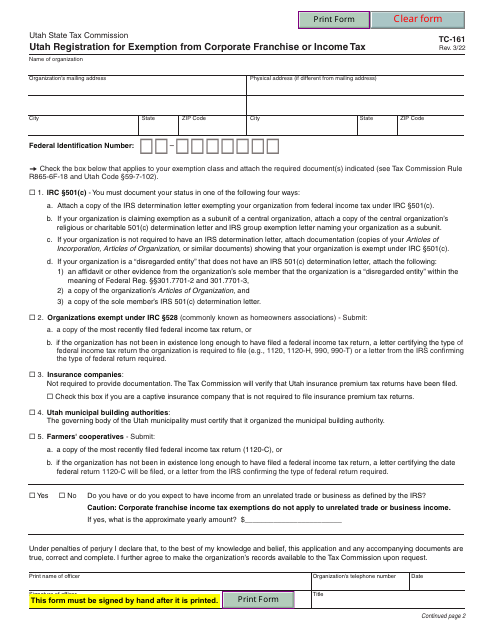

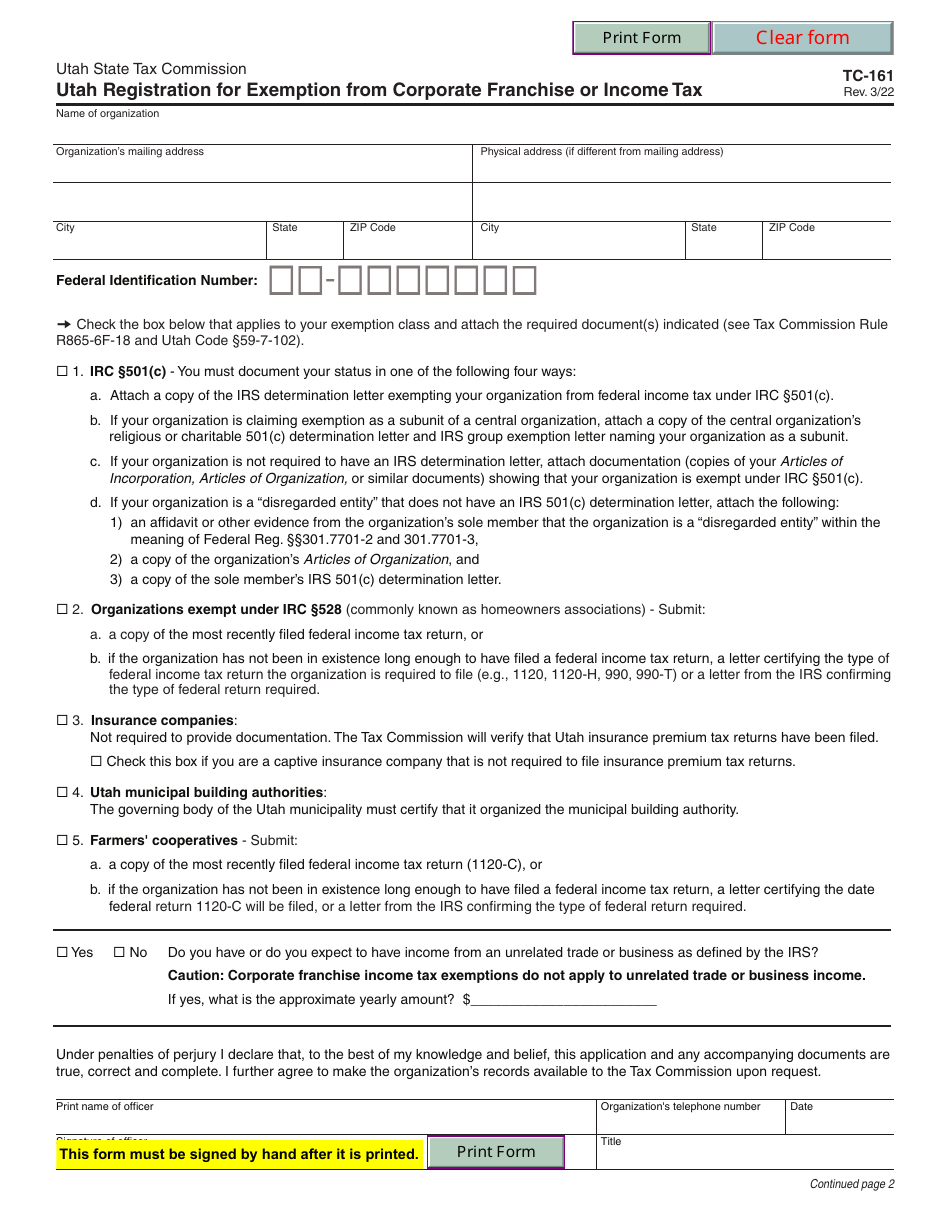

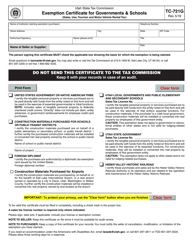

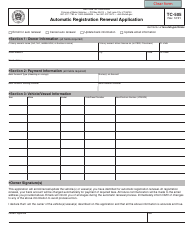

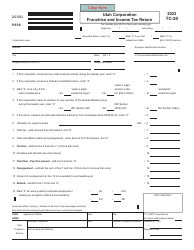

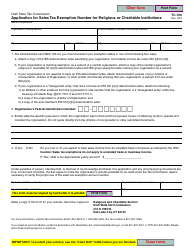

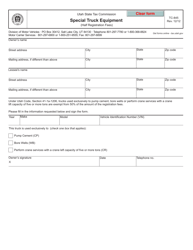

Form TC-161 Utah Registration for Exemption From Corporate Franchise or Income Tax - Utah

What Is Form TC-161?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-161?

A: Form TC-161 is the registration form for exemption from corporate franchise or income tax in Utah.

Q: Who needs to file Form TC-161?

A: Any corporation or other entity seeking exemption from corporate franchise or income tax in Utah needs to file Form TC-161.

Q: What is the purpose of filing Form TC-161?

A: The purpose of filing Form TC-161 is to register for exemption from corporate franchise or income tax in Utah.

Q: Are there any fees associated with filing Form TC-161?

A: No, there are no fees associated with filing Form TC-161.

Q: When is the deadline for filing Form TC-161?

A: The deadline for filing Form TC-161 is typically the same as the deadline for filing corporate franchise or income tax returns in Utah.

Q: Are there any eligibility requirements to qualify for exemption?

A: Yes, there are specific eligibility requirements that must be met in order to qualify for exemption. These requirements are outlined in the instructions for Form TC-161.

Q: What should I do if I have questions about Form TC-161?

A: If you have questions about Form TC-161, you should contact the Utah State Tax Commission for assistance.

Q: Is Form TC-161 specific to Utah?

A: Yes, Form TC-161 is specific to Utah and is used to register for exemption from corporate franchise or income tax in the state.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-161 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.