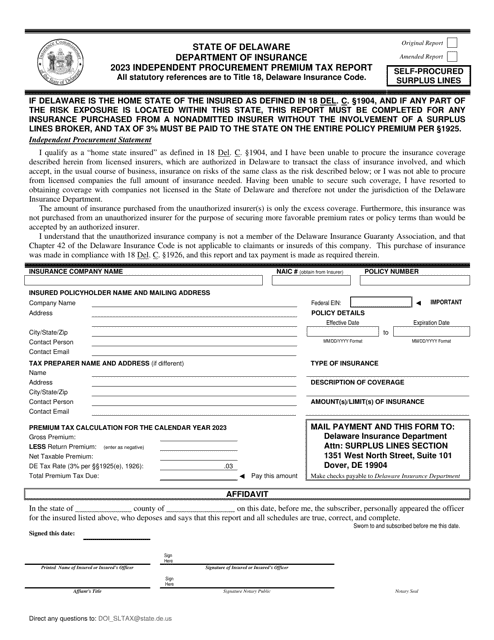

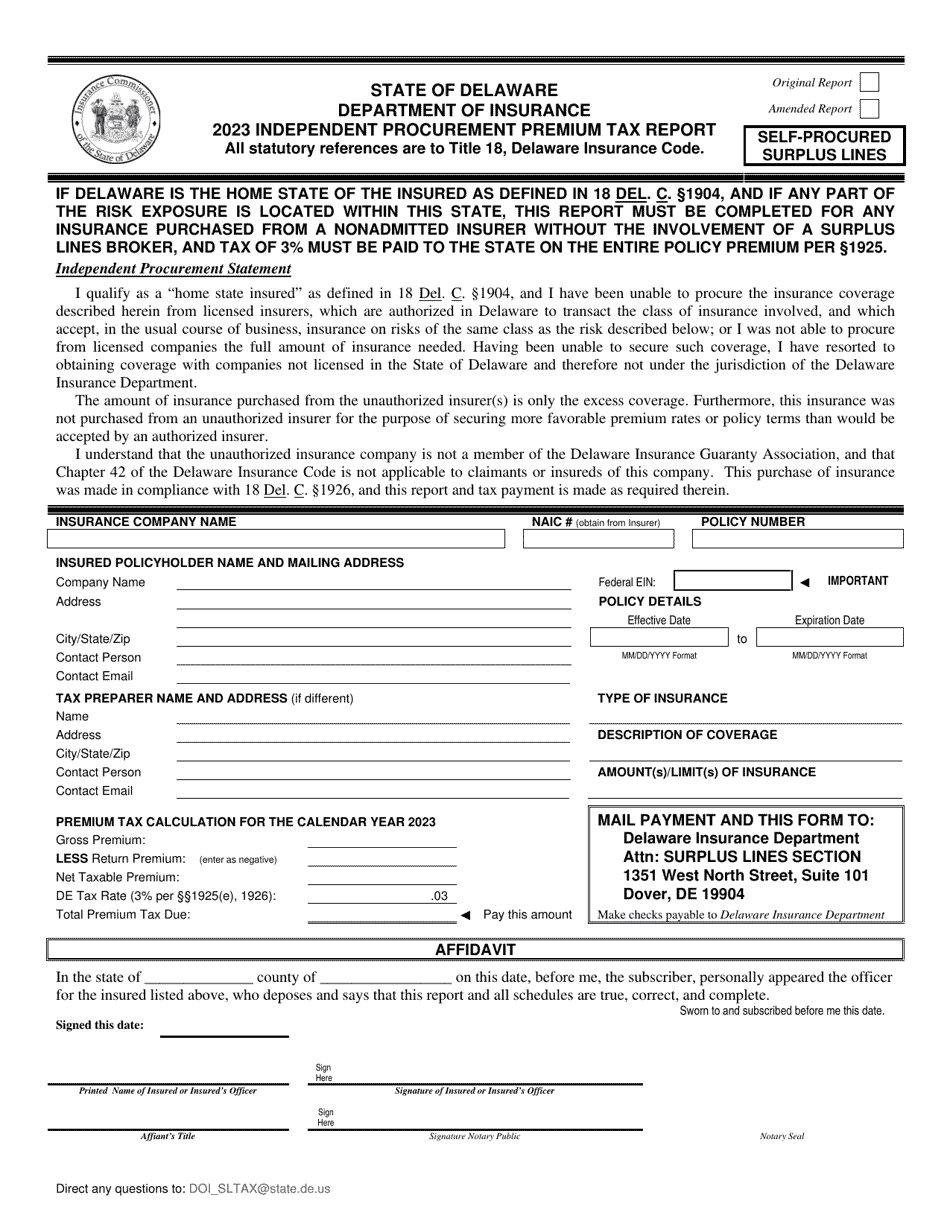

Independent Procurement Premium Tax Report - Self-procured Surplus Lines - Delaware

Independent Procurement Premium Tax Report - Self-procured Surplus Lines is a legal document that was released by the Delaware Department of Insurance - a government authority operating within Delaware.

FAQ

Q: What is the Independent Procurement Premium Tax Report?

A: The Independent Procurement Premium Tax Report is a form used to report self-procured surplus lines insurance taxes.

Q: What are self-procured surplus lines?

A: Self-procured surplus lines refer to insurance policies that are purchased directly by the insured instead of through a licensed insurance agent or broker.

Q: What is the purpose of the Independent Procurement Premium Tax Report?

A: The purpose of the report is to calculate and remit premium taxes owed on self-procured surplus lines insurance policies.

Q: Who is required to file the Independent Procurement Premium Tax Report?

A: Any resident or non-resident person or entity that has procured self-procured surplus lines insurance policies in Delaware is required to file the report.

Q: What information needs to be included in the Independent Procurement Premium Tax Report?

A: The report must include details of the self-procured surplus lines policies, such as the policyholder's name, policy number, premium amount, and tax due.

Q: When is the deadline for filing the Independent Procurement Premium Tax Report?

A: The report must be filed annually on or before March 1st for the preceding calendar year.

Q: Is there any penalty for late filing of the Independent Procurement Premium Tax Report?

A: Yes, there is a penalty for late filing. The penalty is 2% of the tax due per month, up to a maximum of 25% of the total tax due.

Q: Are there any exemptions or deductions available for the Independent Procurement Premium Tax?

A: No, there are no exemptions or deductions available for this tax. The full premium amount is subject to taxation.

Q: Who should I contact for more information about the Independent Procurement Premium Tax Report?

A: For more information or assistance with the report, you can contact the Delaware Department of Insurance.

Form Details:

- The latest edition currently provided by the Delaware Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Insurance.