form CPT125 is a certificate of coverage issued under the Canada Pension Plan (CPP) pursuant to Article 6 of the Convention on Social Security between Canada and Spain.

Q: What is the purpose of Form CPT125?

A: The purpose of Form CPT125 is to certify that an individual is subject to the CPP and exempt from social security contributions in Spain under the terms of the social security agreement between Canada and Spain.

Q: Who needs to complete Form CPT125?

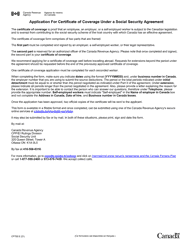

A: Form CPT125 needs to be completed by individuals who are covered by the CPP and are going to work temporarily in Spain, or individuals who are covered by the Spanish social security system and are going to work temporarily in Canada.

Q: How do I obtain Form CPT125?

A: To obtain Form CPT125, you need to contact the agency responsible for the administration of the CPP in Canada, which is the government agency called Service Canada.

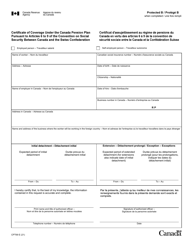

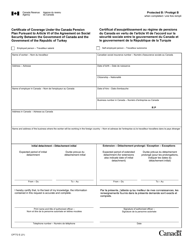

Q: What information is required to complete Form CPT125?

A: When completing Form CPT125, you will need to provide personal information such as your full name, social insurance number (SIN), date of birth, and address. You will also need to indicate the period of coverage and the purpose of your employment in Spain.