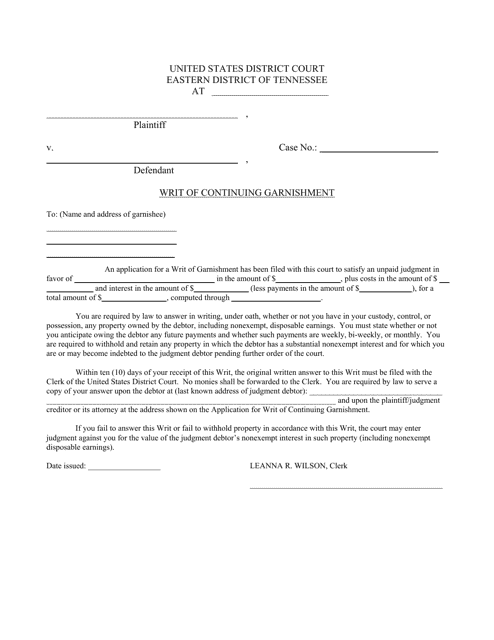

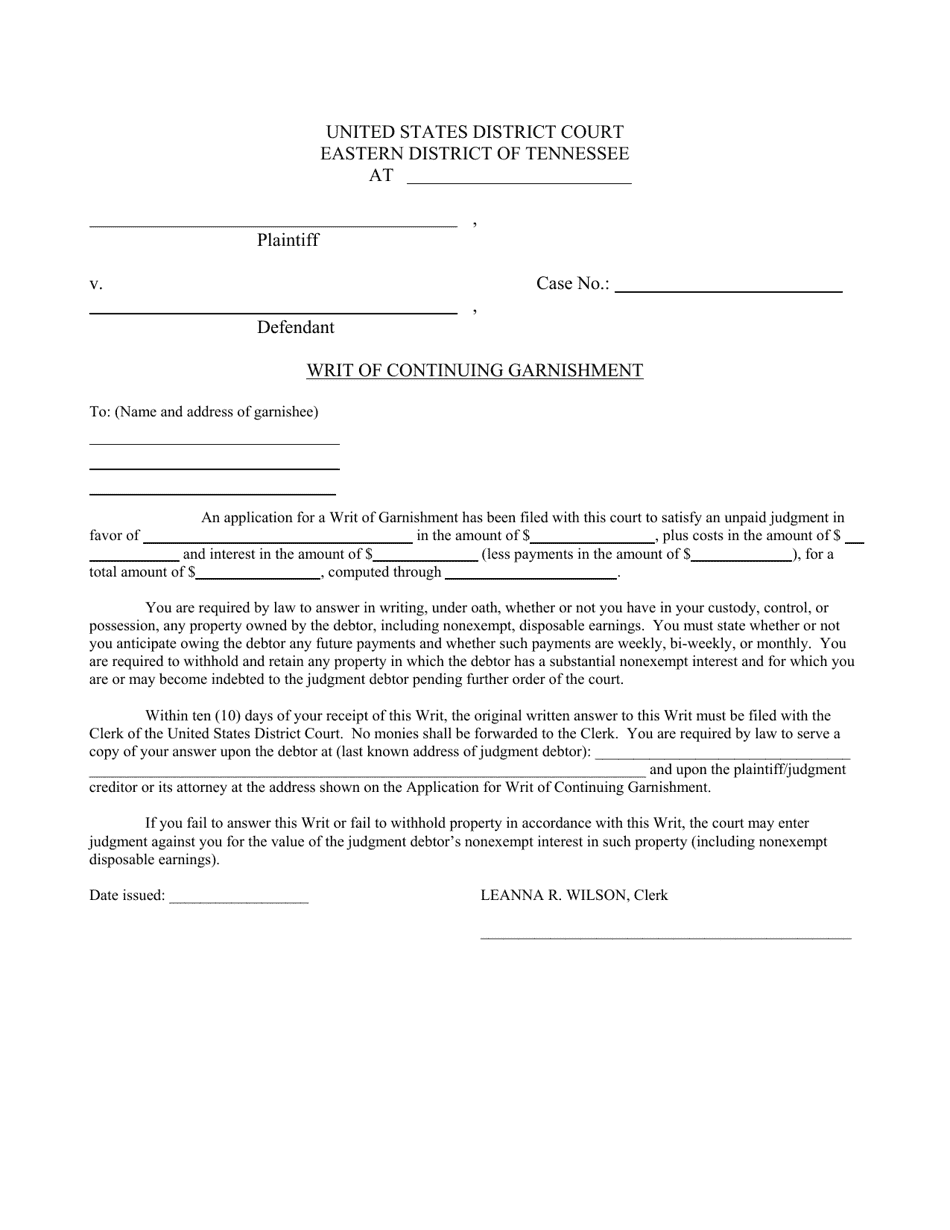

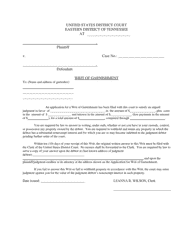

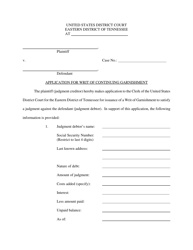

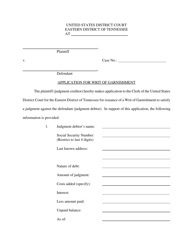

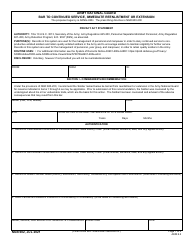

Writ of Continuing Garnishment - Tennessee

Writ of Continuing Garnishment is a legal document that was released by the U.S. District Court for the Eastern District of Tennessee - a government authority operating within Tennessee.

FAQ

Q: What is a Writ of Continuing Garnishment in Tennessee?

A: A Writ of Continuing Garnishment in Tennessee is a legal document that allows a creditor to collect money owed to them by garnishing the wages of a debtor.

Q: Who can apply for a Writ of Continuing Garnishment in Tennessee?

A: Creditors who have obtained a judgment against a debtor can apply for a Writ of Continuing Garnishment in Tennessee.

Q: What is the purpose of a Writ of Continuing Garnishment in Tennessee?

A: The purpose of a Writ of Continuing Garnishment in Tennessee is to help creditors collect the money owed to them by deducting it directly from the debtor's wages.

Q: How does a Writ of Continuing Garnishment work in Tennessee?

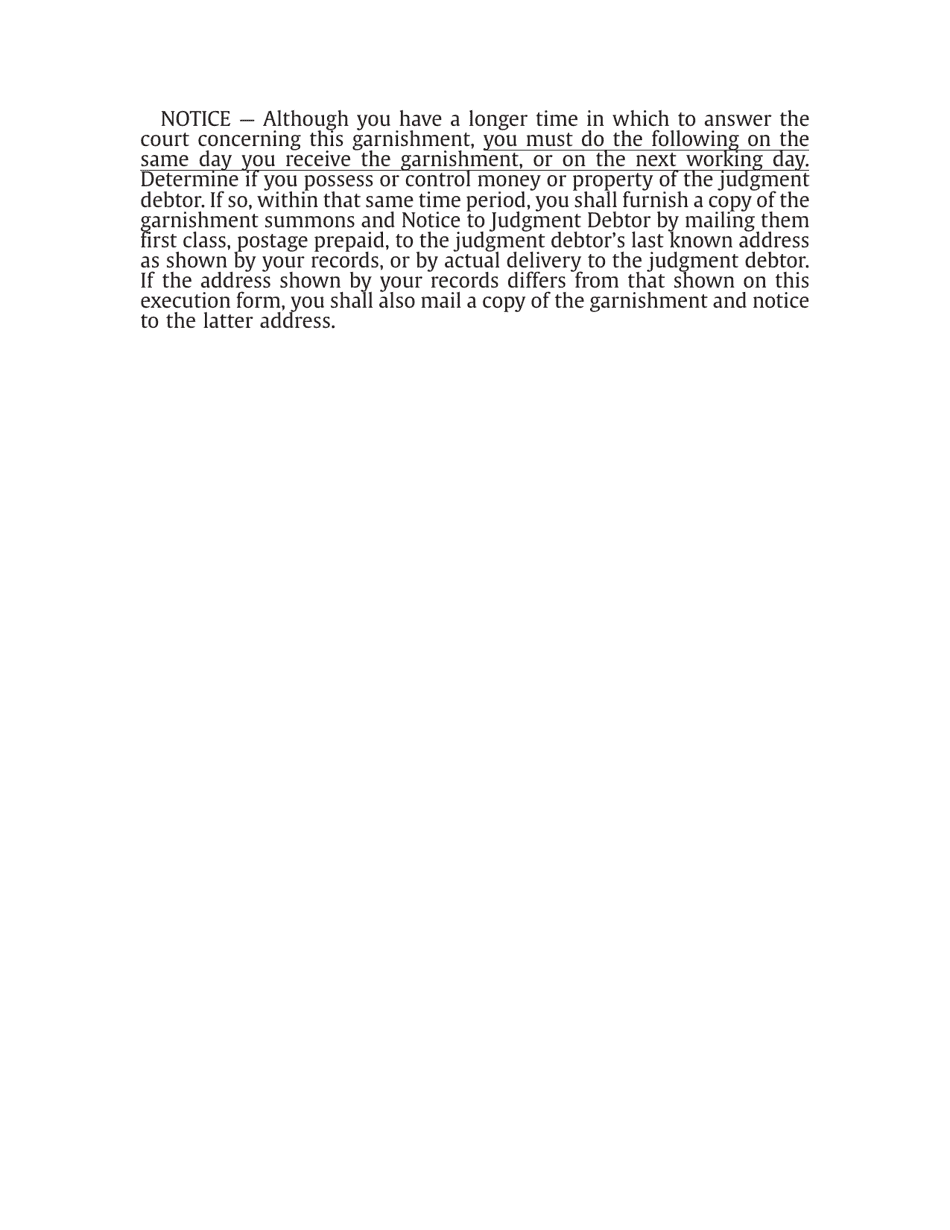

A: Once a Writ of Continuing Garnishment is issued, the debtor's employer is legally required to withhold a portion of the debtor's wages and send it directly to the creditor until the debt is fully paid.

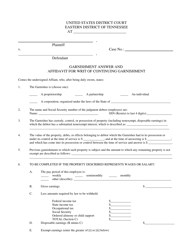

Q: What percentage of wages can be garnished under a Writ of Continuing Garnishment in Tennessee?

A: In Tennessee, the maximum amount that can be garnished from a debtor's wages under a Writ of Continuing Garnishment is generally 25% of their disposable earnings or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.

Q: Are there any exemptions from wage garnishment under a Writ of Continuing Garnishment in Tennessee?

A: Yes, there are certain exemptions from wage garnishment in Tennessee, including income from certain government assistance programs, social security benefits, and disability benefits.

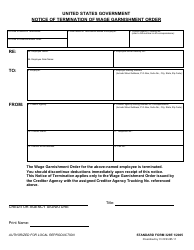

Q: How long does a Writ of Continuing Garnishment last in Tennessee?

A: A Writ of Continuing Garnishment in Tennessee generally remains in effect until the debt is fully paid or until a court orders it to be terminated.

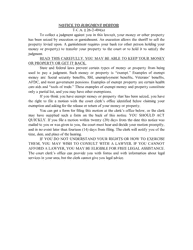

Q: Can a debtor challenge a Writ of Continuing Garnishment in Tennessee?

A: Yes, a debtor has the right to challenge a Writ of Continuing Garnishment in Tennessee by filing a claim of exemption or objecting to the garnishment within a certain timeframe.

Q: What are the consequences of ignoring a Writ of Continuing Garnishment in Tennessee?

A: Ignoring a Writ of Continuing Garnishment in Tennessee can result in further legal action, such as additional fines or penalties, and may negatively impact the debtor's credit rating.

Form Details:

- The latest edition currently provided by the U.S. District Court for the Eastern District of Tennessee;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the U.S. District Court for the Eastern District of Tennessee.