This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC243

for the current year.

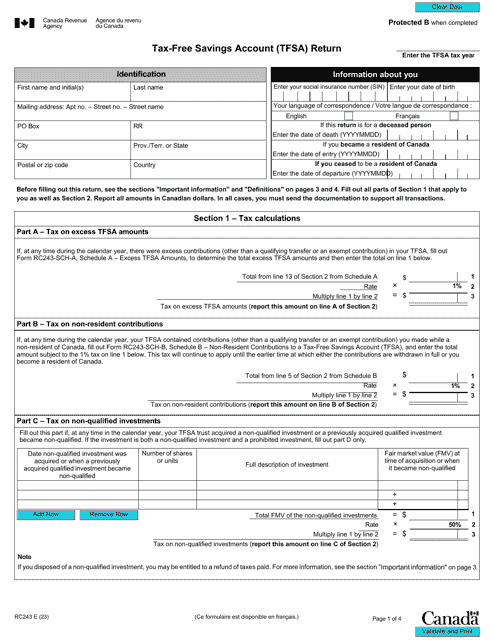

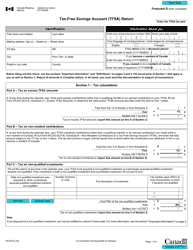

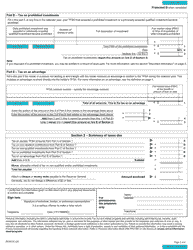

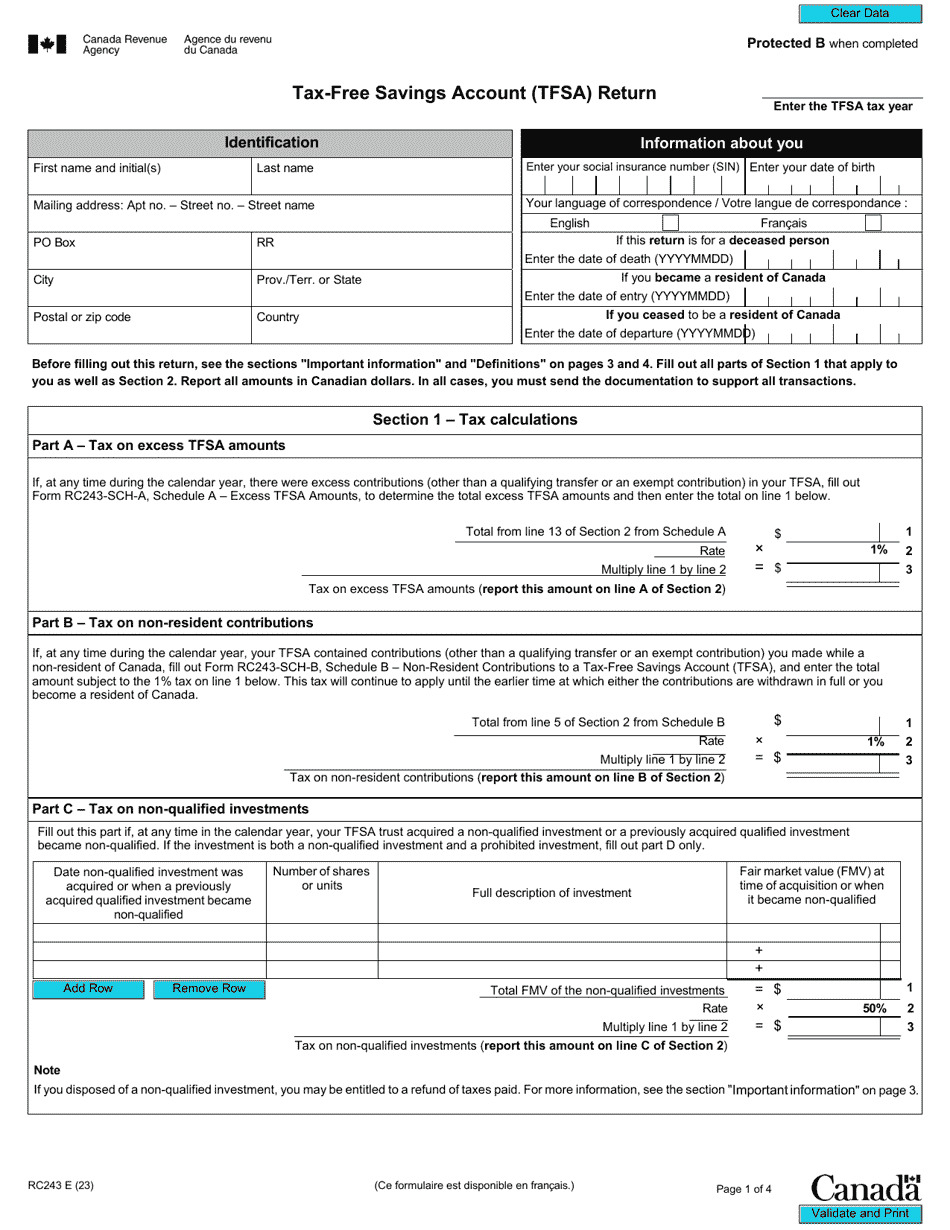

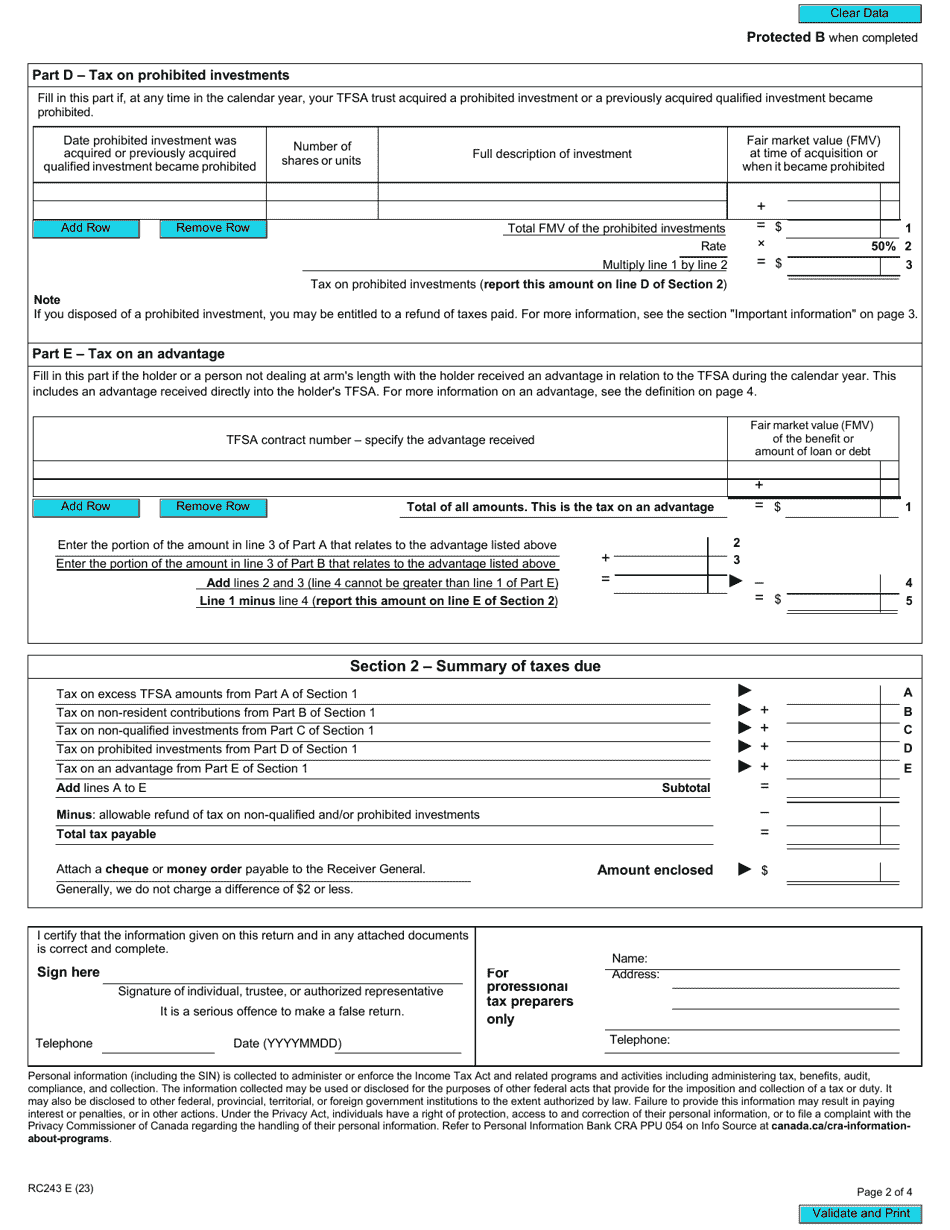

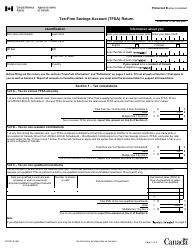

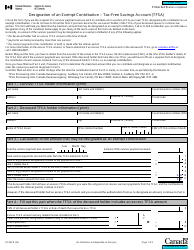

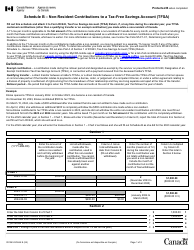

Form RC243 Tax-Free Savings Account (Tfsa) Return - Canada

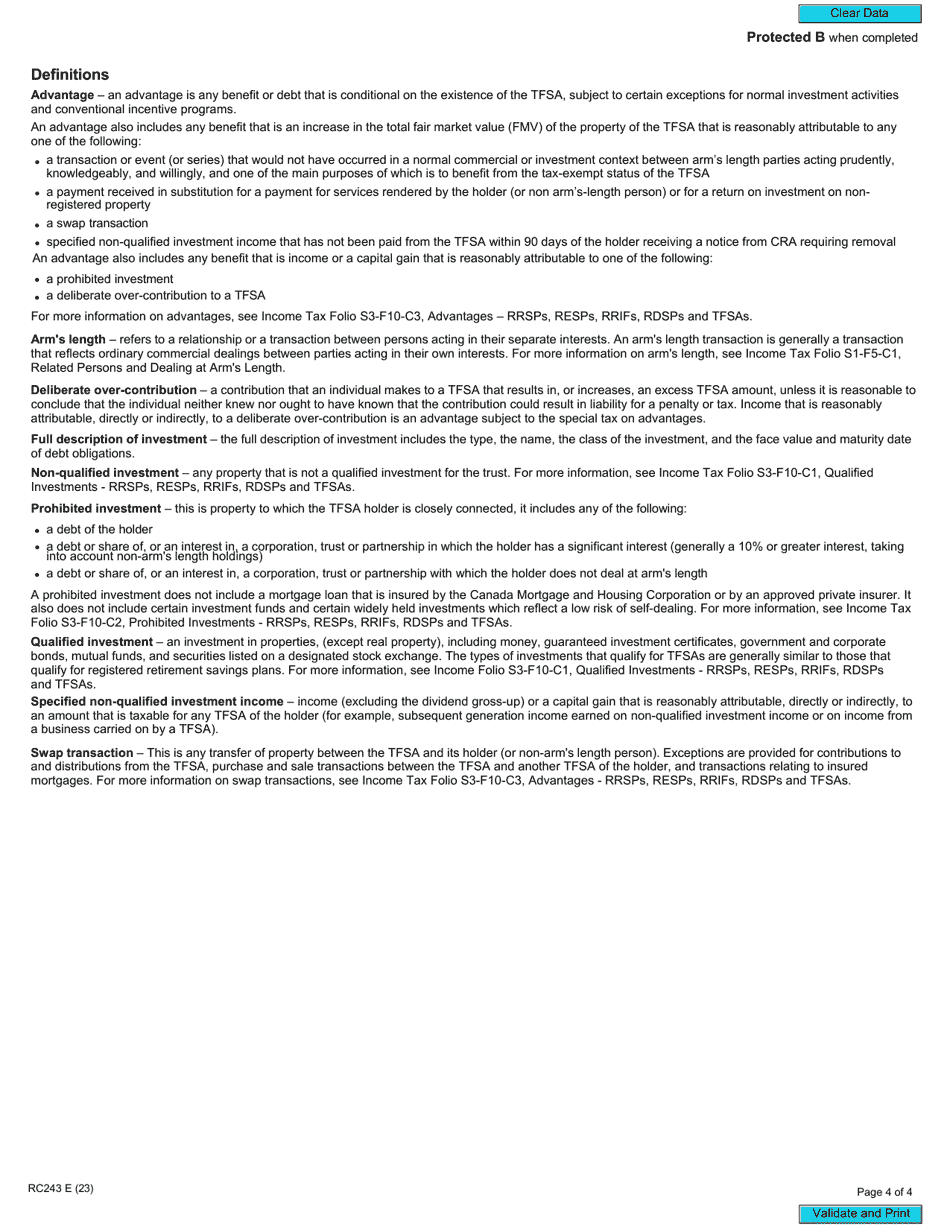

Form RC243 Tax-Free Savings Account (TFSA) Return in Canada is used to report the contributions, withdrawals, and transfers made in a Tax-Free Savings Account (TFSA) during the tax year. It helps individuals comply with the Canada Revenue Agency (CRA) rules and regulations regarding their TFSA.

The Canada Revenue Agency (CRA) is the authority responsible for administering the tax-free savings account (TFSA) in Canada. Individuals who have a TFSA need to file the Form RC243 TFSA Return with the CRA.

FAQ

Q: What is Form RC243?

A: Form RC243 is the Tax-Free Savings Account (TFSA) Return in Canada.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a registered account where you can save or invest money without paying tax on the growth or withdrawals.

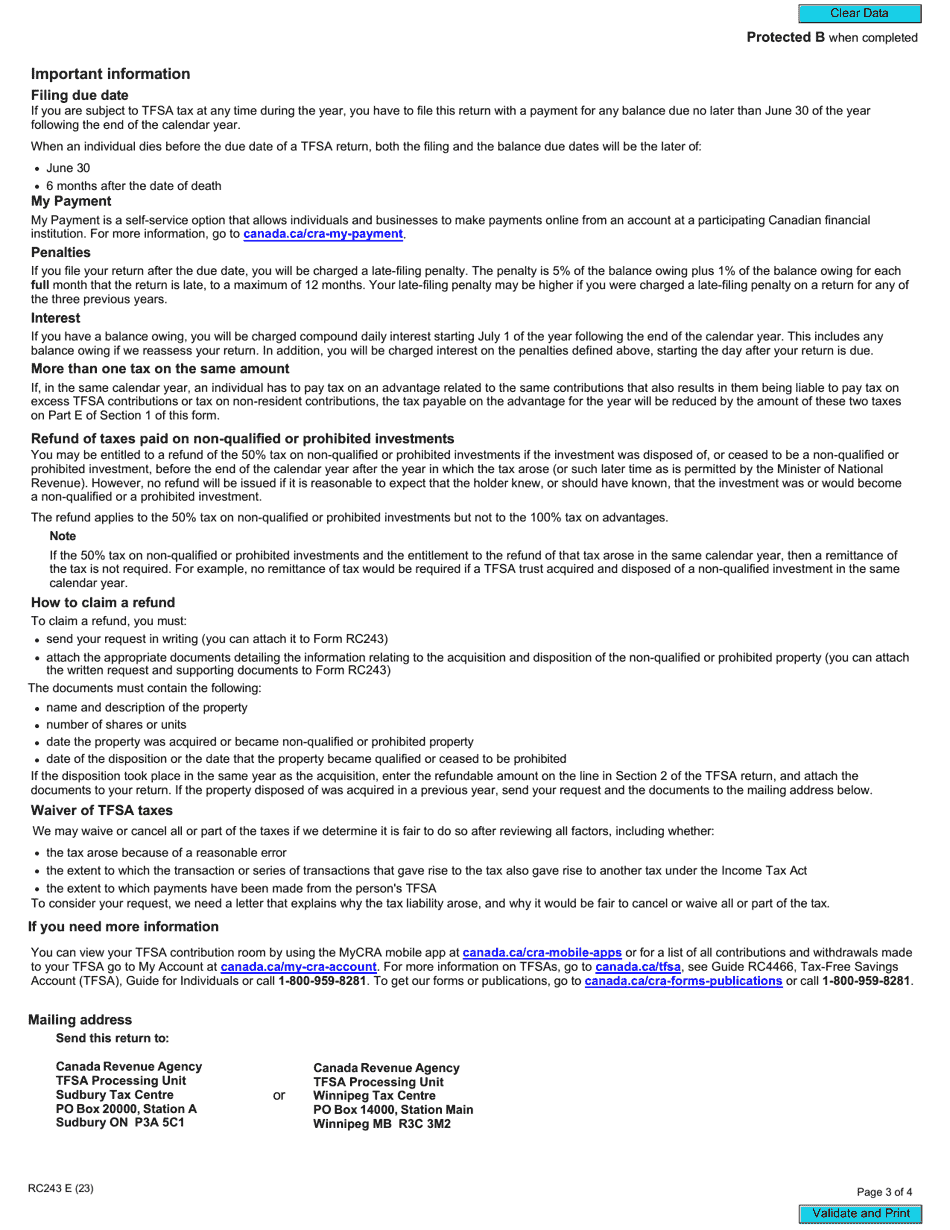

Q: When do I need to file Form RC243?

A: You need to file Form RC243 if you have a Tax-Free Savings Account (TFSA) and there is a transaction to report, such as contributions, withdrawals, or transfers.

Q: What information do I need to fill out Form RC243?

A: You need to provide your personal information, details about your Tax-Free Savings Account (TFSA) transactions, and any other required information as indicated on the form.

Q: How do I submit Form RC243?

A: You can submit Form RC243 electronically using the CRA's My Account service, by mail, or by authorized software.

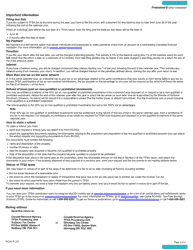

Q: Do I need to file Form RC243 if I didn't have any transactions in my TFSA?

A: No, if you didn't have any transactions in your Tax-Free Savings Account (TFSA), you do not need to file Form RC243.

Q: What happens if I don't file Form RC243?

A: Failing to file Form RC243 when required may result in penalties or interest charges from the Canada Revenue Agency (CRA).