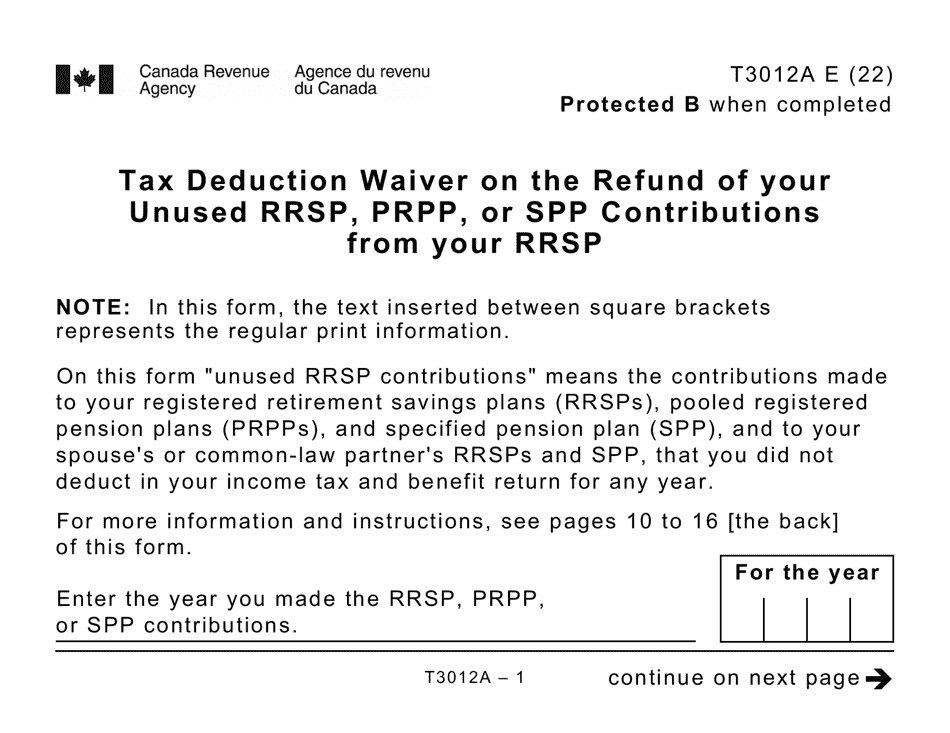

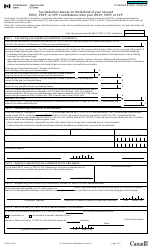

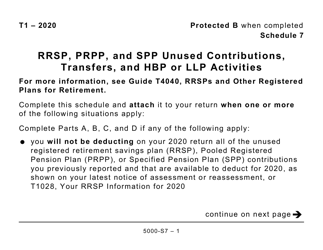

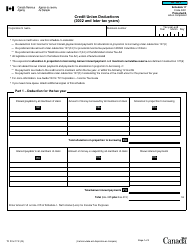

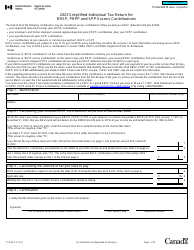

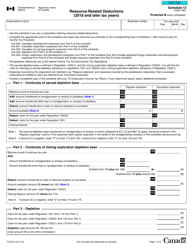

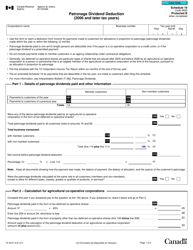

Form T3012A Tax Deduction Waiver on the Refund of Your Unused Rrsp, Prpp, or Spp Contributions From Your Rrsp - Large Print - Canada

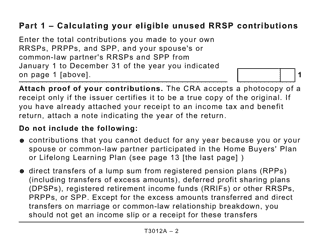

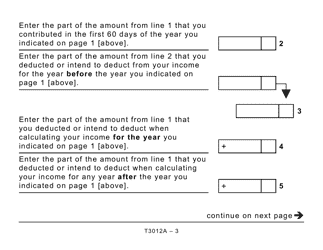

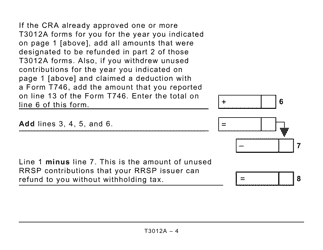

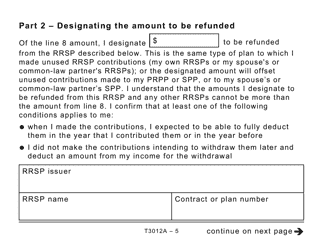

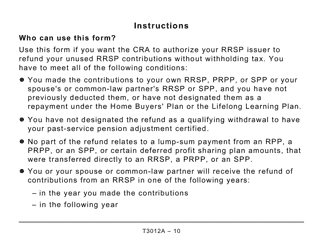

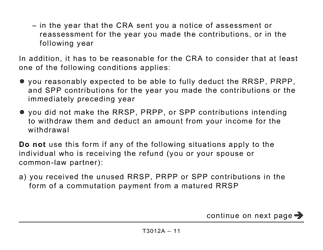

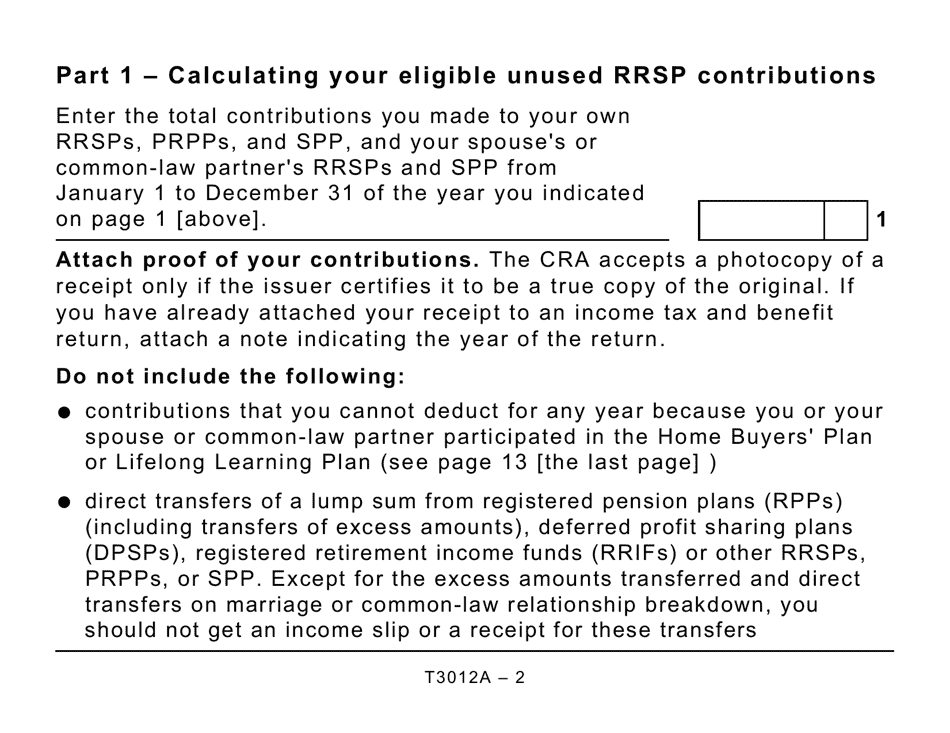

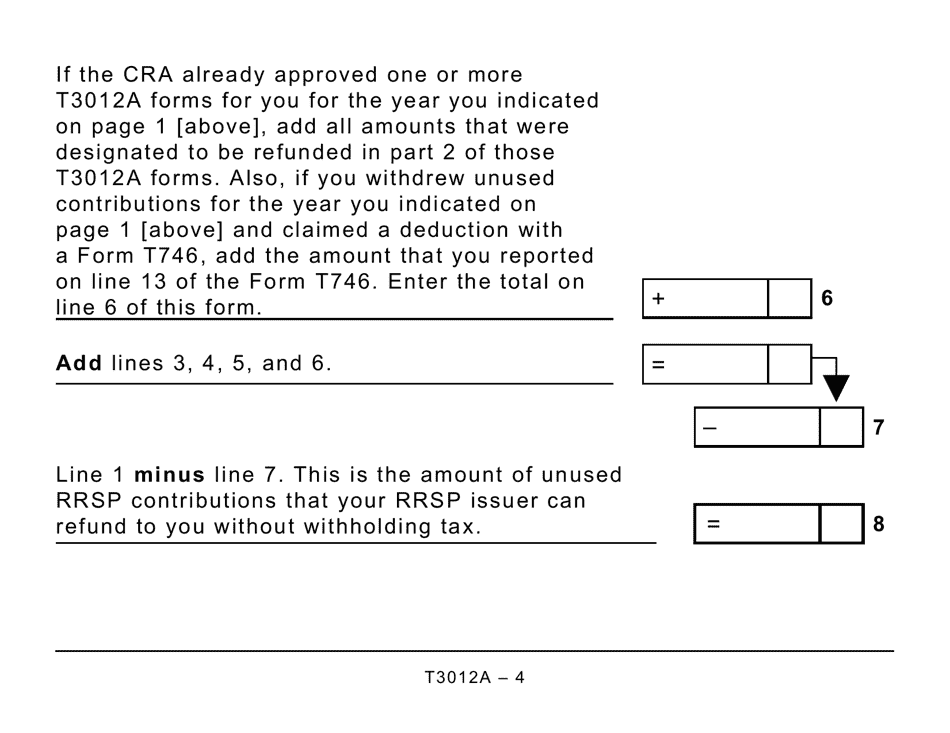

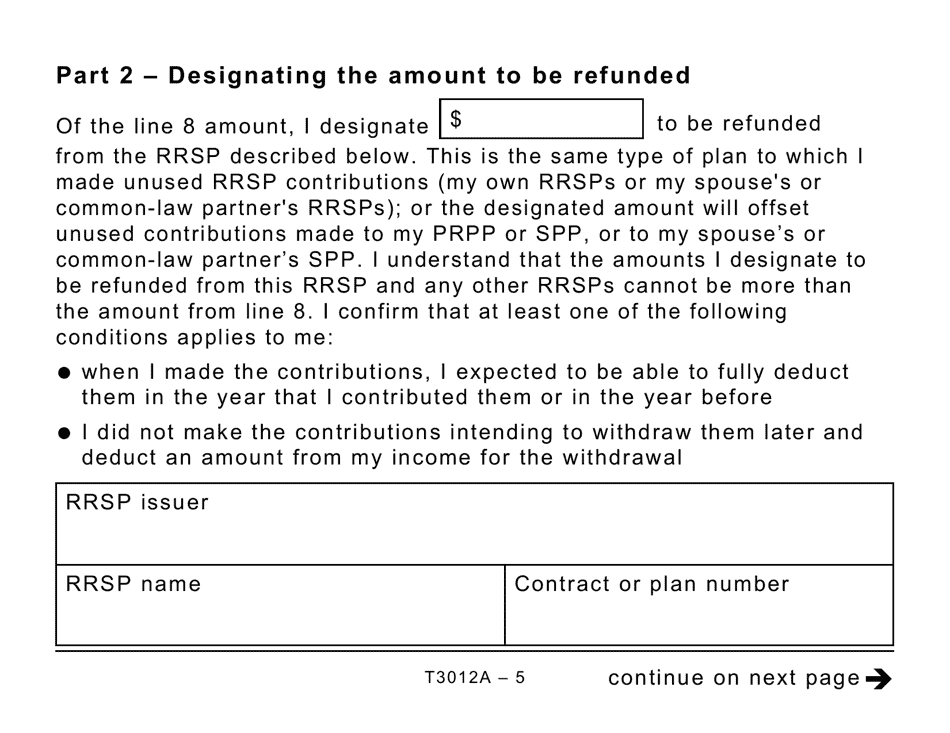

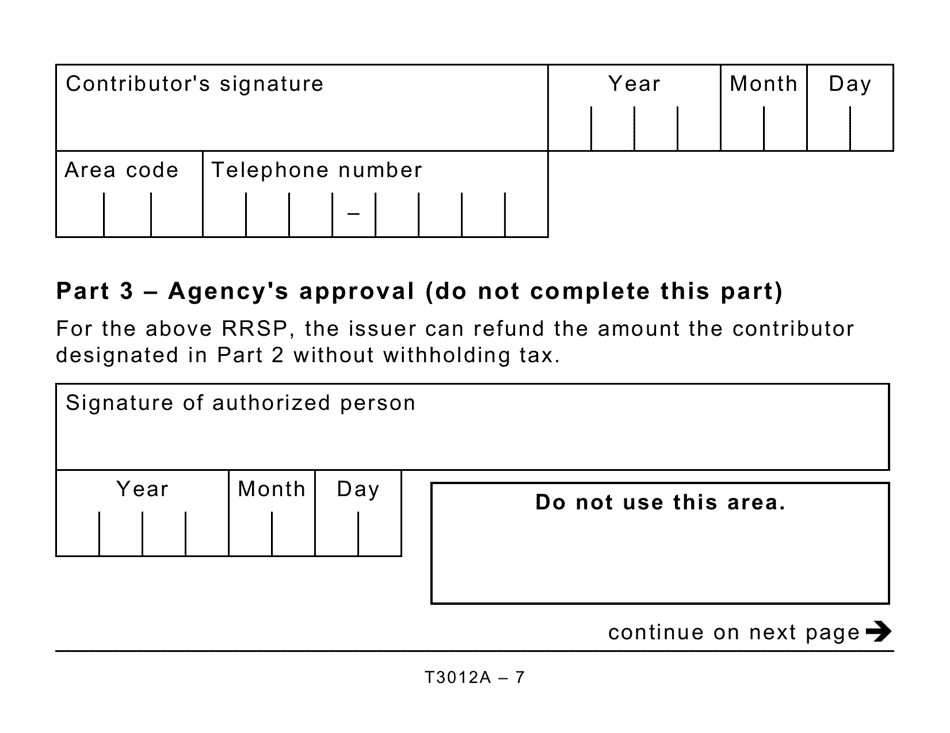

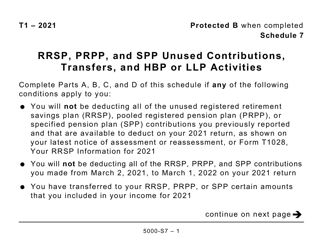

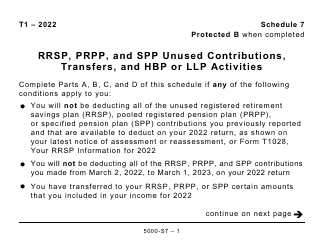

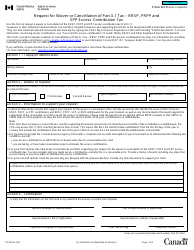

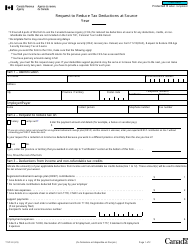

Form T3012A Tax Deduction Waiver on the Refund of Your Unused RRSP, PRPP, or SPP Contributions from Your RRSP - Large Print - Canada is used to waive taxes on the refund of your unused contributions to a Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) in Canada. It allows you to transfer the refund directly to another retirement plan without incurring tax penalties.

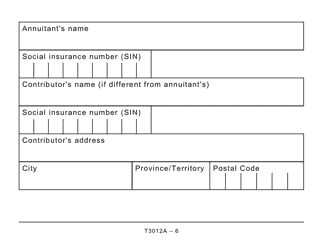

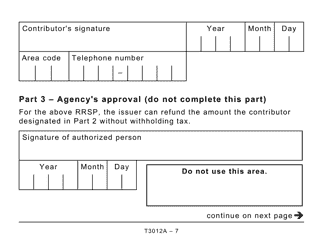

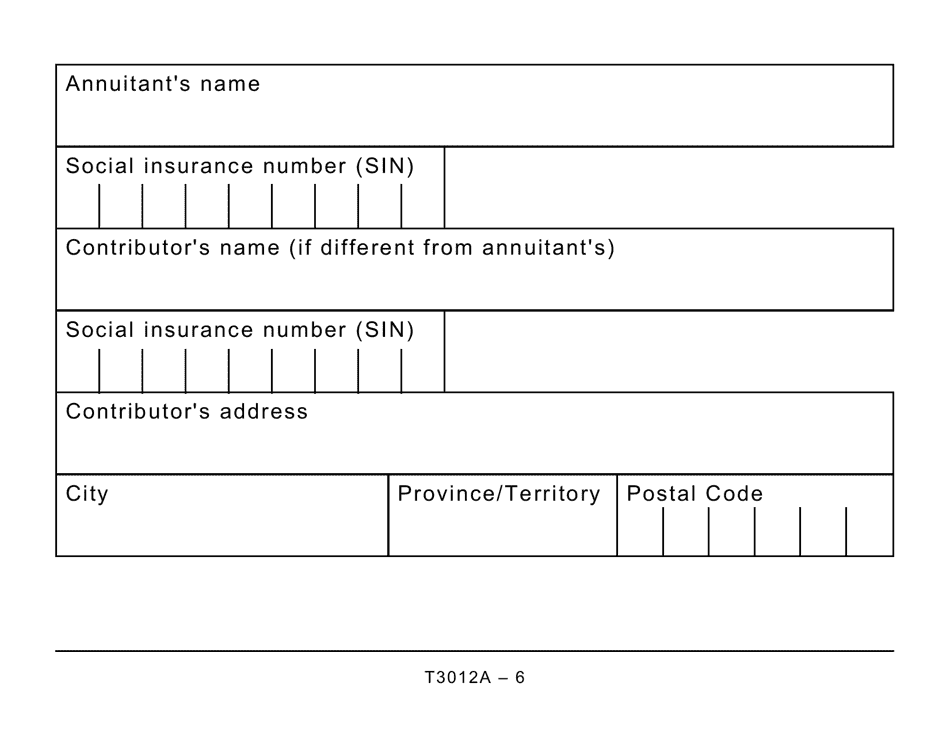

The form T3012A Tax Deduction Waiver on the Refund of Your Unused RRSP, PRPP, or SPP Contributions from Your RRSP - Large Print - Canada is filed by the individual taxpayer.

FAQ

Q: What is Form T3012A?

A: Form T3012A is a tax deduction waiver on the refund of your unused RRSP, PRPP, or SPP contributions from your RRSP.

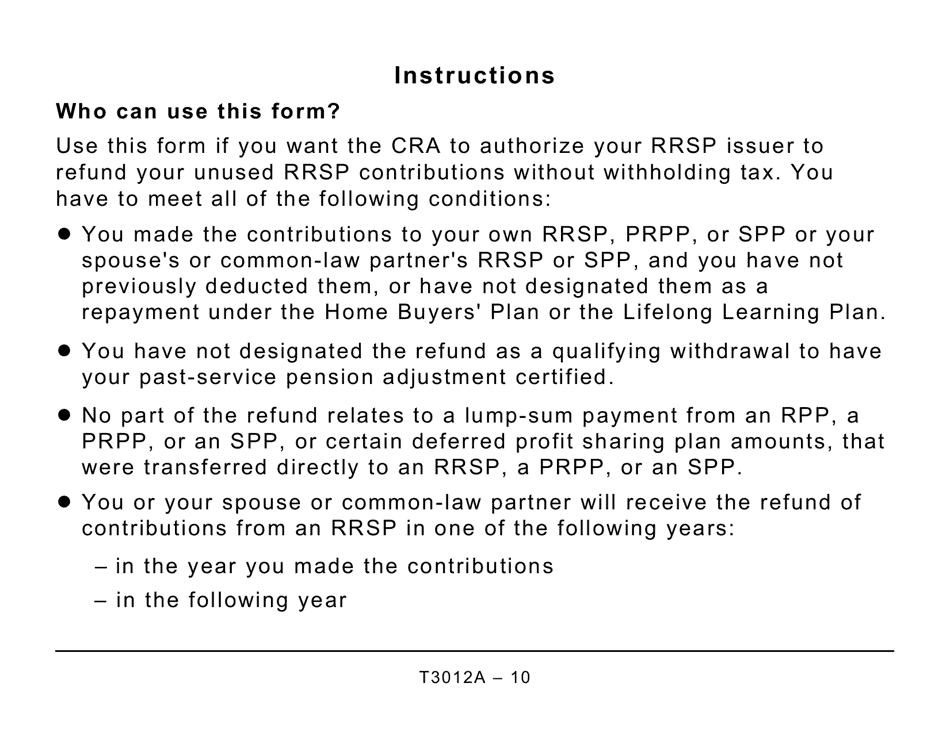

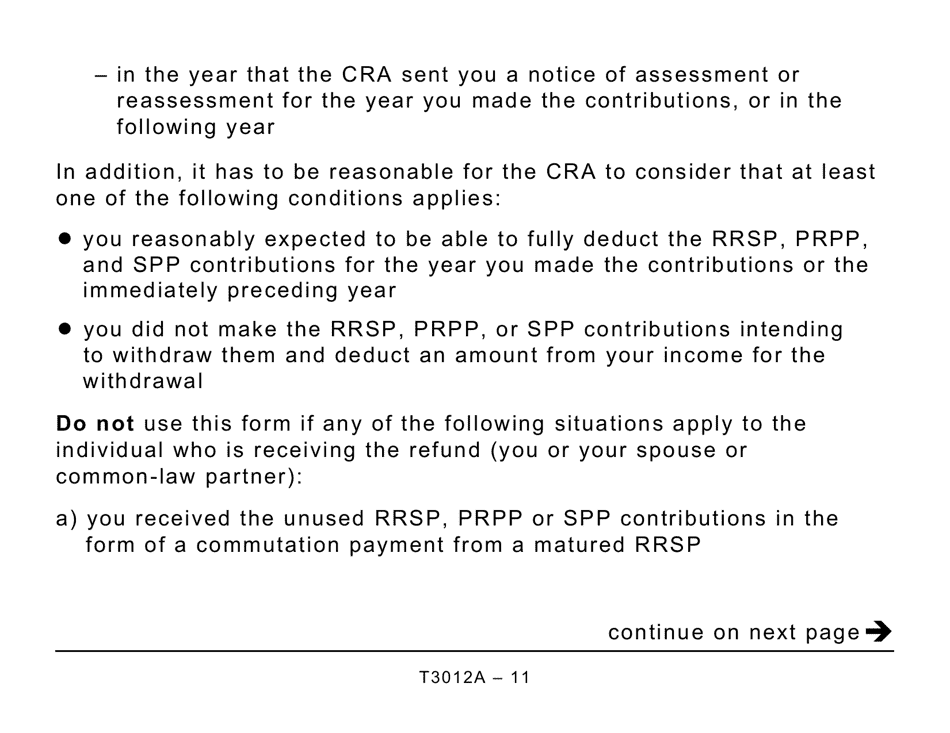

Q: Who can use Form T3012A?

A: Canadians who have unused RRSP, PRPP, or SPP contributions from their RRSP can use Form T3012A.

Q: What does Form T3012A waive?

A: Form T3012A waives the tax deduction on the refund of your unused RRSP, PRPP, or SPP contributions from your RRSP.

Q: What is the purpose of Form T3012A?

A: The purpose of Form T3012A is to waive the tax deduction on the refund of unused RRSP, PRPP, or SPP contributions from your RRSP.

Q: Is Form T3012A available in large print?

A: Yes, Form T3012A is available in large print for individuals who have visual impairments.