This version of the form is not currently in use and is provided for reference only. Download this version of

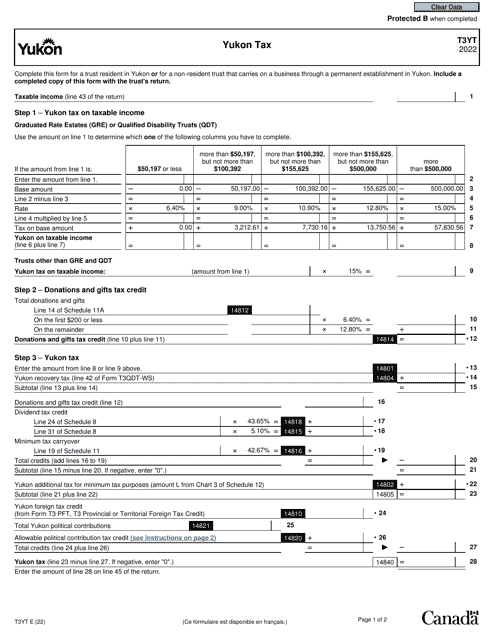

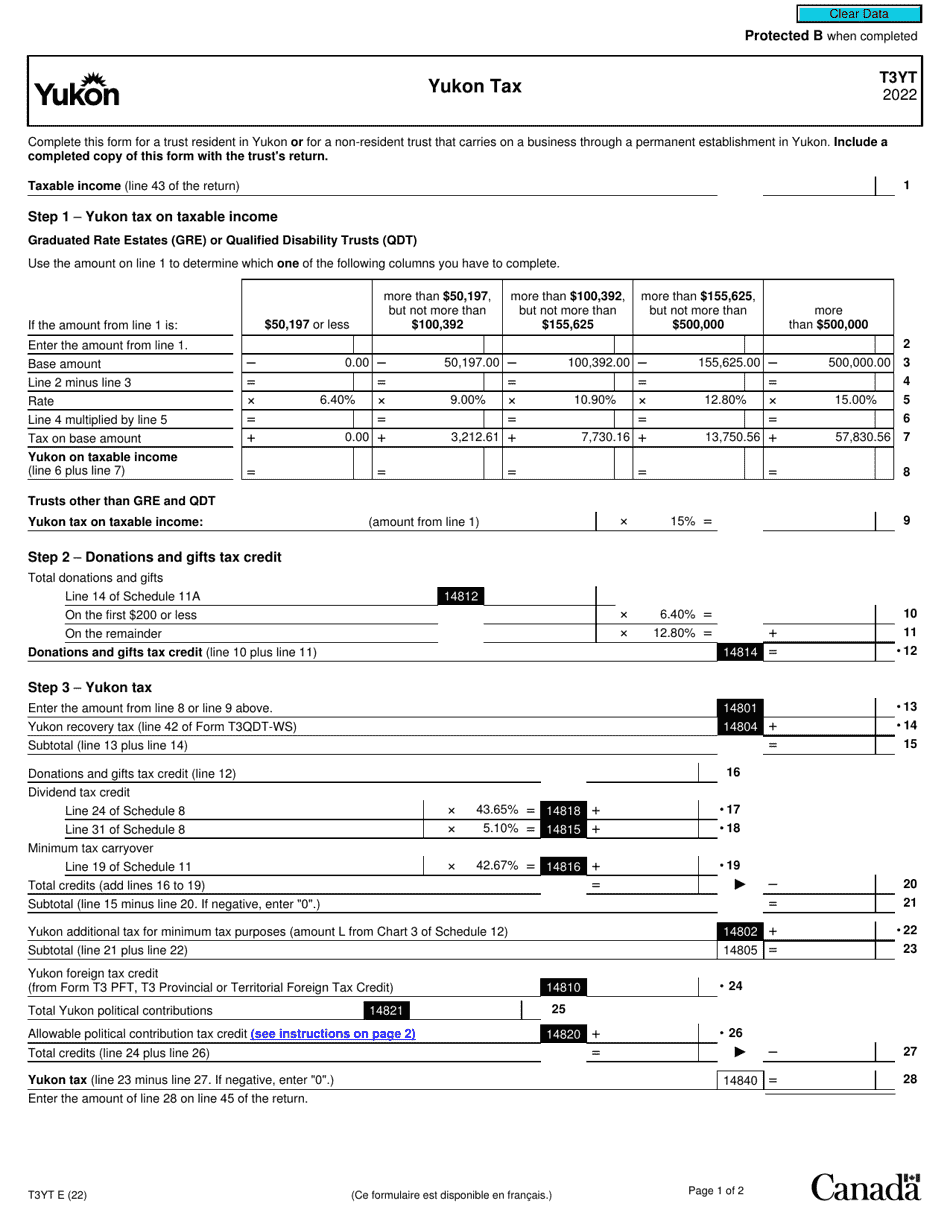

Form T3YT

for the current year.

Form T3YT Yukon Tax - Canada

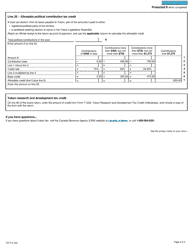

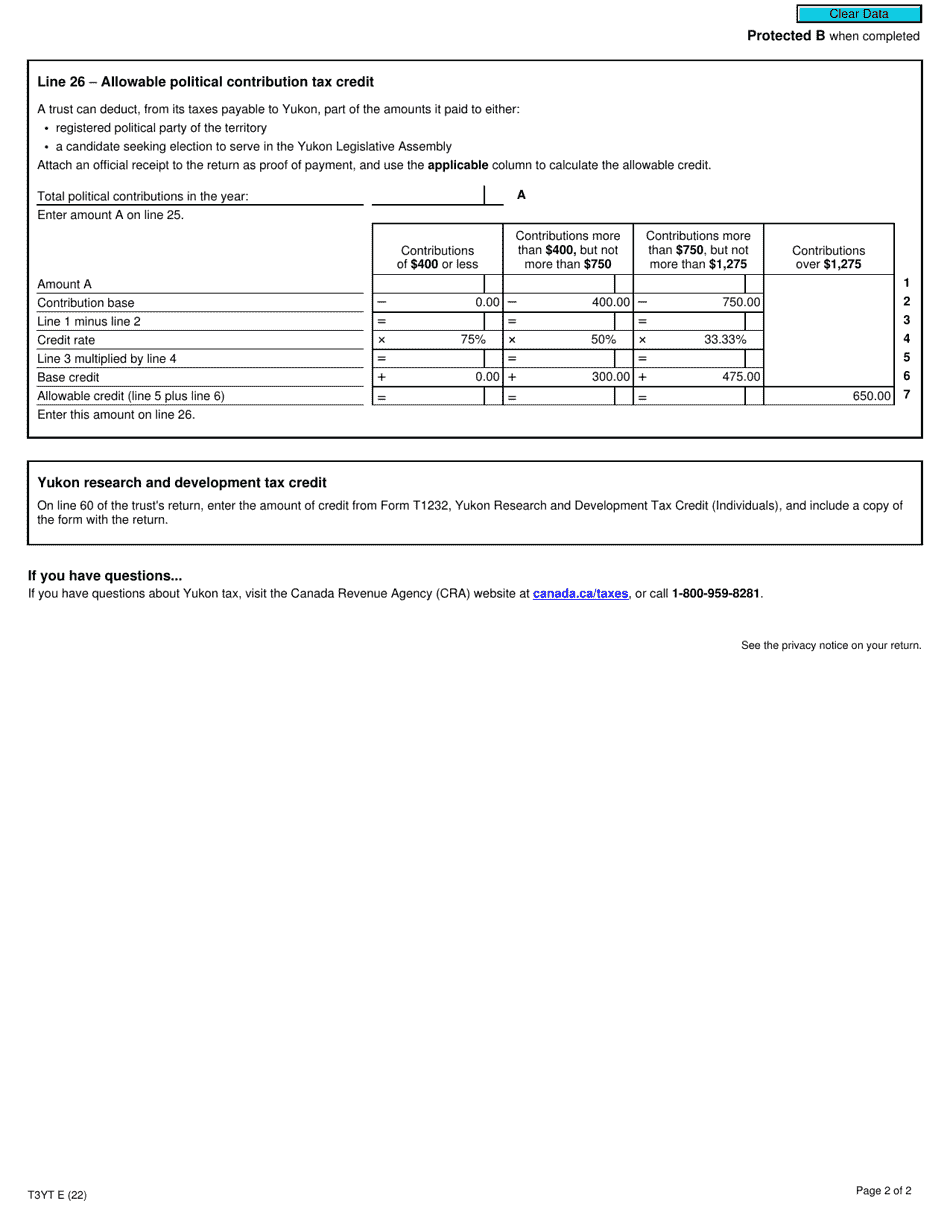

Form T3YT, also known as the Yukon Tax Return, is used by individuals and corporations who are residents of the Yukon territory in Canada to calculate and report their Yukon income tax liability. It allows taxpayers to claim deductions and credits specific to the Yukon territory.

The individual or business residing or operating in Yukon, Canada files the Form T3YT Yukon Tax.

FAQ

Q: What is Form T3YT Yukon Tax?

A: Form T3YT is a tax form used in the Yukon territory of Canada to report income and calculate taxes owed.

Q: Who needs to file Form T3YT Yukon Tax?

A: Residents of the Yukon territory who have earned income or have tax obligations in the territory may need to file Form T3YT.

Q: What information is required to complete Form T3YT Yukon Tax?

A: You will need to provide details of your income, deductions, and any tax credits applicable to the Yukon territory.

Q: When is the deadline to file Form T3YT Yukon Tax?

A: The deadline for filing Form T3YT Yukon Tax is the same as the federal tax filing deadline, which is usually April 30th.

Q: Are there any penalties for late filing of Form T3YT Yukon Tax?

A: Yes, late filing of Form T3YT Yukon Tax may result in penalties and interest charges.

Q: What if I have additional questions about Form T3YT Yukon Tax?

A: If you have additional questions or need further clarification about Form T3YT Yukon Tax, you can contact the Canada Revenue Agency for assistance.