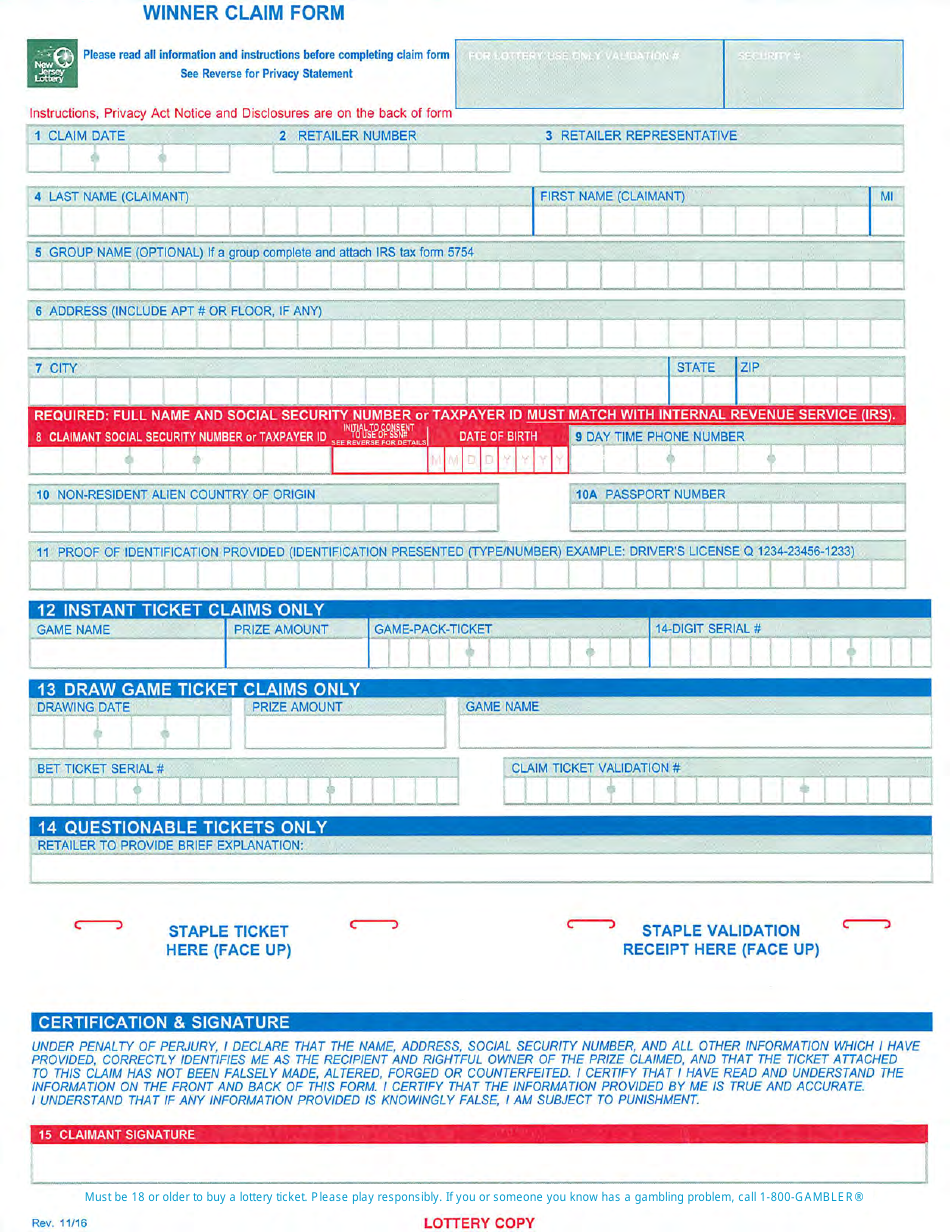

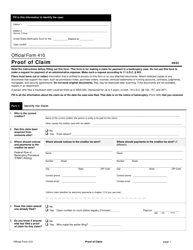

New Jersey Lottery Claim Form - New Jersey

New Jersey Lottery Claim Form is a legal document that was released by the New Jersey Lottery - a government authority operating within New Jersey.

FAQ

Q: What information do I need to provide on the New Jersey Lottery claim form?

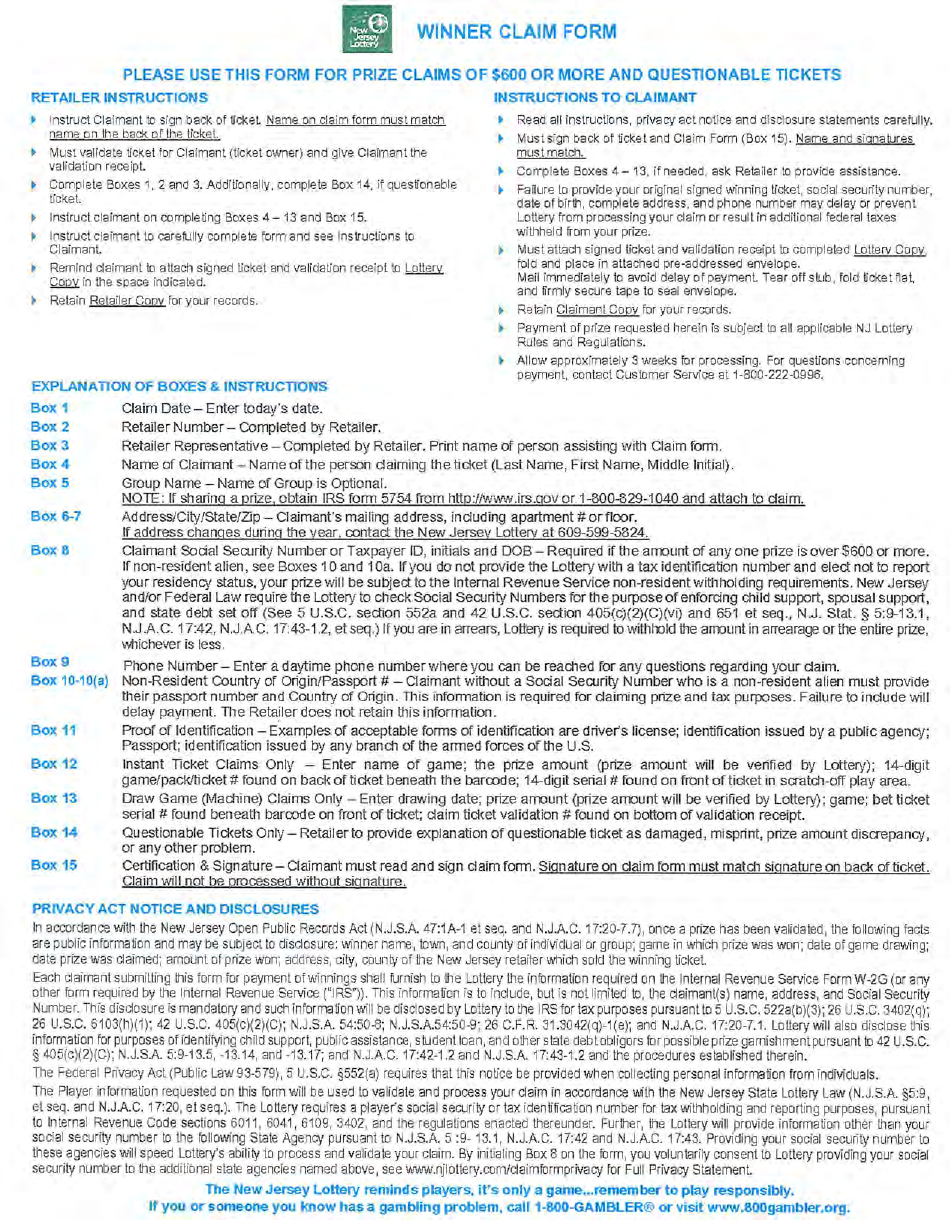

A: On the claim form, you will need to provide your name, address, Social Security number, and details about the winning ticket, including the game, prize amount, and date of purchase.

Q: Can someone else claim the prize on my behalf?

A: No, prizes can only be claimed by the individual or individuals who purchased the winning ticket.

Q: Can I mail the claim form to the New Jersey Lottery?

A: Yes, you can mail the completed claim form along with the winning ticket to the New Jersey Lottery headquarters.

Q: How long do I have to claim my prize?

A: For most New Jersey Lottery games, you have one year from the date of the drawing to claim your prize.

Q: Are lottery winnings taxable in New Jersey?

A: Yes, lottery winnings in New Jersey are subject to both federal and state income tax.

Q: Can I remain anonymous if I win a large prize?

A: No, the New Jersey Lottery is required by law to release the names of winners and the prizes they have won.

Form Details:

- Released on November 1, 2016;

- The latest edition currently provided by the New Jersey Lottery;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Lottery.