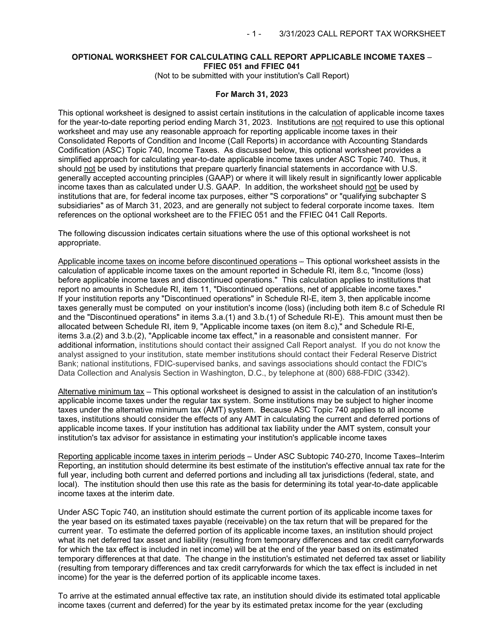

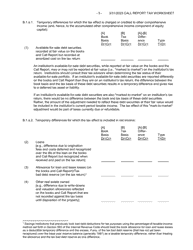

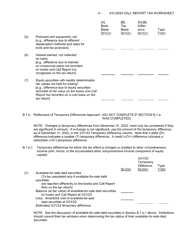

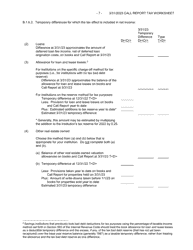

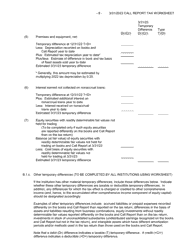

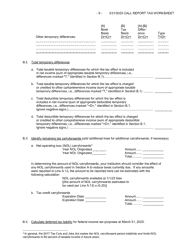

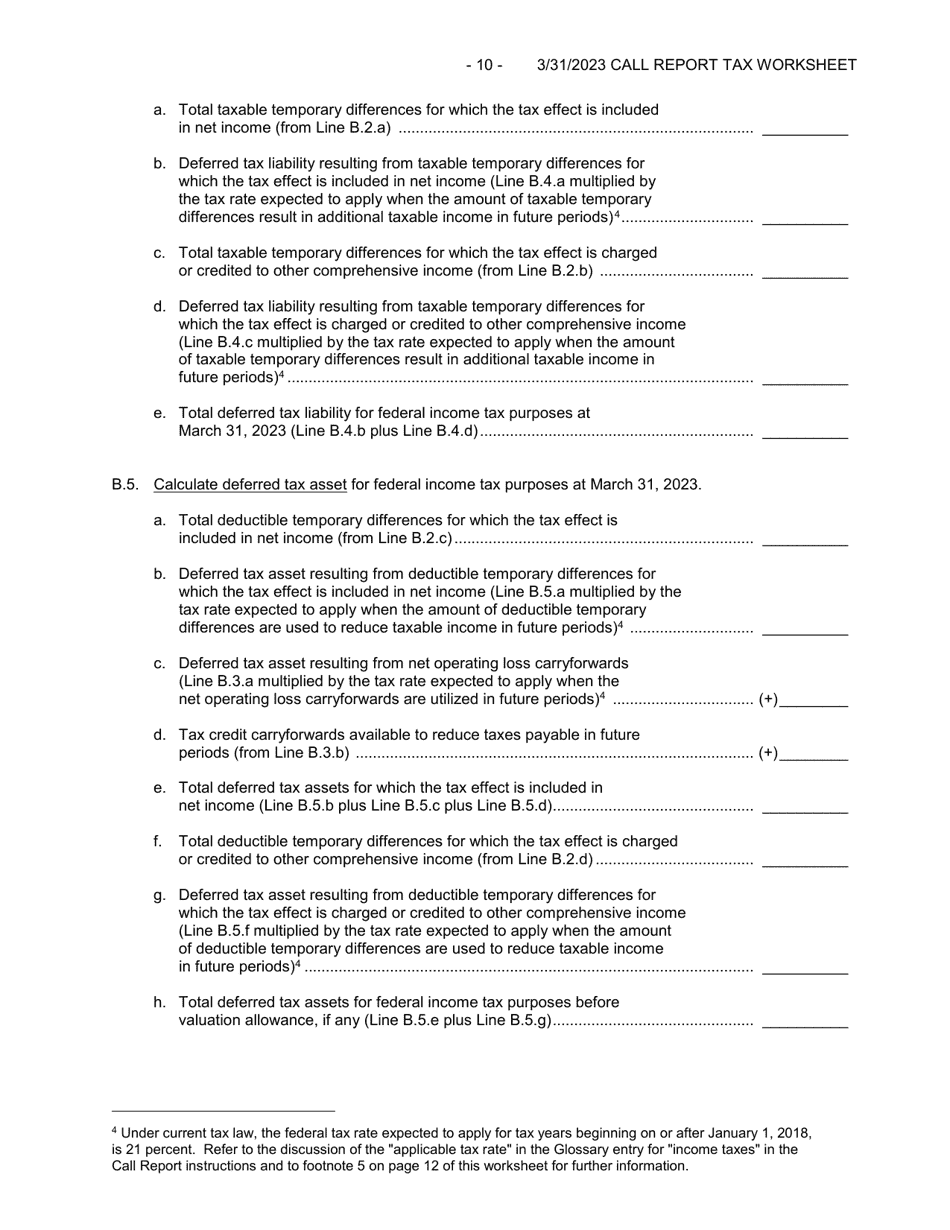

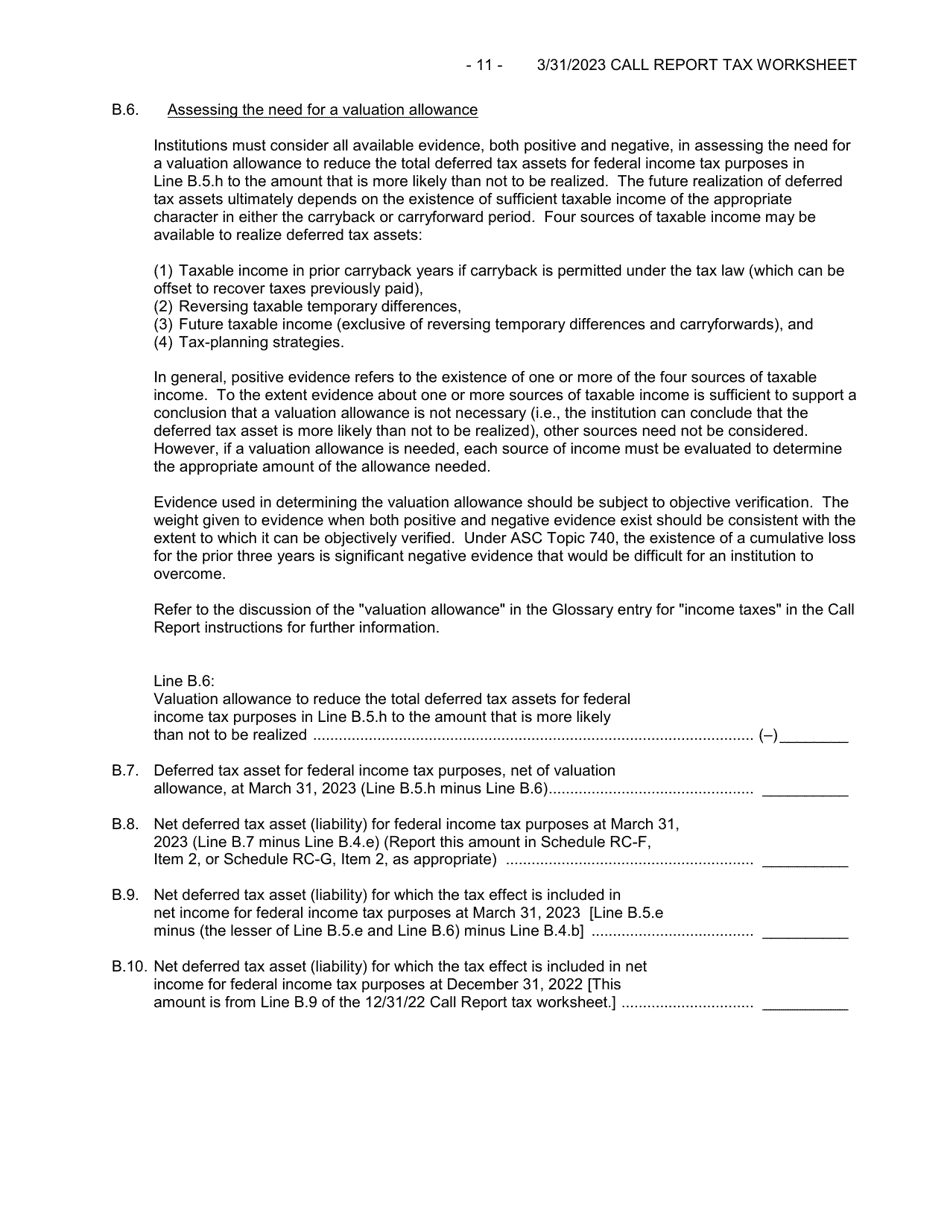

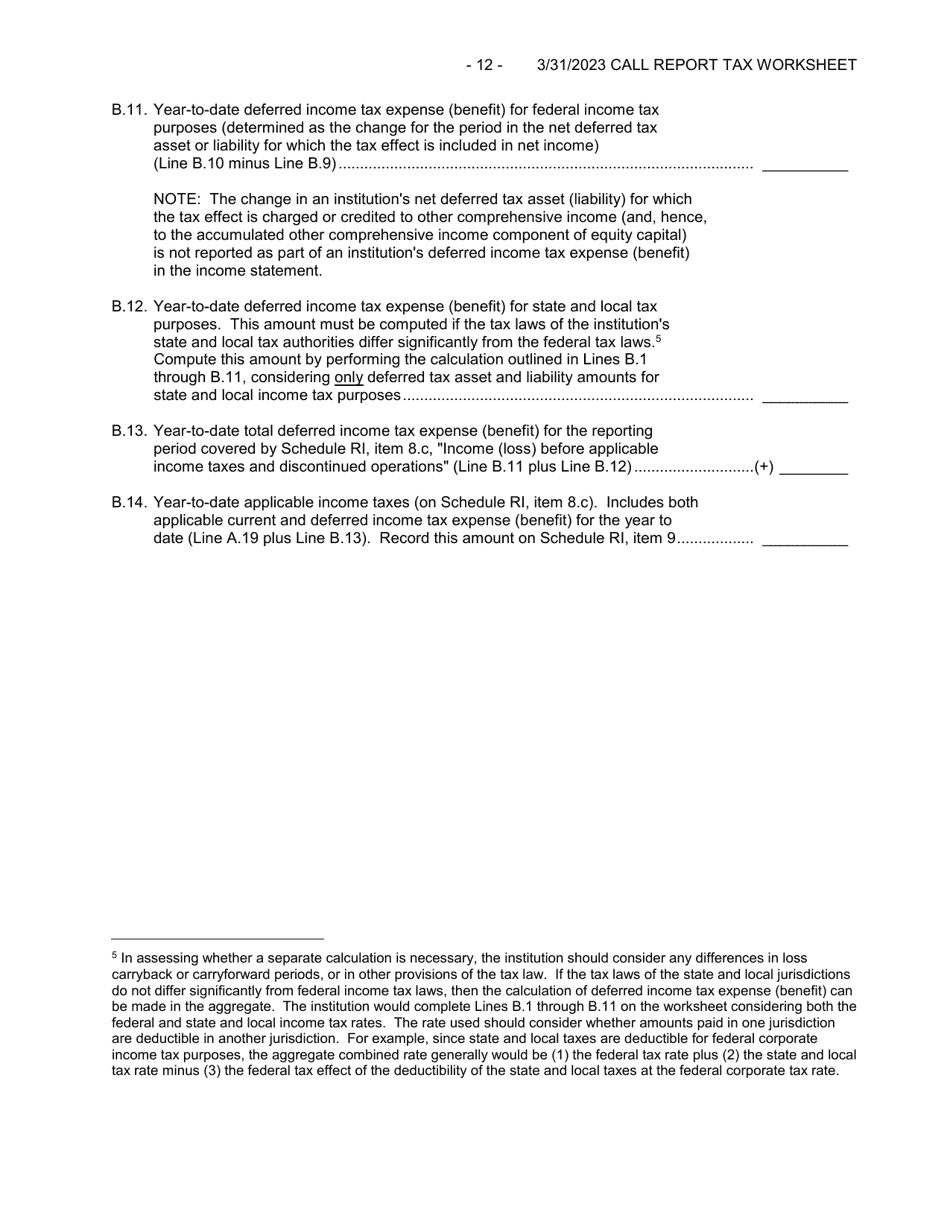

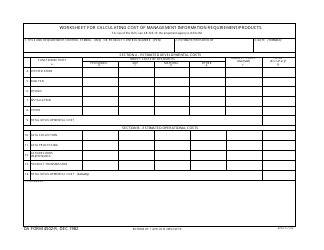

Form FFIEC051 (FFIEC041) Optional Worksheet for Calculating Call Report Applicable Income Taxes

What Is Form FFIEC051 (FFIEC041)?

This is a legal form that was released by the Federal Financial Institutions Examination Council on March 31, 2023 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FFIEC051?

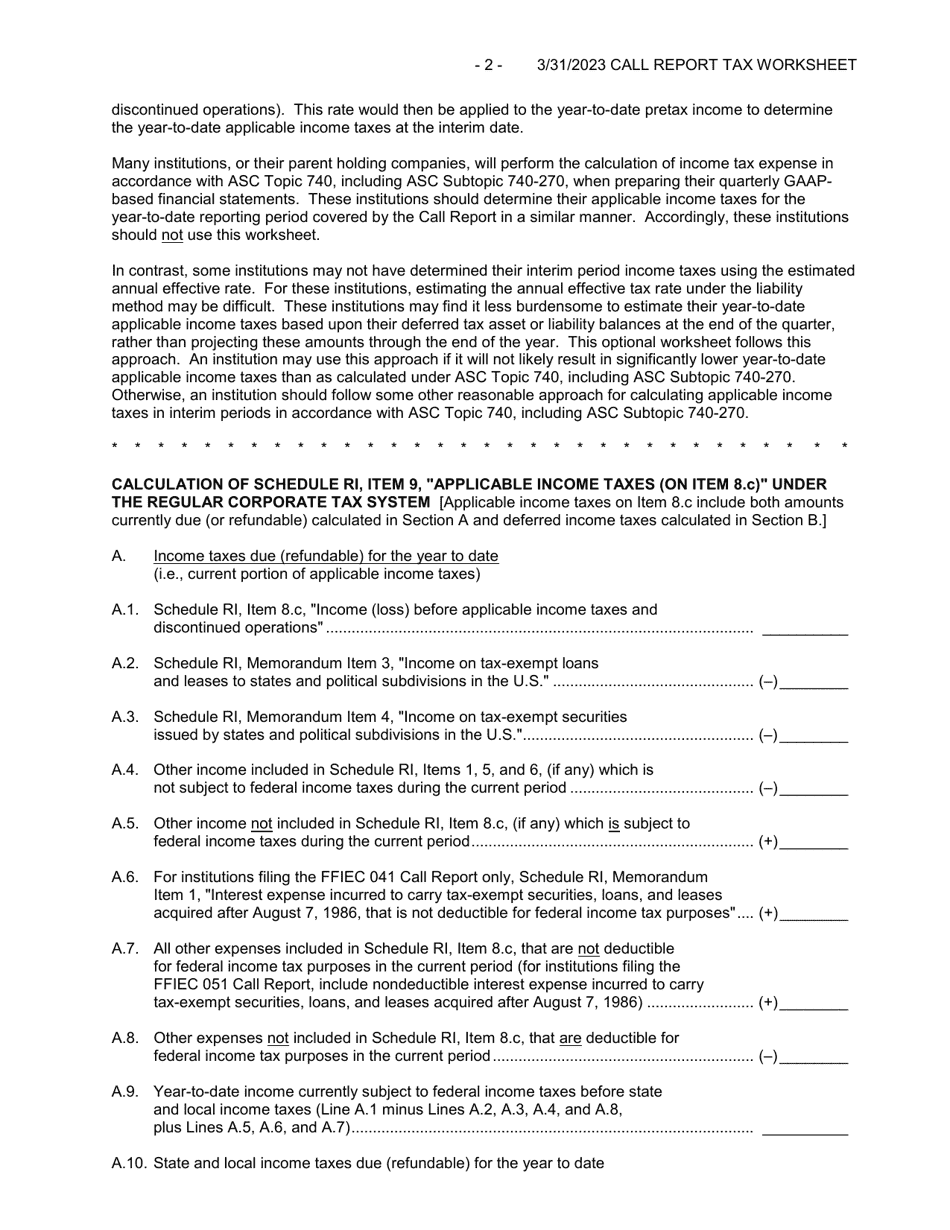

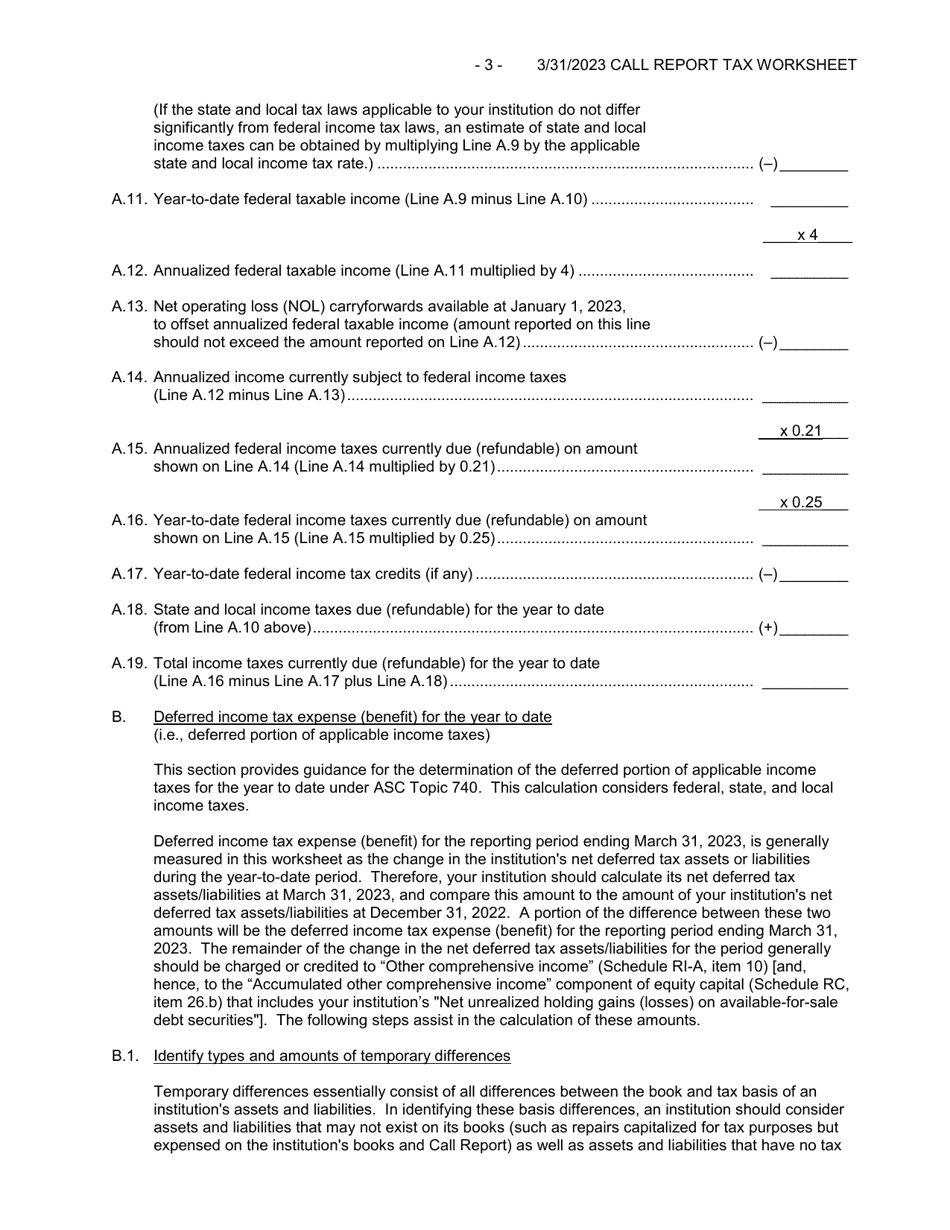

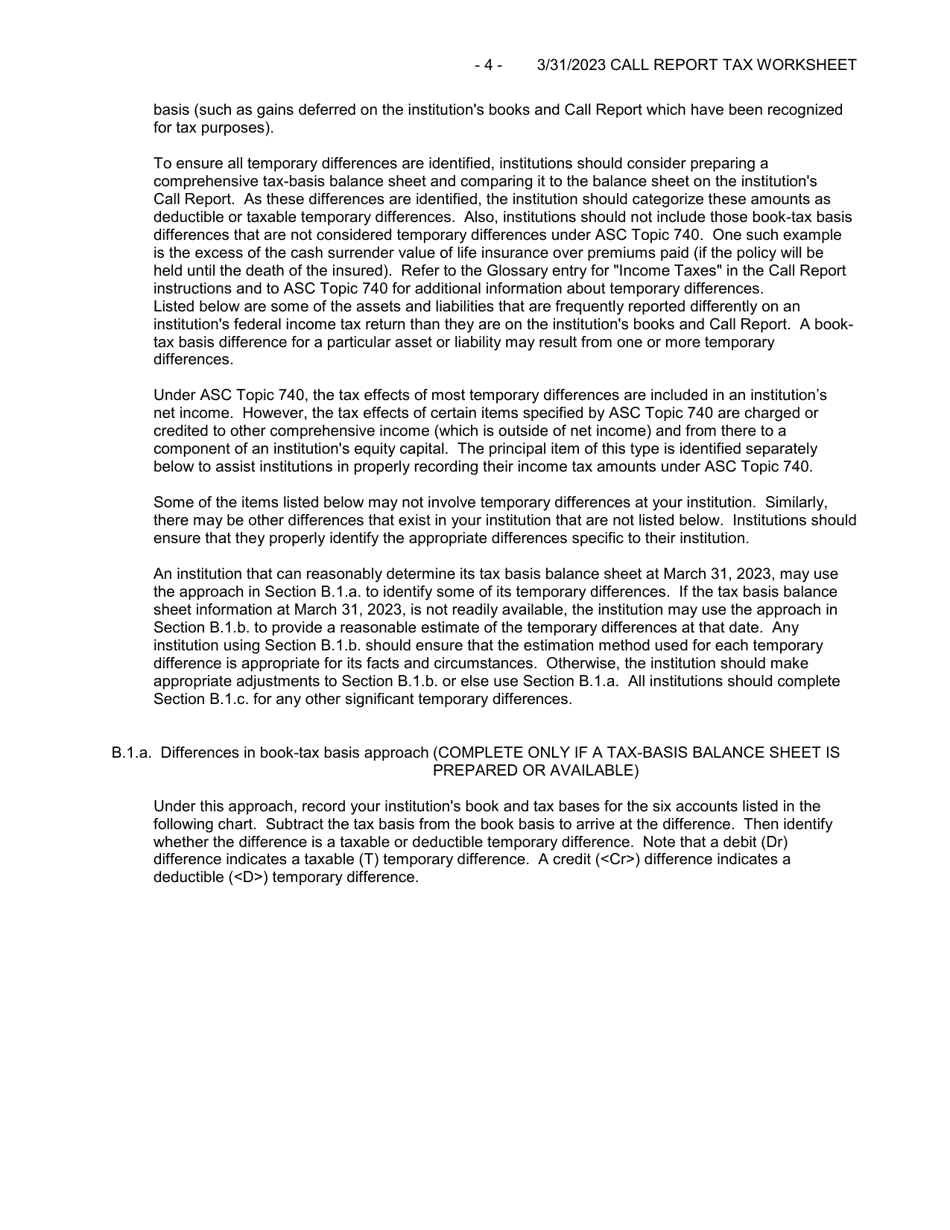

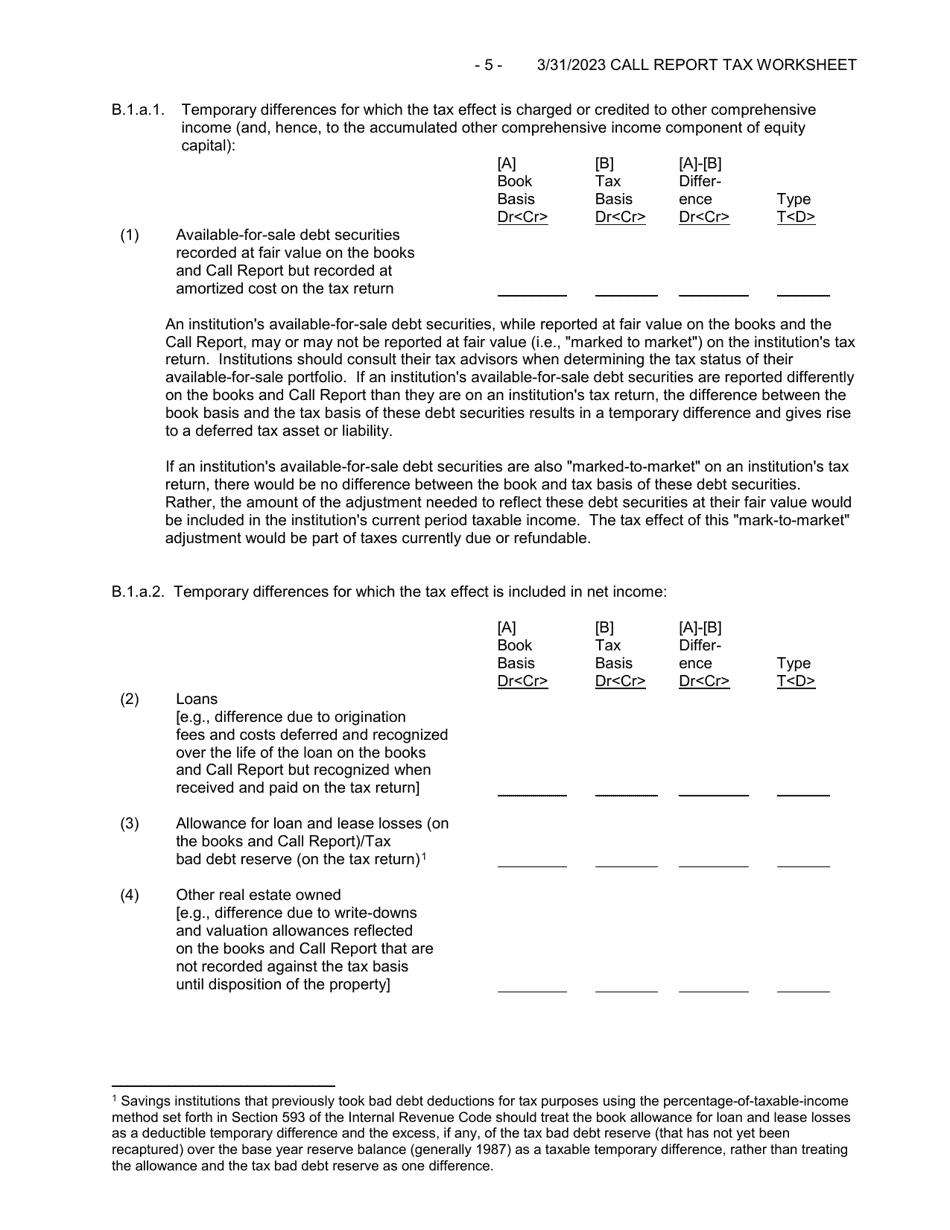

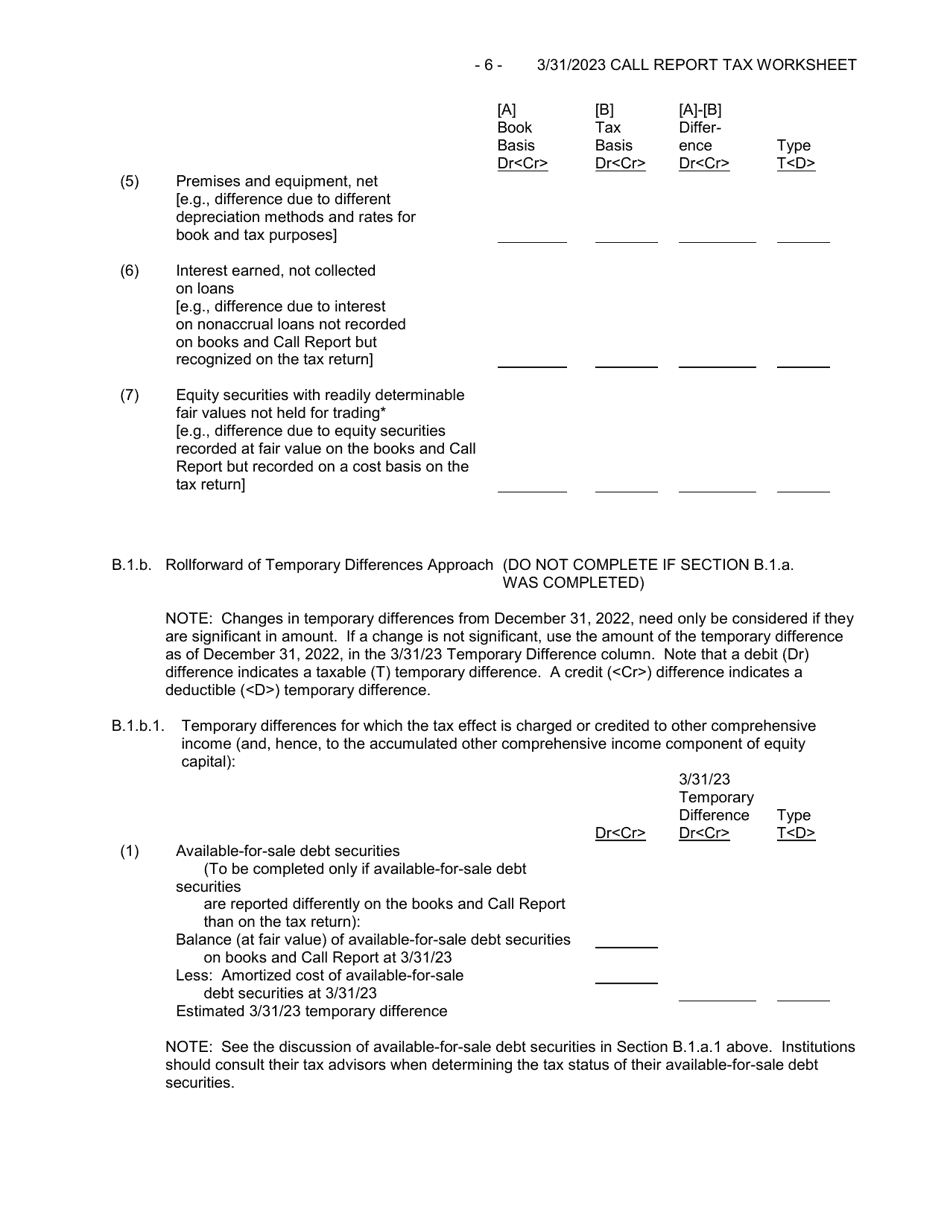

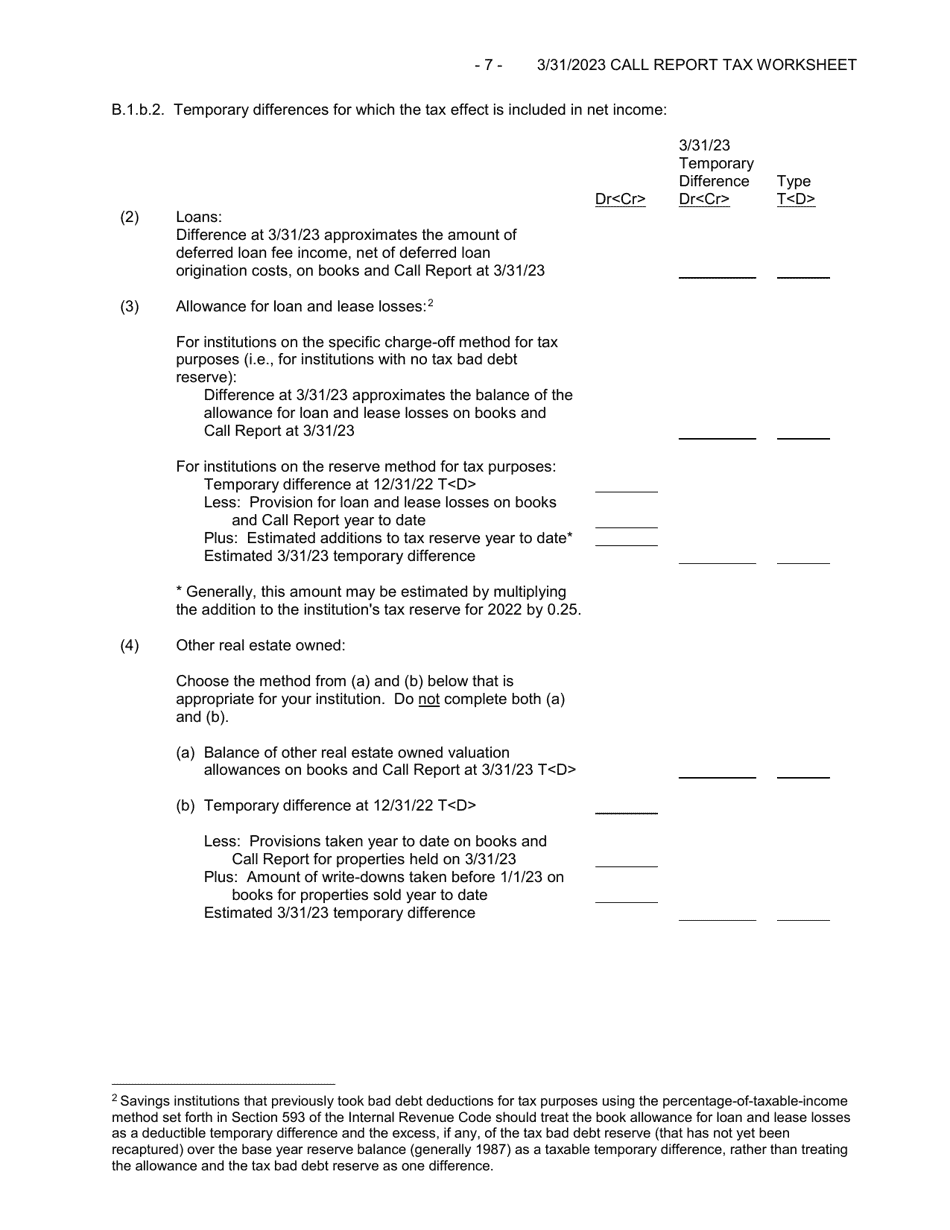

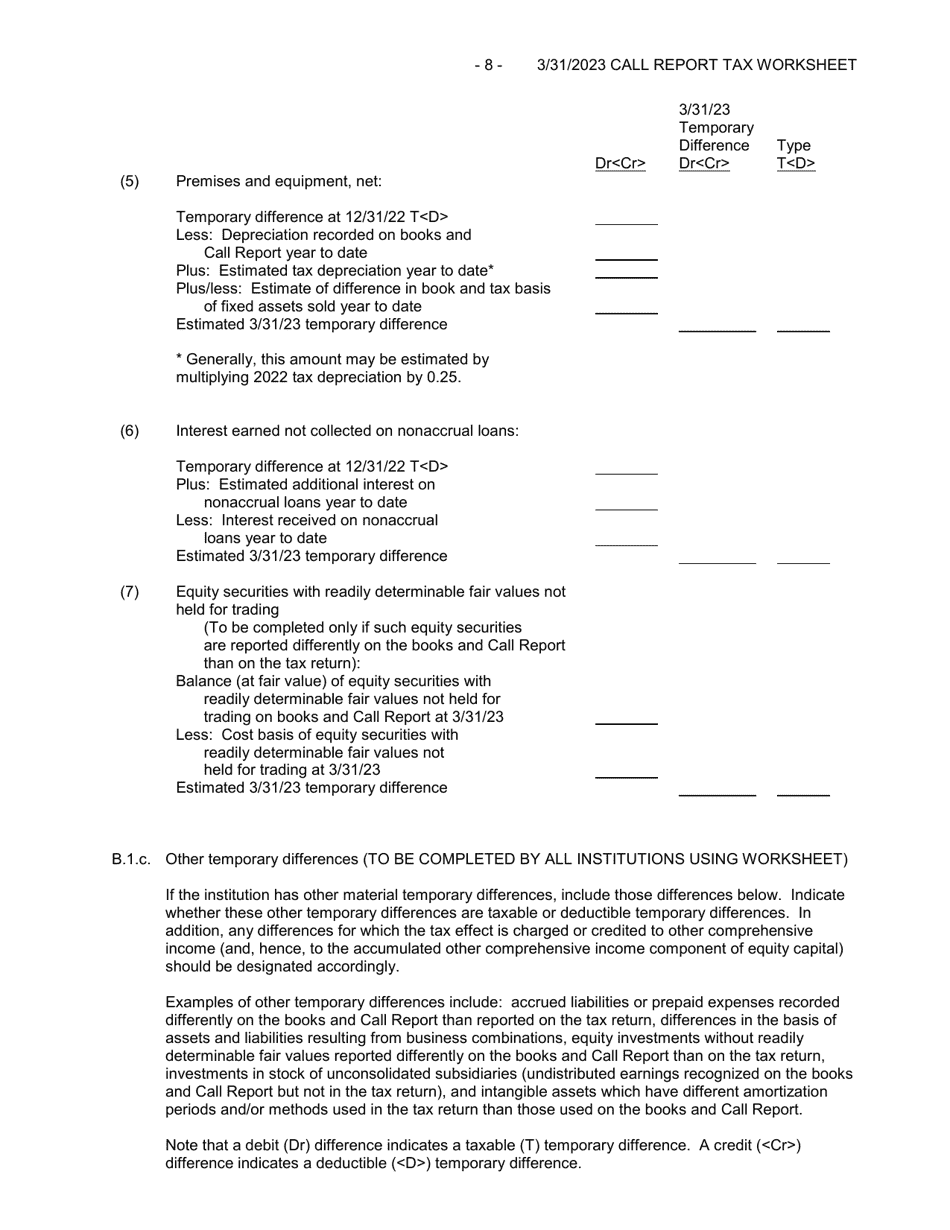

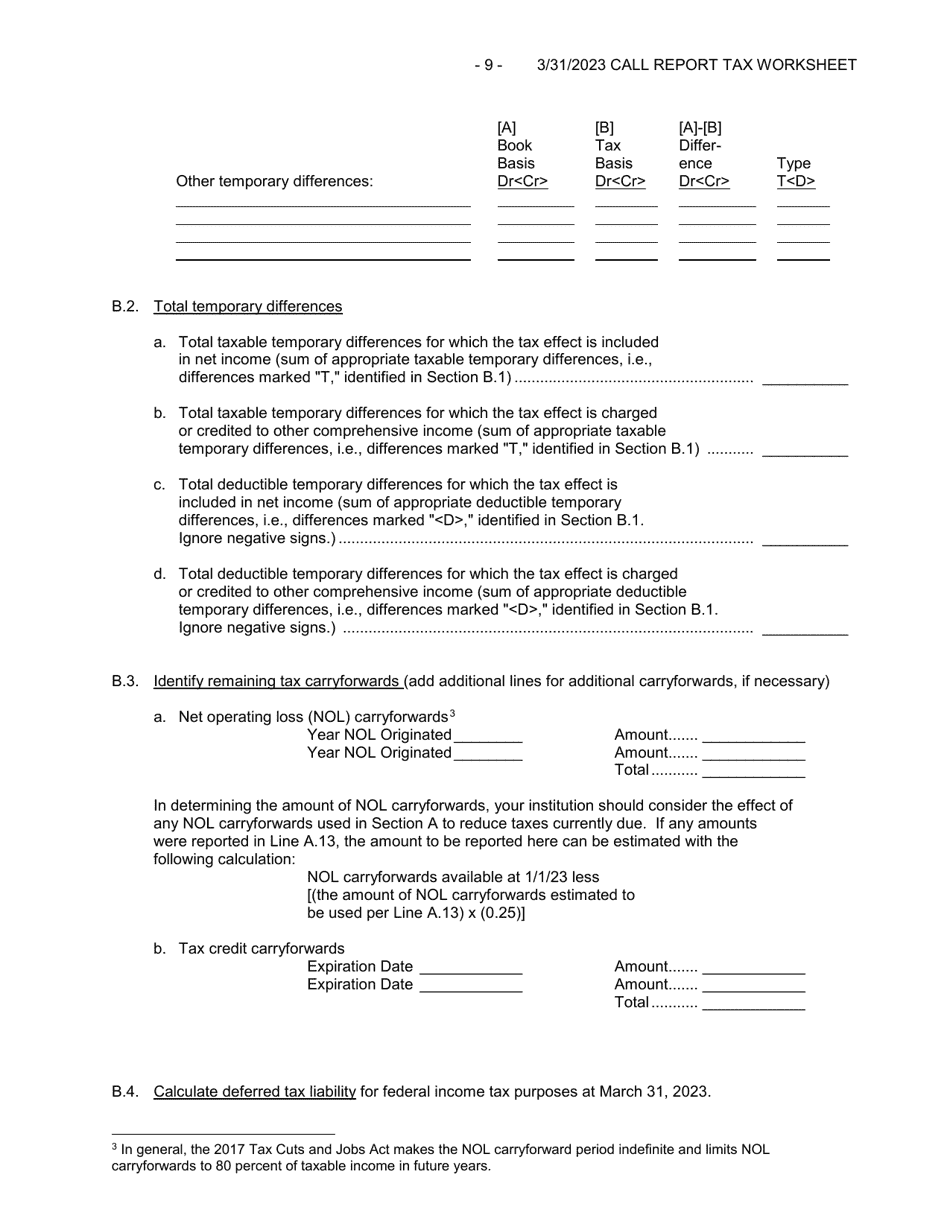

A: Form FFIEC051 is an optional worksheet used to calculate the applicable income taxes for a Call Report.

Q: What is the purpose of Form FFIEC051?

A: The purpose of Form FFIEC051 is to provide a way for banks to calculate their income taxes for the Call Report.

Q: Which Call Report is Form FFIEC051 used for?

A: Form FFIEC051 is used for the FFIEC041 Call Report.

Q: Is Form FFIEC051 mandatory to fill out?

A: No, Form FFIEC051 is optional and banks can choose to use it to assist in calculating their income taxes.

Q: What information is needed to complete Form FFIEC051?

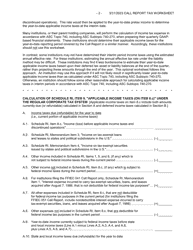

A: To complete Form FFIEC051, banks would need to provide information such as taxable interest income, non-taxable interest income, and net operating loss deductions.

Form Details:

- Released on March 31, 2023;

- The latest available edition released by the Federal Financial Institutions Examination Council;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FFIEC051 (FFIEC041) by clicking the link below or browse more documents and templates provided by the Federal Financial Institutions Examination Council.