This version of the form is not currently in use and is provided for reference only. Download this version of

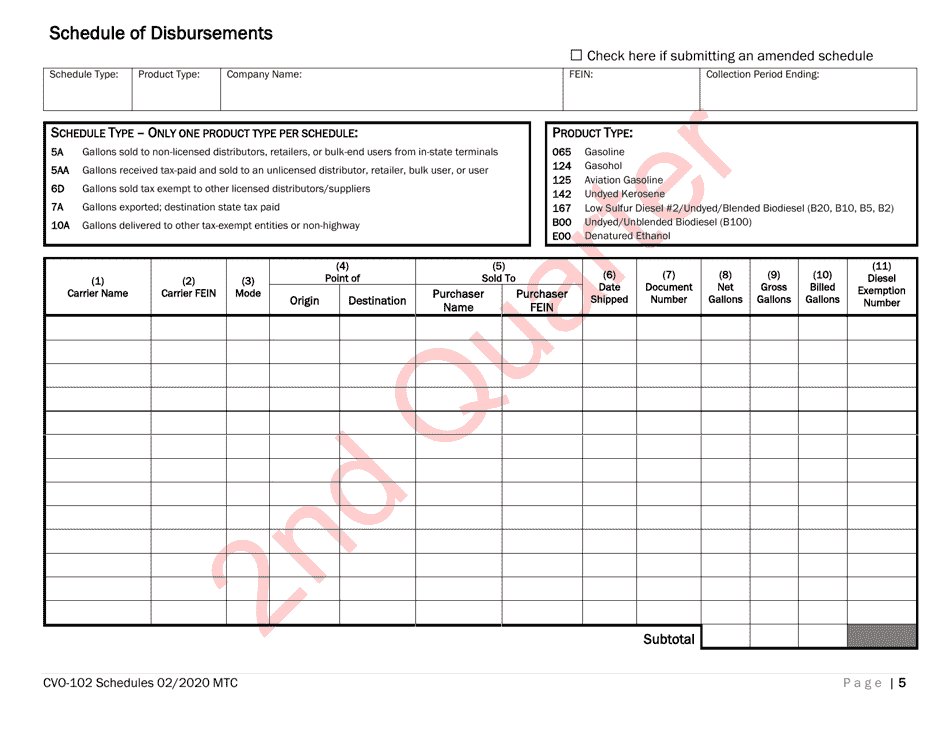

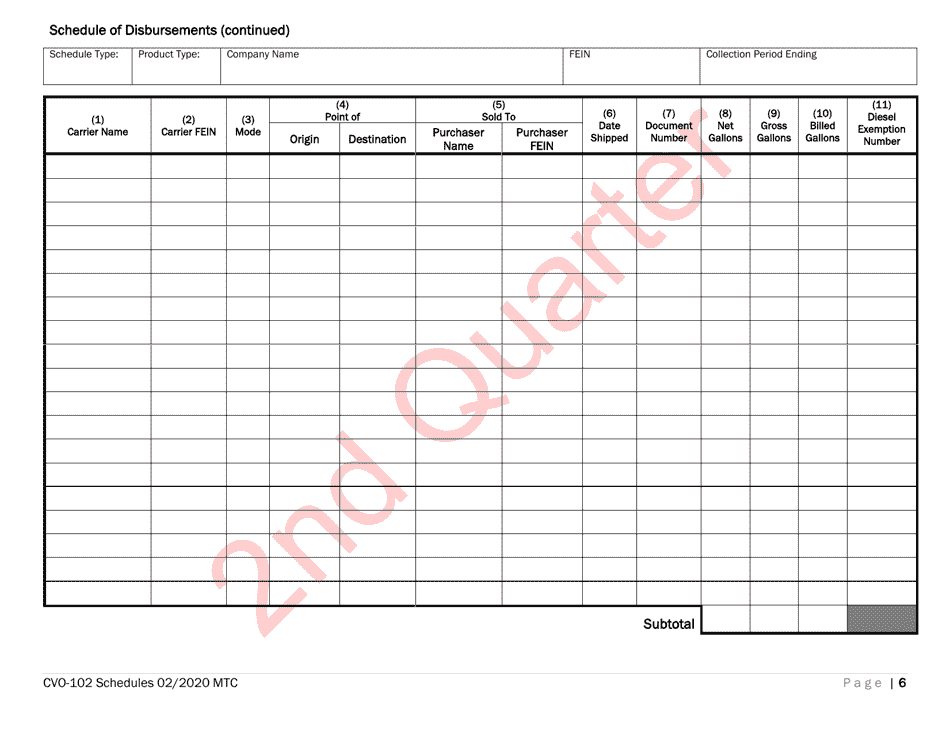

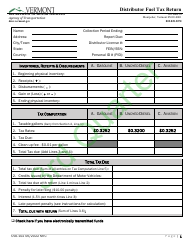

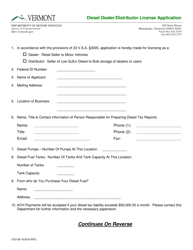

Form CVO-102

for the current year.

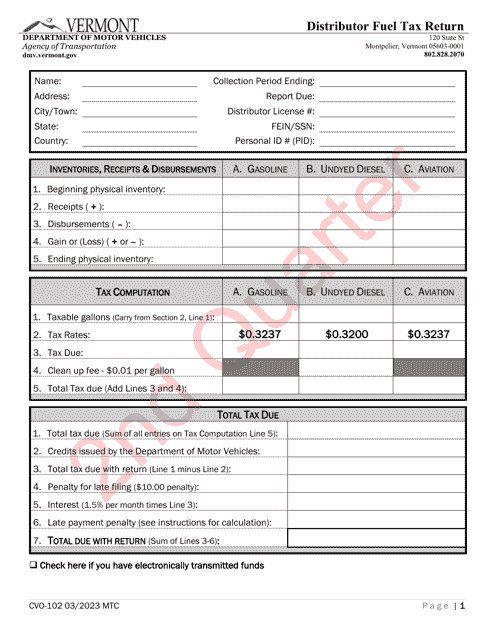

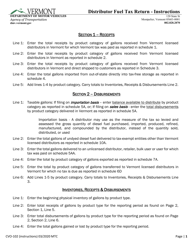

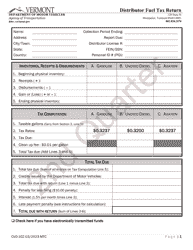

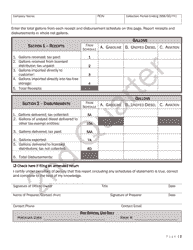

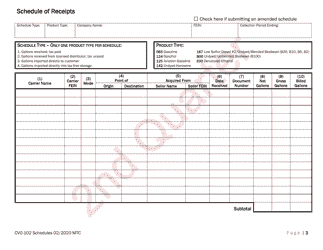

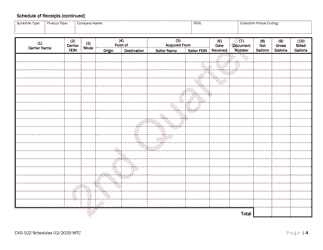

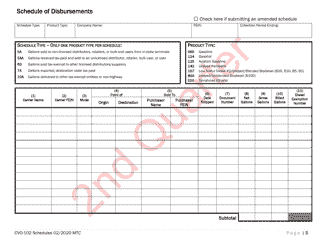

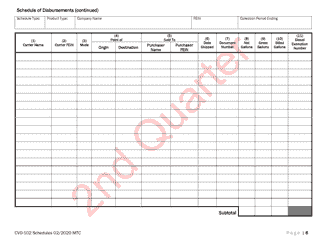

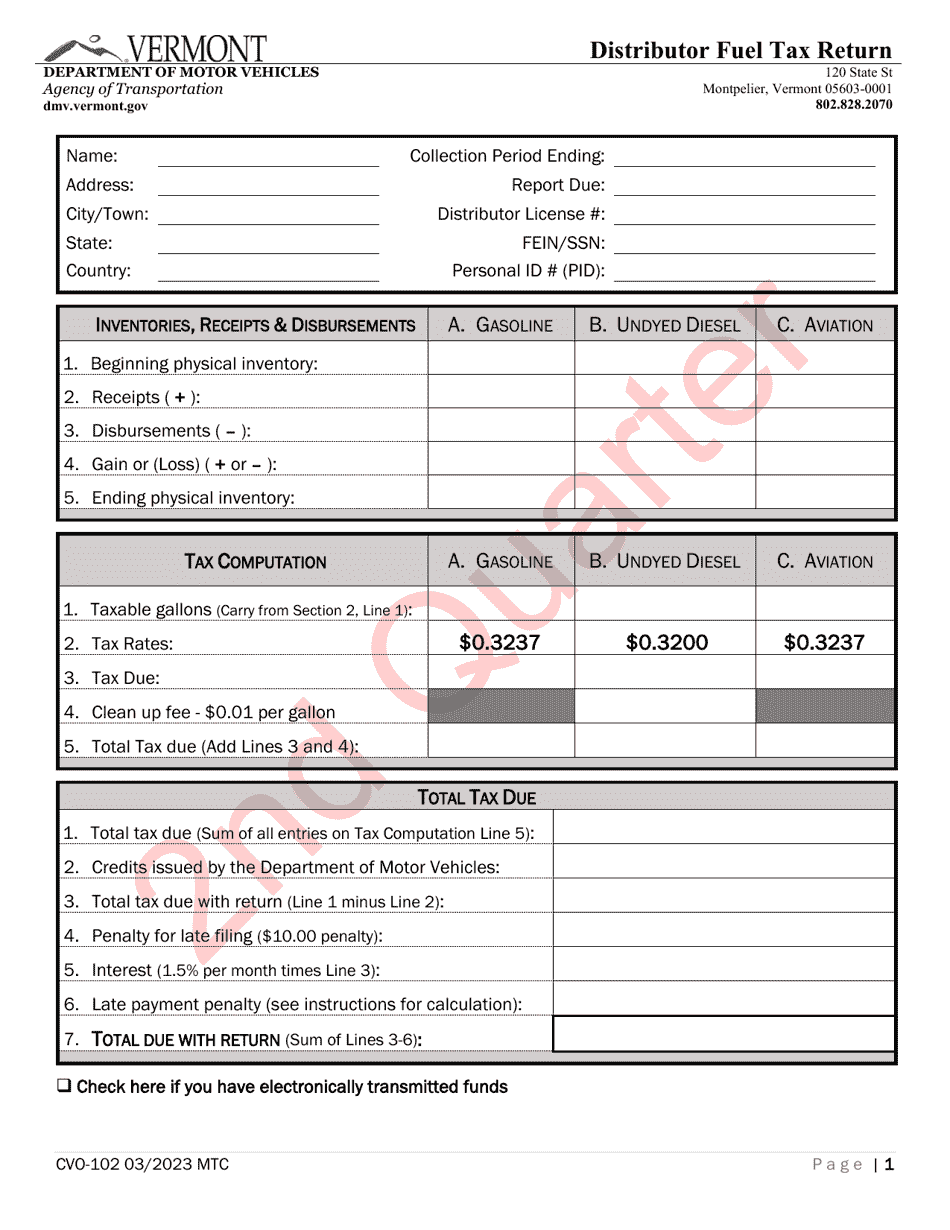

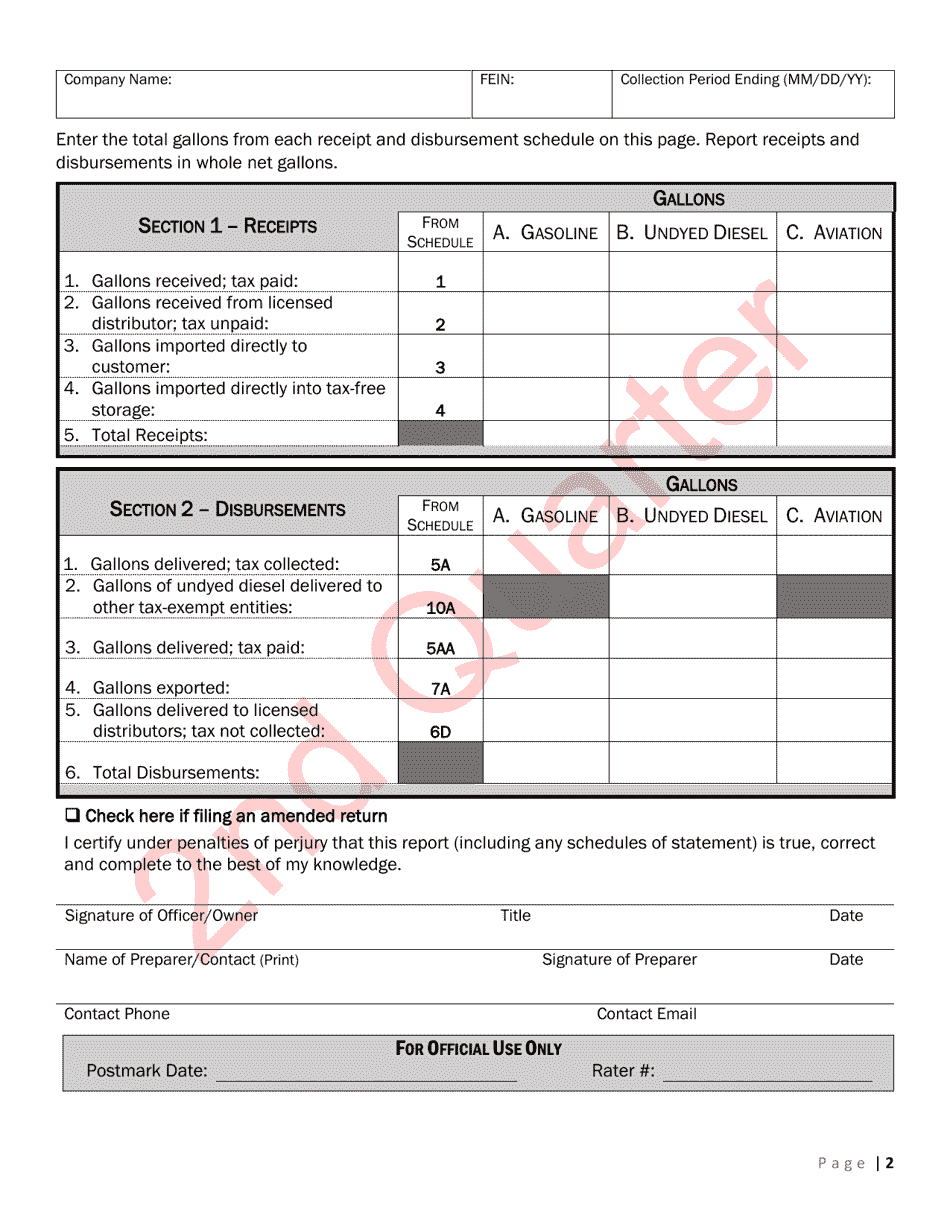

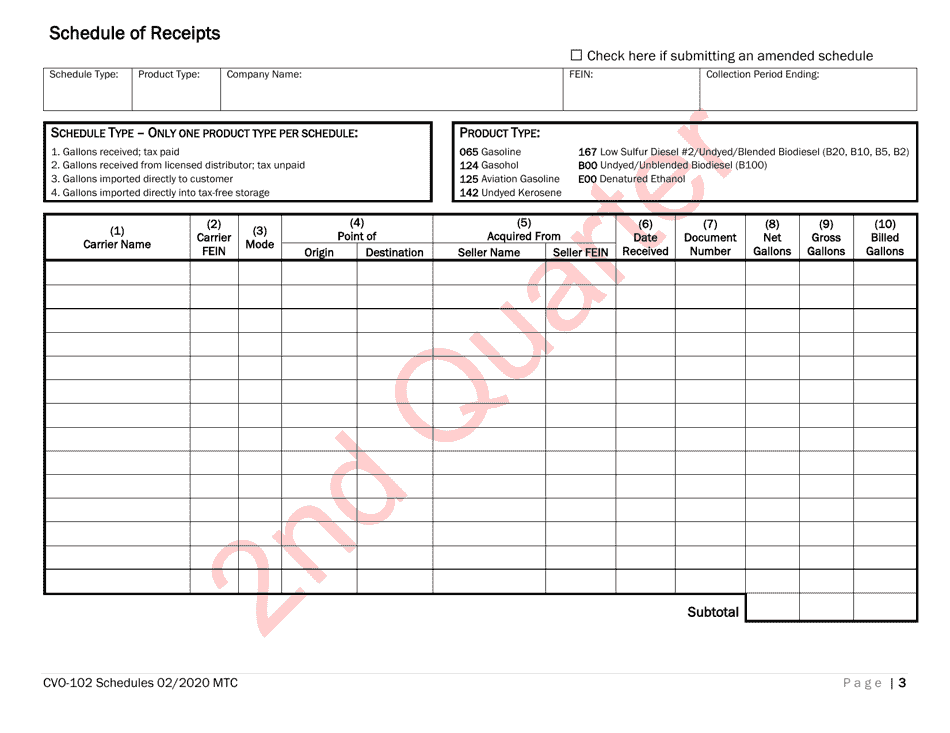

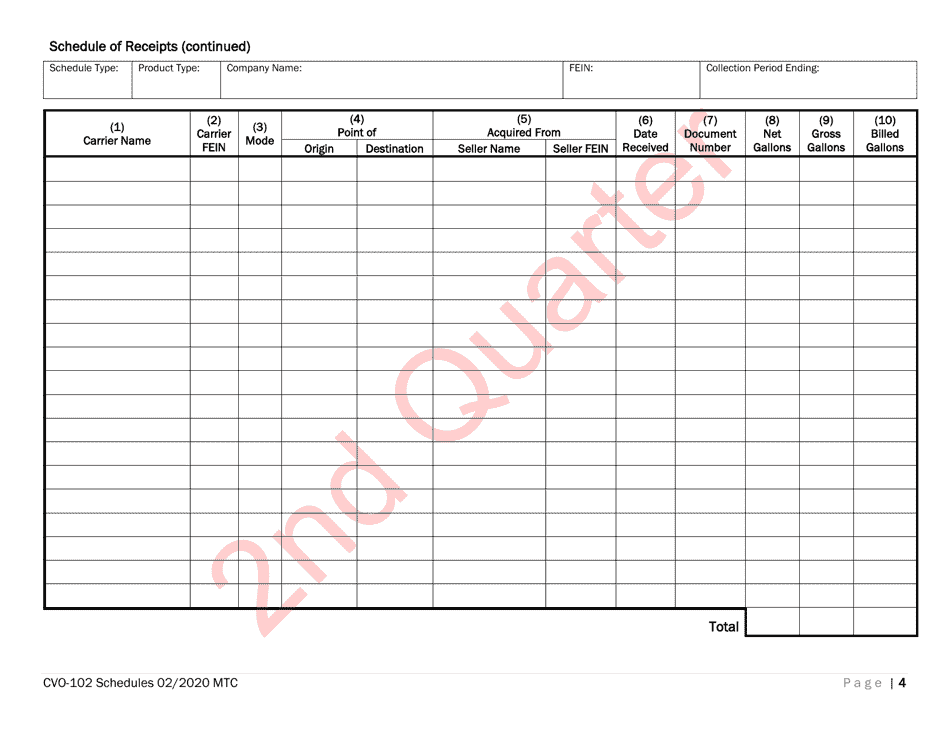

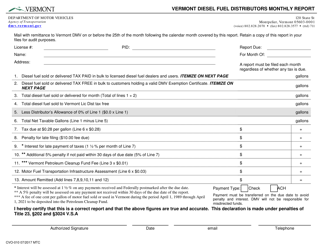

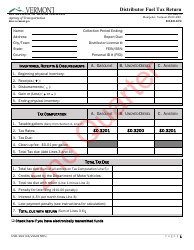

Form CVO-102 Distributor Fuel Tax Return - 2nd Quarter - Vermont

What Is Form CVO-102?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form CVO-102?

A: Form CVO-102 is a Distributor Fuel Tax Return.

Q: When is the Form CVO-102 due?

A: The Form CVO-102 for the 2nd quarter is due on the last day of the following month.

Q: Who needs to file the Form CVO-102?

A: Distributors of fuel in Vermont need to file the Form CVO-102.

Q: What is the purpose of the Form CVO-102?

A: The purpose of the Form CVO-102 is to report and pay fuel tax in Vermont.

Q: What is the penalty for late filing of the Form CVO-102?

A: The penalty for late filing of the Form CVO-102 is 10% of the tax amount due, with a minimum penalty of $10.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.