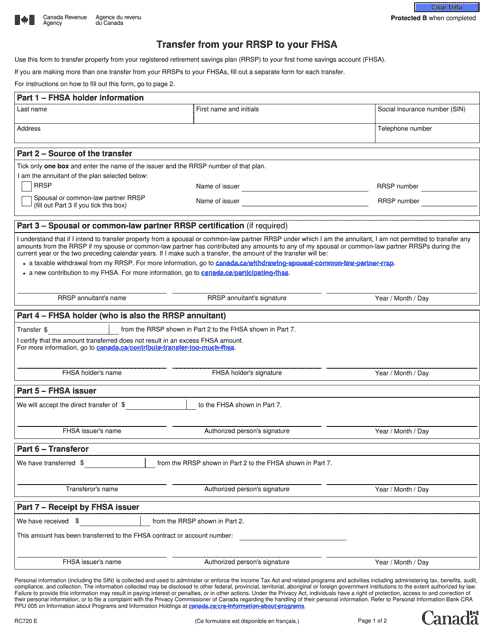

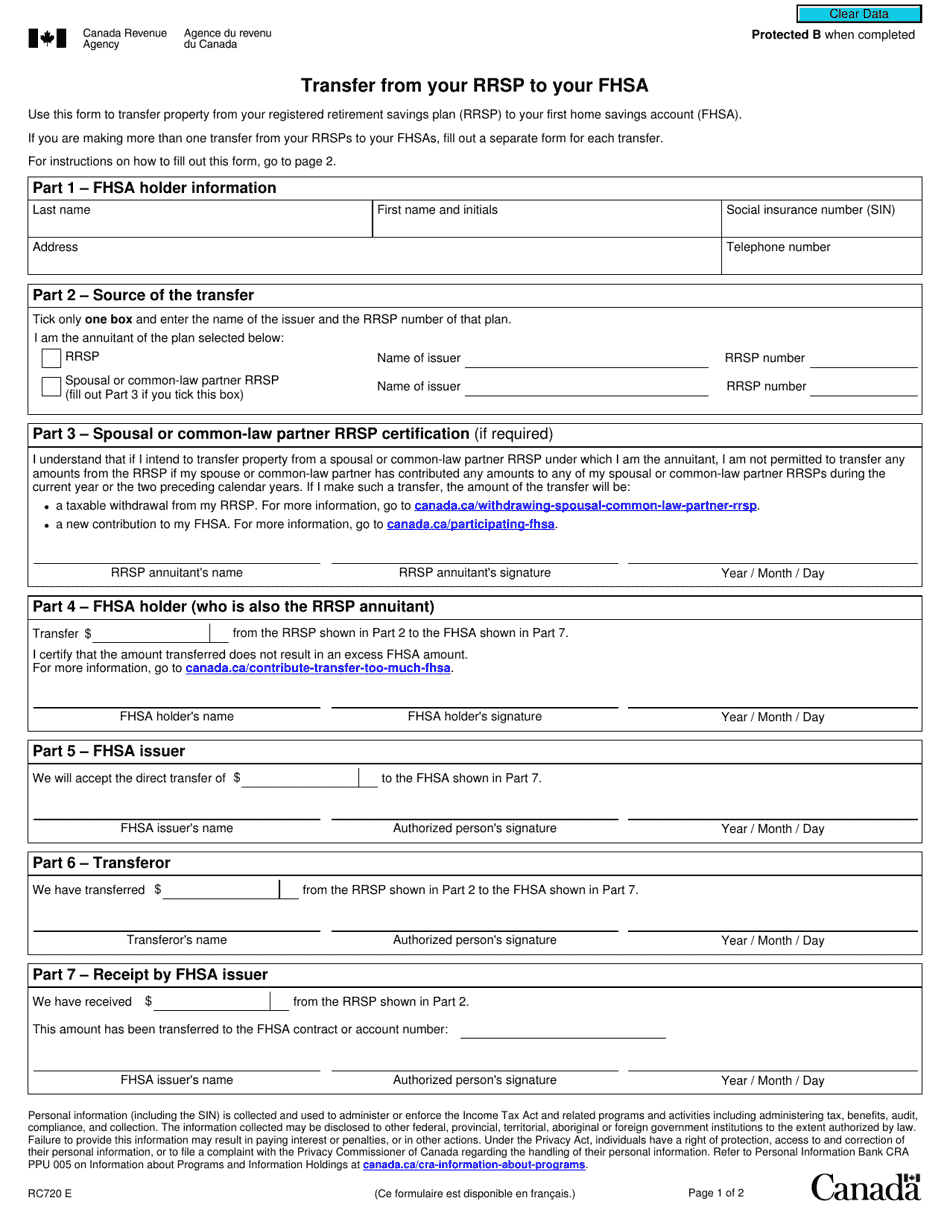

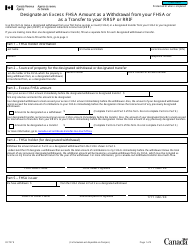

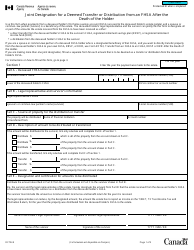

Form RC720 Transfer From Your Rrsp to Your Fhsa - Canada

Form RC720 Transfer From Your Rrsp to Your Fhsa in Canada is used to transfer funds from your Registered Retirement Savings Plan (RRSP) to your First Home Savings Account (FHSA). This allows you to withdraw funds from your RRSP to use towards the purchase of your first home.

The individual who files the Form RC720 Transfer from Your RRSP to Your TFSA in Canada is the taxpayer.

FAQ

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan, which is a Canadian government-approved retirement savings account.

Q: What is an FHSA?

A: FHSA stands for First Time Home Buyers' Savings Account, which is a savings account designed for individuals saving for their first home.

Q: Can I transfer funds from my RRSP to my FHSA?

A: Yes, you can transfer funds from your RRSP to your FHSA under certain conditions.

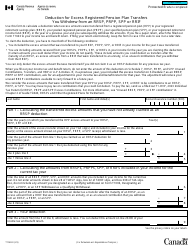

Q: What is Form RC720?

A: Form RC720 is the official form used to transfer funds from an RRSP to an FHSA.

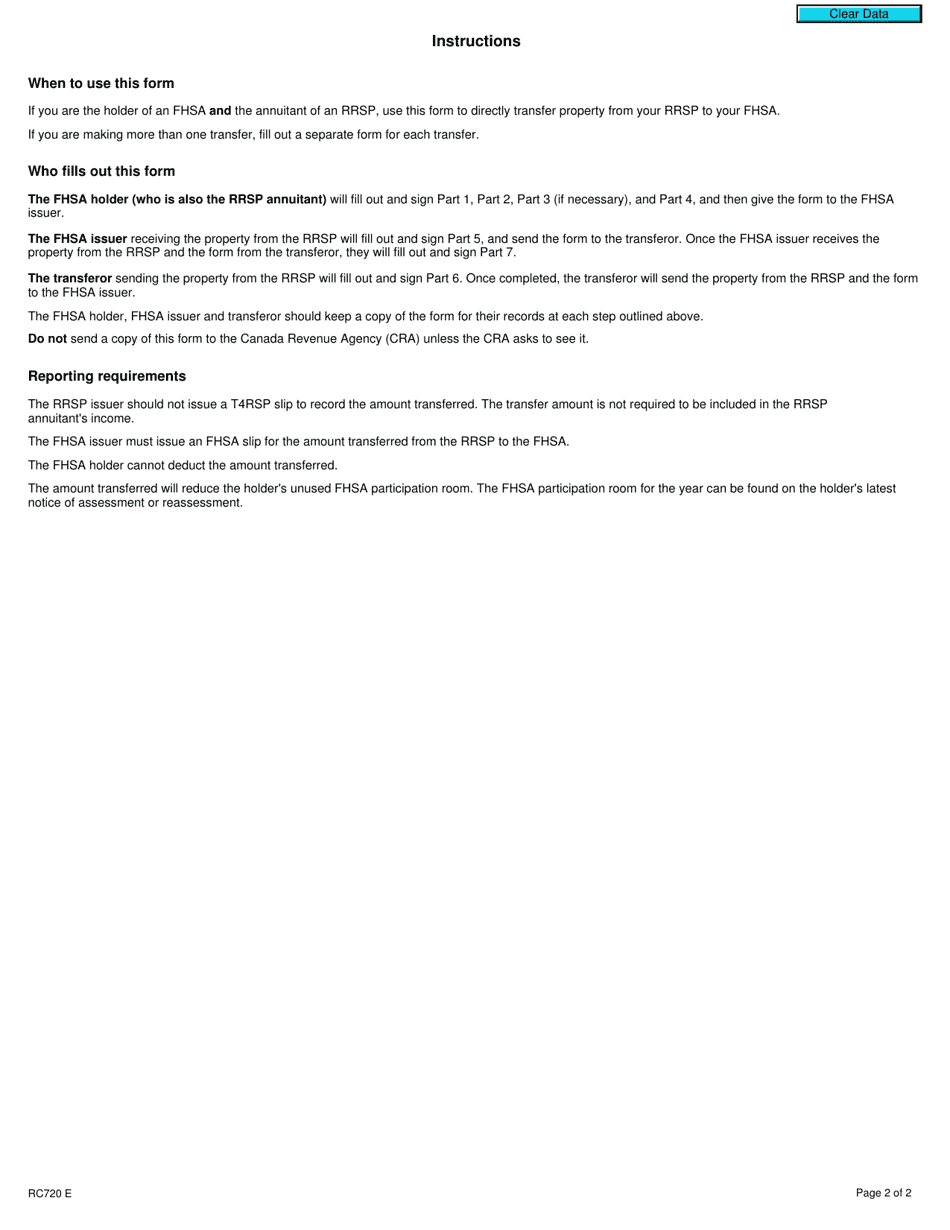

Q: How do I complete Form RC720?

A: You will need to provide information about your RRSP and FHSA accounts, including account numbers, and attach this form to your tax return.

Q: Are there any tax implications for transferring funds from an RRSP to an FHSA?

A: Yes, there may be tax implications. It is important to consult with a tax professional or contact the Canada Revenue Agency (CRA) for specific advice.

Q: Can I withdraw funds from my FHSA without penalty?

A: Yes, you can withdraw funds from your FHSA without penalty as long as the funds are used for eligible home-buying expenses.

Q: What are eligible home-buying expenses for FHSA withdrawals?

A: Eligible home-buying expenses include down payment, closing costs, and other expenses related to purchasing a first home.

Q: Can I transfer funds from my RRSP to an FHSA multiple times?

A: No, you can only make one transfer from your RRSP to an FHSA.

Q: Can I transfer funds from an RRSP to an FHSA if I am not a first-time home buyer?

A: No, the RRSP to FHSA transfer is only available for first-time home buyers in Canada.