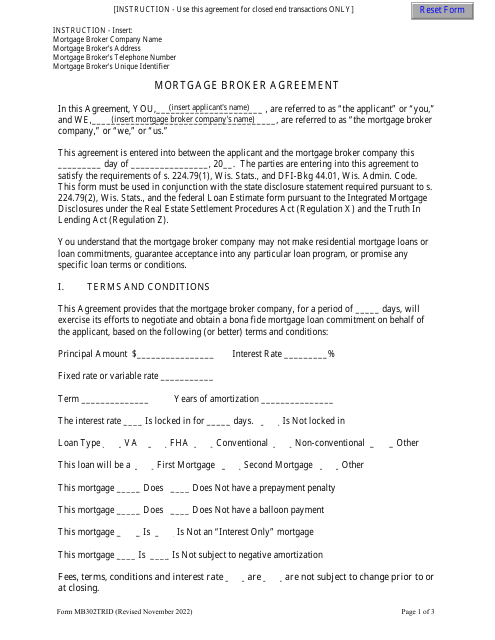

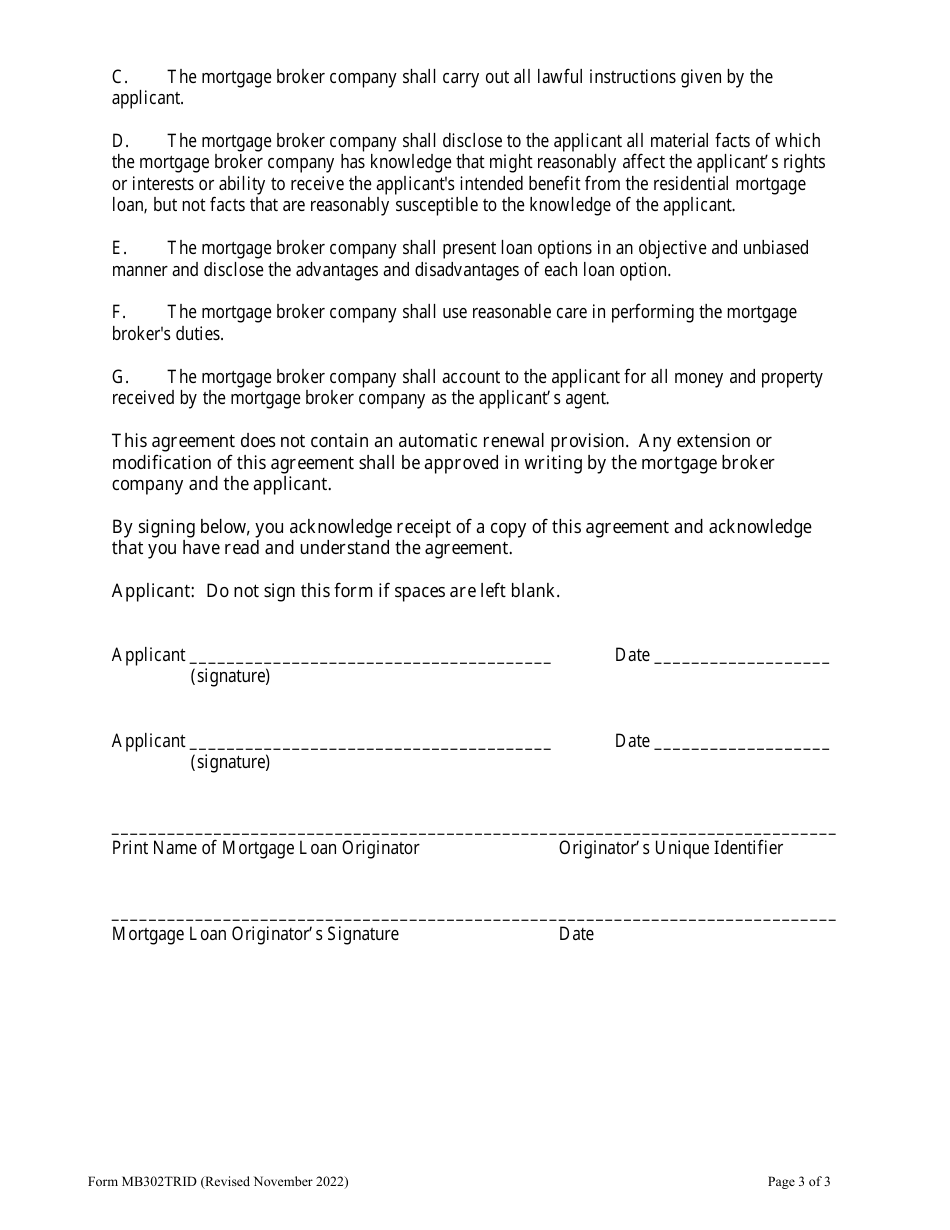

Form MB302TRID Mortgage Broker Agreement - Closed End Transactions (Trid Version) - Wisconsin

What Is Form MB302TRID?

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

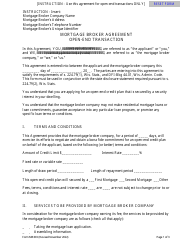

Q: What is the MB302TRID Mortgage Broker Agreement?

A: The MB302TRID Mortgage Broker Agreement is a document used in Wisconsin for closed-end mortgage transactions.

Q: What is a closed-end transaction?

A: A closed-end transaction refers to a loan where the borrower receives a specific amount of money, typically used for a specific purpose, and agrees to repay the loan with fixed payments over a predetermined period.

Q: What is the TRID version of the MB302 Mortgage Broker Agreement?

A: The TRID version of the MB302 Mortgage Broker Agreement is a version that complies with the TILA-RESPA Integrated Disclosure (TRID) rules, which aim to simplify and improve the loan disclosure process.

Q: Who uses the MB302TRID Mortgage Broker Agreement?

A: The MB302TRID Mortgage Broker Agreement is used by mortgage brokers in Wisconsin when entering into agreements with borrowers for closed-end mortgage transactions.

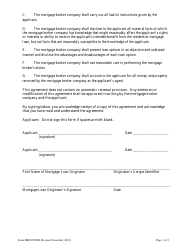

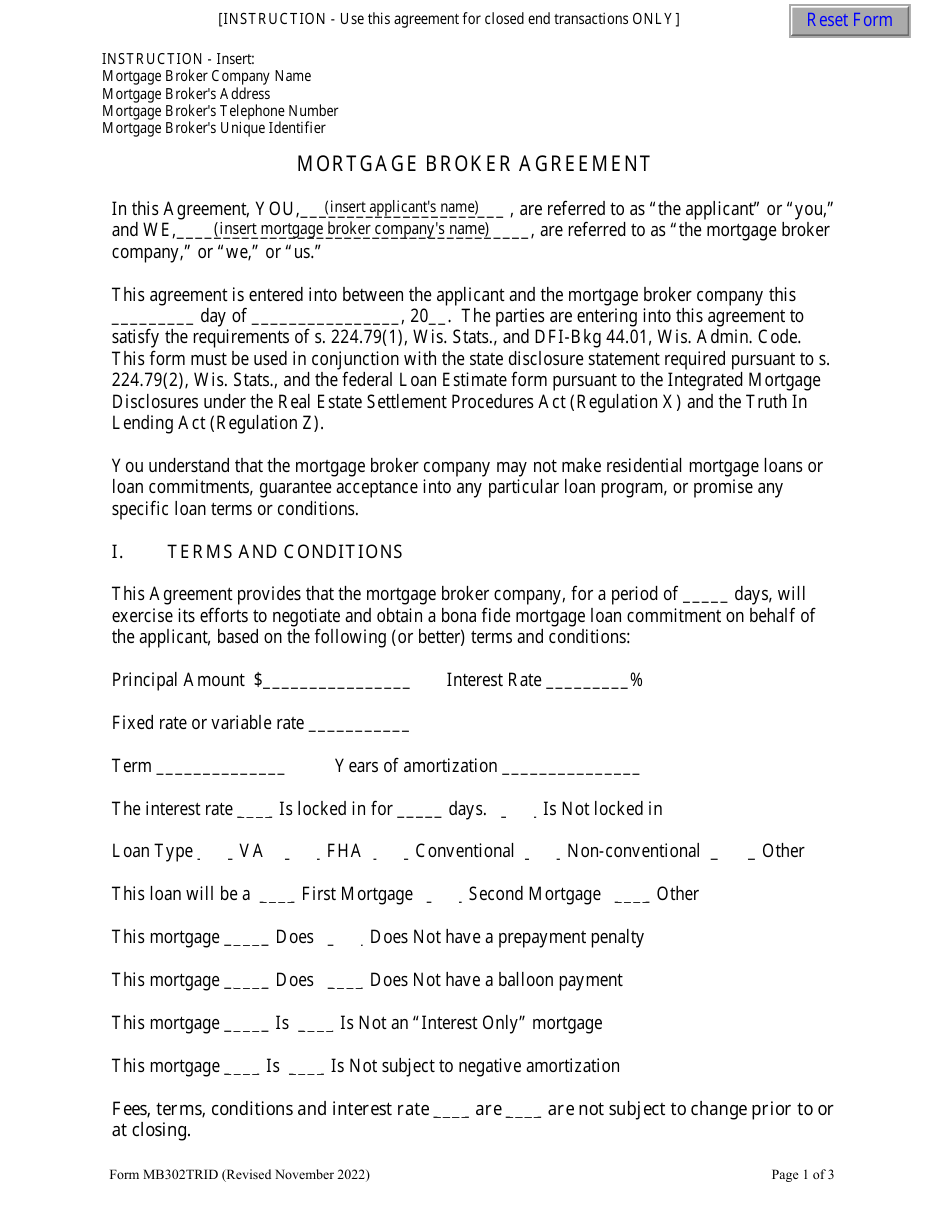

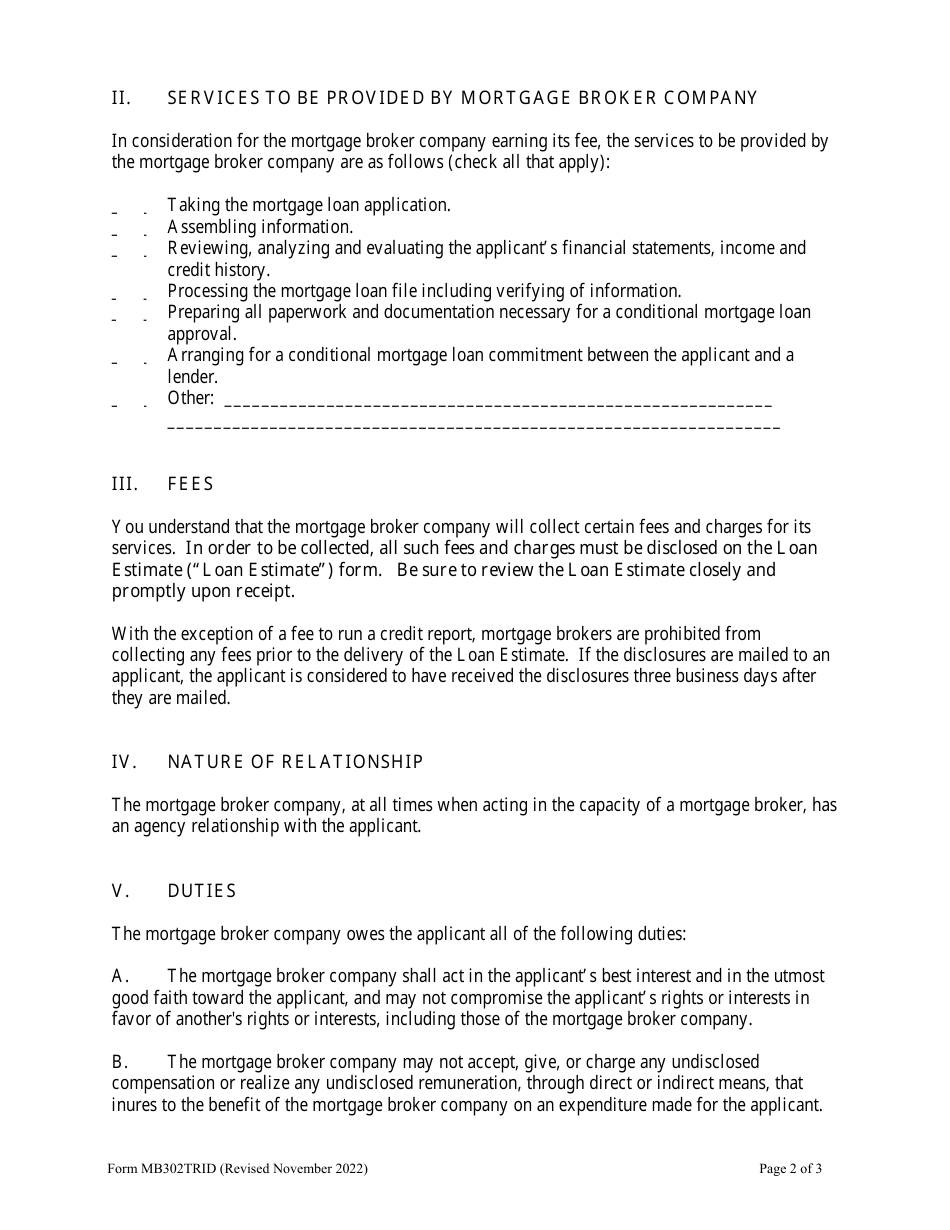

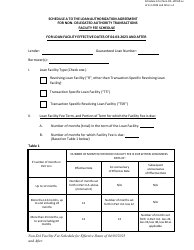

Q: What does the MB302TRID Mortgage Broker Agreement include?

A: The MB302TRID Mortgage Broker Agreement typically includes the terms of the loan, borrower and lender information, fees, and other important details of the mortgage transaction.

Q: Is the MB302TRID Mortgage Broker Agreement specific to Wisconsin?

A: Yes, the MB302TRID Mortgage Broker Agreement is specific to Wisconsin as it is designed to comply with Wisconsin's laws and regulations governing mortgage transactions.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MB302TRID by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.