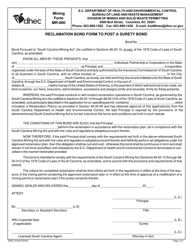

Surety Bond - South Carolina

Surety Bond is a legal document that was released by the South Carolina Department of Labor, Licensing and Regulation - a government authority operating within South Carolina.

FAQ

Q: What is a surety bond?

A: A surety bond is a three-party agreement that offers financial protection and guarantees that a party will fulfill its obligations.

Q: Who are the three parties involved in a surety bond?

A: The three parties involved in a surety bond are the principal (the party required to obtain the bond), the obligee (the party protected by the bond), and the surety (the company that provides the bond).

Q: Why would someone need a surety bond in South Carolina?

A: There are various reasons why someone may need a surety bond in South Carolina, such as for licensing and permit requirements, construction projects, court proceedings, or to guarantee payment or performance.

Q: Do all businesses in South Carolina require a surety bond?

A: Not all businesses in South Carolina require a surety bond. The need for a surety bond depends on the type of business and the regulations set by the state or local government.

Q: How much does a surety bond cost in South Carolina?

A: The cost of a surety bond in South Carolina can vary depending on factors such as the bond amount, the type of bond, and the applicant's credit history or financial strength.

Q: Are surety bonds the same as insurance?

A: No, surety bonds are not the same as insurance. Insurance protects against unexpected events, while surety bonds guarantee specific obligations or responsibilities.

Q: What happens if a party fails to fulfill their obligations under a surety bond?

A: If a party fails to fulfill their obligations under a surety bond, the bond's obligee can make a claim against the bond. If the claim is valid, the surety will compensate the obligee and seek reimbursement from the principal.

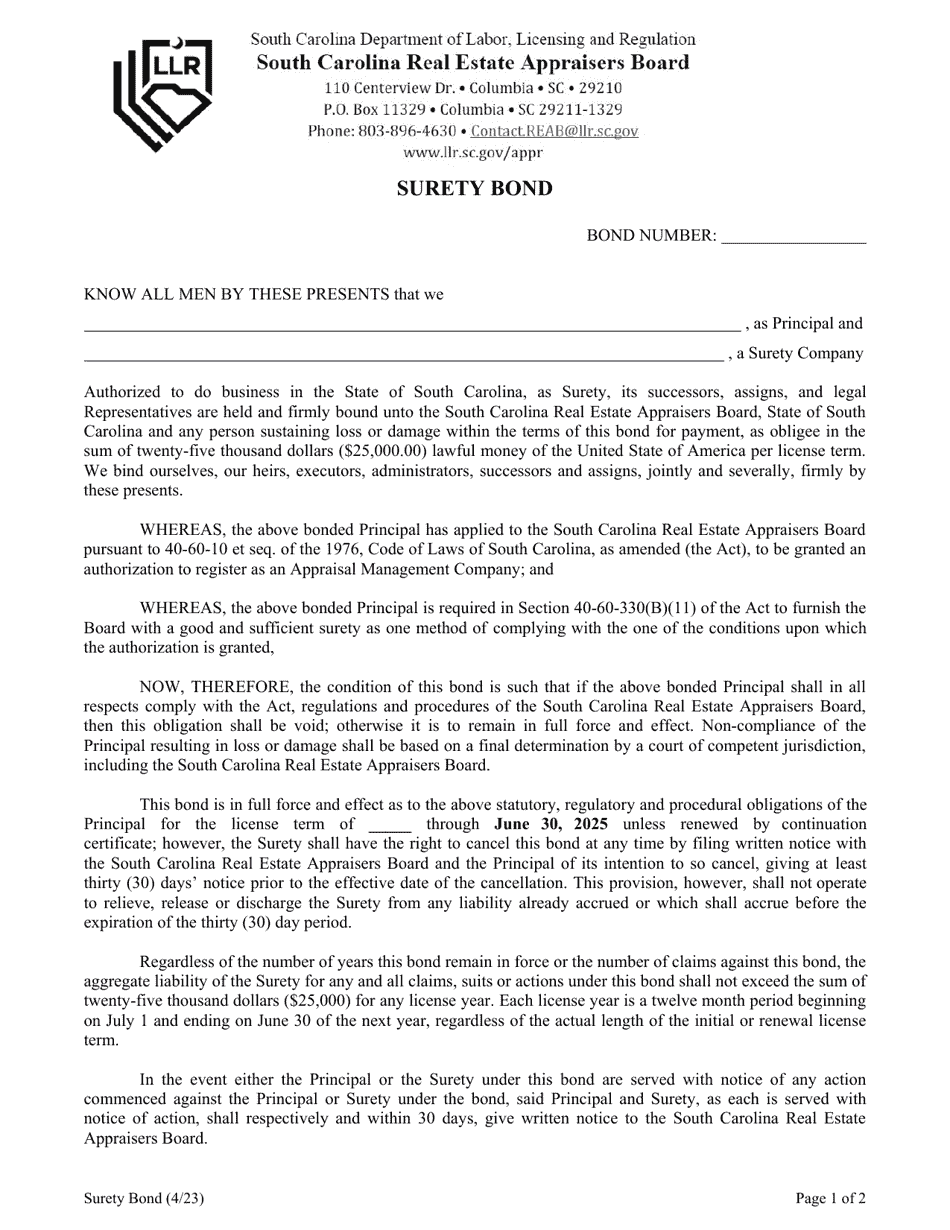

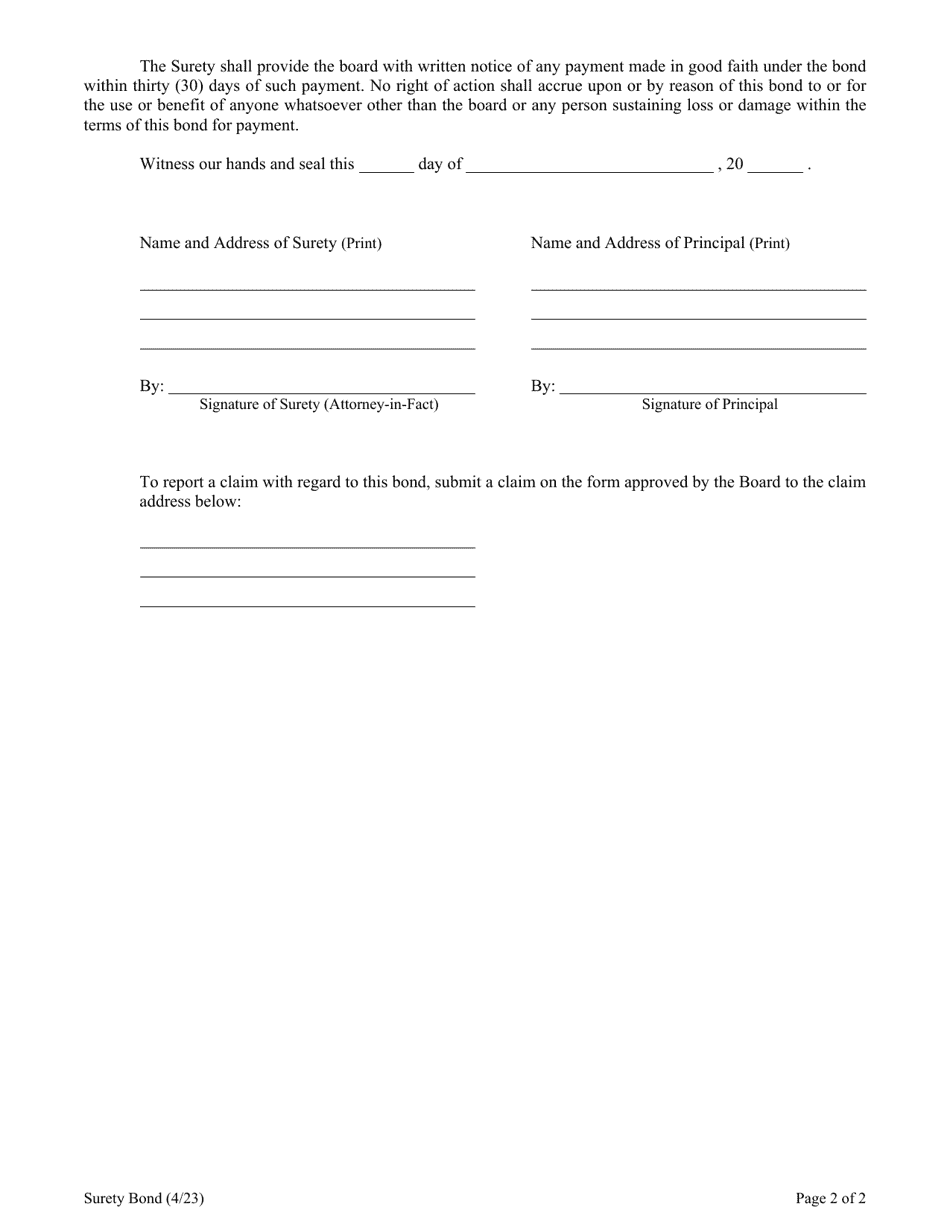

Form Details:

- Released on April 1, 2023;

- The latest edition currently provided by the South Carolina Department of Labor, Licensing and Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Labor, Licensing and Regulation.