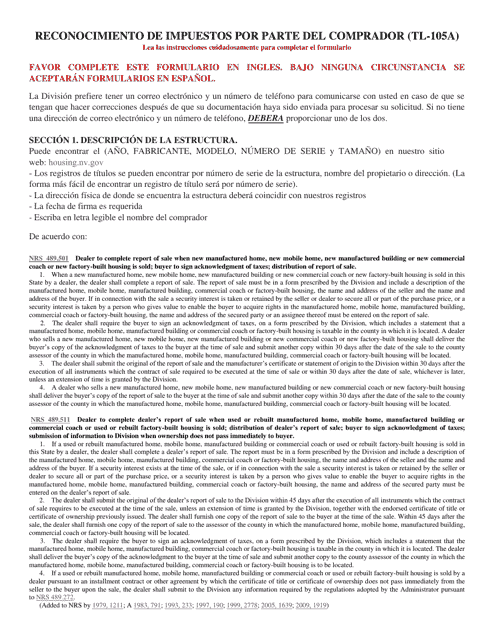

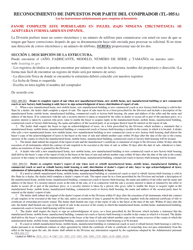

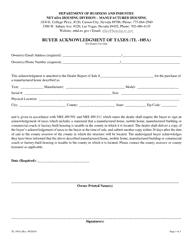

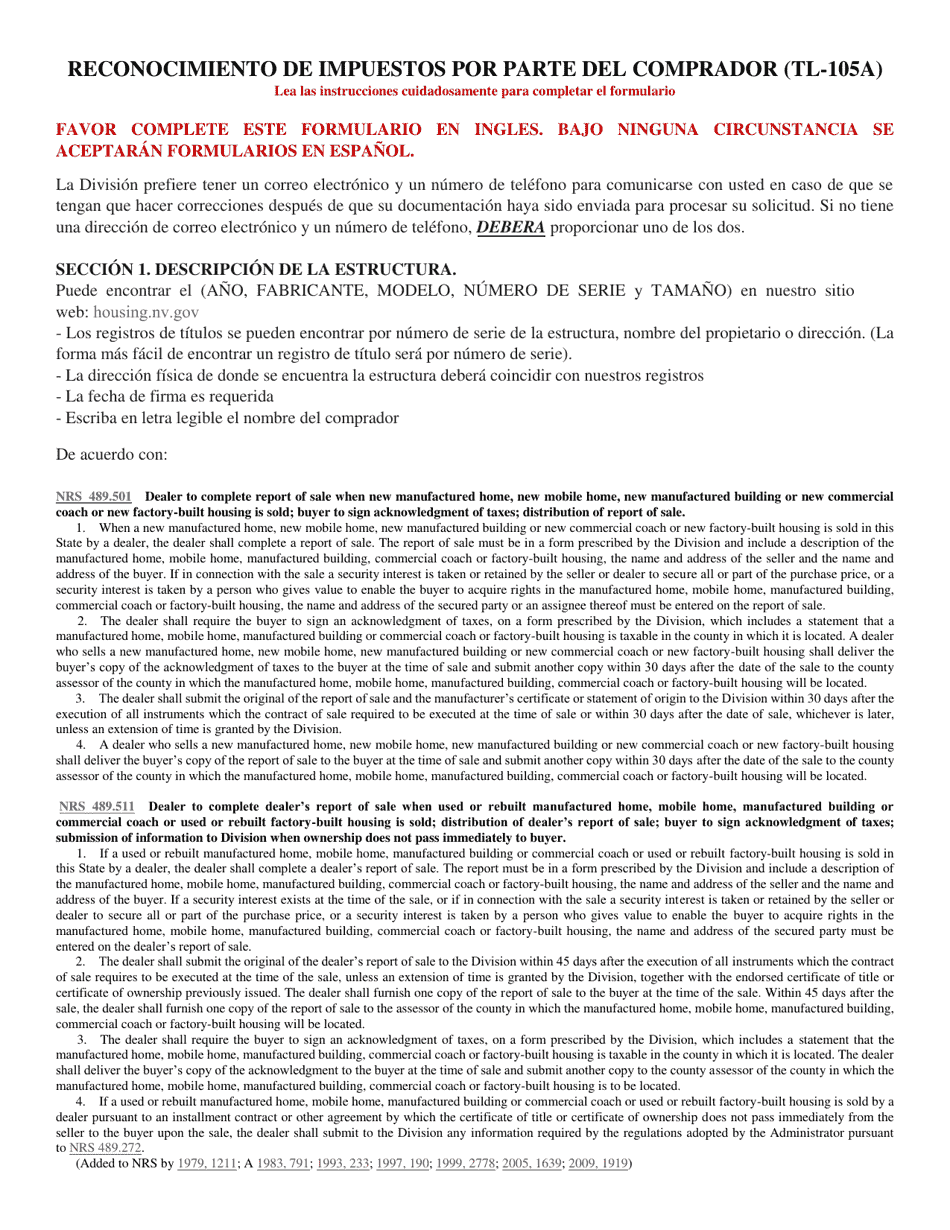

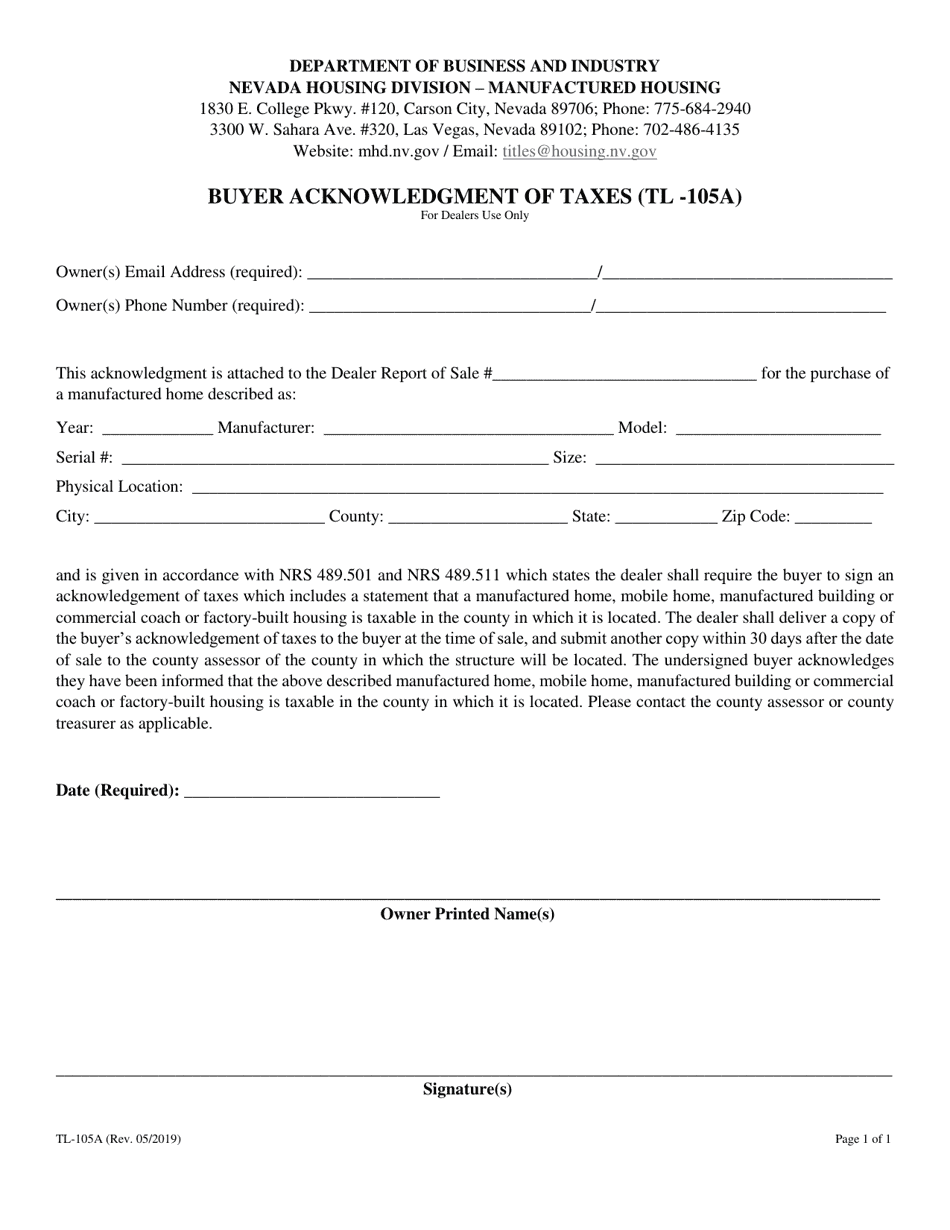

Form TL-105A Buyer Acknowledgment of Taxes - Nevada (English / Spanish)

What Is Form TL-105A?

This is a legal form that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TL-105A Buyer Acknowledgment of Taxes form?

A: It is a form used in Nevada to acknowledge the payment of taxes when buying or selling a vehicle.

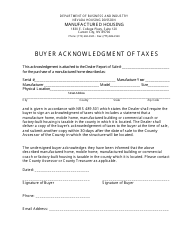

Q: Is the TL-105A form available in both English and Spanish?

A: Yes, the form is available in both English and Spanish.

Q: Who needs to fill out the TL-105A form?

A: Both the buyer and the seller of the vehicle need to fill out the form.

Q: When should the TL-105A form be filled out?

A: The form should be completed at the time of vehicle purchase or sale.

Q: Are there any fees associated with the TL-105A form?

A: No, there are no fees associated with the form.

Q: What information is required on the TL-105A form?

A: The form requires information about the buyer, seller, vehicle identification number (VIN), and the amount paid for the vehicle.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Nevada Department of Business and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TL-105A by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.