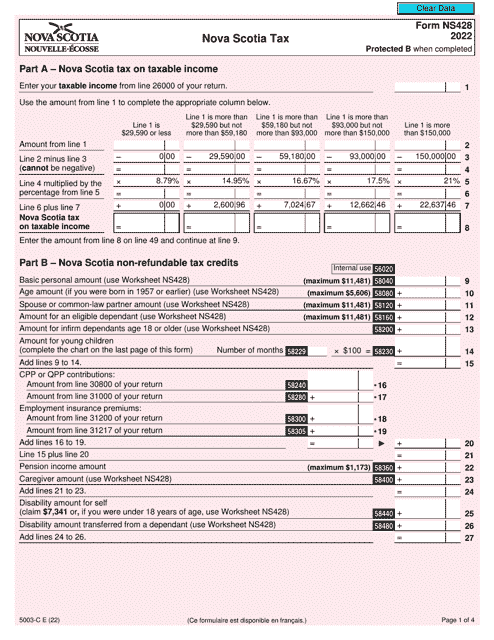

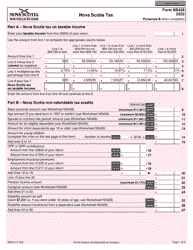

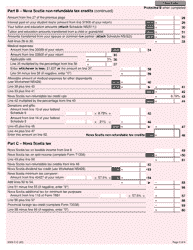

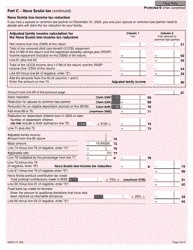

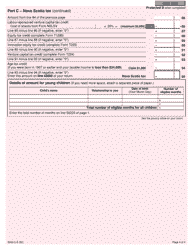

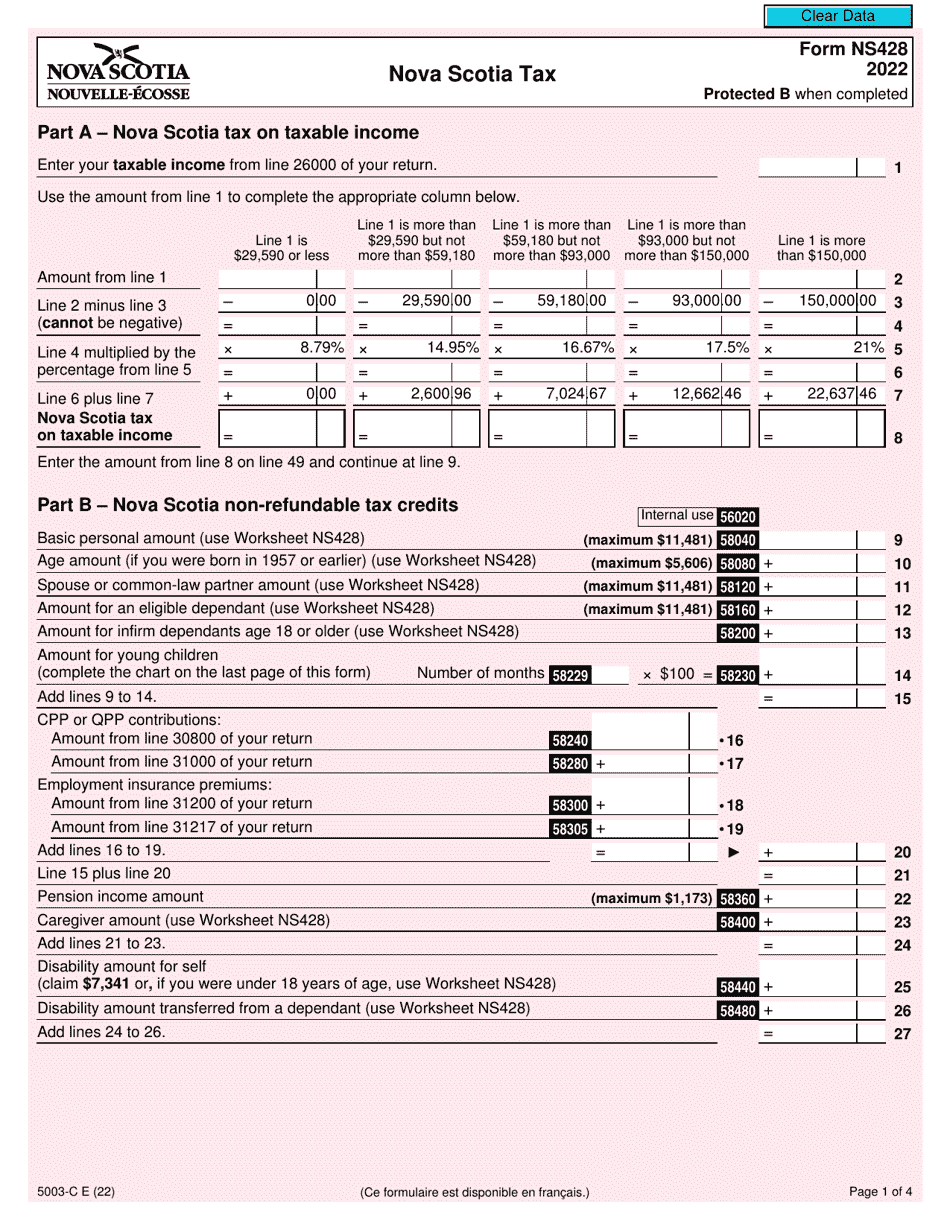

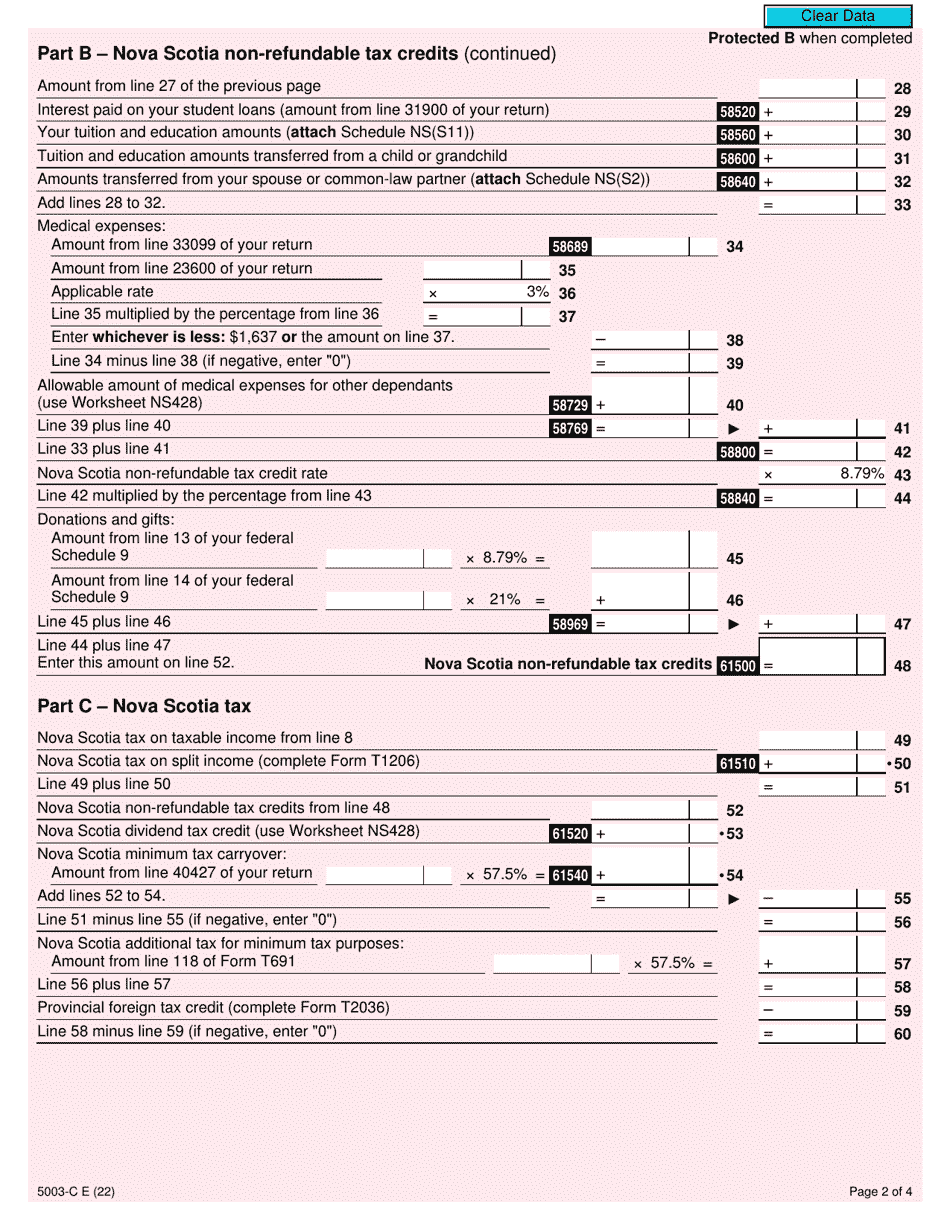

Form NS428 (5003-C) Nova Scotia Tax - Canada

Form NS428 (5003-C) is the Nova Scotia Tax Form used for reporting and calculating your provincial income tax liability in Nova Scotia, Canada. It is specifically designed for residents of Nova Scotia to determine the amount of provincial tax they owe based on their income, deductions, and credits. This form is filed in addition to the federal tax return (T1) and helps individuals ensure they have fulfilled their tax obligations to both the federal government and the Province of Nova Scotia.

The Form NS428 (5003-C), also known as the Nova Scotia Tax form, is filed by individual taxpayers who are residents of Nova Scotia in Canada. This form is specifically used to calculate and claim various provincial tax credits and deductions available in Nova Scotia.

FAQ

Q: What is Form NS428 (5003-C)?

A: Form NS428 (5003-C) is the tax form used by residents of Nova Scotia, Canada to calculate their provincial tax liability.

Q: Who needs to file Form NS428 (5003-C)?

A: Residents of Nova Scotia who need to report their provincial income tax must file Form NS428 (5003-C).

Q: What information is required to complete Form NS428 (5003-C)?

A: To complete Form NS428 (5003-C), you will need information such as your employment income, social assistance payments, investment income, and deductions.

Q: What is the due date for filing Form NS428 (5003-C)?

A: The due date for filing Form NS428 (5003-C) is the same as the federal income tax return deadline, which is generally April 30th of the following year.

Q: Can I file Form NS428 (5003-C) electronically?

A: Yes, you can file Form NS428 (5003-C) electronically using the CRA's Netfile system or through certified tax software.

Q: Are there any tax credits or deductions specific to Nova Scotia?

A: Yes, Nova Scotia offers certain tax credits and deductions such as the Nova Scotia low-income tax reduction and the Nova Scotia volunteer firefighters' tax credit. Form NS428 (5003-C) includes provisions to claim these credits and deductions.

Q: What should I do if I have questions or need assistance with Form NS428 (5003-C)?

A: If you have questions or need assistance with Form NS428 (5003-C), you can contact the Canada Revenue Agency or consult a tax professional.